Health Insurance: How To “Get Rid” Of Deductibles Effectively?

One of the common questions that we hear from clients and friends is, “What is health insurance deductibles?”. After explaining the concept of deductibles to them, the next question that follows is, “How can we get rid of it?”.

We think that it is time someone steps up to fill this knowledge gap and explain once and for all what exactly deductibles is and what are the solutions to “get rid” of it.

MediShield Life: Health Insurance Deductibles, Coinsurance And Claim Limit

While Singapore does have a good healthcare system and a nationwide health insurance coverage under MediShield Life, you would be mistaken if you think that Singapore is like those welfare states in Europe.

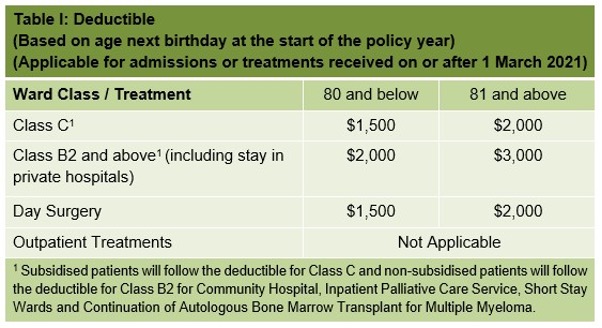

Although every Singaporean is covered by MediShield Life, the reality is that there is a deductible of up to $3,000. The deductible amount is slightly lower at $2,000 if you are below age 80.

Source: CPF Board

Having a deductible of up to $3,000 means that you will need to fork out $3,000 from your pocket before you can start claiming against MediShield Life.

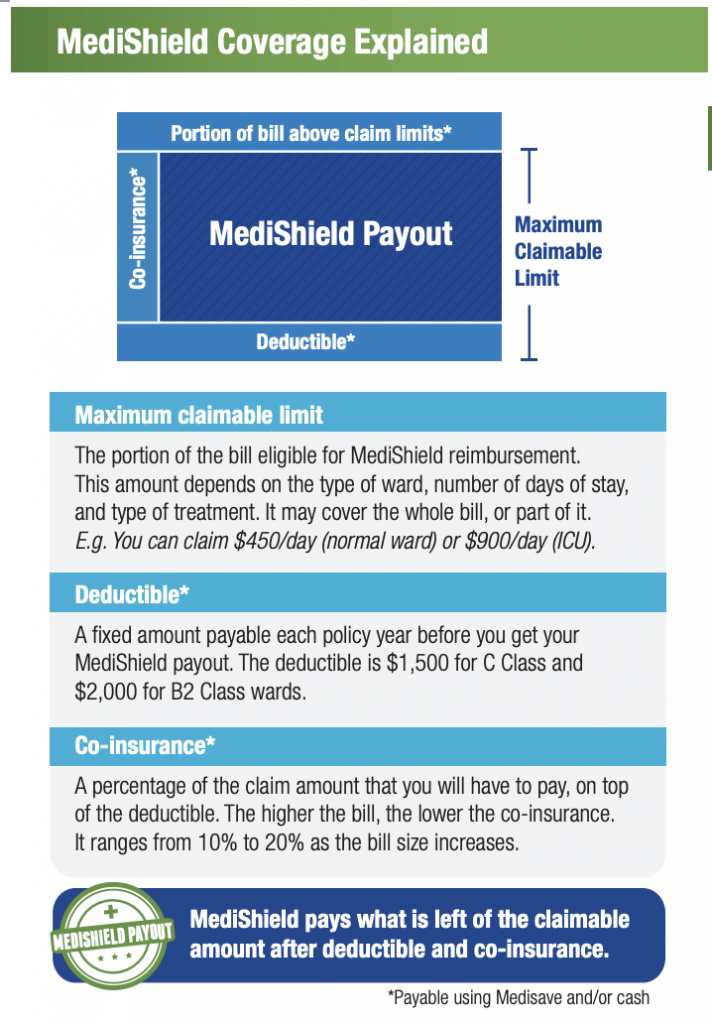

Source: CPF Board

On top of the deductible, there’s also coinsurance. Even after you have already forked out cash from your own pocket (or Medisave) for the deductible, you still have to pay for the coinsurance.

In simple terms, coinsurance means that you need to pay a part of the amount covered by MediShield Life, which is around 10-20% of the medical bill.

Not to forget, there is also a claim limit. If your hospital bill is too hefty and exceeds the claim limit, you will also need to pay for the overspill of hospital bills on your own.

Want To Upgrade To Class A Or Private Care? Upgrade To Integrated Shield Plan

But what if you want to upgrade your hospital coverage to Class A or even private hospital?

Unfortunately, MediShield Life will only pay for your basic healthcare coverage. Any kind of medical care above Class B1 is considered non-essential. Thus, they are not covered by MediShield Life.

That said, you can still defray the cost of a more comfortable stay at the hospital but simply upgrading your MediShield Life coverage with an Integrated Shield Plan.

With Integrated Shield Plan, you can insure against pre and post hospitalisation treatments. It also allows you to increase your hospitalisation coverage to cover Class A, B1, or private hospitals, unlike MediShield Life which only covers up to Class B2.

Need an upgrade for your MediShield Life? Find out which Integrated Shield Plan suit your needs here.

Want To Avoid Health Insurance Deductible? Pair Integrated Shield Plan With A Rider

Then what about the deductibles? Although Integrated Shield Plan comes with a higher tier of hospitalisation coverage up to private hospitals (depending on your plan), you still need to pay for your deductibles.

If you really want to avoid paying for the deductibles, there is a way too. And it’s simple. You just need to tag on a rider when you buy your Integrated Shield Plan. That will defray most of the healthcare cost, except for the 5% co-payment mandated by the government to prevent overconsumption (read: abuse) of healthcare services.

Find out here about the benefits you can enjoy if you buy an Integrated Shield Plan with a rider.

Need Medical Help From A Non-Panel Doctor? Consider A Hospital Cash Plan

If you already have MediShield Life, an Integrated Shield Plan and a rider, you should be safe from deductibles, right? Well… Not quite. That’s because most Integrated Shield Plans have a selected panel of doctors that they work with. If the specialist that you are consulting does not fall under the panel list, then your case will be classified under a non-panel doctor.

While the insurer will not stop you from doing so, the implications of seeking care from a non-panel doctor is that you will be slapped with some deductibles (again). That’s because insurers want to encourage you to seek medical help from the panel of doctors that they have curated. Most of these doctors follow a strict protocol and insurers are confident that they won’t overcharge for any medical treatment.

But what if you really need to seek a non-panel doctor? What can you do?

The straightforward answer is to supplement your Integrated Shield Plan with a Hospital Cash Plan. As the name suggests, Hospital Cash Plan pays out a daily cash amount if you have to spend time in the hospital.

With the Integrated Shield Plan already covering in-hospital or emergency treatments, Hospital Cash Plan provides cash payout that is NOT related to actual expenses incurred at the hospital. Having the extra cash lets you pay for the deductibles of a non-panel doctor in the event you need to seek help from one.

Learn more about how a Hospital Cash Plan can help you to supplement the coverage from an Integrated Shield Plan.

A Personal Accident Plan Works Too, But Only When Accidents Occur

Alternatively, you can also buy a Personal Accident Plan. The Personal Accident Plan not only helps to cover medical bills, it also covers the loss of income. However, the caveat is that the medical bills and loss of income needs to be a result of an accident.

Not Sure How Extensive Your Health Insurance Coverage Needs To Be?

We know, understanding the health insurance coverage and navigating through the terminologies like deductibles, coinsurance and claim limit can be. We hope that this article has helped to shed some light on the hacks you can take to ensure that you have adequate health insurance coverage.

If you are still unsure, drop us a message below and we will arrange for a financial review session with you. We will help you to assess your current financial status and health insurance portfolio. We will then provide the best recommendations to work with you to get the coverage that you need.

2 Comments