Maternity insurance offered by Insurers are anything but simple, there are generally two types of maternity insurance plans. Bundled Maternity…

Add Riders

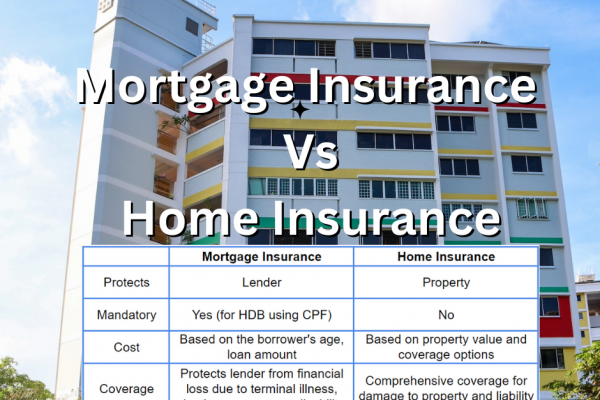

Here are some riders you could add to your mortgage-reducing insurance protection to provide comprehensive coverage:

- Total and Permanent Disability

- Advanced Stage Critical Illness

- Premium Waiver

- Spouse Premium Waiver

Joint Application

You can apply for joint mortgage insurance in Singapore with your spouse. This may potentially be the cheapest mortgage insurance option for you, than getting two separate policies. . Take note that the payout will not be paid twice even if both of you meet the claimable event of death or disability.