Copay, Coinsurance, and Deductible: Choosing Health Insurance in Singapore

When it comes to health insurance in Singapore, understanding the various components is crucial for making informed decisions. Among the factors that significantly impact your coverage and out-of-pocket expenses are copay, coinsurance, and deductible. In this blog, we will delve into these key factors and discuss their implications for choosing the right health insurance plan in Singapore. By the end of this article, you’ll have a clearer understanding of how copay, coinsurance, and deductibles work, and be better equipped to make informed decisions about your health insurance coverage.

I. Copay: Paying Your Share

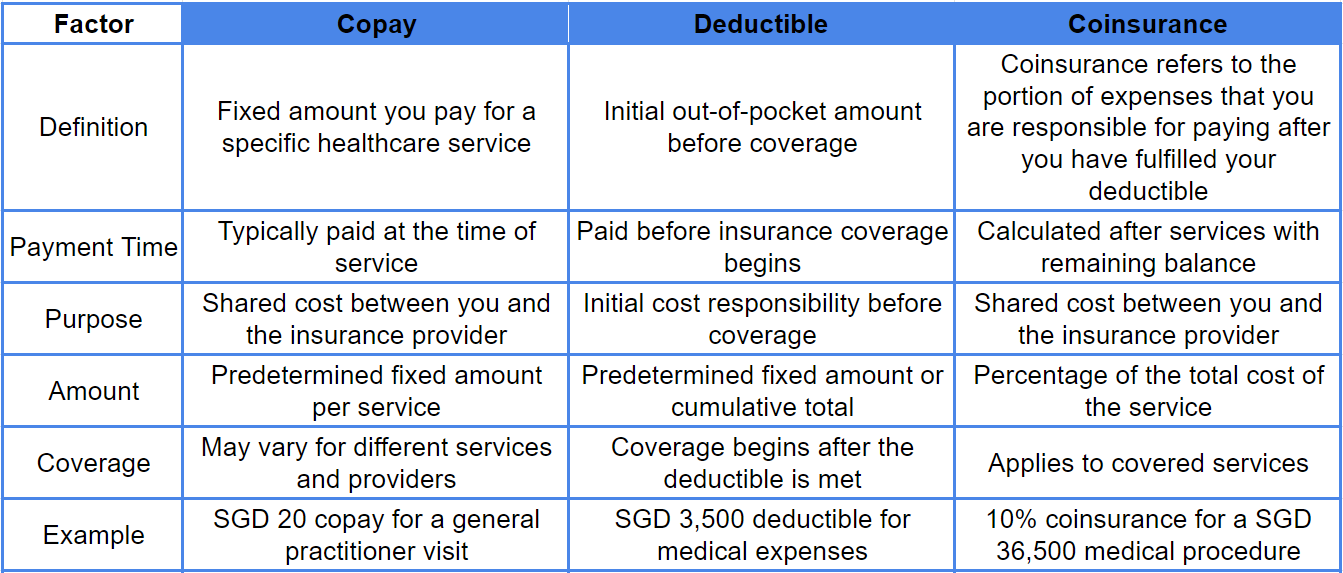

Copay, also known as a copayment, is the fixed amount you pay for a specific healthcare service. This predetermined fee is usually paid at the time of service, such as when you visit a doctor’s office or a pharmacy to collect medication. The purpose of copay is to share the costs of healthcare between you and the insurance provider.

In Singapore, copay amounts can vary depending on the insurance plan and the type of service received. For example, you may have a copay of SGD 20 for a general practitioner visit, while specialist visits could have a higher copay, such as SGD 100 or more. It’s important to review the copay amounts listed in your health insurance plan to understand how much you’ll be responsible for paying when seeking medical care.

II. Deductible: Meeting the Initial Cost

A deductible is the amount you must pay out of pocket before your insurance coverage begins to take effect. It acts as a threshold, and once you meet the deductible, the insurance provider will start covering a portion or the full cost of your healthcare expenses, depending on the terms of your plan.

For example, if you have a deductible of SGD 500 and incur a medical bill of SGD 2,000, you would need to pay the first SGD 500, and the insurance provider would cover the remaining SGD 1,500, subject to any applicable copay or coinsurance.

When choosing a health insurance plan in Singapore, consider the deductible amount carefully. A lower deductible means you reach your coverage limit sooner but may come with higher premiums. On the other hand, a higher deductible typically translates to lower premiums but requires you to pay more out of pocket before your insurance coverage kicks in.

III. Coinsurance: Sharing Costs Proportionally

Coinsurance refers to the portion of expenses you are responsible for paying after fulfilling your deductible. Coinsurance is a cost-sharing mechanism between you and the insurance provider, where you pay a certain percentage of the covered expenses. Unlike copay, which is a fixed amount, coinsurance is a percentage that is applied to the total cost of the healthcare service or treatment.

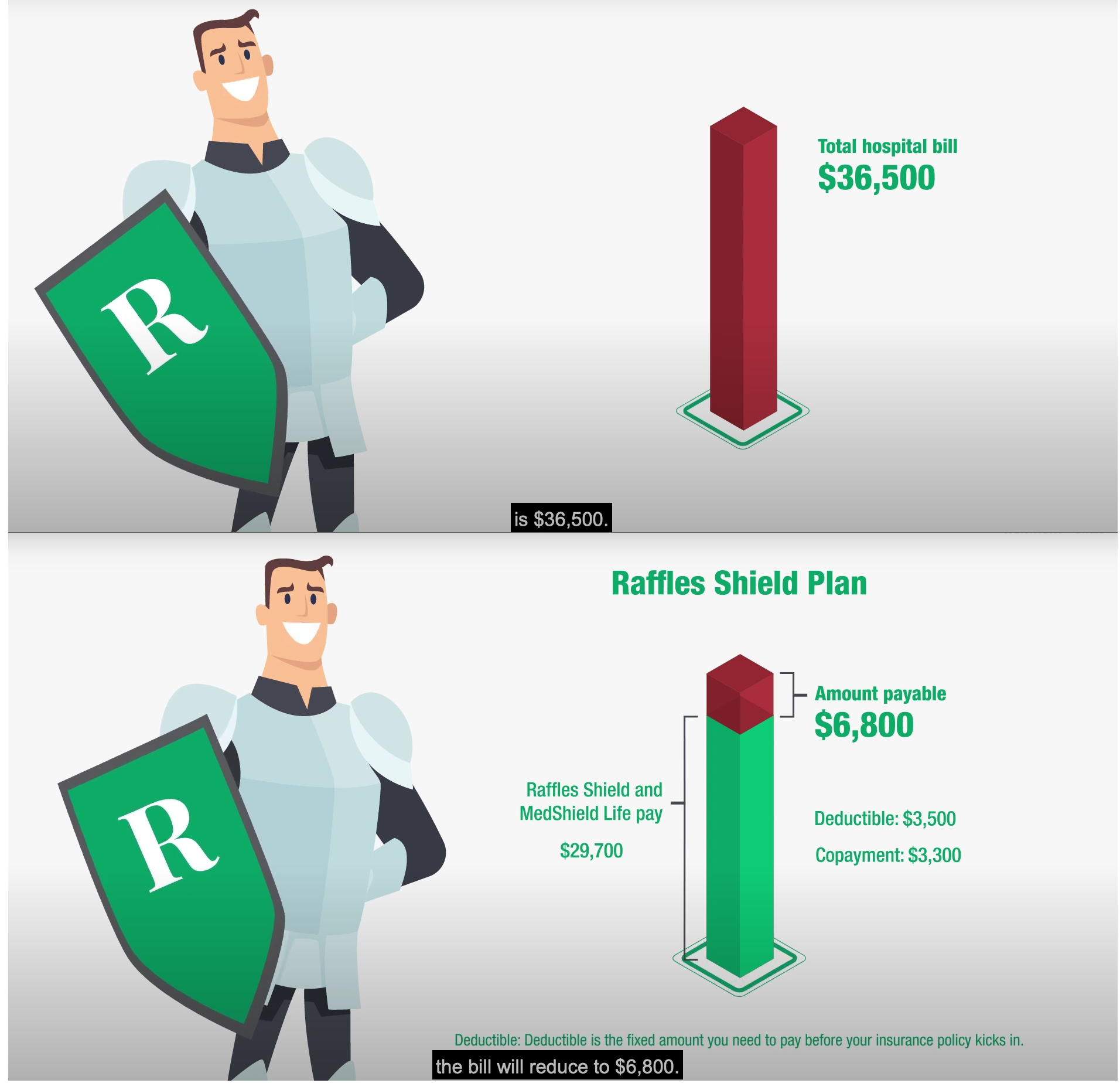

For instance, if you have a deductible of $3,500, a coinsurance rate of 10% and the total cost of a medical procedure is SGD 36,500, you would be responsible for paying SGD 3,300 (10% of SGD 36,500 after less deductible of $3,500), while the insurance provider covers the remaining SGD 6,800.

In Singapore, coinsurance rates can vary depending on the insurance plan and the type of service or treatment / ward type. It’s essential to review and compare different plans to find the one that offers the most favourable coinsurance terms for your healthcare needs.

Source: Raffles Health Insurance

IV. Factors to Consider When Choosing Health Insurance [Copay, Coinsurance, and Deductible]

- Your healthcare needs: Evaluate the types of services and treatments you require regularly and choose a plan that offers comprehensive coverage in those areas.

- Budget and affordability: Consider your budget and how much you can comfortably afford in terms of premiums, copay, coinsurance, and deductibles.

- Provider network: Ensure that the health insurance plan you choose has a network of healthcare providers that meet your preferences and needs.

- Coverage limits: Review the coverage limits and ensure they align with your anticipated healthcare expenses.

- Policy terms and conditions: Carefully read and understand the terms and conditions of the health insurance policy, including any exclusions or waiting periods.

V. Comparing Health Insurance Plans [Copay, Coinsurance, and Deductible]

To make an informed decision when choosing health insurance in Singapore, it’s essential to compare different plans and evaluate their copay, coinsurance, and deductible factors. Consider the following aspects during your evaluation:

- Cost-sharing structure: Assess the copay, coinsurance rates, and deductibles of each plan. Compare how these factors align with your budget and healthcare needs.

- Out-of-pocket maximum: Check if the plans have an out-of-pocket maximum limit. This is the maximum amount you would have to pay in copay, coinsurance, and deductibles within a policy period. Once you reach this limit, the insurance provider covers all remaining costs.

- Network coverage: Review the provider networks of different insurance plans. Ensure that the plan includes your preferred doctors, hospitals, and specialists. Consider whether you are comfortable with a restricted network or if you prefer a broader network for greater flexibility.

- Pre-existing conditions: If you have pre-existing conditions, check how the insurance plans handle coverage for such conditions. Some plans may impose waiting periods or exclusions for pre-existing conditions, which can affect your ability to receive comprehensive coverage.

- Additional benefits: Look beyond copay, coinsurance, and deductibles. Consider other benefits offered by the plans, such as maternity coverage, preventive care, mental health services, or wellness programs. These additional benefits can enhance the value of the insurance plan.

VI. Seeking Professional Advice

Navigating the complexities of health insurance can be overwhelming. Consider seeking guidance from a licensed insurance agent or financial advisor. They can provide valuable insights, help you understand the fine print of different policies, and assist in choosing a plan that aligns with your specific needs and budget.

Insurance professionals can analyze your healthcare requirements, assess your risk tolerance, and provide personalized recommendations. They can also explain the intricacies of copay, coinsurance, and deductible factors, ensuring you have a comprehensive understanding before making a decision.

Remember to ask questions and clarify any doubts you may have. Insurance professionals can provide clarity on terms and conditions, coverage limits, claim procedures, and the overall claims process. Their expertise can save you time and effort, ultimately leading you to make a well-informed decision regarding your health insurance coverage.

VII. Takeaway: Navigating Copay, Coinsurance, and Deductible for Informed Health Insurance Choices

Choosing the right health insurance plan or integrated shield plan in Singapore involves careful consideration of copay, coinsurance, and deductible factors.

By understanding these components and assessing your healthcare needs and financial capabilities, you can make an informed decision. Remember to review different plans, compare their features, and seek professional advice if needed. With the right health insurance coverage, you can protect yourself and your loved ones from unexpected medical expenses, ensuring peace of mind and financial security.

Ready to choose the right health insurance plan in Singapore? Contact us today for expert guidance and personalized recommendations tailored to your healthcare needs and budget!