4 Savings Strategies You Need If You Don’t Have Savings To Last

Source Image: https://quincemedia.com

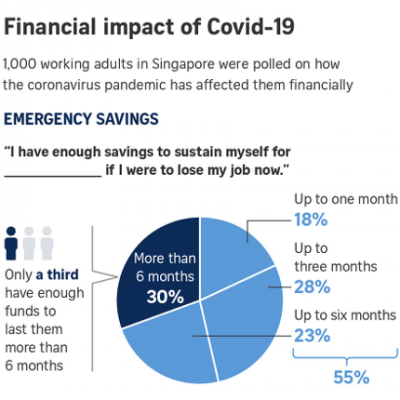

Did you know that 2 out of every 3 working adults in Singapore do not have enough savings to last them beyond 6 months? Indeed, according to OCBC’s survey, many of us can’t sustain our current lifestyle if we are more than 6 months unemployed. This can be attributed to a variety of factors such as lifestyle inflation, lack of savings strategies and the urge to spend on credit.

Did you know that 2 out of every 3 working adults in Singapore do not have enough savings to last them beyond 6 months? Indeed, according to OCBC’s survey, many of us can’t sustain our current lifestyle if we are more than 6 months unemployed. This can be attributed to a variety of factors such as lifestyle inflation, lack of savings strategies and the urge to spend on credit.

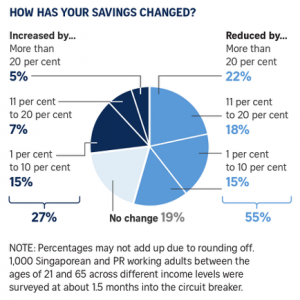

Source: OCBC, Straits Times

If you are one of those facing the challenge of depleting savings, here are some saving tips that we think can help you turn the situation around.

-

Automate Your Savings So That You Won’t Have The Urge To Spend

For some of us, you might have this unexplainable urge to spend whenever you see money in our bank account. It is hard to explain why there’s such an urge to spend when you see extra cash lying around in your savings account. If you can relate to this, then here’s what you need to do.

The solution you need is actually really simple. All you have to do is to automate your savings into another account every time you receive your salary. If you just keep enough for your expenses in your ATM account, you won’t see the extra cash. In that way, you won’t have the urge to spend.

-

Start Practicing The 50-30-20 Rule

Another reason for the lack of savings is the absence of good savings discipline. Rather than prioritizing your savings first, you prioritize your spending first. You only save whatever you are left with at the end of the month. Instead of doing that, you need to switch your mindset to a save-first mode. You can do this by practicing the 50-30-20 rule.

The 50-30-20 rule is a guideline for you to split your monthly income into savings (50%), expenses (30%) and wants/retirement savings (20%). This ensures that you practice good savings discipline to save at least 50% of your monthly income. Adherence to the 50-30-20 rule also ensures you do not overspend past 30% for your expenses.

-

Create A Forced Savings Mechanism For You To Save

What happens if you really can’t practice good saving habits? If that’s happening to you, then you might have to resort to a forced savings mechanism. A forced savings mechanism can be created in various ways such as signing up for a savings plan or investing in a property. With a savings plan and/or property, you are committed to paying a regular amount from your bank account every month. Since it is a legal obligation, you can’t run away from it, which forces you to “save” in the form of an asset.

-

Set A Savings Goal For Yourself

One possible reason why you can’t save is because you don’t have a target in mind. Without a target in mind, you won’t know how much to save and whether you are making good progress. That’s why it is important to first set a savings goal for yourself so that you know what you are aiming for.

As a starter, you should aim to have at least 6 months’ worth of income as your emergency expense. If you already have that kind of savings, the next level is to aim for 9 or 12 months’ worth of income.

What’s Next After You Hit Your Savings Target?

Once you start putting these savings strategy into action, you will bound to hit your savings target within the next 12 months. Once you have the basic foundation of savings in place, you need to consider about the next level of financial planning, i.e. how to grow your wealth. This is when you can reach out to Moneyline.sg to start making plans for your retirement or budgeting for the next stage of life (e.g. kids, marriage).

2 Comments