3 Best Endowment Savings Plan With Flexible Withdrawal and Can Be Pass On to the Next Generation

If you have gotten an endowment savings plan in the yesteryears, you might have figured out that a typical endowment plan comes with the following limitations.

- Fixed maturity period

- Partial withdrawal requires taking up a policy loan

- No or low guaranteed breakeven even at maturity

- Lump-sum pay-out upon the life assured’s death, no option to continue the purpose of the long term accumulated growth to be passed on to the next generation

Hence, before you decide to take up a new endowment savings plan with the above limitations, you will be glad that you have come across our page because the 3 plans we are about to share with you may rattle your decision.

Read also: Best 3 Retirement Plans in Singapore

We select our best 3 plans based on the following criteria

- Lifetime maturity capability

- Flexible to partial withdrawal with no penalty and without taking a policy loan

- Guaranteed issuance – no medical or simplified medical underwriting

- Ability to transfer the plan to a 2nd life assured

Our Top 3

- Best endowment savings with premium freeze option – Manulife Readybuilder

- Best endowment savings with life stages benefit pay-out – Aviva MyLifesavings

- Best endowment savings with earliest principal guaranteed – NTUC Gro Gen Saver (Formerly known as “Revogift”)

Best Endowment Savings Plan with Premium Freeze Option

Manulife ReadyBuilder

The main feature of Manulife ReadyBuilder is that it allows the policy owner to enjoy premium holiday for the up to 2 times after a minimum of 2 full premium terms has been paid.

What to look out for on this benefit

- No bonus declaration during the 1 year premium freeze

- Exercisable for one time for 5 years premium term

- Exercisable for two times for 10/15/20 years premium term

What we like about Manulife ReadyBuilder

- Premium term of Single Premium/5/10/15/20 years (Plan is SRS Eligible for Single Premium)

- Withdraw cash anytime without penalty as long as there is cash value

- Plan accumulates till primary life assured reaches 120 years

- Guaranteed breakeven on 15th policy years for SP/5/10/15/20 years premium term

- Option to transfer to a secondary life assure up to 3 times

- 2 years interest-free loan of up to 50% cash value any time after the premium payment term

What we don’t like

- No joint-life application allowed

- No additional cash benefit features

Available riders

- Joint Life Premium Waiver

- Easy Payer Premium Waiver

- Cancer Premium Waiver

- Critical Illness Premium Waiver

- Payer Critical Illness Premium Waiver

Best Endowment Savings Plan with Life Stages Benefit Pay-Out

Aviva MyLifeSavings

The Aviva MyLife Savings Plan provides a cash payout of 3% sum assured from the 5th policy year upon reaching two separate life milestones.

What to look out for on this benefit

- 2 out of any of the following 4 events, change in marital status; buy new property; life assured or child enrolling into tertiary education; new born.

What we like about Aviva MyLifeSavings

- Premium term of 5/10/15/20/25 years

- Withdraw cash anytime without penalty as long as there is cash value

- Plan accumulates till primary life assured reaches 99 years old

- Guaranteed breakeven on 15th policy years for 5/10/15 years premium term, 20th policy year for 20 years premium term & 25th policy year for 25 years premium term

- Option to change life assured even with a joint life assured

- Leaving a legacy – Death benefit to be paid out when the last of the 2 joint life assured dies

What we don’t like

- Not eligible for SRS Savings

- Maturity till primary life assured reaches age 99, other two plans are 120 years old

Available riders

- Critical Illness Premium Waiver

- Cancer Care Premium Waiver

- Payer Benefit Rider

- Payer Benefit Plus Rider

Best Endowment Savings Plan with Earliest Principal Guaranteed

NTUC Income Gro Gen Saver Formerly “RevoGift”

The NTUC Gro Gen Saver provides an early principal guaranteed on the 10th policy year if Single premium feature is chosen.

What to look out for on this benefit

- Principal is guaranteed on the 10th policy year for Single Premium Term

- Principal is guaranteed on the 13th policy year for other regular premium term

What we like about NTUC Gro Gen Saver Formerly “RevoGift”

- Premium term of Single Premium/5/10/15/20 years (Plan is SRS Eligible for Single Premium)

- Withdraw cash anytime without penalty as long as there is cash value

- Plan accumulates till primary life assured reaches 120 years

- Option to transfer to a secondary life assure up to 3 times

- Retrenchment benefit of up to 6 months premium waiver

- Premium Waiver upon Policy Owner TPD

What we don’t like

- No joint-life application allowed

- No additional cash benefit features

- Lack of Riders

Available riders

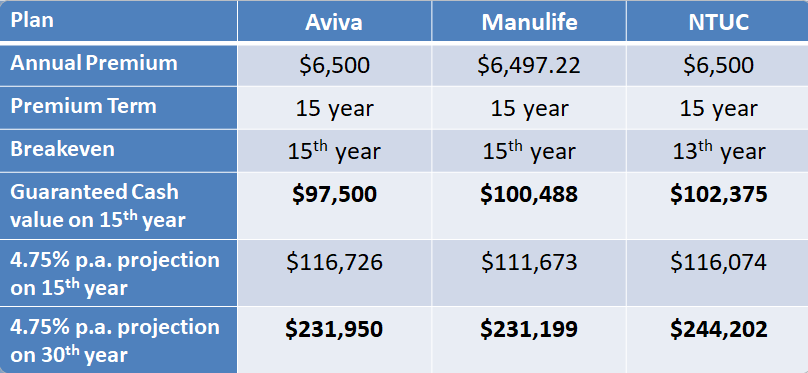

15 years premium term comparison Age 40 Male

What do you do next?

Get all three insurers quotes

A Licensed Planner will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

3 Comments