Introduction of Etiqa Essential Whole Life Cover

Good day folks, in this article, I will bring you through a review of one of the most competitive whole life plan in Singapore. For those who are looking at more details on the product itself, stay on.

What is a whole life plan?

As per the plan name’s product name, the word whole life indicates that Etiqa Essential Whole Life Cover covers an individual for life (up till age 100). It is a plan with cash value that covers for Death, Terminal Illness, Total and Permanent Disabilities, Different Stage of Critical Illnesses with options of add-on rider.

Features of Etiqa- Essential Whole Life Cover

- Options to choose Additional Sum Assured of 100%,200% and 300%

- Options to choose Additional Sum Assured expiry date of age 65 or age 80

- Premium Term: 5, 10, 15,20

- Cash Value upon Surrendering of Plan after certain years

- Retirement Option: Upon attaining Age 65, options to start receiving regular yearly premium for a period of 10

- Guaranteed insurability benefit– Enjoy the option to purchase another plan at certain life stages without proof of good health, in the event of marriage, birth or adoption of your children or graduation from tertiary education

- Minimum Sum Assured: $50,000

- Minimum Sum Assured of ECI and CI: 20% of Main Sum Assured selected

- Total Critical Illness Covered: 37

- Total Special Conditions covered (above 17 years old): 12

- Special Condition Benefit: Additional 20% of the rider’s Basic sum insured in one lump sum

Choices of rider available

- Extra secure waiver rider- waives the Premium of the Basic policy and any attaching riders if the Life insured is diagnosed with a covered severe-stage critical illness

- Early Critical Illness Protection Rider- option of accelerating the death benefit of the Basic policy by 20%, 50%, 80% or 100%

– Additional Monthly Benefit ( twelve (12) monthly) payouts, starting from the Policy month immediately after the date of diagnosis. The monthly payout is equivalent to 1% of the rider’s Basic sum insured.

- CI Protection Rider- Option of accelerating the death Benefit of the Basic policy by 20%, 50%, 80% or 100%

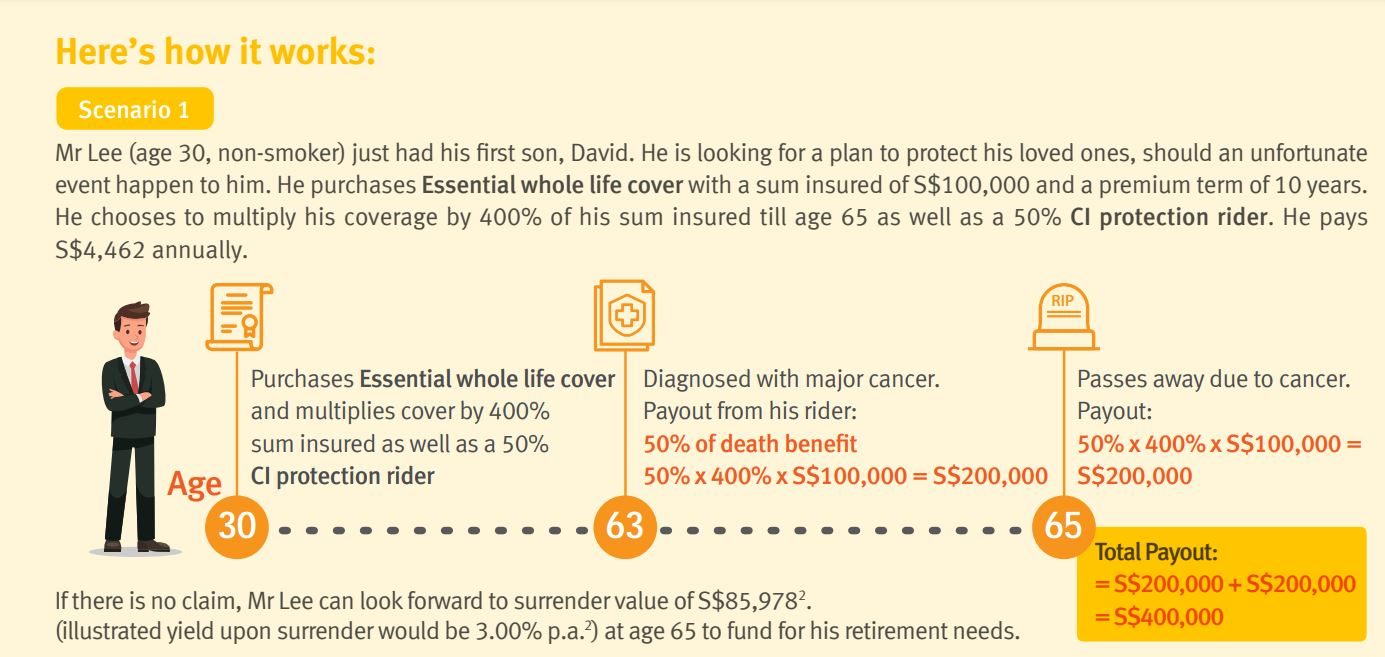

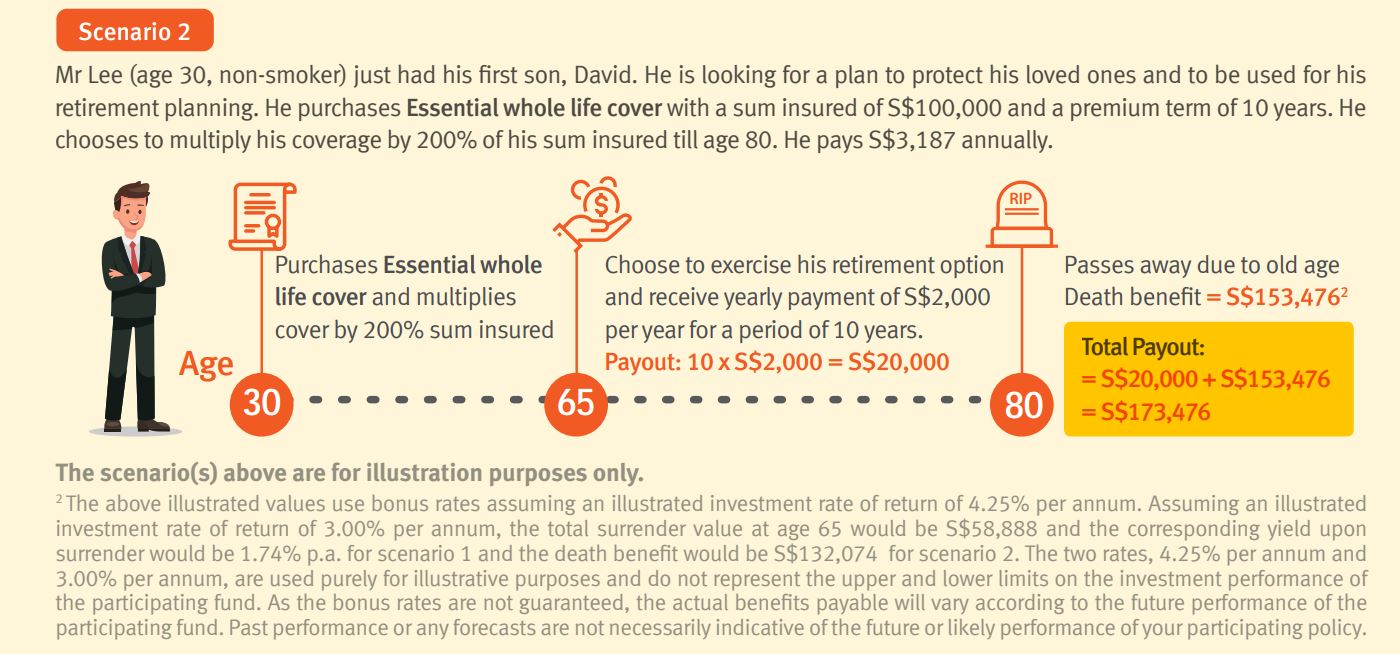

Illustration of how Etiqa Whole Life Essential covers works

Now that we understand how the plan works and the features of it, let’s take a look at which group of individuals suit the product most.

This product is suitable for folks who are looking at getting a plan with:

– Cash value

– Limited pay option and coverage for life

– Retirement option at age 65, for 10 years

– Additional Monthly Benefit payout for ECI rider

– Additional Sum Assured (Multiplier) till age 80

– Life time coverage at a competitive premium

On the other hand, this product is not suitable for folks who are looking at getting a plan with:

- Without cash value

- Minimum Sum Assured of below $50,000

- Without any Additional Sum Assured (Multiplier)

- Significantly high amount of Sum Assured with low premium

- Option to choose age 70,75 as Additional Sum Assured (Multiplier) expiry date

- Looking at getting a plan with flexibility of withdrawing cash

Conclusion

Apart from the above mentioned features, there are several other that needs to take into consideration when looking at getting a whole life plan that suits your needs. The factors include Break Even Years and Illustrated Yield.

For more official updates on healthcare issues, do visit: https://www.moh.gov.sg/

Related Article: https://www.moneyline.sg/whole-life-insurance/

Do feel free to consult our Financial Adviser by filling up the form below for personalised financial planning that suits your need.

7 Comments