FWD Invest First Max: 7 Key Features Why FWD Invest Max Is Unlike Your Ordinary ILP

FWD recently released a new investment-link policy (ILP) into the market: FWD Invest Max. After an initial look into FWD Invest Max, we realised that there are many interesting features about it that warrants us to do a comprehensive writeup about it.

We think it deserves its own featured analysis so that our readers can understand how to take advantage of this new ILP.

Disclaimer: This is not a product recommendation

7 Key Features That Makes FWD Invest Max Unlike Your Ordinary ILP

-

Access to Accredited Investor Fund

-

Let Bonuses Build Your Retirement Nest For You

The feature that make FWD Invest Max attractive to use as a retirement planning tool is its bonuses. FWD Invest Max comes with three types of bonuses that every policyholder can qualify for:

Booster Bonus: For First Two Years

The Booster Bonus is a bonus that is paid out on the first two years of your policy inception. It is calculated on a simple formula:

The general rule of thumb is, the higher your regular premium, the more Booster Bonus you will receive.

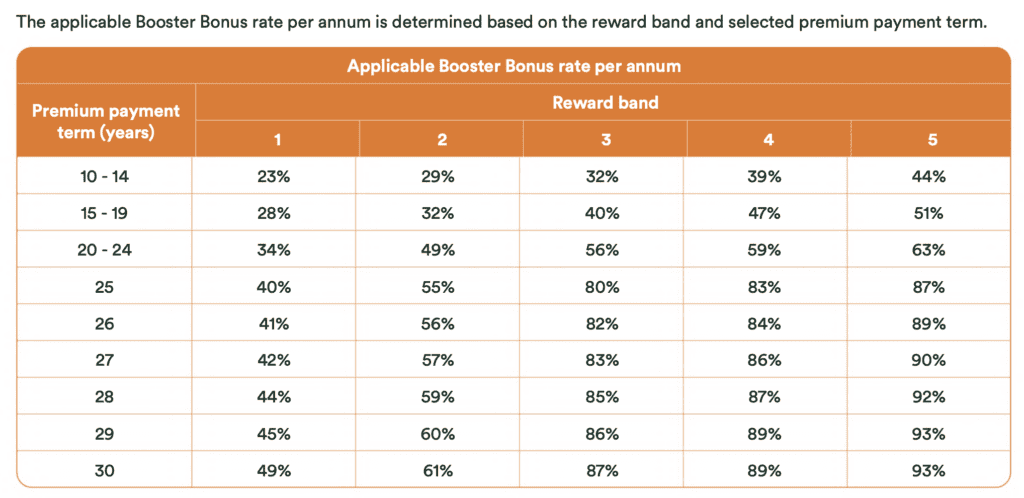

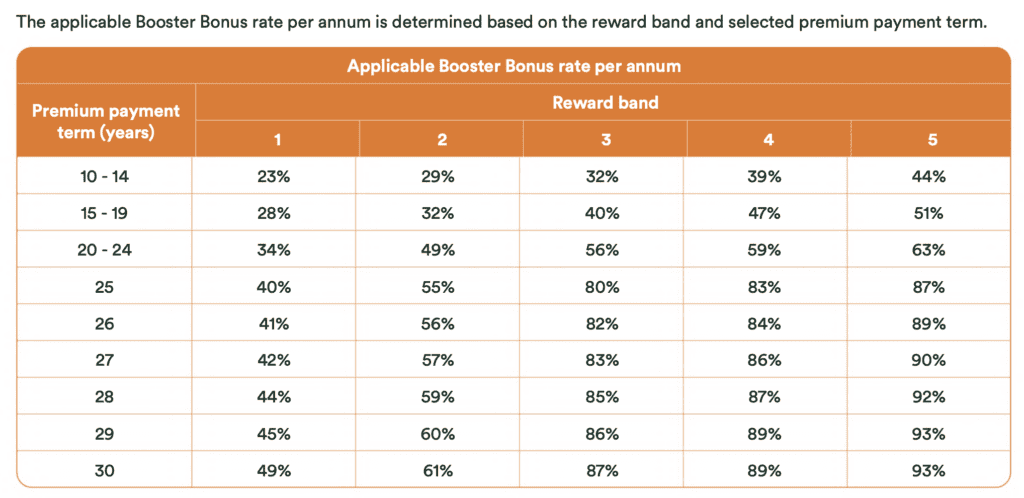

To figure out the exact Booster Bonus you qualify for, you first need to determine your reward band. This is based on your annualised regular premium (i.e. monthly premium x 12).

Source: FWD

An easy way to interpret this is to think of it in increments of $1,000. For every $1,000 monthly premium you contribute, you will move into the next tier of reward rate. Of course, some of us prefer to pay our premiums once (annual) or twice (semi-annual) a year. For simplicity, the reward bands are calculated at an annualised rate.

Source: FWD

Another factor that affects how much Booster Bonus you will receive is the number of premium payment years on your policy. In general, the longer you continue to pay premium for, the higher Bonus Booster rate you will enjoy.

The maximum Booster Bonus you can enjoy will be 186% of your annualised regular premium. This means that you qualified for reward band 5 (i.e. annualised regular premium of ≥$48k) and your premium payment term is 29 or 30 years.

With that, you will get 93% of your annualised regular premium as bonus for each of the first two years, which adds up to 186%.

Loyalty Bonus: From Third Year Onwards

With the Booster Bonus, it ends after the second year of the policy inception. However, the beauty of FWD Invest Max is that you will then enjoy the Loyalty Bonus from the third year onwards. This means that you will be enjoying bonuses on every single year of your policy.

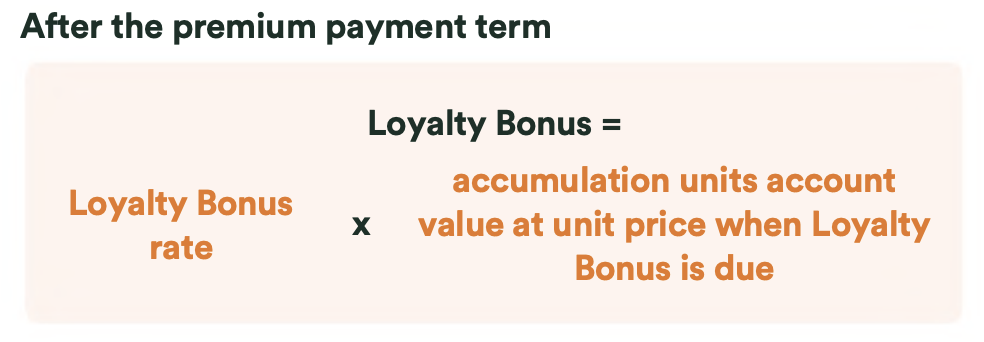

Source: FWD

The Loyalty Bonus is calculated by adding a bonus rate to the existing assets you have accumulated on your FWD Invest Max. Depending on which year you are in the policy, you will get either a 0.7% or 1.1% bonus rate.

Source: FWD

Because FWD Invest Max allows you to make withdrawals during the year, your Loyalty Bonus will be adjusted if you choose to make a withdrawal. However, if you don’t make any withdrawals, you will not be subjected to any adjustments.

Accumulation Bonus: At Regular Intervals Through The Policy From 10th Year Onwards

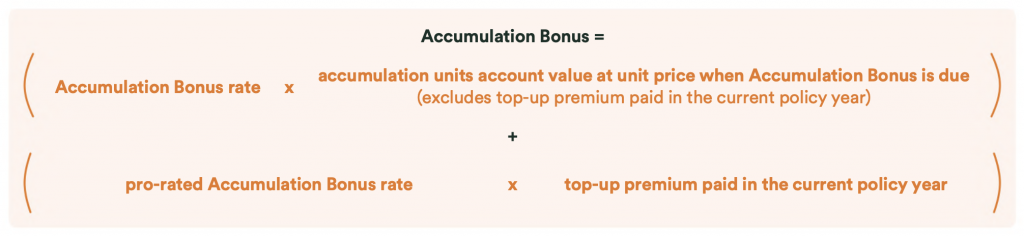

For the Booster Bonus and Loyalty Bonus, they are predefined and in effect at the point of policy inception. On top of those, you will also enjoy a one-time bonus from FWD at interval years of your policy through the Accumulation Bonus. Note that this starts from the 10th year onwards.

Source: FWD

The Accumulation Bonus is determined by your premium payment term. The longer your premium payment term, the more Accumulation Bonus you will enjoy.

For example, if you have a 20-year premium term, you will get an Accumulation Bonus in the 10th, 15th, and 20th years of your policy. Each time you will get a 2% top up multiplied by the existing assets under your FWD Invest Max policy in that year.

Source: FWD

In addition, you can earn even more Accumulation Bonus by making a one-off top up to your FWD Invest Max if you have additional cash on hand. If you choose to do that, the top up will also qualify for an Accumulation Bonus.

Note that since the top up will not be made at the start of the year, it will be pro-rated by the number of days remaining in the year.

For example, if you make the top up at the mid of the year, the pro-rate will be ~50% (183 days / 365 days = ~50%).

Therefore, if you want to maximize your Accumulation Bonus, make the top up as early as possible at the start of the year.

-

Take A Break When You Need It

As with any type of investments, the longer you keep the money invested, the more you will get at the end of the policy. But what if you have some emergency expense that you didn’t plan for?

With FWD Invest Max, it comes with an emergency withdrawal feature. This means that if you need access to your money for any unforeseen spending, you can make a withdrawal without any penalty. You can do so starting from the 25th month when your Booster Bonus period ends.

The other option you have is to take a premium holiday. You can skip on your regular premium from the 25th month onwards. Instead of paying for it in cash, you can pay for it with the investments you have in your FWD Invest Max. And when your cash flow is feeling less tight, you can resume your regular premium payment.

-

Grow Your Base Even While You Enjoy Your Dividends

Since FWD Invest Max offers penalty-free withdrawal, it allows policyholders to make use of this feature to create a passive income strategy.

You can invest 100% of the money in your FWD Invest Max into a dividend paying fund. Let’s say the dividend paying fund pays a 4% dividend every year. You can cash out the dividend paid out in the year. At the same time, your investment in the fund will continue to stay at 100% to enjoy any capital appreciation in the fund.

It is a win-win strategy for those who wants to enjoy bits of the fruits of your investments while still staying invested in the market in the long run.

-

Rewarding Long-Term Policyholders With Reduced Charges

In order to keep the ILP running, FWD charges fees to its policyholders. This is a standard practice among all insurers that are managing ILPs.

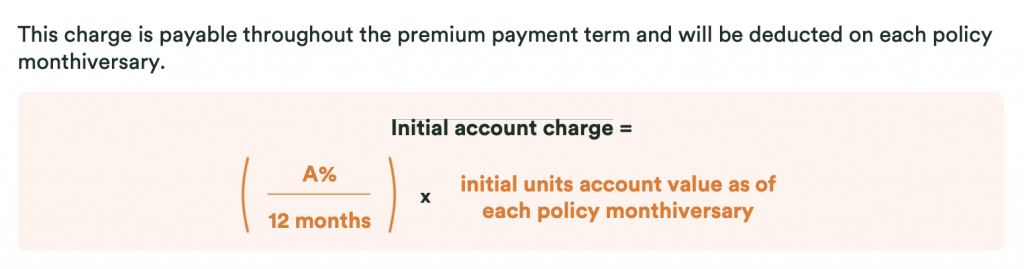

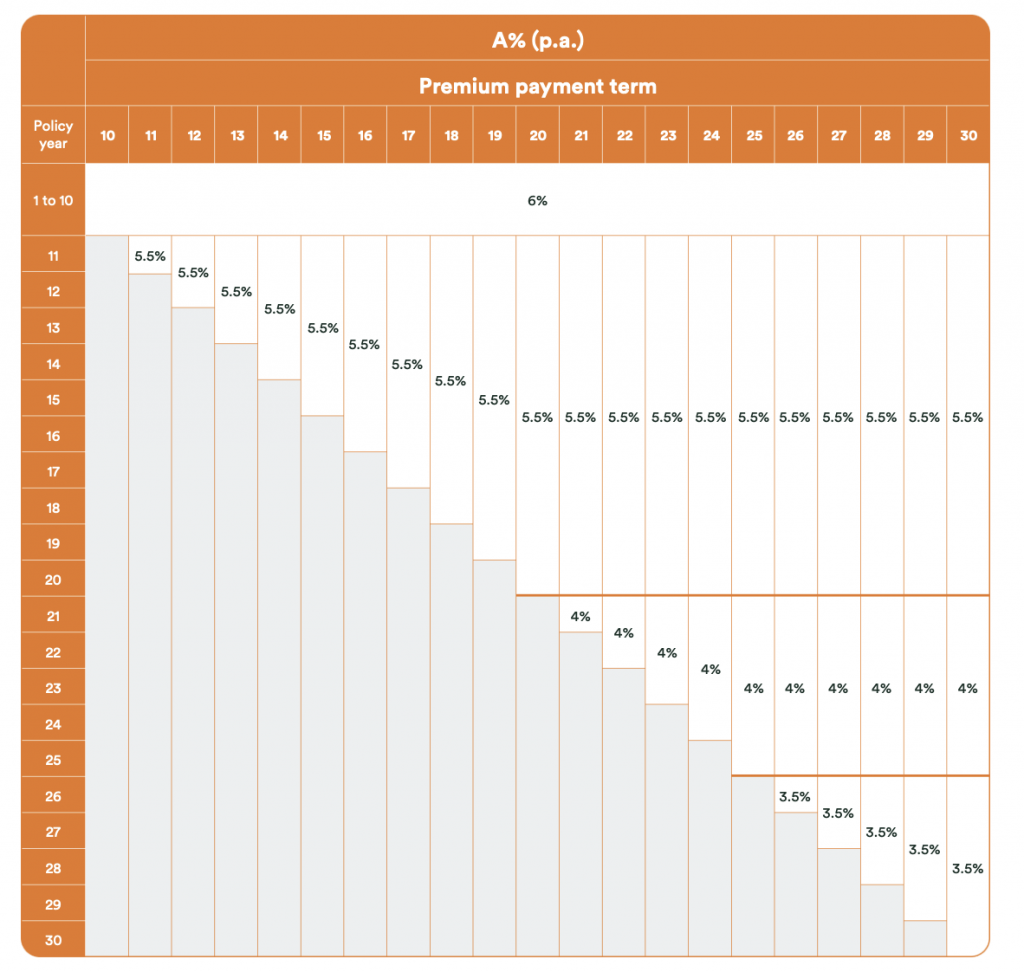

Under FWD Invest Max, there is an Initial Account Charge (IAC) and Accumulation Account Charge (AAC).

Source: FWD

To reward long-term policyholders, FWD is choosing to reduce both charges over time. This means that the longer you hold on to the policy, the less you will get charged for both IAC and AAC. For policyholders, less cost means more for you to pump it into investments to grow it over time.

-

Complimentary Auto-Rebalancing And Unlimited Free Fund Switches

To add on to the low cost of FWD Invest Max, policyholders can enjoy two additional free features.

Firstly, you can leverage on the free auto-rebalancing option that FWD offers. This is a risk management strategy that helps you to rebalance your portfolio so that your investment risks are not lopsided on a single area of investment.

Secondly, if you feel that you have an inclination of how the market is going to shift, you can switch your investment strategy any time. Be it whether you want to switch to a better performing fund, match your changing risk appetite, or adapt to changing market conditions, all of these will be available to you. And thanks to the unlimited free fund switch feature, it is not going to cost you anything.

However, do note that frequent fund switching may not be the most optimal strategy. While it is free, you will still incur a hidden cost when switching funds known as the spread cost. This is due to the gap between the bidding and asking price of funds. This is generally true for all types of investments, not just for FWD Invest Max.

-

Competitive Break-Even Yield Because Of Lower Charges, Bonuses

Thanks to the bonus feature and low cost feature of FWD Invest Max, it helps policyholders to get the most bang for their buck. The way to measure this is to use the break-even yield.

The break-even yield is simply the growth that your investments need to growing every year to offset the cost.

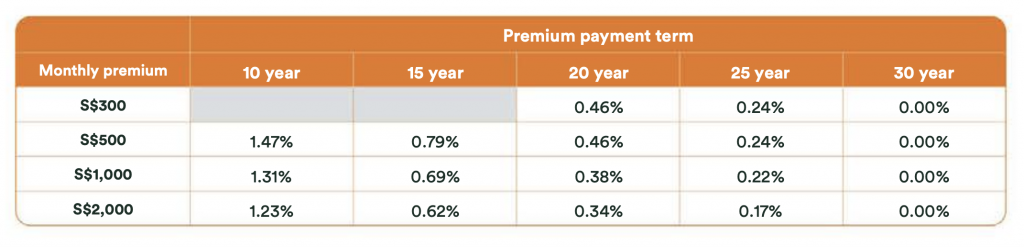

Source: FWD

If you have a premium payment term of at least 15 years, the growth needed for your investments is not even 1% p.a.! That’s even lower than the long term inflation rate.

Who Can Apply For FWD Invest Max?

-

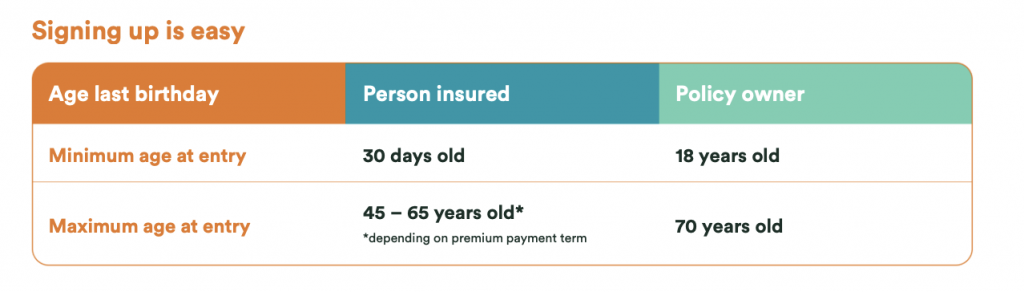

If You Meet The Age Requirements

Source: FWD

The first criterion of eligibility for FWD Invest Max is really simple. All you need is for the life to be insured to be at least 30 years old. For the policy owner, it will be at least 18 years old.

Besides a minimum age, there is also a cap on the maximum age.

Maximum Age ≤ Current Age + Premium Payment Term

If you add your premium payment term and your age, it can’t exceed 75 years old. Otherwise, you will have to adjust your premium payment term to fall within the 75 year old limit.

-

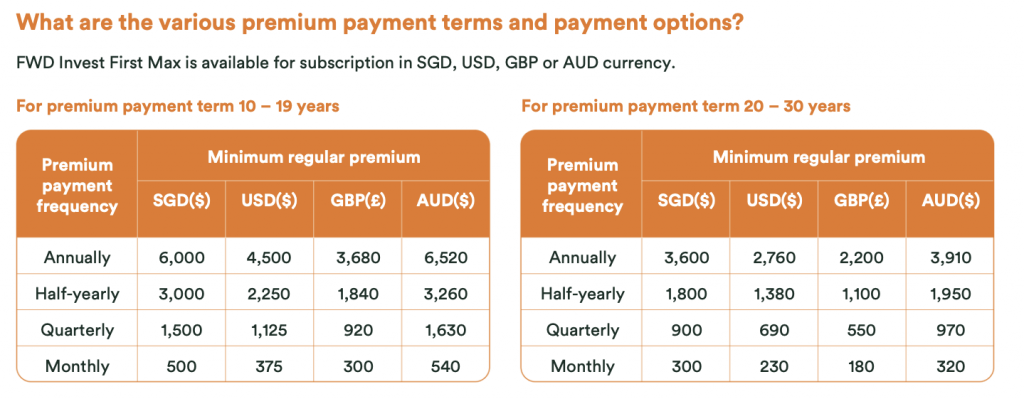

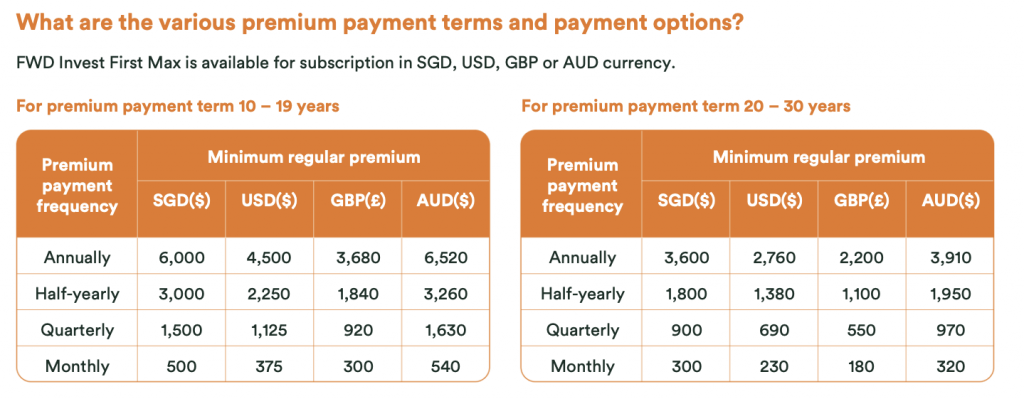

Minimum Premium Commitment

Source: FWD

Besides age, there is also a minimum requirement on the payable premium.

For a premium payment term of less than 20 years, you need to be prepared to fork out at least $6k annually. You can choose from four premium payment frequency: Annually, semi-annually, quarterly, or monthly.

If you decide on a longer premium payment term (i.e. ≥ 20 years), then the minimum annual premium is $3.6k. If you choose to do it monthly, you can just divide it equally over 12 months.

Is FWD Invest Max The Right ILP For My Retirement Needs?

You might be thinking about all the unique features that FWD Invest Max brings. But one lingering question might be whether it is the right kind of ILP for your retirement needs.

Understanding ILP not only takes time but may also require a professional to guide you through the thought process. If you are unsure whether FWD Invest Max is the right one for you, reach out to us so that we can do a comprehensive financial planning analysis for you. This will help you to better understand where FWD Invest Max will help to cover the gaps you have in your existing financial plan.