Etiqa Invest Builder: ILP with Low Breakeven Yield and Access to Managed Portfolios

Etiqa Invest builder is an investment-linked insurance plan that helps individuals accumulate wealth. The plan allows for premiums to be paid for a period of 3, 5, 10-20 years. In the first two years of investment, policyholders can receive a start-up bonus of up to 64% of the premium. Additionally, policyholders can receive an additional bonus of 0.1% p.a. of account value from the 6th to 10th policy year, as well as a loyalty bonus of 2.0% p.a. of account value from the 11th policy year onwards.

Policyholders also have the flexibility to make partial withdrawals at no charge or take a break from paying premiums in the event of a covered life contingency. The policy covers death at the higher of 105% of net premiums or account value less any outstanding amounts. Policyholders can also continue their policy without paying premiums upon the life insured’s diagnosis of any of the 37 severe-stage critical illnesses. No medical checks are required to enroll.

Disclaimer: This article has not been reviewed by MAS and Etiqa and is accurate as of 21st Jan 2023, Moneyline.SG is not an Exempt Financial Adviser and act only as an information portal. Please seek advice from a licensed financial advisor or leave your contact details below for a proper fact find by a licensed practitioner before making any decision. All information provided are public and can be found directly on the providers website or via any financial representatives that represents the product provider.

Summary

Premium Term: 3, 5, 10 – 20 years

Minimum Annual Investment: $10,000 (3 & 5 Years), $4800 (10 – 19 years), $2,400 (20 years)

Start up bonus: up to 64% of First Year Premium

Additional Welcome Bonus: 5% (End 31st March 2023)

Loyalty Bonus: 0.1% p.a. from 6th – 10th policy year, 2.0% from 11th year onwards

Charges: 2.3% p.a. (Charges exclude fund management fees, cost of insurance, and early surrender fees and other partial withdrawal fees)

Entry Age: Before age 65

Access to Accredited Investor Fund: Yes

Dividend Withdrawals: With Etiqa Invest Builder, you have the option to either reinvest or receive payments of dividends paid by the ILP sub-funds. The frequency of the dividends is determined by the relevant ILP sub-fund managers, and the dividends will be distributed within 30 days of the declaration date, subject to a minimum of $40. If the amount of dividends is less than $40, it will be reinvested as additional units in the ILP sub-fund.

Partial Withdrawal: You may request partial withdrawals at any time while the policy is in force, but it must be at least $500, in multiples of $100 and the remaining account value must be at least $1,000. If the remaining account value falls below the minimum after withdrawal(s) it’s not allowed. The company reserves the right to change the partial withdrawal requirements at any time with 30 days’ written notice. If you choose to perform partial withdrawal during the premium payment term, it will be subject to a partial withdrawal charge. Any partial withdrawal made will be first deducted from the top-up amount (if applicable), then from the remaining account value (excluding top-ups).

Prime Feature “Life Contingency Benefit”: The Etiqa Invest Builder policy provides a life contingency benefit, which can be exercised once per policy and only after 24 months from the policy’s commencement date. The benefit includes a waiver of a partial withdrawal charge for withdrawals up to 15% of the account value or a waiver of premium shortfall charge for up to 12 months if the policyholder stops paying premiums. To claim the benefit, policyholders must inform the company in writing within 90 days of the event and provide any requested documents or evidence. The company reserves the right to reject claims if terms and conditions are not met. A life contingency event includes hospitalization for at least 6 consecutive days, retrenchment and unemployment for at least 30 consecutive days before age 65, total and permanent disability before age 66, or a severe critical illness diagnosis.

All information are public and made available via Etiqa’s Website

Etiqa Invest Builder may be a suitable option for individuals who are looking for:

- A long-term investment opportunity with the potential for financial returns

- An investment-focused policy with little to no insurance coverage

- The ability and willingness to tolerate investment risks and fluctuations in the financial markets

- The potential for higher returns compared to traditional endowment and whole life policies

- The ability to enroll in an insurance plan without undergoing medical underwriting.

- Access to accredited investor funds through retail platform.

It is important to note that, as with any investment, past performance does not guarantee future results and that individual investment results may vary. It is recommended to do thorough research and consult with financial professionals before making any investment decisions.

Etiqa Invest Builder may not be a suitable option for individuals who are looking for:

- High protection coverage, such as death and terminal illness coverage

- Insurance coverage for early critical illness, critical illness or total permanent disability

- Guaranteed financial returns in the long-term

- Principal guaranteed upon termination or maturity of policy.

- An insurance policy with a high surrender value in the early years of the policy

- Expecting an urgent need for withdrawal during a financial market downturn.

It is important to note that this is a strictly investment-focused policy with little to no insurance coverage included, and that the value of the policy is dependent on the performance of the underlying investment. Furthermore, the financial market can be volatile and uncertain, so it is important to consider your own risk tolerance and financial goals before making a decision on this or any other financial product.

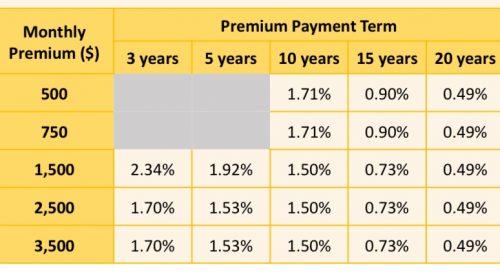

Breakeven Yields

All information are public and made available via Etiqa’s Website

*Excludes Additional Welcome Bonus of 5%

Conclusion

We think the Etiqa Invest Builder is a great option for those looking for a long-term investment opportunity with the potential for financial returns. The policy’s loyalty bonus of 2% per year from the 11th policy year, plus additional bonuses from the 6th to 10th policy years, significantly reduce policy charges and breakeven yields. Additionally, the policy offers the flexibility of replacing the policyholder with a spouse or child, access to AI funds and managed portfolios, and dividend distribution. However, the policy may not be as flexible during the premium payment term, and it may not have as high of an upfront bonus as other options on the market. Ultimately, it is important to consider your own financial goals and risk tolerance when making a decision on any financial product.

Read Best 3 101 Wrapper in Singapore

Here is what we can help you with

Our MAS-Licensed Partner will provide you with objective advice and help you compare insurance quotes from different providers. 100% Free & No Commitment. Retrieve your info using your Singpass App or Manually fill in the forms below.