Top 4 Financial Concerns Among Singaporeans From HSBC FinFit 2021 And How To Alleviate Them

Are you financially fit? That’s what HSBC tried to find out about Singaporeans’ financial fitness in their inaugural Financial Fitness (FinFit) study. In this article, we dive into the findings from the HSBC FinFit study to highlight some of the key findings on the top financial concerns amongst Singaporeans. We also look at ways how we can alleviate these financial concerns for our readers.

What Is HSBC FinFit Study?

The FinFit study is a financial fitness study that measures Singaporeans’ knowledge in 4 key areas:

- Financial habits (28%)

- Example: Money saving habits, monitoring of expenses

- Financial knowledge (19%)

- Example: Awareness of wealth management products, ability to understand benefits and risks of different financial products

- Financial security and safety (31%)

- Example: Regular financial review, financially prepared for emergencies

- Financial planning (22%)

- Example: Changing internet banking password regularly, careful about banking PIN

Based on the response to the 4 key areas, HSBC then measures the financial fitness score, which is a value that ranges between 0 to 100.

Key Findings From HSBC FinFit Study

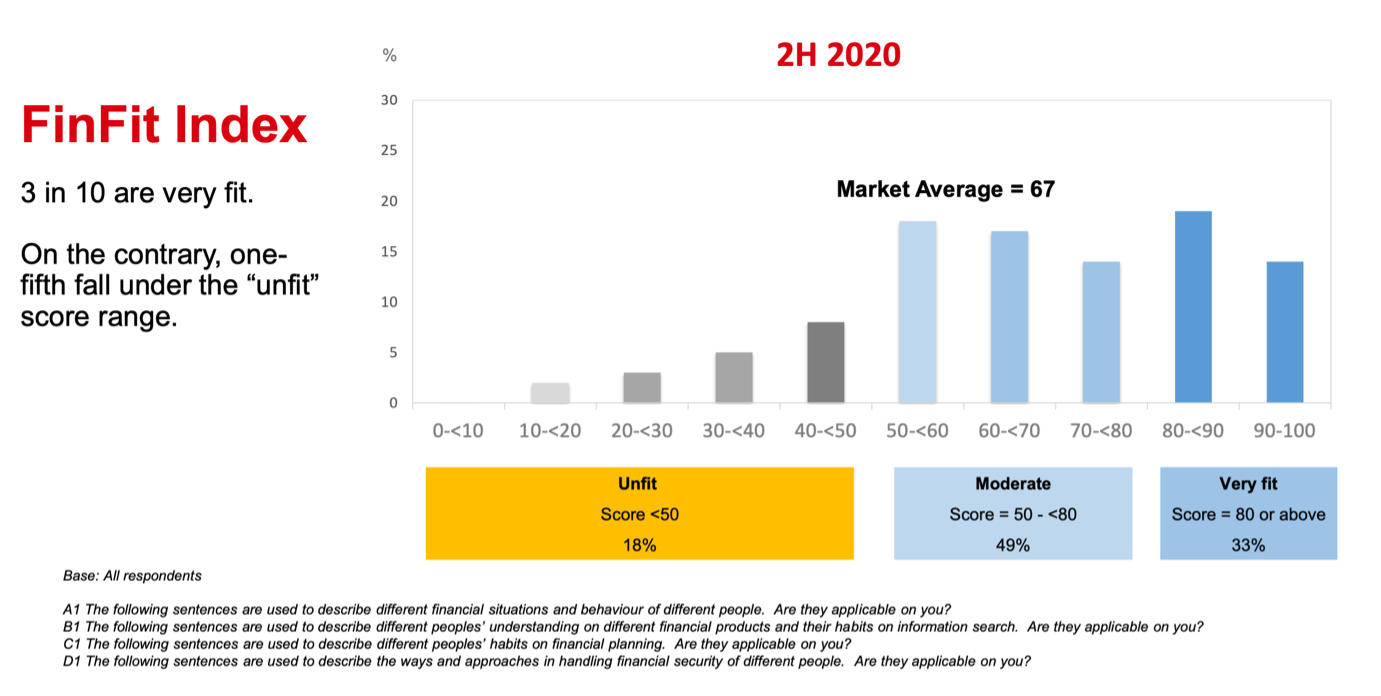

HSBC FinFit study found that Singaporeans have a moderate level of financial fitness. On average, Singapore scored 67 out of 100 on the FinFit score.

Source: HSBC

Source: HSBC

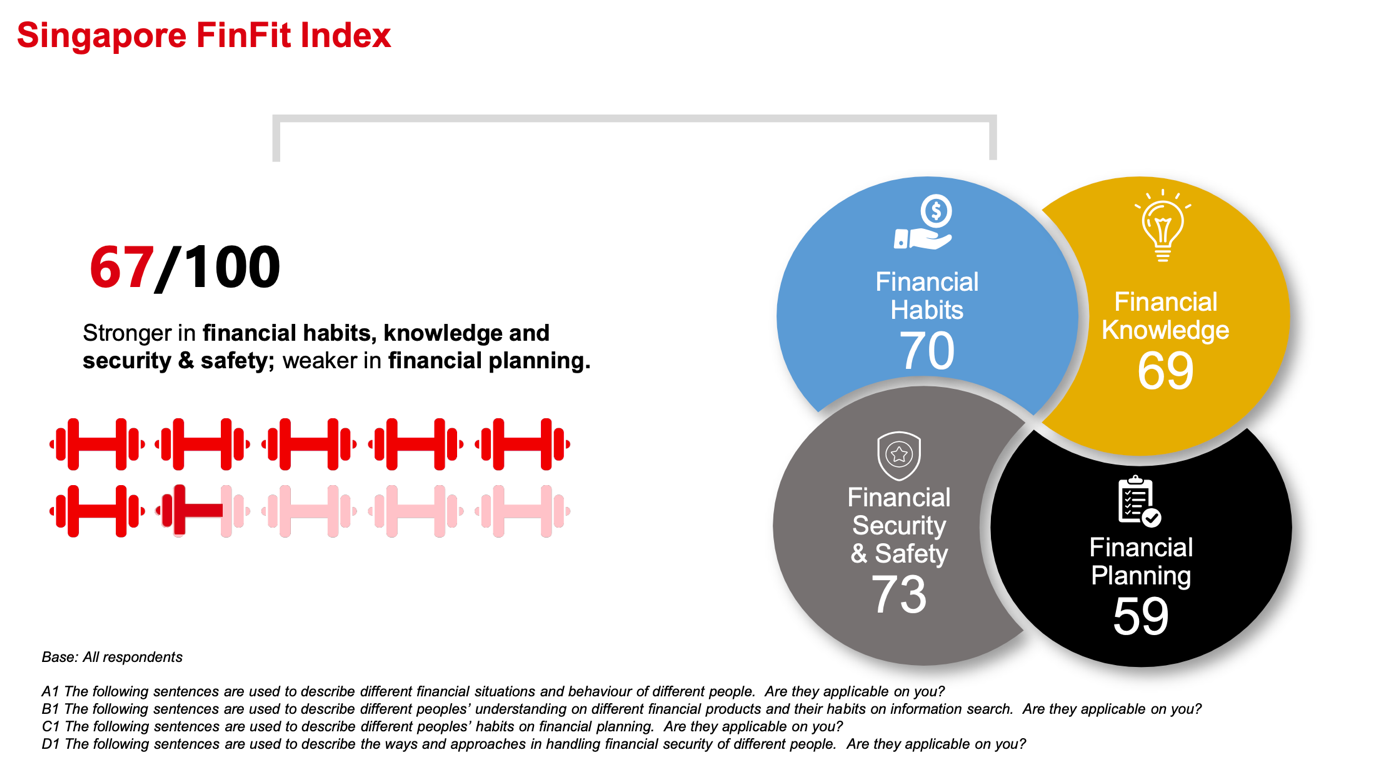

Among the 4 key areas, we scored better in financial habits, knowledge and security & safety. The area where more Singaporeans were weak in was the financial planning segment where the average score was only 60.

Source: HSBC

Source: HSBC

Top 4 Financial Concerns Among Singaporeans In 2021

But let’s not get too fixated on the FinFit scores. That’s because the FinFit score is an average score that measures the responses from the participants. Beyond the scores, it is more important for us to look at the findings from the HSBC FinFit study.

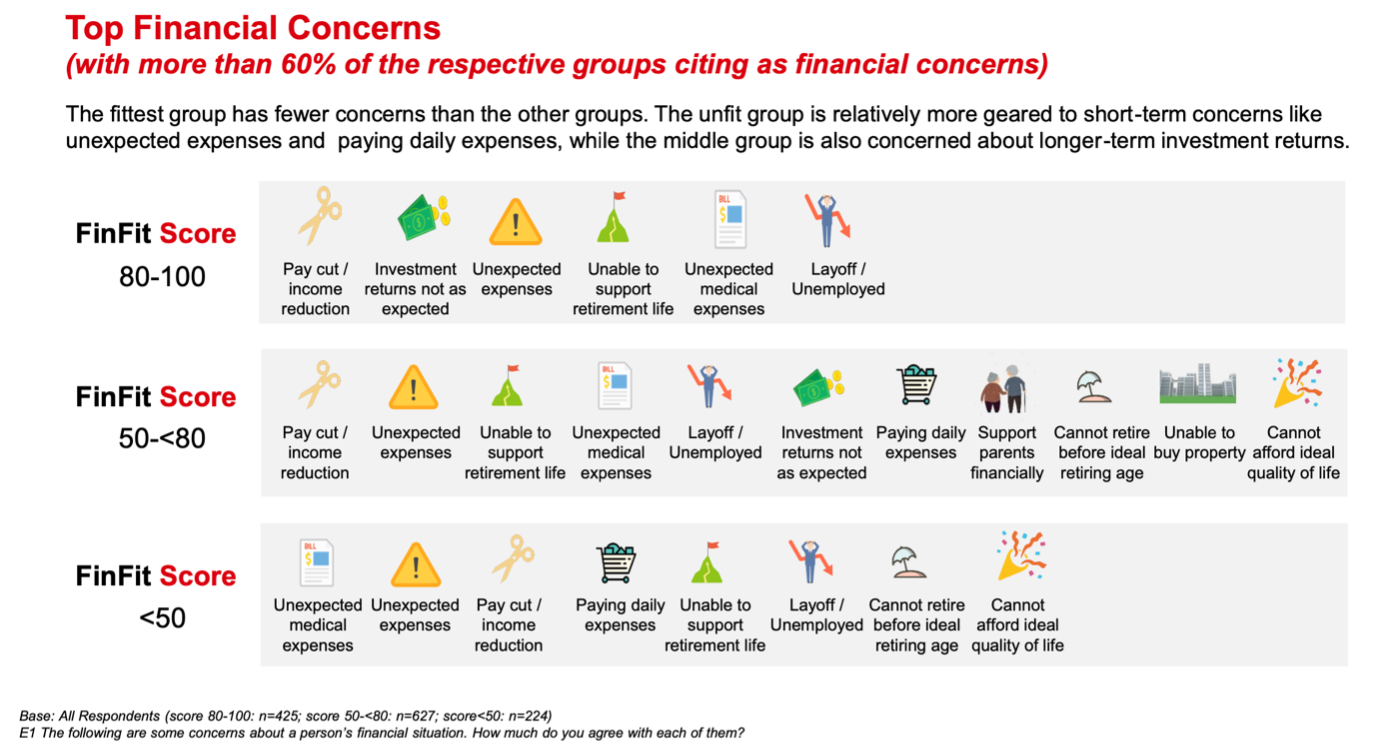

As part of the study, HSBC dug into the top financial concerns of Singaporeans with different level of financial fitness. Interestingly, there were some common financial concerns that plagued even the fittest.

-

Unexpected Medical Expenses

It is hardly a surprise why unexpected expenses was a common financial concern for Singaporeans, regardless of FinFit score. That’s because the unexpected nature of such expenses can really derail your savings and financial plans.

Just imagine what kind of financial, emotional and social consequences there will be if you were suddenly hit with a $20k hospitalisation bill or be told that you are diagnosed with cancer. But fortunately, unexpected medical expenses can be alleviated. And it’s simple too.

Get yourself the right insurance combo so that your insurer will cover those unexpected medical expenses for you. With the right insurance combo, you don’t have to worry about forking out money from your own pocket to pay for unexpected hospital bills.

-

Unable To Support Retirement Life

Most of us want to retire and we want to retire by a certain age. But the prerequisite for retirement is that you need to have enough retirement savings. Without retirement savings, you wouldn’t be able to support your retirement life. And that’s exactly the financial challenge that many of us face.

To support your retirement life, it is not rocket science. But it definitely requires discipline and good retirement planning. Without these two, you won’t achieve your dream of retiring.

And if you want a good chance of achieving that retirement dream (early), here’s a tip for you: Start your retirement planning early. In fact, the earlier you start, the higher your chance of retiring and alleviating the concern of being unable to support your retirement life.

-

Investment Returns Not As Expected

Letting your money work hard for you is one of the ways that financially fit Singaporeans do to support your other financial plans. However, investment isn’t for everyone and investment returns can also fluctuate. What happens if investment returns are not as high as what you expected? Then what happens to your financial planning?

Thus, we need to be smart about what kind of investments we make. If you need high investment returns to support your financial planning, then make sure to find the right kind of investments. For instance, endowments and traded endowments are useful financial tools that can help you boost your investment returns.

-

Layoff / Unemployment

Getting retrenched is a legitimate concern, especially if you are in your 40s. Last year, Covid-19 has shown us just how vulnerable the labour market in Singapore can be. In addition, the hard truth is that Covid-19 won’t be the last of the infectious disease. There can be many other viruses that will create the same kind of pandemic, or even worse.

Since we can’t avoid infectious disease and their impact on the economy, the only way we can deal with it is to be prepared for it. But how?

There are few ways you can be prepared for it. From an income perspective, you need to constantly upskill and upgrade so that you keep yourself relevant and keep your income stream coming in. From a financial planning perspective, you should discuss with your financial planner to come up with a solid financial plan. Even in the scenario where you are retrenched, you will still have enough savings to tide you through.

Need a trusted financial planner to plan for you? Set up an appointment with Moneyline.sg today.

2 Comments