Want To Save $100k In 2021? Here’re 4 Things You Need To Do

Saving $100k by 30 (or earlier) is a financial milestone that is common among Singaporeans, especially those who are looking to FIRE (financial independence, retire early). But is it even possible? Based on some rough calculation based on a monthly salary of $3,000, it sure is. All it takes is 5 years and you can save up at least $100k.

But what if you want to save $100k in a shorter time period? Perhaps by end of 2021? Well, you can. There are 4 things that you need to do to make that a reality.

-

Make An Annual Review Of Your Financial Plan

As the saying goes, if you fail to plan, you plan to fail. That applies to almost everything in life, including personal finance. If saving up your first $100k is THE personal finance goal you are aiming for in 2021, then the first thing you need to do is to review your current financial situation.

A review of your current financial situation will tell you how far away you are from your goal and how much effort and discipline you need to work towards it. For instance, you need to make sure that you have all the right protections in place (i.e. health, life insurance) before you start investing and growing your money.

While reviewing your financial plan is easy as it sounds, it is no mean feat. The financial jargons can confuse average non-finance background individual. If that sounds like you, perhaps you want to consider engaging professional help to do a comprehensive review of your financial plan for you. Because one wrong analysis of your financial plan can lead to unwanted repercussions.

Get in touch with a financial planning expert here to help you with your financial planning today.

-

Take Advantage Of Planning Tools To Keep Track of Your Financial Goals

Having the right financial goals is the way to go. But often times, you find that not many are able to achieve their financial goals. And that’s because of the lack of discipline and motivation as time passes.

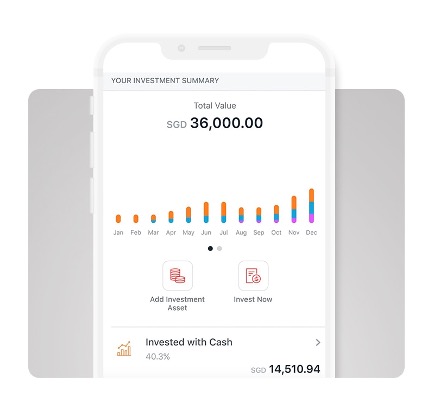

To ensure that your level of discipline and motivation do not decline after the first three months of the year, you can take advantage of planning tools like DBS Nav Planner, OCBC OneView (coupled with SGFinDex) to help you.

These tools not only let you set financial goals, they also help you to keep track of them. They can help you transfer savings into your savings jar automatically so that you do not fall behind on any of your financial goals. They also provide you with useful tips on how you can level up your personal finance with some interesting nuggets of information and insights to supercharge your financial planning.

-

Max Out Your HDB Grants

For those who are just starting out your career and building up your financial plan, there’s one life hack that you should know: HDB grants.

Did you know that HDB grant lets you get as much as $160k in your CPF Ordinary Account to offset the cost of owning an HDB? That’s right, the Enhanced Housing Grant (up to $80k), Family Grant ($40k to $50k) and Proximity Housing Grant ($20k to $30k) will add up to $160k. Of course, it depends on whether you fulfil the criteria for each of them. But if you do qualify for all 3, then you and your (future) spouse will be granted $80k each into your CPF Ordinary Account.

With that, you are just $20k away from your $100k savings goal in 2021.

For those who have already missed the window of opportunity for HDB grants, fret not. Apart from HDB grants, the other hack that can help you save more is to switch from an HDB loan to a bank loan for your home. At current interest rates, the cost of financing your home with a bank loan is almost half of what you would be paying for an HDB loan.

Check out what are the best home loan rates you can find on the market at the moment right here.

-

Invest For Higher Return On Your Cash

If you have already been there and done that for the steps listed above, congratulations. You earned the right to progress into the final and most important step to saving $100k in 2021: Investing for higher rate of return. If you want your wealth to grow faster, this is the most important step you need to take.

Investing for higher return lets you take advantage of the 8th wonder in the world (compound interest) to grow your current savings at a faster rate. For those with high appetite for risk, you might want to invest in the stock market with financial tools like exchange traded funds (ETFs) or even individual stock investments.

If you don’t think that you are experienced enough or prefer a lower risk investment, perhaps you want to consider traded endowments. Traded endowments come with 2.5% to 3.5% investment return with a short investment time horizon of 1 to 5 years. It sure beats inflation and the savings rate that you are getting in return from banks. So there’s really no reason for you to miss this opportunity if you are really interested in hitting your $100k goal in 2021.

Alternatively, you can also check out endowment savings plan with a longer investment horizon.

Start Today And Reap The Benefits When 2021 Ends

Regardless of where you are in your financial journey, the most important thing to do from now onwards is to start. Remember, the earlier you start, the more likely you are going to achieve your $100k saving goal by 2021.

Read: Truth about 3 personal finance questions that Singaporeans ask