Moneyline Singapore compares over 10 life insurance companies to get you the best whole life insurance plan in Singapore.…

There are 3 types of insurance in Singapore, life; general & health insurance. In this article, we will understand the 3 main types of plans for individuals and most importantly the crucial sub categories of each type of insurance that one should consider getting in Singapore to be comprehensively protected.

Let’s explore. image by rawpixel.com /freepik.com

This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. Read our General Disclaimer

Life insurance for a simple fact, protects the life of a person and their love ones against their death, disability or critical illnesses. There are different kinds of life insurance plans namely, Term life; Whole life and Investment Linked policies. There is also Universal life which is typically catered to high-net-worth individuals and their family members. Though recently, even emerging affluents are utilising universal life as a one size fit all solution to provide death coverage.

The common type of life insurance that an individual will get in Singapore are as followed;

Whole life insurance policies is a protection plan that provides the insured with a lifetime coverage, such policy does not lapse unless the policy holder fails to pay the premium. In modern time, there are whole life insurance plans which can be paid off within a specific time frame and its coverage can be enhanced within a separate specific time frame. Such plans are also known as “whole life limited pay with multiplier coverage benefits.”

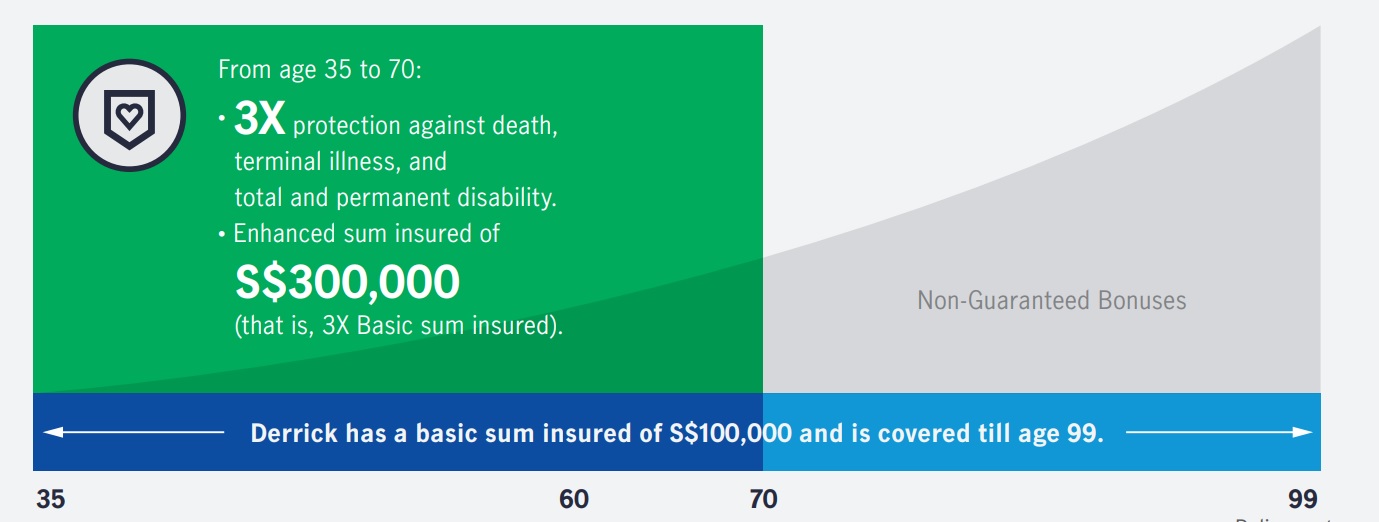

Image from Manulife.com.sg

Instead of getting an outright coverage of 300,000, the insured can purchase a whole life insurance plan @ 100,000 sum assured with a multiplier benefit of 4x. This multiplier benefit of 3x will end after a specific age (e.g. 65 or 70 years of age) and revert the coverage back to 100,000. The policy holder may also choose to pay off the premium of the whole life insurance plan within a specific period of time i.e., 5, 10 or 25 years.

Normally, a whole life insurance plans will allow the policy holder to invest part of the premium into the insurer’s participating fund. This will let policy holder accumulate guaranteed and non-guaranteed cash value via participating in the insurer’s investment strategy. Once bonuses are declared, they are guaranteed and will form part of the overall cash value of the policies. As for the cash value, they can be withdrawn, or a policy loan can be taken out of it.

Check out the list of whole life insurance plans we are able to compare

Investment linked policies are life insurance plans that allows the policyholder/life assured to be insured and accumulate cash value by investing part of the policy premium into Mutual Funds/Unit Trust. Premiums paid to the insurance company will cater to a “cost of insurance” component and an investment component. The difference between ILP and a whole life policy is that, in an investment link policy arrangement, the insurer neither guarantees any of the principal nor the returns on the investments.

In an ILP, the cost of insurance increases as the life assured age. As such, the life assured may suffer a potential lapsation of policies should the investment returns of the plan fail to keep up with the annual cost of insurance in the long run.

Term insurance are life plans that provides coverage for a fix period at a specified amount. They are the cheapest form of life insurance mainly due to the absence of cash value.

There are also two types of term life. A level and a reducing term. A reducing term is usually bought to protect a client’s outstanding mortgage loan. The client will pay a fixed premium periodically while the coverage decreases each year to the intended end of policy term. A level term on the other hand provides the same amount coverage throughout the policy life span.

A renewable term can also be bought if the client has short term protection needs but wants the option to renew the plan later on without being subjected to any medical underwriting. Such event will also cause the premium to increase at each renewal period and the policy holder can continue to renew the coverage as long as the policy allows.

A typical life insurance policy will insure the following events:

Death coverage is usually the basic coverage of a life insurance plan. It is always the main coverage for a whole life and investment linked policies. Most insurer includes terminal illness coverage as part of death coverage.

The disability coverage usually comes as a rider to the main plan, most insurers provide the same definition for TPD and usually the disability rider will terminate by the time the life insured reaches 70 years old.

Critical illness can be rider to any life policies and can also be bought as a standalone plan, the critical illness plan can be categorised into early/intermediate stage and advance stage coverage. While in the industry there is a general definition for critical illness, some insurer provides more coverage than what has been defined.

Check out the list of term insurance plans we are able to compare

Any type of insurance that do not come under the umbrella of a life insurance is a general insurance. There are commercial general insurance and personal general insurance, in this section we are going to discuss the most common type of personal general insurance that a person can get in Singapore.

Personal accident insurance plans provide a lump sum pay out to an individual or their family members in the event of their death or permanent disability caused by an accident. Such product may also incorporate coverage for their medical bills incur due to an accident that requires short- or long-term treatment. To make their plans more holistic, some insurer provides additional coverage such as, Traditional Chinese Medicine (TCM) procedures and medical treatments required caused by infectious diseases e.g. dengue, certain flu strains or even corona viruses.

The premium for Personal Accident policies is usually charged base on an individual’s occupation, e.g. a desk bound person will pay a lesser premium for a similar coverage compare to a person who works mostly in an outdoor environment. Premium also differs between children, adults and senior citizens.

Home content insurance provides protection for the contents in the policy holder’s home including furniture, renovation and other personal belongings against loss and damages due to fire, flood, burglary and theft. Some insurers also provide substitute accommodation expenses when the insured’s home becomes unliveable.

Fire insurance covers the building of the home from structural damages due to fire and other known perils. Depending on the insured’s property type, a fire insurance may or may not be required e.g.

HDB Flat owners must purchase fire insurance approved by HDB Fire Insurance Scheme, which covers the building and its structures, whereas for private properties such as condominiums, the Management Corporation (MC) the strata titled development is responsible for insuring the buildings and common property for fire damage. For landed properties, the home owners are to purchase their own fire insurance to insure their own buildings and structures.

If a person owns a vehicle in Singapore, it is compulsory to purchase a motor vehicle insurance. Example, if the person owns a car, he/she is expected to buy a car insurance. Car insurance comes in main types of covers -Third party only insurance; third party, fire and theft insurance; and comprehensive car insurance. Most first-hand owners within the first 10 years of their vehicle registration will buy a comprehensive car insurance. Motor Insurance also typically comes with a No Claim Discount where a person gets to enjoy progressive savings year after year if they do not make any claim from their insurer.

A typical motor insurance will not only cover the insured but also covers any third-party medical bills or lump sum liability that is involved in a collision or accident of which the insured’s vehicle is involved in.

Health insurance can be classified as a class of insurance by itself because it works very differently from life and general insurance, in some cases, health insurance can be classified under both life and general insurance. To prevent confusion, we decide that health insurance should have its own section especially in Singapore.

In Singapore, due to the robust healthcare system and government’s initiative. Personal health insurance can be classified into two types. Integrated Shield Plans and Non-Integrated Shield (Private Health Insurance).

As a Singaporeans and Permanent Residents in Singapore, you will be automatically enroll into Medishield Life, this is a basic universal healthcare plan administered by the CPF Board. The purpose is to provide a form of affordable health insurance for everyone including those with pre-existing conditions to pay off large hospitalisation bills specifically those who choose to seek treatment in a government hospital and stay in a C/B2 restructured wards.

The Medishield life coverage can be enhanced with an integrated shield plan to provide comprehensive coverage for higher class wards in restructured and private hospitals.

However, any Foreigners holding a valid pass in Singapore, is also eligible to purchase integrated shield plan with one of the seven appointed insurers. Singaporeans and PR can choose to use their Medisave to fund the premium for the integrated shield subjected to a yearly withdrawal limit.

All integrated shield plans provide a coverage that can amount to 90% (after deductibles) of the overall medical bills. The plan typically can be classified into 3 different ward types. Government B1, Government A and Private Hospitals.

Govt B1 = 4 bedders Government/Restructured Hospital Room or Below

Govt A = Single Bedder Government/Restructured Hospital Room or Below

Private Hospital = Any Standard Room in a Private Hospitals and Government/Restructured Hospitals

Premium gets exponentially higher if an individual chooses to go for a plan that provides coverage for private hospital.

A person may also compliment their integrated shield with riders to provide coverage for co-insurance and deductible, daily cash benefit, additional outpatient health care service and personal accidents by paying with cash.

Since March 2018 there will no longer be integrated shield plan riders that will cover 100% of hospitalisation expenses. Instead, integrated shield plan insurers now provide a rider that will cover a maximum of 95% of the overall hospitalisation expenses. There will also be a cap on the 5% co insurance at $3,000 each year if the life assured seeks treatment within the provider’s list of panelled doctors in a private hospital or any doctors at a restructured hospital.

Private health insurance plans can be purchased by Singaporeans/PR or foreign residents (with or without work pass) that regularly travels abroad for work or leisure, such plans are usually bought by individuals who would like comprehensive coverage abroad or in Singapore which provides any of the following coverage that are not provided by integrated shield plans.

Private health insurance is usually customizable in terms of its scope of coverage and the percentage of medical bills an insured will want it to cover. Policy holder can also choose the region they wish to be cover in and they can be kept regardless of change of residency status in the country they purchase the policy from. Private health insurances are also able to provide up to 100% coverage on the medical bill which integrated shield plan are not able to provide at the moment.

Health insurance plans premium increases as the insured age. It does not matter whether the policy holder decide to purchase when they are young as there are no way to lock in the premiums for life. Another thing to note is that even though the premium increases as you grow towards a certain age band, premiums are typically not guaranteed and will be adjusted to keep up with medical inflations.

Check out the list of health insurance plans we are able compare

You may acquire these insurance products either from banks, insurance agencies, the insurer directly or financial advisors. Read here to know the difference

Over here in Moneyline.SG we are able to help you compare the type of insurance plans you’re looking at. Let us know what you’re looking for below!

Moneyline Singapore compares over 10 life insurance companies to get you the best whole life insurance plan in Singapore.…

We Compare over 15 Life insurers to get you the best Maternity insurance plan in Singapore Learn about the different…

Compare Best Diabetes Insurance Singapore (2024) We Compare over 15 Life insurers to get you the best diabetes insurance plan in Singapore Learn about the different…

Comments are closed.

21 Comments