Manulife ReadyBuilder (II) review : An overview of the product

Manulife ReadyBuilder (II) review — it’s a savings plan that provides flexibility when growing your wealth. Life can be unpredictable. You may need to pause your premiums or get a Retrenchment Benefit in the event of prolonged unemployment to keep you financially safe in times of uncertainty. You can continue your wealth accumulation up to age 120 by appointing your loved one as new life insured.

What special features does this product offer?

This plan offers more than I expected.

The flexibility provided allows me to pause my premiums while keeping my policy in force, or receive a Retrenchment Benefit in the event of prolonged unemployment.

This helps to keep me financially safe in times of uncertainty.

What makes ReadyBuilder a good plan? Not the fact that it has premium payment terms options or the retrenchment benefit. It’s the fact that it is built around YOU.

- It provides flexibility when growing your wealth with the option to pause your premiums while keeping your policy in force or receive a Retrenchment Benefit in the event of prolonged unemployment to keep you financially safe in times of uncertainty

- You can also continue your wealth accumulation up to age 120 by appointing your loved one as the new life insured

- It has 5 premium payment terms options 5, 10, 15, 20 years or all at once with a single sum

Premium Freeze Option —Manulife ReadyBuilder review

Allows you to stop paying premiums while keeping your policy in force.

You may stop paying premiums for up to a year while your insurance policy stays in force, provided that it has been in effect for at least two policy years

Eligible to apply for premium freeze once if your selected premium payment term is 5 years; or up to 2 times if your selected premium payment term is more than 5 years.

Retrenchment Benefit —Manulife ReadyBuilder (II) review

Get a lump sum payout and minimize disruption to your retirement goals.

If you are retrenched and remain unemployed for a minimum period of 30 days, during the premium payment term or up to your 65th birthday, whichever comes sooner, the plan pays you 50% of the total annual mode premium in 1 lump sum.

Waiver of Premium on TPD —Manulife ReadyBuilder (II) review

For added assurance, all future premiums will be waived in event of total and permanent disability (TPD)

On the Basic Plan, if your life insured suffers TPD before their 70th birthday, they will not charge you any future premiums on that plan.

Access to your cash value up to Age 120 —Manulife ReadyBuilder (II) review

Allows you withdraw from the cash value.

Whenever cash value is available, you may take that money in the following ways:

(a) Withdrawal of Bonus; or

You may withdraw the cash value of any accumulated bonuses on your policy. The death benefit and future cash value will be reduced.

(b) Surrender the Policy

You may choose to surrender some or all of the policy for cash. The minimum amount for a partial surrender is $500.

Change of Life Insured

Allows you appoint your loved ones as your policy’s new life insured to continue your wealth accumulation.

After two years, you may request that the life insured be changed. You must have an insurable interest in the person at the time of the change (for example spouse or child).

Loss of life and Terminal Illness Coverage

The plan also provides coverage for loss of life and Terminal Illness (TI).

If you die during the policy term, It will pay either (1) 105% of the total premiums paid or (2) 101% of the total surrender value (whichever is greater)

Example—How does ReadyBuilder help you grow your savings?

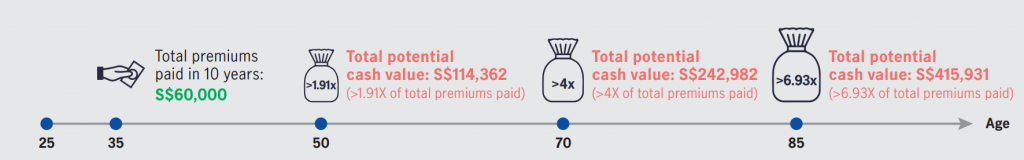

Tom, aged 25, bought a ReadyBuilder (II) plan with monthly premium of $500 and chooses a premium payment term of 10 years.

Total premiums paid in 10 years: $60,000

Total potential cash value:

| Age 50: |

$114,362 (>1.91X of total premiums paid) |

| Age 70 |

$242,982 (>4X of total premiums paid) |

| Age 85: |

$415,931 (>6.93X of total premiums paid) |

Source: Manulife

Who will find this product useful? —Manulife ReadyBuilder review

The Manulife ReadyBuilder plan is an endowment plan that allows you to save for your child’s education, or personal goals.

- If you are looking for value-for-money endowment plan

- People who want to have disciplined saving habits

- Those who want to save money

You can choose a single premium payment option, or a regular premium payment option, which allows you to pay in instalments over a period of time. The regular premium payment option allows you the flexibility to adjust the frequency of your payments (monthly/quarterly/annually) and the amount that you would like to pay during each payment period.

Think of this product as a piggy bank that helps you save money while giving you the flexibility to make withdrawals when you need them most.

Takeaway: To know more about this product, request for a free quote now!

Protect your wealth while it grows with ReadyBuilder.

Manulife ReadyBuilder provides you with a range of options that allow you to control how—and when—you save your money, including:

- Taking a premium holiday (i.e., pausing your premium payments while keeping your policy in force)

- Receiving a Retrenchment Benefit in the event of prolonged unemployment

Build your savings with the Manulife ReadyBuilder, a plan that helps you save money. Whether you’re a millennial looking to purchase a house in 5 years or an older person who’s about to retire, ReadyBuilder can help you reach your savings goal.

3 Comments