OCBC Financial Wellness Survey 2021 vs 2020: What Have Singaporeans Learned In The Past Year

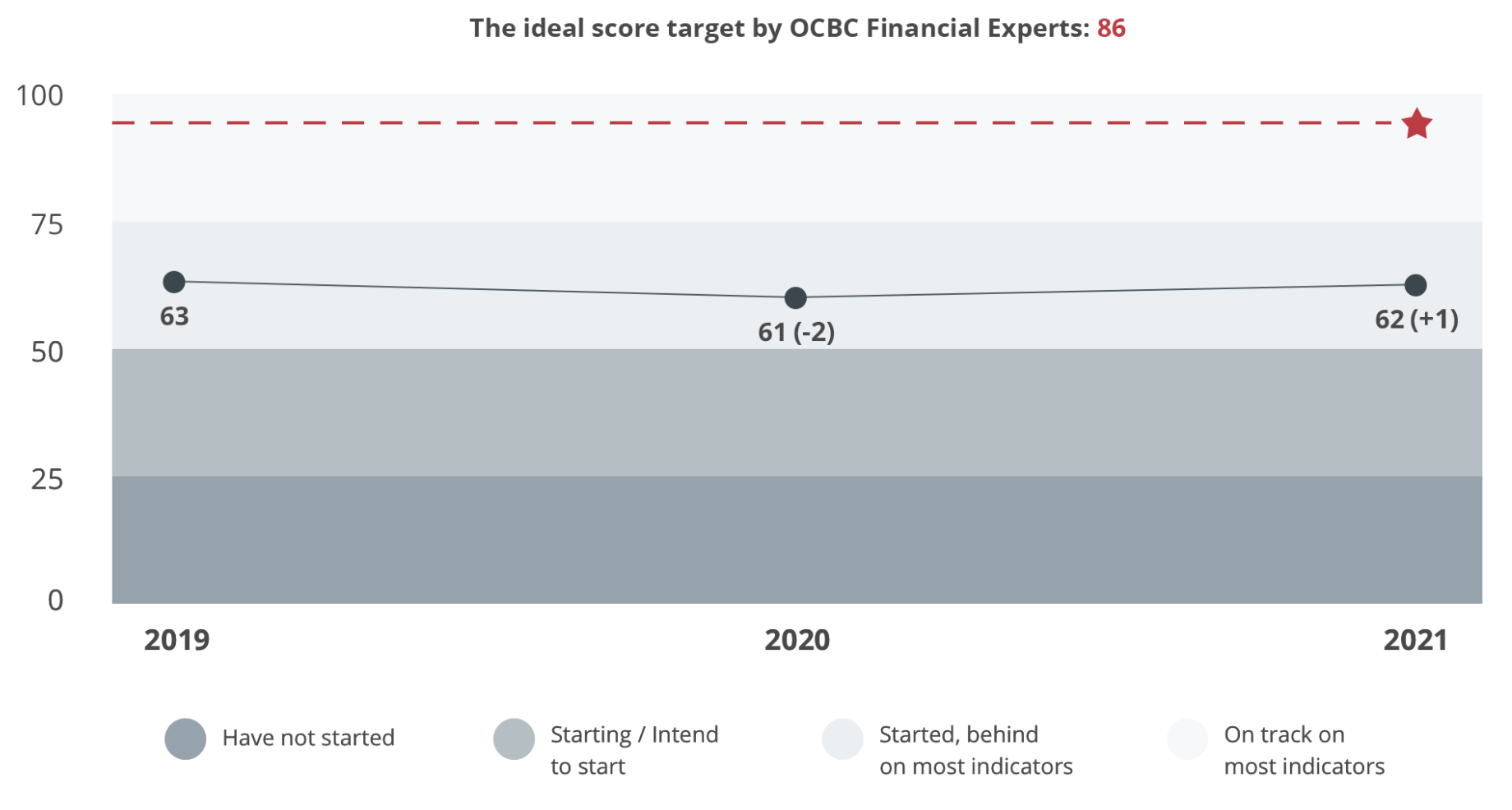

Since 2019, OCBC has been running the OCBC Financial Wellness Index to study Singaporeans’ financial health. 2,000 working adults in Singapore aged between 21 and 65 are surveyed online on questions relating to their financial situation every year.

In this year’s survey, Singaporeans continue to score way below the ideal score that OCBC financial experts deem appropriate. At a score of 62, it indicates that most Singaporeans have started but are behind on most indicators in terms of financial wellness.

Source: OCBC Financial Wellness Survey 2021

Source: OCBC Financial Wellness Survey 2021

We take a deeper dive into the key takeaways in this year’s OCBC Financial Wellness Survey.

Takeaway 1: Fewer People Are Committing To Undesirable Habits

One of the key to having good financial wellness is the discipline to stay consistent even when faced with temptations. But let’s be honest. It can be a tough ask to resist every temptation that gets thrown at us. This is especially so in today’s situation where we are so connected to the internet and we get so much temptations to spend, gamble or speculate.

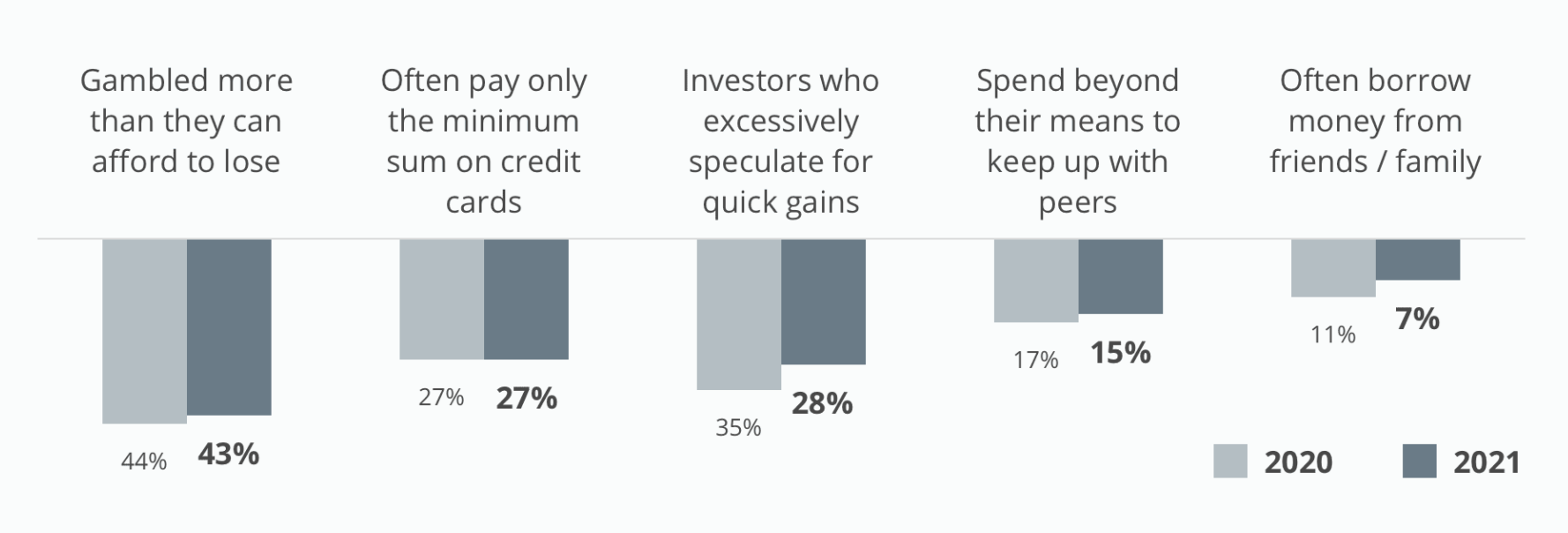

The good news is that OCBC Financial Wellness Survey 2021 found that we are getting better at resisting temptations. In fact, fewer people are committing to bad financial habits, even when temptations get in our face.

Source: OCBC Financial Wellness Survey 2021

Source: OCBC Financial Wellness Survey 2021

Proportion of respondents that reported speculation, spending beyond means to keep up with peers and borrowing money from friends/families have come down since 2020. That said, paying minimum sum on credit card and gambling more than one can afford to lose is still a huge proportion.

Takeaway:

- Gambling is a fool proof way to be in financial ruin. It will not bring you financial freedom.

- Credit cards are useful, but they can be debilitating if you don’t use it properly. If you only make minimum payments every month, it will take you 7 years just to pay off your debt.

Takeaway 2: Singaporeans Are Showing More Awareness About Retirement, But Still Underestimates Retirement Amount

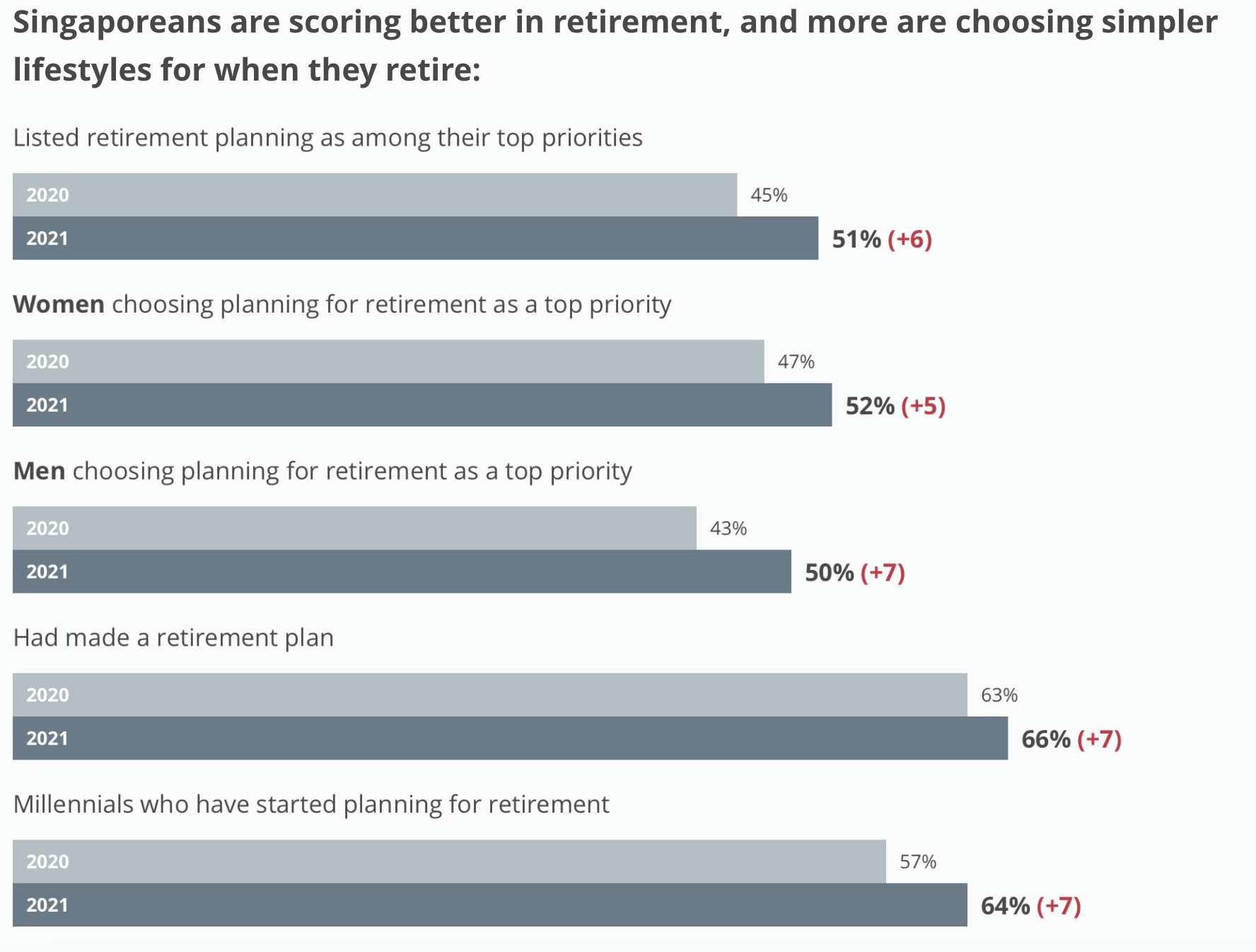

Source: OCBC Financial Wellness Survey 2021

Source: OCBC Financial Wellness Survey 2021

According to OCBC Financial Wellness Survey 2021, Singaporeans are showing greater awareness about retirement. More than 50% of those surveyed listed retirement planning as one of their top priorities. 66% also indicated that they have already made plans for retirement.

This phenomenon is not just seen in the mature working adults. It is also pretty significant for millennials with 64% indicating that they have already started planning for retirement despite being below the age of 40.

It is great to know that more Singaporeans have started placing emphasis and importance about retirement. However, the reality is still harsh. The survey found that some 8 in 10 Singaporeans are still underestimating the amount they need for retirement. This shortfall in retirement amount is around 31% on average. This means that the retirement amount that most Singaporeans are planning for would only last for 2/3 of the retirement years planned.

Takeaway:

- Having stronger awareness about retirement is great, but it is also important to plan the right amount for retirement.

- Plan for too little retirement fund means that you might end up with a shortfall.

- Plan for too much and you will find that it can take a toll on you as you work harder and longer to hit a retirement amount that isn’t realistic.

Need professional advice on how you can and should be planning for retirement? Reach out to us to help you with your retirement planning today.

Takeaway 3: More Are Choosing Simpler Lifestyles For When They Retire. Is This By Choice Or Forced?

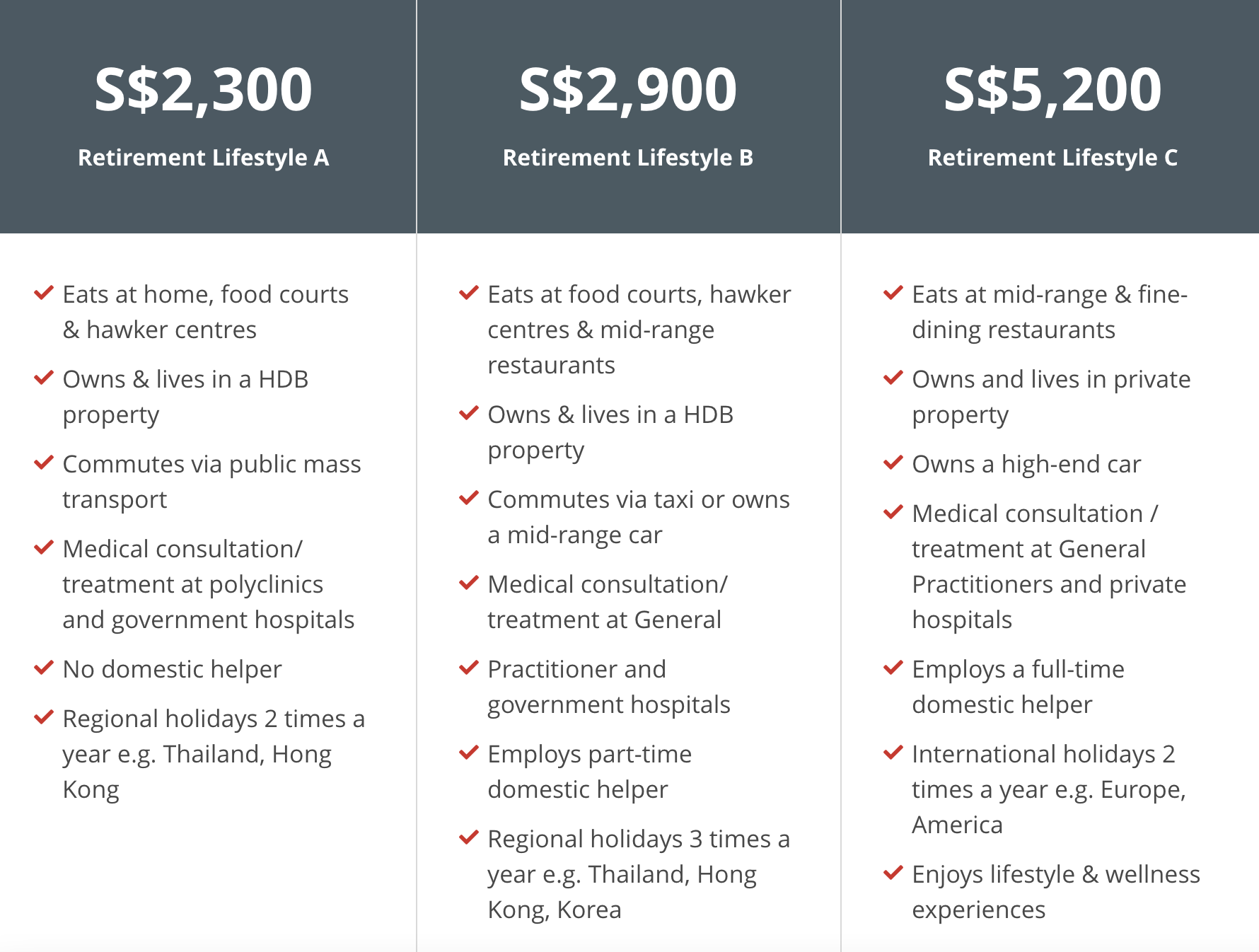

In the survey on retirement, OCBC also sought to find out about the type of retirement lifestyle that Singaporeans are seeking.

Source: OCBC Financial Wellness Survey 2021

Source: OCBC Financial Wellness Survey 2021

3 types of retirement lifestyle were given as option to respondents: Retirement lifestyle A, B and C. These 3 retirement lifestyles can be loosely translated to modest, moderate and extravagant.

Interestingly, 40% of respondents picked the modest retirement lifestyle among the 3. Modest retirement lifestyle means either eating at home or dining out at food court/coffeeshop/hawker centre. It also entails living in HDB, having no maid, going to polyclinic for healthcare treatment and taking public transport.

A thought that we have in mind was whether the choice of modest retirement lifestyle was by choice or by circumstances. Considering that respondents underestimated the amount needed for retirement, is this because we underestimate even the cost of the most modest retirement lifestyle? Or did we underestimate the cost of inflation on the retirement lifestyle that we chose?

Takeaway:

- This is a poignant reminder for every Singaporean about the importance of retirement planning.

- The earlier you plan for retirement, the more leeway you have to adjust your plans along the way if you need to.

Do The Survey: Gauge Your Own Financial Wellness

Want to know whether you have the right financial habits? OCBC provides a quick 12-question quiz to give you an indication of your financial wellness score. The questions are based on the 10 pillars of financial wellness defined in the comprehensive OCBC Financial Wellness Survey 2021.

Set Up An Appointment For A Comprehensive Financial Review

Need a more comprehensive evaluation of your current financial wellness? Set up an appointment with Financial Advisors and they will do a full financial review for you. This review includes an evaluation on both your mindset on finances, your current assets and liabilities and financial goals/gaps. We will also provide free recommendation and how you can close those financial gaps to achieve your financial goals.

1 Comment