Mortgage Insurance Singapore: Why choose Level term? — Mortgage Insurance Singapore

Mortgage Insurance Singapore: Buying a home is one of the biggest purchases in your lifetime. It’s understandable for anyone to be mindful about the safety of their monthly payments, so when it comes to protecting your mortgage, it’s only natural that you would want to be fully protected. This is where level mortgage insurance comes into play and the reason why you should consider it over other kinds of mortgage protection that you might already have.

Mortgage level insurance is an insurance policy that protects you against the risk of not being able to pay off your mortgage if you become disabled, terminally ill or die. Level term insurance is one of the two types of term insurance available.

You may be wondering, why choose level mortgage insurance over reducing term mortgage insurance? There are three main reasons.

1. Cost savings

2. The policy has a higher level of cover

3. It offers more flexibility

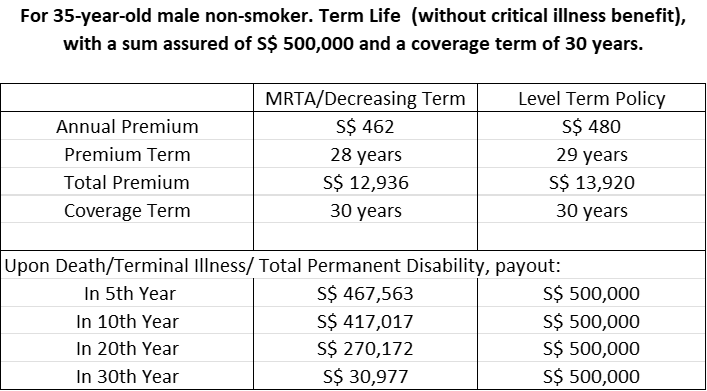

Premiums are generally comparable to or only slightly above the MRTA. — Mortgage Insurance Singapore

You will usually pay around the same amount or only a little more than the Mortgage Reducing Term Assurance (MRTA), which is a decreasing term life insurance policy. This is because MRTA premiums are based on the sum insured and the interest of your housing loan.

Level mortgage insurance premiums are not affected by the interest rate or outstanding balance on your home loan. The main factors affecting your level mortgage insurance premium are the length of cover and your age at commencement.

The insurance premiums can be paid monthly, quarterly or annually depending on what suits your budget. Level mortgage insurance premiums are also known as Term life insurance.

Unlike Decreasing Term or Mortgage Reducing Term Assurance (MRTA), even if you pay down your loans, your remaining coverage doesn’t drop.

Decreasing Term or Mortgage Reducing Term Assurance (MRTA) is a type of mortgage insurance that drops over time. This means that as you pay down your loan, the remaining coverage drops as well.

For example, if you have a $500,000 mortgage with $500,000 MRTA and you pay off $80,000 of your mortgage, your remaining coverage will now be $420,000. If you continue to make regular payments on the remaining balance and then pay off the full amount in the future, you’ll still have $0 coverage amount after the last payment.

Level mortgage insurance is different because even as you pay down your loans, your remaining coverage doesn’t drop. This means that no matter how much or how often you prepay your loans over time (or even pay off the entire balance), you’ll always have full mortgage protection of $500,000 until it expires at age 65 or 70 depending on which policy option you choose when buying level term insurance.

You don’t need to worry about increasing interest rates as compared to MRTA

Level mortgage insurance is suitable for people who are planning to purchase a home loan and want to protect the outstanding balance in their home loans in case the interest rate increases.

With level term insurance, you don’t need to worry about increasing interest rates as compared to Mortgage Reducing Term Assurance (MRTA). You need to specify an interest rate in which the MRTA will decrease for the next, say, at 3% p.a. 30 years. If the actual home loan interest increases, to say 5%, the MRTA coverage will not be sufficient to pay off the outstanding home loans if death or disability occurs.

With level-term insurance, there is no need to worry about this since it provides exactly the same original loan amount as long as the policy term.

You can also continue to cover your new home when you buy a new one. — Mortgage Insurance Singapore

If you have an existing mortgage, it is a good idea to get level term insurance from the day your loan is approved. This will help you in two ways:

We all know that Mortgage Reducing Term Assurance (MRTA)’s coverage decreases with time. When you are buying your next property, you need to buy a new policy to cover the new loan amount, as the MRTA is not enough to cover a fresh new loan amount. With level-term insurance, however, the coverage remains unchanged throughout its tenure and can be used at any point in time.

Level-term insurance is an ideal solution for this situation because it provides protection against death, terminal illness or permanent disability from day one until maturity. This means that you don’t have to worry about increasing premiums when you buy another property, because you have lock-in the insurance rates at a younger age with your level term insurance.

You now know the benefits of level term insurance over Mortgage Reducing Term Assurance (MRTA). Consider asking your broker about it, or looking for some options online. You will be glad you did!

Any unused coverage can be converted into personal coverage, which is useful since most people are under-insured

Mortgage Insurance Singapore: The point is to make sure you’re properly protected in case of a loss. You don’t want to be selling or giving away your belongings just to cover your mortgage. So what else could go wrong? You could get sick, or have an accident that forces you to take time off work, you might have dependents to support. Chances are that no matter how much coverage you have, it isn’t going to be enough.

The main benefit of level mortgage insurance is that, when you have it, it doesn’t matter if your mortgage payments reduces the balance loan amount. The amount of money you pay to the insurer doesn’t change no matter what—you’ll just stay insured at a level policy (hence the name) while still paying based on your entry age rates. And with personal coverage, once you’re paying off a mortgage, any unused coverage continues to build as long as you stay insured.

You’ll have the extra protection you need should something catastrophic happen.

Whether it’s for peace of mind, stability in your home, or financial security; having sufficient insurance coverage is a must. Keep in mind that there are a few different types of insurance you will want to consider and it would be smart to do some research first before deciding on who you want to buy your policy from. That way, you won’t have to worry about any surprises and know exactly how much you will need.

Why Critical Illness is needed with your Basic Term Plan

Critical illness insurance provides additional coverage for medical emergencies like heart attacks, strokes, or cancer. Because these emergencies or illnesses often incur greater-than-average medical costs, these policies pay out cash to help cover those overruns when traditional health insurance may fall short. These policies come at a relatively low cost. Critical illness insurance provides a benefit if you experience one or more of the following medical emergencies:

- Heart attack

- Stroke

- Organ transplants

- Cancer

- Coronary bypass

Takeaway: Please consider level mortgage insurance for your protection — Mortgage Insurance Singapore

In summary, it is more beneficial for you to take level mortgage insurance, as it will meet your needs in a better way. Level mortgage insurance is different from decreasing term and MRTA policies. It is intended to protect against the situation you are most likely to encounter which is the increase in interest rates.

If you are a homeowner and you live in Singapore, then you should seriously consider level mortgage insurance to protect your home.

Compare Mortgage Insurance today! Tell us your Loan amount and tenure, and we’ll send you a list of the cheapest quotes.

3 Comments