Critical Illness Plans for folks with Pre-Existing conditions in Singapore

Have you heard of critical illness protection plans rejecting or excluding application if you have certain pre-existing health condition (s)? Fancy looking at having certain critical illness protection even if you have pre existing health condition(s)?

In this article, a few plans with simplified medical questionnaire that is catered to people with pre existing conditions will be discussed into details.

1) Manulife Critical Selectcare

Manulife Critical Selectcare is a term plan catering to people with pre-existing conditions like High Cholesterol, High Blood Pressure, High Blood Sugar for protection mainly against selected critical illnesses. Let’s take a look at the product features and benefits below.

Benefits of Manulife Critical Selectcare

– Death Benefit

– Open to every individual (Including those with pre-existing health condition like High Cholesterol, High Blood Pressure, High Blood Sugar etc)

-No Claim payout Benefit -(In the event where no claim is made,25% of premium paid to date will be paidout)

– Easy to buy with just 3 questions- (Typically, applying for protection plans require full medical questionnaire)

Features of Manulife Critical Selectcare

– No Cash Value

-100% Sum Assured payable if diagnosed against listed against listed Critical Illness

– 25% Sum Assured payable if diagnosed against listed Special Benefit

– Covers individual to age 85

– Minimum Sum Assured: $50,000

– Maximum Sum Assured: $500,000

Suitable for:

-People between age 40 to 70 (Application age)

– People looking for certain critical illness coverage with pre existing conditions (High Cholesterol, High Blood Pressure, High Blood Sugar etc)

– People looking at plan to cover for shortfall in Critical illness coverage.

2) Singlife-Mycore CI Plan II

Singlife-My Core CI Plan II is a term plan catering to people with pre-existing conditions like being diagnosed with High Cholesterol, High Blood Pressure, High Blood Sugar and diabetes for protection mainly against selected critical illnesses. Let’s take a look at the benefits, features and who is more suitable for this plan in the content listed below.

Benefits of Singlife-Mycore CI Plan II

– Death Benefit

– Terminal Illness Benefit

– Total and Permanent Disability Benefit

– Critical Illness Benefit

– Diabetic Conditions Benefit – No Claim Benefit (up to 20% of total premium paid to date at end of policy period)

— Open to every individual (Including those with pre-existing health condition like High Cholesterol, High Blood Pressure, High Blood Sugar etc)

– Advanced lump-sum payout (up to $25,000)

– Easy to buy with 6 simple questions

Features of Singlife-Mycore CI Plan II

– No Cash Value

-100% Sum Assured payable if diagnosed against listed against listed Critical Illness

– Advanced 10% of Sum Assured (up to $25,000) upon Angioplasty & Other Invasive Treatment For Coronary Artery

– 20% Additional Sum Assured upon diagnosis of listed Diabetic complication, subject to caps limit per condition per life

-Covers individual for 15 years or up to age 85 (Age Next Birthday)

– Minimum Sum Assured $30,000

– Max Sum Assured $500,000

Suitable for :

– People age between 25 to 75 (For Application)

– People looking for certain critical illness coverage with pre existing conditions (High Cholesterol, High Blood Pressure, High Blood Sugar etc)

– People looking at plan to cover for shortfall in Critical illness

3) AIA Diabetes Care

AIA Diabetes Care Plan is a term plan catering to people with pre-existing conditions like being diagnosed with being pre-diabetic as well as Type 2 Diabetes for protection against selected critical illnesses. The plan covers for key diabetes-related conditions.

Benefits of AIA Diabetes Care

-Death Benefit

-Selected Critical Illness Benefit

– Easy Access to protection with only 5 simple questions

– Guaranteed coverage for 5 key diabetic-related conditions

– Extra payout for special condition

-Option to add on protection with Cancer Cover

Features of AIA Diabetes Care

– No Cash Value

-100% Sum Assured payable if diagnosed against listed against listed Critical Illness

– 20% Additional Payout of Sum Assured upon amputation of leg due to diabetes related complication

– Coverage for up till age 80

-Minimum Sum Assured-$30,000

-Maximum Sum Assured-$250,000

Suitable for:

– People age between 30 to 65 (For Application)

– People looking for certain critical illness coverage with pre existing conditions (pre-diabetic, type 2 diabetes)

– People looking at plan to cover for shortfall in Critical illness coverage.

-Non-smoker only

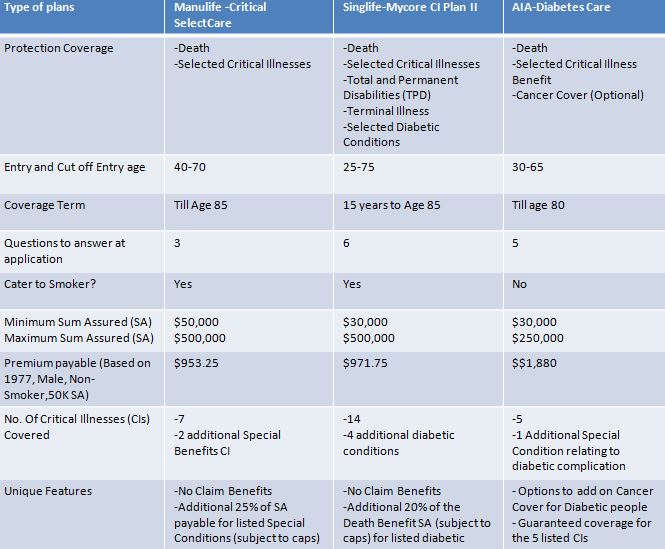

Here is a Summary table of the difference in the 3 plans mentioned above:

Conclusion

It does not necessary mean that individual with pre-existing conditions, especially of those that faces high rejection rate on application generally is not able to get covered for completely. With the 3 plans discussed above, it is possible to get protection against selected Critical Illnesses together with other benefits that the individual plan offers.

For more official updates on healthcare issues, do visit: https://www.moh.gov.sg/

Related Article: https://www.moneyline.sg/manulife-critical-select-care-covering-diabetes-type-1-2-for-age-40-and-beyond/

Feel free to leave down your personal particulars to discuss more on the product details to suit your situation and budget on the link below.

2 Comments