FWD Life Protection – All Good In One Whole Life

Are you searching for the ideal life policy that offers a winning combination of affordability, comprehensive protection for critical illness, multiplier coverage until the lifespan age , and flexible premium payment terms? Look no further, as we introduce you to the FWD Life Protection Plan, the latest whole life insurance product in the market that is the apex of every aspect you seek.

FWD has built a reputation for their direct online approach on simple life and general insurance product, and you’ve likely come across their advertisements emphasizing the benefits of going direct. However, they have recently shifted their strategy, placing a stronger emphasis on providing the public with life insurance through financial advisory.

This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. Read our General Disclaimer

Let’s delve into the strengths of this plan and how it can be your all in one life protection

Good #1 Comprehensive CI Protection

FWD offers various critical illness protection riders, including:

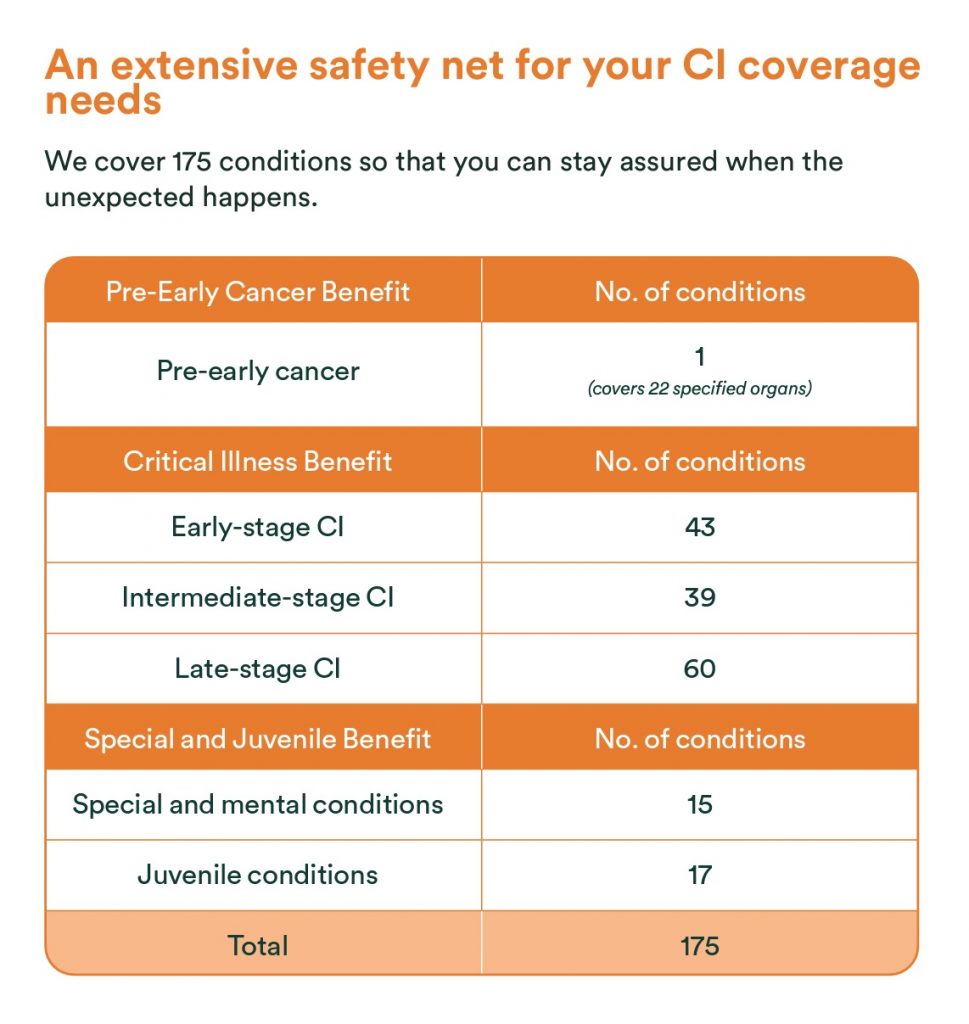

- FWD Early CI Protection Rider covering all stages of CI, Intensive Care Unit Benefit, Pre-Early Cancer Benefit, and Special and Juvenile Benefit.

- FWD CI Protection Rider covering 60 late-stage CI conditions.

- FWD CI Premium Waiver Rider, which waives future premiums upon the diagnosis of any covered CI conditions.

- FWD Payer Premium Waiver Rider, which waives future premiums in the event of the insured person’s death, total and permanent disability, or diagnosis of any covered CI conditions. These riders can be added to the base plan.

source fwd.com.sg

Good #2 High Multiplier Till Age

Enhance your coverage by 2x, 3x, or 5x until you reach your chosen minimum protection level (MPL) age of 75 or 85 years. Following this, the increased coverage will gradually decrease by 10% each year for the subsequent 5 years, ensuring that you maintain 50% of your augmented coverage for added peace of mind. the Minimum Sum Assured is $50,000

- Increase coverage by 2x, 3x, or 5x¹ until MPL age (75 or 85).

- Gradual 10% annual reduction for the following 5 years.

- Maintain 50% of the boosted coverage for added peace of mind.

Good #3 Retirement Income

Enhance your financial security by converting your policy’s Surrender Value, which encompasses the guaranteed surrender value, accumulated Reversionary Bonus, and Terminal Bonus, minus outstanding fees and charges. Starting at age 55, you can transform up to 80% of this value into an annual income stream to meet your retirement needs. The minimum income withdrawal period is up to 10 years or max till age 100

Good #4 Choice of Premium Term and Stay Financially Resilient

Stay financially resilient, even in the face of retrenchment. FWD got you covered with a 12-month premium waiver if you experience job loss, allowing you to safeguard your policy without depleting your emergency funds.

You can also choose premium payment term to suit your needs. Select from 5, 10, 15, 20, or 25 years, providing you with the flexibility that aligns with your financial goals.

Good #5 Adjust Coverage during Milestones

Tailor your coverage to match life’s milestones effortlessly. Enjoy the freedom to boost your coverage when you reach significant life events like completing your tertiary education, buying a new home, or expanding your family through childbirth or adoption, all without the requirement of demonstrating good health.

Good #6 Enjoy FWD Value Added Services

- Medicine Delivery: Skip waiting in line for prescriptions; get teleconsultation medicine delivered to your doorstep.

- Preferred Rates: Access over 600 MHC General Practitioner (GP) and dental clinics at discounted rates, making healthcare more affordable.

- Family Coverage: Extend FWD HealthFirst benefits to your family and dependents, including your spouse, children, parents, and grandparents.

- Teleconsultation (Virtual): Benefit from free 24/7 teleconsultation with experienced healthcare professionals from the comfort of your home.

Good #7 Competitive Premium

Did we mention this yet? We ran some quotes and FWD Life Protection indeed provides one of the most competitive quotes for the same permutation across different premium term, multiplier against other forces in the market.

Get in touch now to get your customized FWD Life Protection Quote!

Our Financial Advisors are equipped with experience to advise you on your protection needs, whether you are a young adult, parents or retiree seeking to protect your retirement chest, we have the right advice for you! Get in touch now to compare whole life insurance plans.