Singapore Savings Bond 2022 – Important Details for New Buyers of Singapore Savings Bond(SSB)

In an emergency, you have to be able to access your hard-earned money at any time. This is where a Singapore Savings Bond (SSB) comes in.

If you haven’t heard of SSBs before, don’t fret. This article will bring you up to speed on what they are, how they work and why they could prove useful for your personal finance goals.

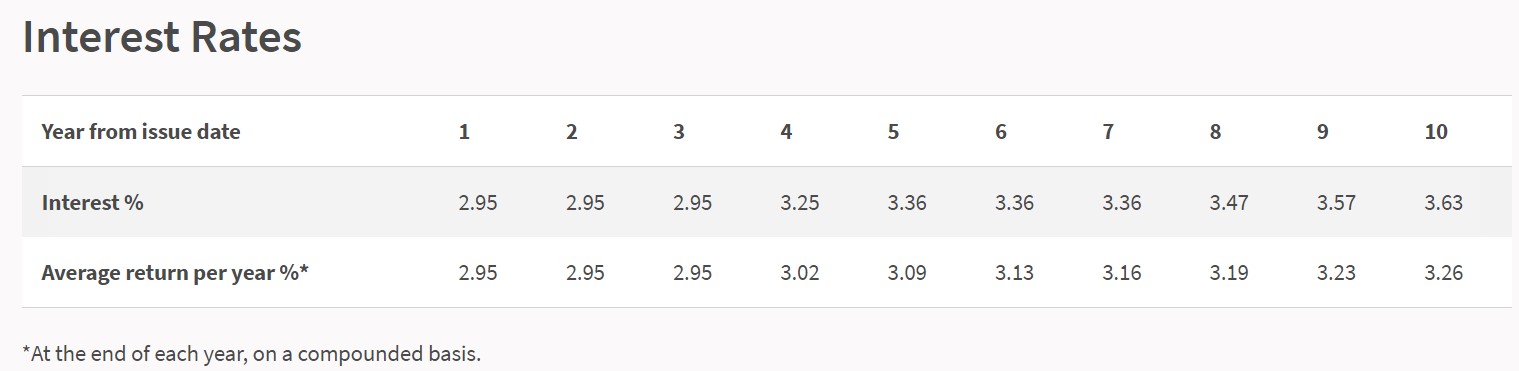

Interest rates for the Dec 2022 issue have been announced! The 10-year average return 3.26%. This is great news for people looking to grow their long-term savings in the coming year.

Source: Singapore’s Savings Bond Dec 2022 SBJAN23 GX23010Z Bond Details

If you buy $1,000 worth of Singapore Savings Bonds and hold them for 10 years, you’ll earn an effective rate of 3.26% per year—and get $328 in interest.

Rates are based on the average Singapore Government Securities (SGS) yields the month before. Interest rates “step up” (increase) each year. At issuance, interest rates for the entire 10-year term are fixed and locked in for each issue.

The SSB Is Backed By the Republic of Singapore. Singapore Savings Bonds(SSB) have a tenor of ten years and pay coupons semi-annually.

Think of the SSB as a “savings account” that allows you to earn interest from your savings. Unlike normal savings accounts, SSBs are not issued by banks or any other financial institution.

Instead, they’re issued by the Government of Singapore and backed by the Republic itself — which means that you can rest assured knowing that your investments in SSBs are guaranteed.

You can hold your bond for up to 10 years and earn interest that increases over time.

Other developed countries, such as the US and the UK, have issued savings bonds to retail customers. Neighbouring Malaysia and Thailand have similar programmes in place.

Every month, you can invest in SSBs through Supplementary Retirement Scheme(SRS) account, or use cash to apply for it. With regular fixed deposits, you need to invest a minimum sum upfront and lock it in for a certain period of time before you can withdraw your money. This means that there might be penalty fees if you withdraw your money early from a fixed deposit with the bank. You will not have this problem with SSBs, as you can withdraw them at any time without penalty fees!

The Singapore Savings Bonds are a type of bond that’s issued by the Government of Singapore. It’s similar to an investment bond, except that it’s usually targeted at retail investors with more modest sums to invest.

In simple terms, the SSB’s interest rate is variable. As such, the amount you can earn in interest fluctuates with time.

You can think of the SSB as a hybrid product between a fixed deposit account and a typical investment bond. Like a fixed deposit, you get your principal back when it matures. Like an investment bond, it pays you interest based on market conditions.

The interest rate of an SSB will increase over time, provided you hold on to it for at least 12 months from the date of purchase.

Interest rates are calculated based on your initial investment amount (also known as its principal). The longer you hold on to your SBS, the more interest it will accrue.

You can also redeem your principal investment and accrued interest anytime you want without any penalty.

Can Anyone Buy Them? Yes! If you’re a Singaporean citizen or permanent resident, you can buy them. And if you’re not a Singaporean citizen or permanent resident but fulfil the following criteria, then you can also buy them!

Singapore Savings Bonds are open to individuals aged 18 years and above who have a bank account with one of the three local banks (DBS, OCBC, UOB) and an individual CDP Securities account. – anyone who individual CDP account or an SRS account, and a bank account with DBS/POSB, OCBC or UOB in Singapore.

The minimum per bond purchase is: S$500. You can invest any amount at least $500 and in multiples of $500. So you can buy S$500, $1000, $1500 etc.

You can buy up to S$200,000 worth of savings bonds.

Each individual is allowed to hold a maximum of S$200,000 across all Savings Bond issues.

The minimum amount that can be bought is S$500, which means the most you can buy is 400 bonds. If you want to buy less than 400 bonds, it has to be in multiples of S$500.

A non-refundable $2 transaction fee will be charged by the bank for each buy application request.

You will need:

An individual CDP (Central Depository) account (for cash applications) or an SRS account (for SRS applications). Note: CPF funds are not eligible!

Steps:

Apply online through DBS/POSB, OCBC, and UOB or at ATMs or Internet Banking Portals. Make sure you have your CDP account number ready when you apply. A $2 transaction fee will be deducted from your bank account each time you apply.

for savings bonds are completed through an SRS operator’s Internet banking portal. A non-refundable $2 transaction fee will be charged by the bank for each application request. You cannot apply for savings bonds in person at the bank counters. Once submitted, application requests cannot be amended or cancelled.

MAS will allot savings bonds among applicants on the 3rd last business day of the month. The result will be announced online after 3pm on Allotment Day. Savings bonds will be issued on the 1st business day of the following month. If you invested using cash, you will be notified by CDP via mail of the amount of Savings Bonds allotted to you. You can check your holdings online through the CPD internet service (investors.sgx.com). You may also call CDP 6535 7511 for assistance.

Alternatively, you can log in to the My Savings Bonds portal to check and keep track of all your Savings Bonds holdings.

If you invested using Supplementary Retirement Scheme (SRS) account, your SRS operator will send you a letter telling you the amount of Savings Bonds allotted to you. You can also check your holdings of Savings Bonds with your SRS operator.

You can also log in to the My Savings Bonds portal with MAS (https://eservices.mas.gov.sg/ssb/) to view and track your bond holdings.

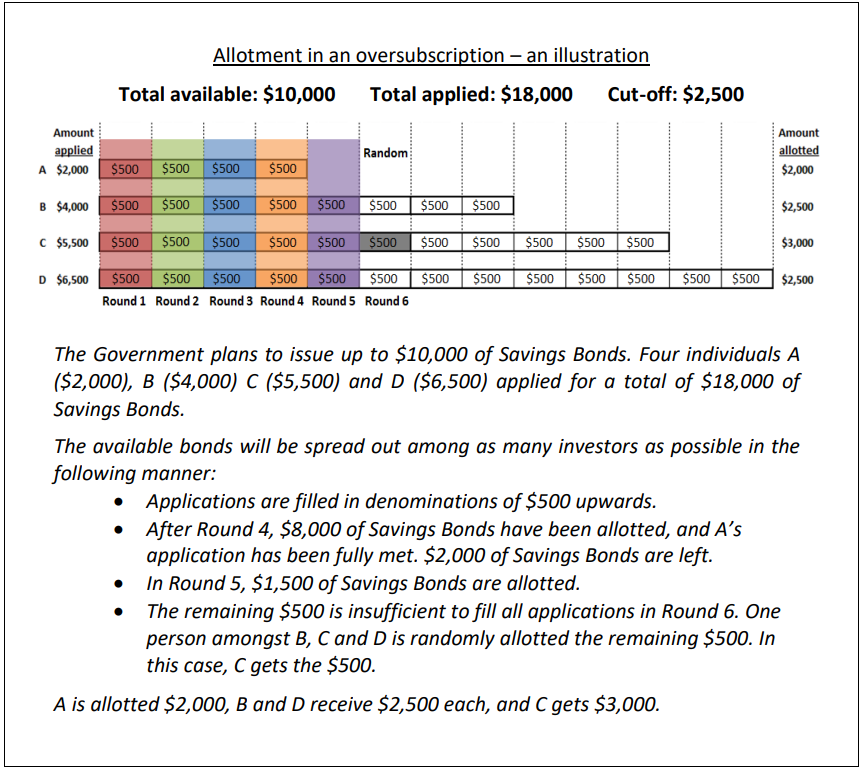

In the event that a particular issue is oversubscribed, you will not receive the full amount of your application.

Once the application period ends, MAS will add up all applications using cash and SRS funds. MAS will check that these applications do not exceed the Individual Limit and will distribute bonds to applicants.

When there are more applicants than bonds, each applicant receives at least $500 of Savings Bonds, with the amount increasing in multiples of $500 for every applicant until an applicant has received the full amount that he has applied for, or until all the available bonds have been allotted, whichever comes first.

If the applicants is so many that issuing $500 to each applicant will exceed the total issuance size, the bonds will be allocated on a random basis among applicants, at $500 each.

Lastly, if you have both cash and SRS applications and are partially filled due to oversubscription of the issue, your order will be allocated on a first-come-first-served basis according to the time of each application.

Each 10-year savings bond has a term of 10 years. At the end of those 10 years, your principal and the last interest payment will be automatically credited to your checking or savings account (for cash applications), or to your SRS account (for SRS applications). The process is automatic and transaction fee does not apply.

You can redeem your savings bonds in any given month before they mature, without incurring a penalty for exiting your investment early. To redeem, submit your request by the closing date through your bank or SRS Operator. The minimum redemption amount is S$500.

There are no fees for redeeming or Selling your SSB.

Savings Bonds pay interest every 6 months. If you redeem your bond, you get both the interest that is due and your original investment.

If you redeem the bond before the scheduled interest is paid, you will receive a pro-rated amount, called accrued interest.

If you bought $1,000 of savings bonds in January and it’s scheduled to make an interest payment of $6 in July,

If you submit a request to redeem the full $1,000 of your January bond by the end of June, you’ll receive the amount by the second business day of the following month, i.e 2nd business day of July:

However, if you decide to redeem earlier in March instead, you will receive by the end of the 2nd business day of April:

Source: Investing in Savings Bonds

Upon death, savings bonds can be transferred to beneficiaries according to the person’s will or under the intestacy law. These transfers are not subject to the individual limit of S$200,000.

Savings Bonds aren’t transferable, except in the event of a death.

The Singapore Savings Bonds (SSB) has always been a topic of the investment community. They are fixed-income securities issued by the Singapore Government, and they promise guaranteed returns, with virtually no risk of capital loss. It is a popular choice among retail investors who want a relatively safe investment with a decent return.

That’s because the SSB, which is like a fixed deposit that you can sell anytime. And unlike some fixed deposits, which charge you fees if you withdraw before maturity, there’s no penalty for doing so with the SSB.

There are other reasons why the SSB is popular — it has good liquidity and requires a lower minimum sum of $500 to invest in it — but I suspect most people buy it for its safety. and yield.

It’s no secret that Singapore Savings Bonds (SSBs) are one of the safest investments there is. But what are some cons to these bonds? Firstly, SSBs tend to have low returns compared to other fixed-income instruments.

These bonds also have a transaction fee of $2 per application. Additionally, if total applications exceed the total issuance size, you may be allotted less than the amount you applied for.

While SSBs tend to combat core inflation, they’re not likely to beat out overall/headline inflation or the consumer price index (CPI). This means that if inflation goes up and interest rates go higher, your interest rate will stay flat.

As of February 2022:

“Most economists expect core inflation to stay above 2% for 2022 after prices rose at fastest pace in 9 years” – Singapore’s core inflation eases to 2.2% in February

We’ve rounded up the pros and cons of Singapore Savings Bonds, so you can decide if they’re right for you.

SSBs are a safe and flexible investment solution, however their risks should be thoroughly considered before buying them. SSBs may not be a suitable investment vehicle if you expect to grow your money according to the market performance.

Also, for a shorter time period than 10 years, you might want to consider options like Safe Financial Products to Put Your Money to Work in this Low Interest Rate Environment.

However, if you plan to save for longer-term goals beyond 10 years, you may wish to consider a retirement-savings focused option that provides you with an opportunity to share in the profits of an insurance company’s par fund. Some of these retirement plans are bundled with great features such as providing you extra 100% income upon disability. The best way to compare such plans is by visiting our Retirement Plan Comparison page.

Source Image: https://quincemedia.com Did you know that 2 out of every 3 working adults in Singapore do not have enough…

: Secure Your Golden Years with the Right Choice Introduction In the sunny island nation of Singapore, making the right choice…

Comments are closed.

1 Comment