3 Important Things We Learnt From Endowus Retirement Report 2022 And How You Can Address Them

A retirement report was recently released by fintech firm Endowus. The report dives into the retirement choices that Singaporeans have made (and a lack thereof). It details the concerns that Singaporeans have about retirement and some of the challenges that we face as a society.

In this article, we highlight some of the key lessons that we learnt while reading the Endowus Retirement Report 2022. Not just that, we will also offer insights on how you can address those concerns so that you can start 2023 on a brighter note towards your own retirement.

-

Top Ranked Financial Concerns In 2022: Inflation

Source: Endowus Retirement Report 2022

Unsurprisingly, the biggest financial concern that is bugging many Singaporeans today is inflation. For slightly more than a decade, we have kind of forgotten what this word meant until the second half of 2022.

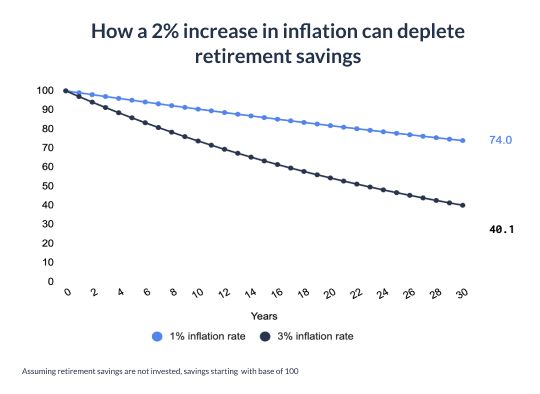

We all know that inflation has an eroding effect on our wealth, but do you know by how much?

Data from Endowus shows that, at an inflation rate of 1%, our purchasing power will decrease by 26% over 30 years. In that same period, if inflation rate jumps to 3%, our purchasing power shrinks to 40%. This means that a 2% increase in inflation rate (from 1% to 3%) over the long term will erode our wealth by more than 45.8% (from 74% to 40%). That is indeed very scary and perhaps why many singled this out as the top source of concern when asked in the survey.

Pro tip: While you can’t change the macroeconomic outlook of the world, the next best approach is to fix yourself. You will want to reassess your own spending habits so that you spend only where it is necessary.

For instance, you want to cut back on more luxury spending and allocate more to your daily expenditure. You might also want to consider cutting back on dining out and settle for home cooked meals.

Or you can relook some of the monthly expenses which you can reduce. An example is your mortgage loan. If you haven’t been refinancing it, you might be paying expensive interest rates on your current loan package. Make sure you get the best home loan rate from Moneyline so that you don’t spend unnecessary dollars on your budget.

-

Retirement Adequacy Concerns On The Rise

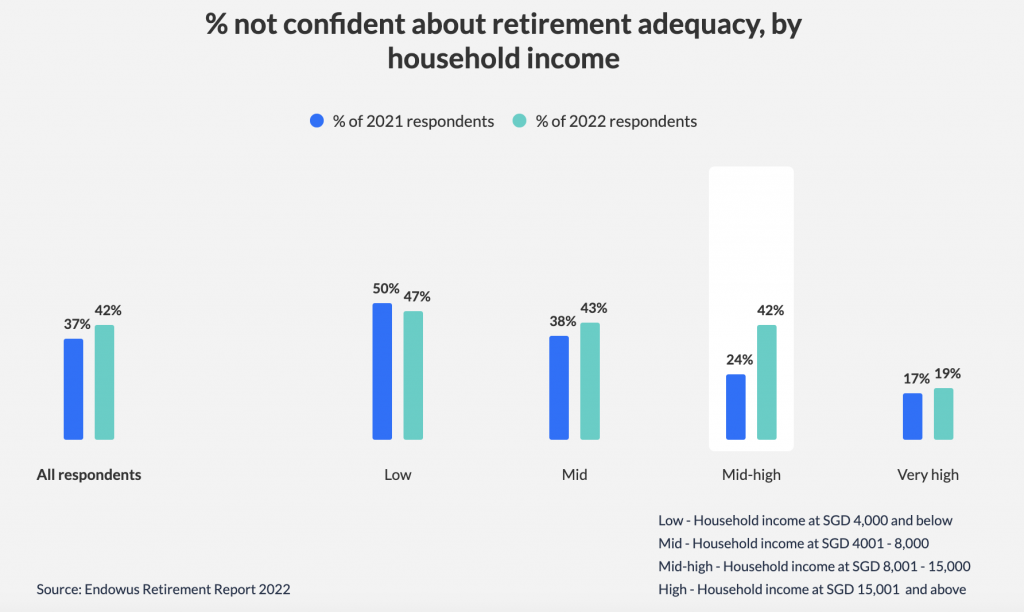

It is not just the top financial concern that caught our attention. In fact, the second ranked financial concern of retirement adequacy also made us take notice.

Source: Endowus Retirement Report 2022

Overall, there is an increase in the number of respondents (37% to 42%) who are concerned about whether you have enough money for retirement. This is particularly so for the middle ($4k – $18k monthly income) and middle-high ($8k – $15k monthly income) income households.

The challenge with retirement adequacy is that it is very counter intuitive. It is hard for you to save your way to retirement because you will simply not be saving at a fast enough rate.

Pro tip: If you want to achieve retirement adequacy, you need to be investing. Whether it is investing in bonds, stocks, endowments, or a retirement plan, doing something beats just saving with the bank. The reality is that the bank is paying you less than 1% interest rate on your savings while your money is eroding at 1% (or more) because of inflation.

That’s why it is important to engage a good personal financial advisor to plan your investments with you, not for you. Getting an MAS regulated expert to plan with you the allocation for your cash, Supplementary Retirement Savings (SRS), and CPF money is the best way to get started.

-

Different Strategies To Plan For Retirement

Source: Endowus Retirement Report 2022

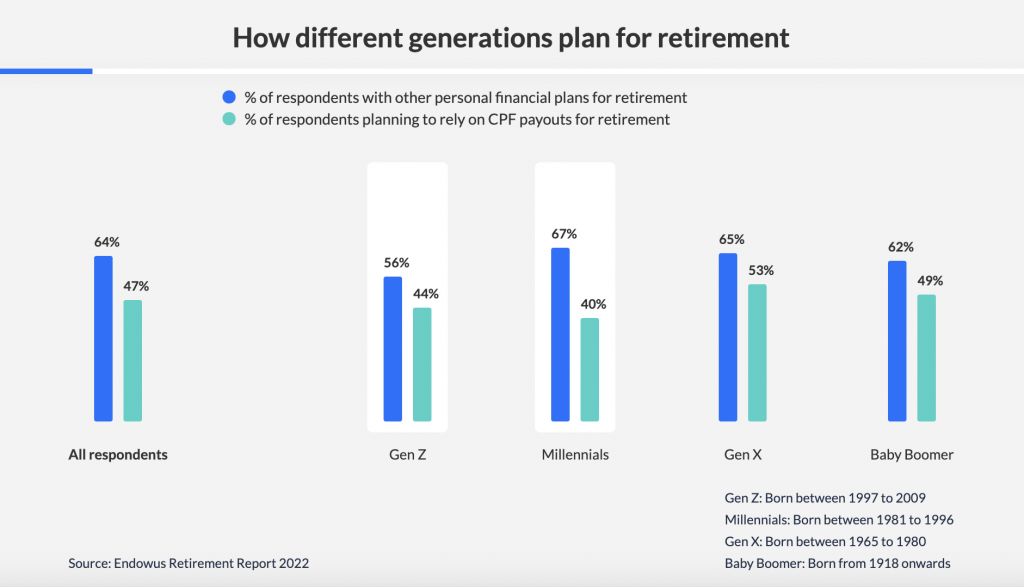

Planning for retirement isn’t a one-size-fits-all thing. Depending on your background and the environment that you grew up in, it shapes how you think about retirement planning. For instance, baby boomers and Gen X are more likely to relay only on CPF payouts for retirement compared to millennials and Gen Z. Millennials are also much more likely to add other personal financial plans into the retirement mix.

As you can see, there’s no one strategy that fits everyone. It should be personalised to meet your own retirement needs.

Read top 4 financial concern by HSBC finfit 2021

Pro tip: To create a personalised retirement plan, the first thing you should do is to sign up for a free comprehensive financial planning session with a qualified personal financial advisor.

Be it whether you prefer face-to-face or an online planning session, you will get an objective session to answer all the questions you have in mind about your retirement. You will also learn more about the different strategies that you can adopt to better fulfil your retirement goals.

2 Comments