5 Lessons Everyone Should Learn From Endowus Wealth Insights Report 2023

Endowus recently published its Wealth Insights Report 2023, which documents the economic sentiments and financial health habits of Singaporeans. As we read through the report, we found several interesting insights and lessons that we think every Singaporean needs to know.

-

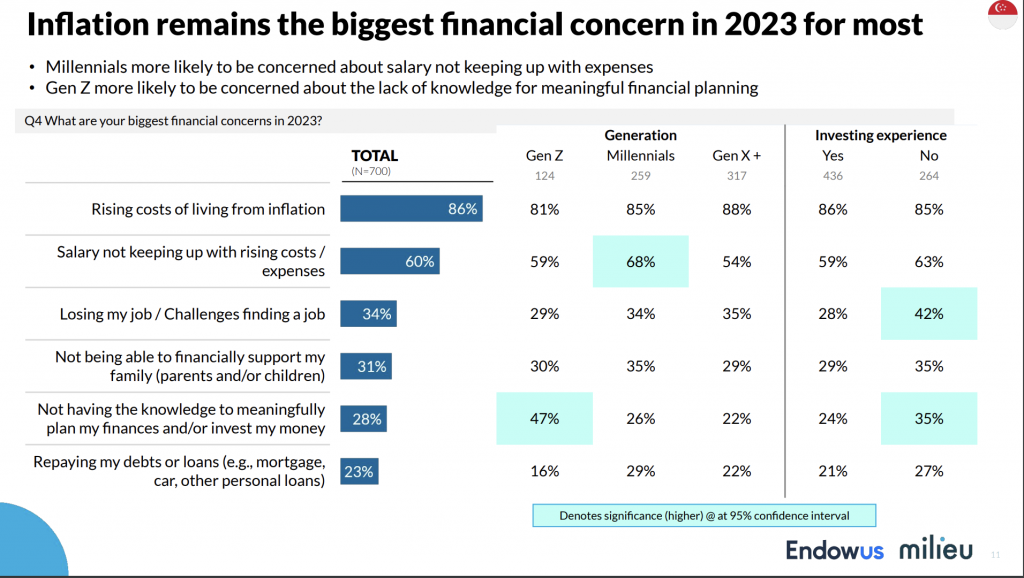

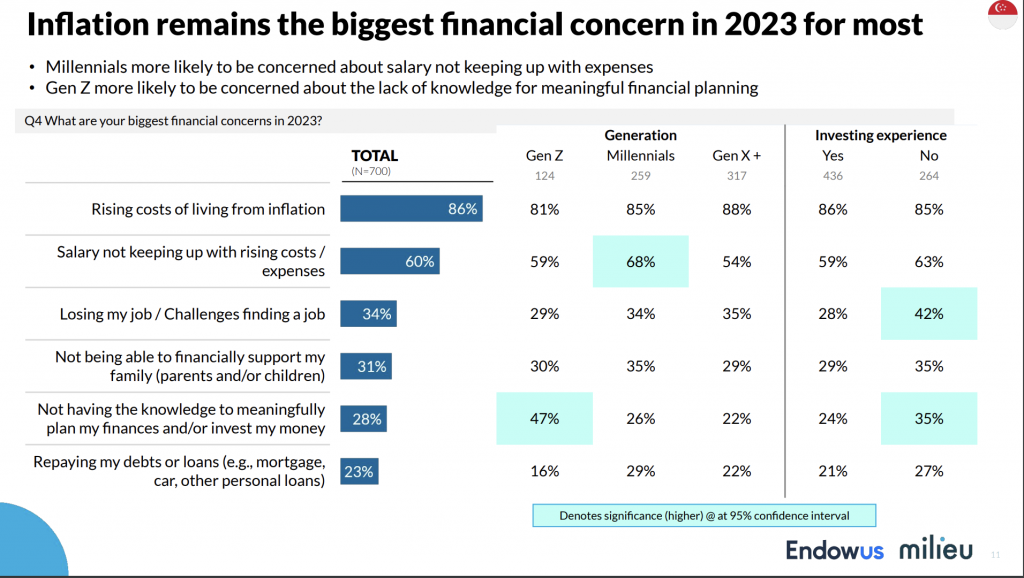

Inflation Is The Biggest Concern For Everyone

Source: Endowus

One of the key findings from the Endowus Wealth Insights Report 2023 is that rising cost of living is scaring everyone. Be it whether you are a Gen X, Gen Y (millennials), or Gen Z, it is hurting everyone. In fact, it is hurting everyone to the extent that more than 80% of each segment puts it as the biggest financial concern in 2023.

Source: TradingEconomics.com

With inflation trending near the all-time high of close to 8%, it is no wonder why everyone is worried about it.

Lesson 1: You Can’t Get Away With Inflation, But You Can Fight It

The first lesson takeaway is that inflation isn’t going anywhere anytime soon. But here’s what you can do to protect against inflation: Invest and beat it. If inflation is going at 8%, then you need to ensure that you can earn at least 8% return on your investments to counter the impact of inflation.

For instance, you can do so with Moneyline’s value-added investment planning service. We adopt a methodology that helps you extract the most returns based on your assessed risk appetite.

-

Those Who Are More Concerned About Bread And Butter Finances (Debt, Mortgage) Tend To Have Less Investing Experience

Another interesting finding which caught our attention is that those who are concerned about bread and butter issues are the ones that aren’t investing much. While this is the last concern on the list, it is one that we think is the most worrying. And here’s why.

Source: Endowus

Source: Endowus

If you are thinking about your monthly mortgage or car loan repayments, then you have a myopic focus on the short term. Some of us might be living from month to month and just getting by to meet our monthly obligations. Such bread and butter issues can impede on our ability to look beyond the short term and think far ahead to the long term.

Lesson 2: You Need To Be Investing, Even If It Means Having A Small Capital

Many people think that you need to have a huge amount of capital before you start investing. Well, that’s not the right way to think about it. Be it whether you have $100 or $1M, you need to get started with investing. Any little bit of money that you are setting aside for investing purpose is a good start.

If you need professional advice, you can get it at Moneyline. Moneyline provides investment planning for free to help you build a sleep easy investment portfolio. These advice are from professional financial planning advisors that are well versed in how investing can help you build a solid investment portfolio.

-

Financial Safety Net Is Important

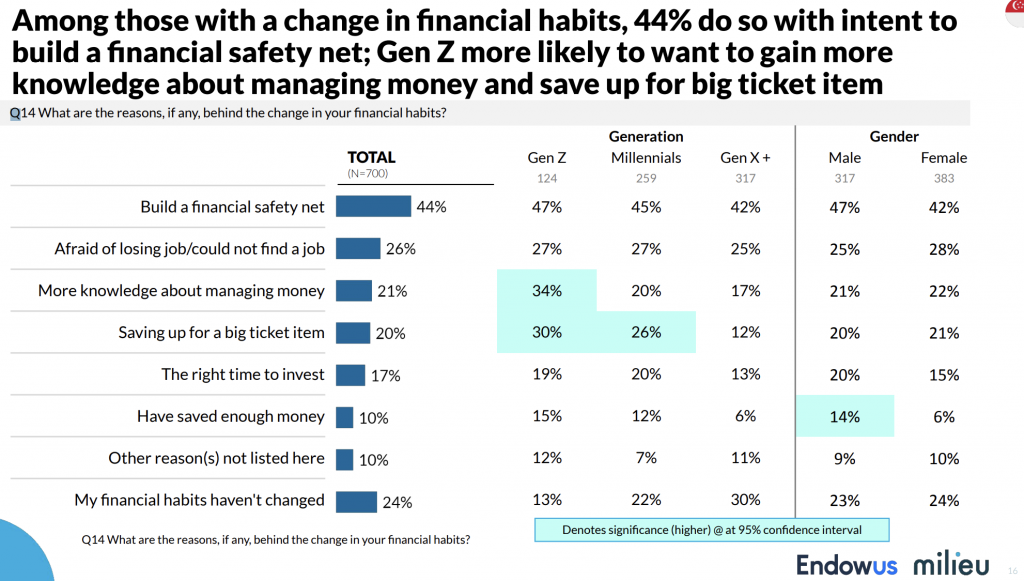

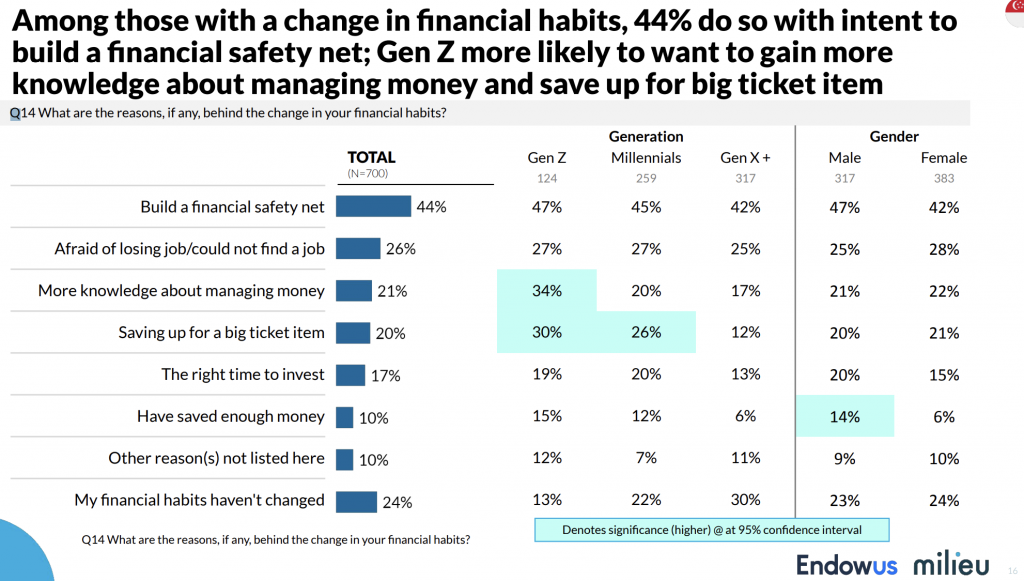

It is heart-warming to see that Singaporeans are learning the importance of building a financial safety net. This is the biggest reason among all three generations (X, Y, and Z) on why they are changing financial habits.

One of the reasons that might have sparked this change could be the downturn of the economy. Some of us might have gotten the much-dreaded layoff while others are constantly fearing whether it will be our turn next. Indeed, living from pay check to pay check can be worrisome. It can be draining on our mental health too if we don’t have a safety net we built up earlier. Source: Endowus

Source: Endowus

Lesson 3: Build Your Financial Safety Net Today With The Right Insurance Plans

If you haven’t already built your own financial safety net, here’s how to get started. First, make sure you have all the basic financial protection plans in place.

For example, you definitely need a health insurance plan that will cover all your medical expenses in case you are hospitalised.

And if you have loved ones, you want to make sure that you are covered with at least a term plan. This is so that, in case you meet with a mishap, your family will still be able to carry on with their lives (financially) even though you are no longer there with them. Morbid as that may sound, it is how you keep your loved ones protected.

-

Financial Knowledge Is Power

Around 21% of participants surveyed said that they are changing financial habits because they now know more about managing money. In particular, the Gen Zs have a statistically significant percentage of 34% that are better at managing their money because they have more financial knowledge. Source: Endowus

Source: Endowus

Some of these Gen Z-ers could be influenced by fin-fluencers. While that may not be the most legitimate source of financial advice, it is still a step in the right direction.

Lesson 4: Stay Regularly Updated About Financial News

Therefore, we think it is important that everyone stays regularly updated about what’s happening in the markets. For instance, you want to know what’s the best mortgage deals you can find when you are about to do your refinancing. You also want to know what are the different investment tools you can invest in so that you can park your spare cash.

This is also why we have strongly advocated for a space on our website to educate our readers.

-

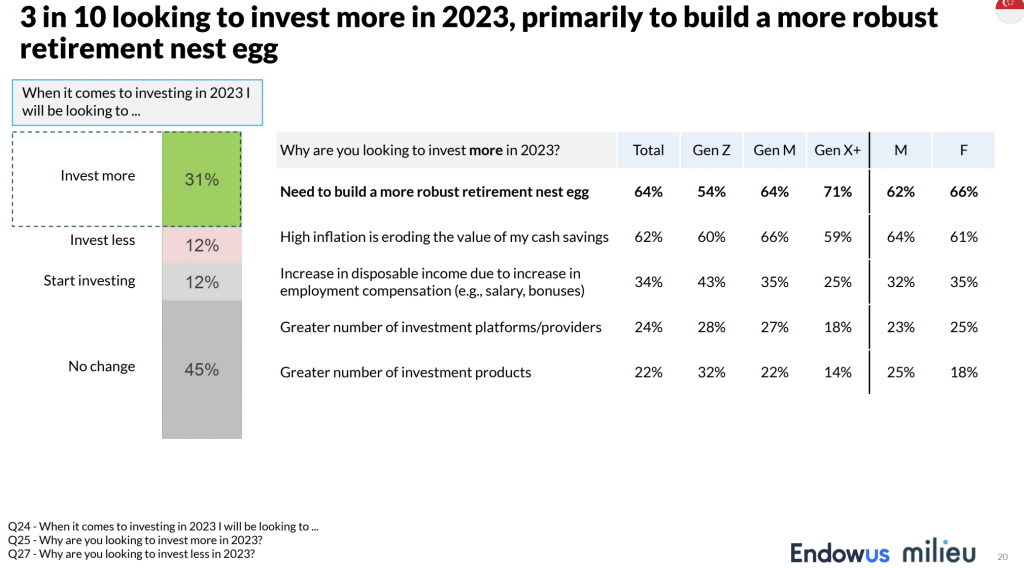

Investing To Build A Robust Retirement Nest Egg

Besides inflation, the other reason for investing is to build a robust retirement nest egg. We all want to be retired, but we want that retirement to be comfortable. This means building up a sizeable amount of retirement savings that can last us through our retirement.

Source: Endowus

Source: Endowus

Lesson 5: Make Investing For Retirement Easy With Moneyline.SG

The first step towards an earlier or more comfortable retirement is to start your investing journey today. And investing doesn’t have to be hard. In fact, it isn’t. You can start investing by simply linking up with Moneyline. At Moneyline, we can help you assess what are the right investment products suitable for you, depending on your age, life stage, and comfort with taking on investment risks. Get your free appointment with us here today.