: Secure Your Golden Years with the Right Choice Introduction In the sunny island nation of Singapore, making the right choice…

3 Best Education Savings Plan in Singapore (Updated 2024)

To most parent or future parents, one of the immediate concerns of having kids is the cost it takes to support them. Out of all the main cost the parents must bear, the one that tops it all is the cost of tertiary education.

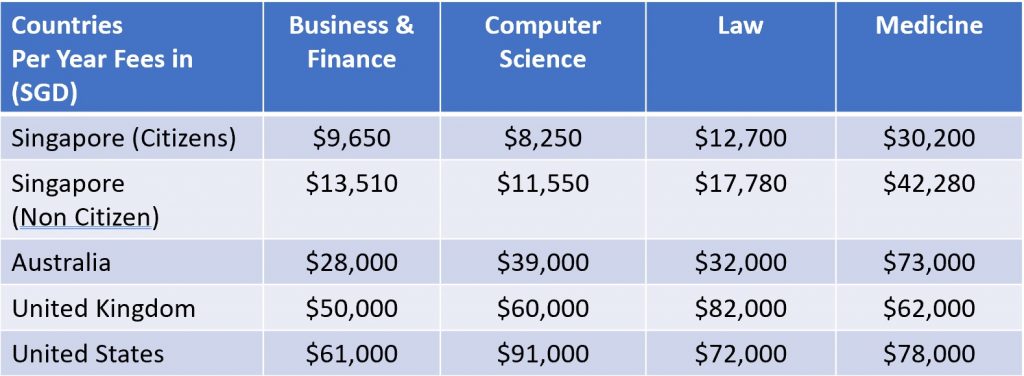

In Singapore, we have one of the most effective and lucrative education systems in the world, and for your kids to be able to meet their life’s potential via a prospect of a degree, the last thing we want is to hold them back due to our own financial in-capabilities. Here is a look at how much tuition fee per annum we may have to bear depending how capable is the academic capacity of your child and where you intend to place them in

This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. Read our General Disclaimer

(Source: various university websites)

As of 2023, the fees for a subsidised top local university is about $10,000 p.a. for a business degree. Hence for a 3 years course, it will be $30,000 excluding accommodation and living expenses

Bearing in mind inflation of 2.5% p.a., if your child was only born this year, you will have to factor in an increase of about 50 – 60% by the time he/she is ripe for Uni.

A typical education savings plan in Singapore typically offers an estimated 2-4% per annum average return, though these figures are based on standard projections provided by insurance companies.

These plans often come with coverage for children, with different insurers offering unique protection features, such as medical or child accident benefits, as well as a basic death and disability benefit. While some may consider investing in stocks or investment funds for potentially higher returns, these options lack principal guarantees and come with associated risks.

When choosing an education savings plan, it’s essential to consider factors like the effective interest rate, payout structure, and whether the plan is tailored for male or female children, considering the two-year compulsory national service that male children must complete before starting their tertiary education. Here we identify 3 insurers backed education plan that may fit into your financial objective.

Best Education Savings Plan with flexible withdrawal Option & retrenchment benefits

Manulife ReadyBuilder II

Benefits

- Payout Structure – Access to cash value & withdraw your money whenever you need it to fund key milestones in your life, can be structured to include other purposes such as legacy planning.

- Benefits – Enjoy Retrenchment benefit payout 50% of Regular premium and 12.5% of Single Premium

- Benefits – Enjoy Premium Freeze Option for 1 year

- Benefits – Appoint a Secondary life assured to pass on the accumulation to your loved ones

- Payment Term – Single Premium, 5,10,15,20 years

- Choice of payout – lump sum or partial withdrawal is allowed as long as there is cash value

- Underwriting – Guaranteed issuance if no optional riders are selected

- Principal Guaranteed – Principal and interests are guaranteed from 15th policy year

What we don’t like

- Other than death, terminal illness and total permanent disability, other variation of riders are not available on the child’s life

Best Education Savings Plan For flexible maturity date

Singlife ChoiceSaver

Benefits

- Payout Structure – Choose to withdraw a lump sum from the 10th – 25th year or at age 99 and can be structured as a legacy plan

- Benefits – Receive Additional 100% Sum Assured in the event of Accidental Death of Life Assured

- Benefits – Enjoy Interest Waiver for up to 12 months if retrenched or unemployed

- Benefits – Appoint a Secondary life assured to pass on the accumulation to your loved ones

- Payment Term – 5, 10, 12, 15, 18, 20 or 25 years

- Choice of payout – lump sum payout upon maturity, can be structured as a flexible maturity plan with maturity at age 99

- Underwriting – Guaranteed issuance if no optional riders are selected

- Principal Guaranteed – Principal and interests are guaranteed at maturity

- Riders – Easy Term, Payer Waiver Rider & CI Premium Waiver

What we don’t like

- No partial withdrawal allowed, only full surrender or draw out lump sum at maturity

- Retrenchment/Unemployed benefits are weak

Best Education Savings Plan with Shortest Principal Guaranteed Term @ 5th year

China Taiping i Wealth Saver

Benefits

- Payout Structure: Choose from policy terms of 10, 15, 20, or 25 years and premium payment terms, including single premium, 5, 10, 15, or 20 years.

- Capital Guarantee: Enjoy 100% capital guarantee as early as the end of the 5th policy year, ensuring the safety of your investment.

- Benefits: Maintain policy continuity with the Secondary Life Insured (SLI) option, providing added security.

- Benefits: Expect attractive and competitive maturity returns

- Premature Death Benefit: In the unfortunate event of premature death, the policy provides a lump sum benefit to beneficiaries.

What we don’t like

- Simple plan, no other option for policy payout term

As we can see, the 3 plans have different payout structure and benefit, we hope you can make a good decision with these write ups. The plans we choose has a reasonable timeframe that provides principal guarantee which is rare in endowment plans after the 1st July 2021 par plan projection repricing.

Here is what you can do next to get the best education savings plan.

Get all insurers quotes for the most competitive plan here !

A Licensed financial planner will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

Get Your Education Savings plan quotes here!

2 Comments