ABSD Rates Hike in Singapore: Everything You Need to Know

The Singaporean government recently announced a hike in the Additional Buyer’s Stamp Duty (ABSD) rates, effective from 27th April 2023. The move has significant implications for property buyers and investors in Singapore, and it’s essential to understand what this means for your investments.

In this blog post, we’ll break down the latest ABSD rates hike and explore how it could impact the property market in Singapore. We’ll also provide some tips and strategies for navigating the changes and making informed investment decisions.

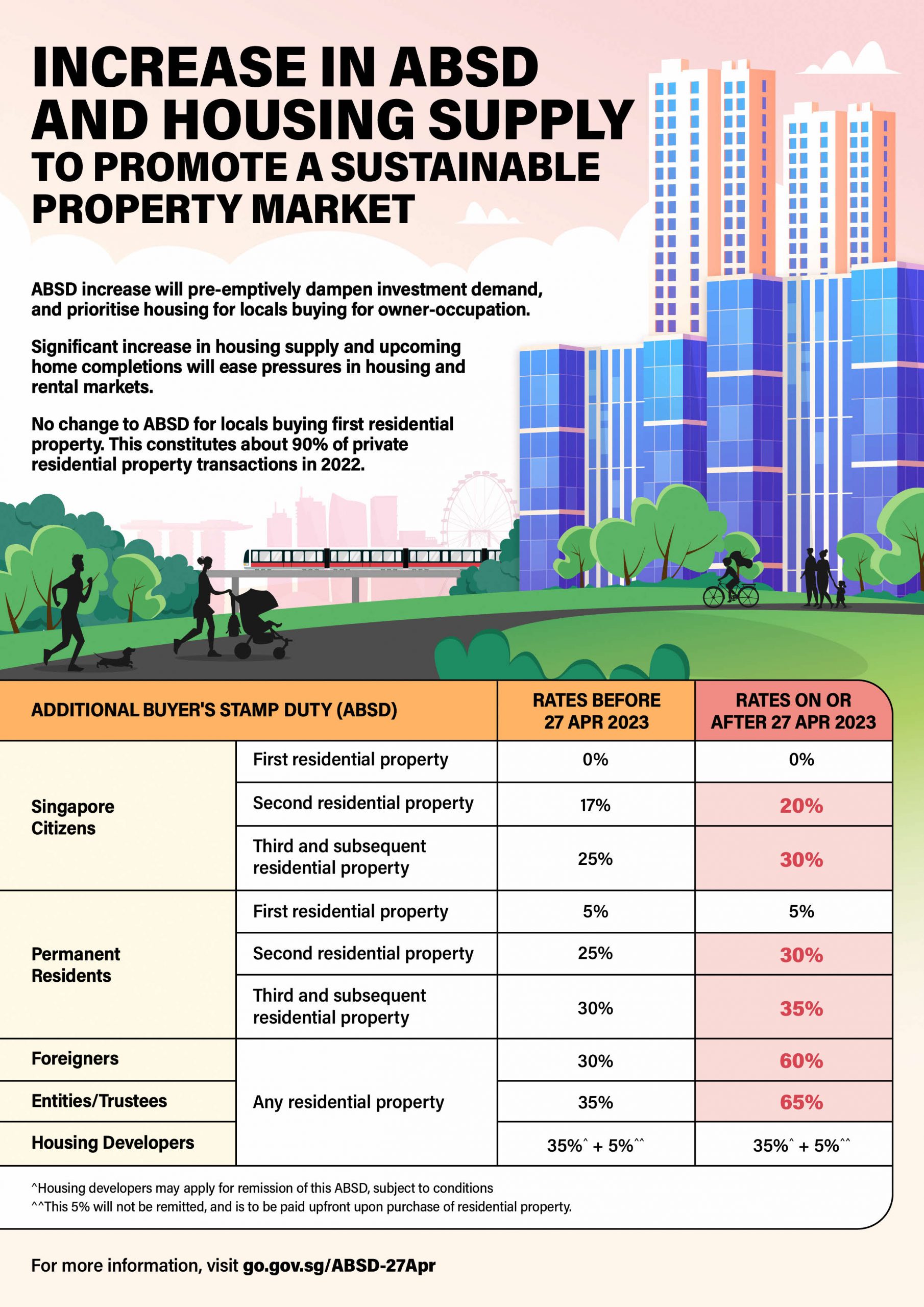

Source: Ministry of National Development (MND)

What is Additional Buyer’s Stamp Duty (ABSD)?

For those who are unfamiliar, Additional Buyer’s Stamp Duty (ABSD) is a tax that buyers need to pay when purchasing residential property in Singapore. It was first introduced in December 2011 as a measure to cool down the rapidly rising property market. The tax is levied on top of the standard Buyer’s Stamp Duty (BSD) and applies to all property buyers, including Singaporean citizens, permanent residents, and foreigners. When you purchase a property, you may be required to pay Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) rates. These fees are calculated based on the purchase price stated in the dutiable document or the market value of the property (whichever amount is higher). It’s important to keep this in mind when budgeting for your property purchase, so you can avoid any unexpected costs down the line.

How Does ABSD Rates Work?

The ABSD rates are calculated based on the nationality of the buyer and the number of residential properties they already own. For example, a Singaporean citizen purchasing their first residential property would not have to pay any ABSD. However, a Singaporean citizen purchasing their second residential property would need to pay 20% of the property’s purchase price as ABSD.

What You Need to Know About the Latest ABSD Rates Hike in Singapore

The Singaporean government recently announced an increase in ABSD rates, effective from 27th April 2023.

If you’re planning to buy property in Singapore, it’s important to understand the latest changes to the Additional Buyer’s Stamp Duty (ABSD) rates. These changes were made to promote a sustainable property market and prioritize housing for owner-occupation.

Table below summarises the adjustments to the ABSD rates.

Changes to the ABSD Rates for Residential Property:

| Additional Buyer’s Stamp Duty |

Rates from 16 December 2021 to 26 April 2023 |

Rates on or after 27 April 2023 |

| Singapore Citizens |

First residential property |

0% |

0%

(No change) |

| Second residential property |

17% |

20%

(Revised) |

| Third and subsequent residential property |

25% |

30%

(Revised) |

| Permanent Residents |

First residential property |

5% |

5%

(No change) |

| Second residential property |

25% |

30%

(Revised) |

| Third and subsequent residential property |

30% |

35%

(Revised) |

| Foreigners |

Any residential property |

30% |

60%

(Revised) |

| Entities |

Any residential property |

35% |

65%

(Revised) |

| Trustees |

Any residential property |

35% |

65%

(Revised) |

| Housing Developers |

Any residential property

|

35% (remittable, subject to conditions) + 5% (non-remittable) |

35% (remittable, subject to conditions) + 5% (non-remittable)

(No change) |

So what do the changes mean for you? Here are the key points you need to know:

- The ABSD rates have been raised for certain buyers.

- Singapore citizens (SCs) purchasing their second residential property will see the ABSD rates increase from 17% to 20%.

- SCs purchasing their third or subsequent property, as well as Singapore Permanent Residents (SPRs) purchasing their second property, will see the rate increase from 25% to 30%.

- SPRs purchasing their third or subsequent property will see the rate increase from 30% to 35%.

- Foreigners purchasing any residential property will see the ABSD rates increase from 30% to 60%.

- Entities or trusts (except housing developers) purchasing any residential property will see the rate increase from 35% to 65%.

- These changes will affect about 10% of residential property transactions, based on 2022 data.

- However, if you’re a first-time homebuyer, you won’t be affected by these changes. The ABSD rates for SCs and SPRs purchasing their first residential property will remain at 0% and 5%, respectively. This constitutes about 90% of residential property transactions based on 2022 data.

What Does the ABSD Rates Hike Mean for Property Buyers and Investors?

The ABSD rates hike means that property buyers and investors in Singapore will have to pay more taxes when purchasing residential properties. This could have several implications for the property market, including:

Reduced demand for high-end properties: The ABSD rates hike is likely to deter foreign buyers and investors from purchasing high-end properties in Singapore. This could lead to a reduction in demand for such properties, which could, in turn, lead to a drop in prices.

Increased demand for lower-end properties: Conversely, the ABSD rates hike could increase demand for lower-end properties, as buyers look to avoid paying higher taxes. This could lead to a surge in demand for mass-market properties and HDB flats.

Slower transaction volumes: The ABSD rates hike could also lead to slower transaction volumes in the property market, as buyers take a more cautious approach to their investments. This could be particularly true for buyers who are close to hitting the ABSD thresholds for their nationality and property ownership status.

More cautious investment decisions: The ABSD rates hike is likely to make property buyers and investors in Singapore more cautious in their investment decisions. Investors may be more inclined to hold onto their existing properties rather than selling them, while buyers may take longer to decide on their purchases.

Potential for increased rental demand: The ABSD rates hike could lead to an increase in rental demand as buyers opt to rent instead of buying. This could be particularly true for foreign buyers who are deterred by the higher taxes.

Navigating the Changes of ABSD Rates Hike

The ABSD rates hike could make it more challenging for property buyers and investors to navigate the Singaporean property market. However, there are several strategies you can use to make informed investment decisions:

Consider your nationality and property ownership status: It’s essential to understand your ABSD rates based on your nationality and property ownership status. Knowing your ABSD obligations can help you plan your property purchases and investments more strategically.

Look for opportunities in the mass-market segment: With the potential increase in demand for lower-end properties, it could be worth considering opportunities in the mass-market segment. This could include HDB flats and smaller condominiums.

Be cautious in your investment decisions: The ABSD rates hike could make property buyers and investors more cautious in their investment decisions. Take your time to research the market and consider your options carefully.

What can you do if you’re affected by the ABSD rates hike? Here are some tips:

- Understand your ABSD obligations based on your nationality and property ownership status. This will help you plan your property purchases and investments more strategically.

- Consider looking for opportunities in the mass-market segment, such as HDB flats or smaller condominiums.

- Take your time to research the market and consider your options carefully. The ABSD rates hike could make buyers and investors more cautious in their investment decisions.

- If property investments are less attractive, it could be worth exploring alternative investment options, such as stocks, bonds, and other financial instruments.

- Seek professional advice when making property investments. A real estate agent, financial advisor, or tax expert can help you make informed decisions about your property portfolio.

Overall, the ABSD rates hike has significant implications for property buyers and investors in Singapore. However, by understanding the new ABSD rates and taking a strategic approach to your investments, you can navigate the changes and make informed decisions.

Explore alternative investment options: If the ABSD rates hike makes property investments less attractive, it could be worth exploring alternative investment options. These could include stocks, bonds, and other financial instruments.

Takeaway: Stay informed and seek professional advice for your property investments

In conclusion, the latest ABSD rates hike in Singapore is a significant development for property buyers and investors. The government’s aim is to promote a sustainable property market and prioritize housing for owner-occupation. If you’re planning to invest in property, it’s important to understand how the new ABSD rates hike may affect you and take a strategic approach to your investments. By staying informed and seeking professional advice, you can make informed decisions and navigate the changes in the property market.

If you need help navigating the new ABSD rates or making strategic property investments, don’t hesitate to contact us. Our team of real estate agents, financial advisors, and tax experts can provide you with professional advice and help you achieve your investment goals!

2 Comments