2023 Guide To Earning Good Investment Returns: Beating Inflation Without Taking On Excessive Risk

Investing can be a daunting task, especially for those new to the world of finance. The stock market can seem like a gamble, and many people fear the risk of losing their money. However, not every investment you make has to be risky. In fact, there are several investment options available for retail investors to beat inflation with minimal risk.

In this article, we will focus on some sure-win strategies that can help you earn good investment returns while beating inflation without taking on excessive risk.

4 Investments To Help You Beat Inflation Without Taking On Excessive Risk

-

T-Bills

T-bills, or Treasury bills, are short-term debt securities issued by the government. T-bills are a low-risk investment option that offers a guaranteed return. By purchasing a T-bill, you are lending your money to the government.

Since T-bills are backed by the government, they are (almost) risk-free. Therefore, T-bills are a good option for those looking to invest with minimal risk. After all, if the Singapore government is unable to repay its debt, the country is most likely in a dire state anyway.

The return on T-bills is typically lower than other investment options. However, in the past year, return on T-bills is as high as 4.5% pa. For a risk free investment vehicle that returns 4.5%, what’s there to not like about T-bills?

T-bills come in different maturity periods with options of 3-month, 6-month, or 12-month. You can find the latest auction yields for T-bills on Monetary Authority of Singapore (MAS) website.

To invest in T-bills, you can do so through your brokerage account or through your bank. You can also make use of your CPF OA account, which is what many investors are doing nowadays.

-

Singapore Savings Bond

The Singapore Savings Bond (SSB) is another low-risk investment option that offers a guaranteed return. It is a savings product launched by the government to provide individuals with a safe and flexible way to save and invest their money.

The biggest draw for SSB is its flexibility. While the SSB has a ten-year maturity period, but investors can choose to redeem their investment anytime without any penalty. To reward long term holders, you get step-up interest rates on SSB the longer you hold it.

Just like T-bills, the yield for SSB is also not fixed. The interest rate on the Singapore Savings Bond is reviewed every month. You can find the latest SSB yields on MAS website as well.

To invest in the Singapore Savings Bond, you can do so through your bank either on the internet banking platform or through the ATM.

-

High Interest Savings Account

What if you don’t want to lock in your cash for such a long period? You can opt for high interest savings account instead. Because of the rising interest rate environment, banks are also fighting for you to keep your cash deposits with them. Therefore, banks have been aggressively promoting its high interest savings account.

High interest savings accounts are a great option for those looking to earn higher returns on your savings. These accounts offer higher interest rates than traditional savings accounts, making them a great option for individuals who want to earn a risk-free return on their savings.

Some popular high interest savings accounts in Singapore include UOB One, OCBC 360, and DBS Multiplier. These accounts offer a high interest rate on savings if you meet some of their requirements.

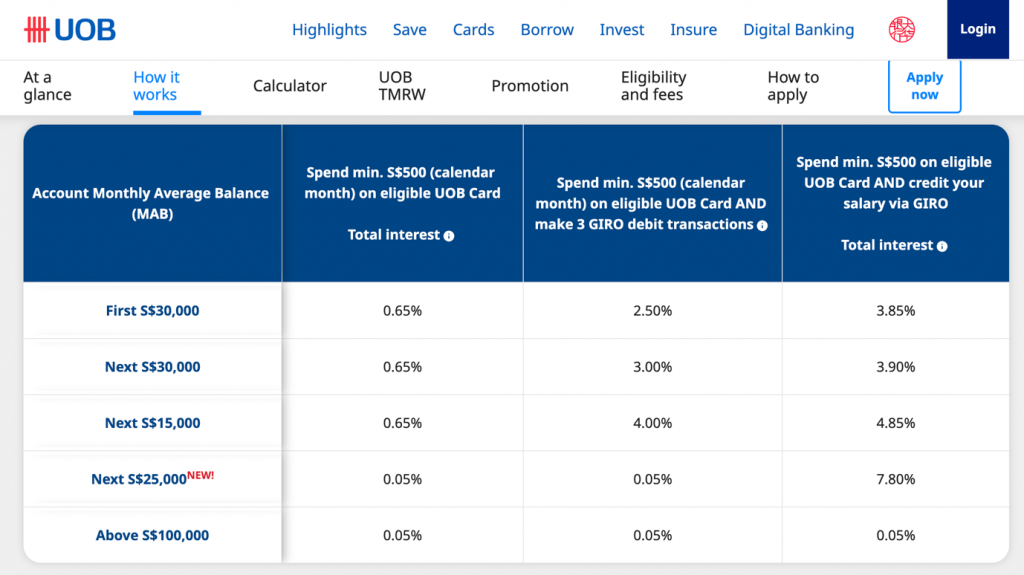

For instance, if you credit your salary (minimum of $1,600) and spend $500 on your debit card, then you can effectively earn up to 5% interest rate per annum on your savings at UOB One.

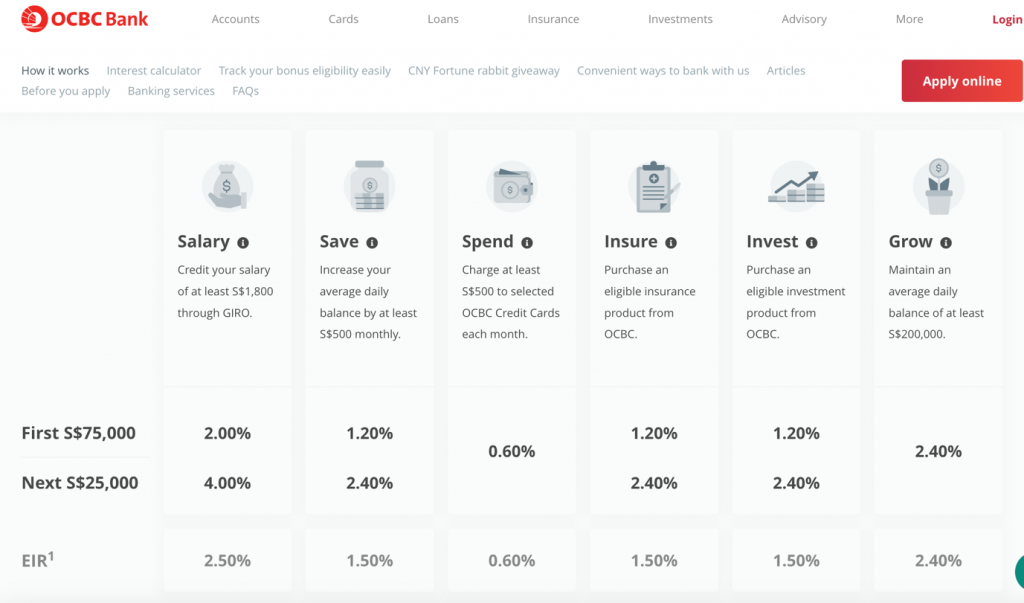

For others like OCBC 360 and DBS Multiplier, you get to earn up to 4.65% and 4.10% pa respectively if you also insure and invest with them.

-

Endowment Plan

When it comes to investing, it’s important to assess your risk tolerance and investment goals carefully. If you’re willing to take on more risk for potentially higher returns, you may want to consider investing in stocks or mutual funds.

However, if you prefer a low-risk investment option, endowment plan is one of the sure-win strategies that can help you earn good investment returns.

Endowment plans represent a medium term investment plan that provides a guaranteed return. These plans are usually offered by insurance companies and encourages investors to invest a lump sum amount for a specified period (e.g. 5 years). At the end of the period, investors receive a lump sum payout along with the guaranteed return.

On top of the guaranteed return, an endowment plan may also provide a non-guaranteed return. The amount of non-guaranteed return you get will be based on investment returns from the insurer. You can think of this like a bonus. If the investments do well, then you get a bonus. If not, then you still have your guaranteed return that the insurer promised.

Diversify To Create Higher Returns, But Make Sure You Can Take The Risk

Relying on any single type of investment brings about risk for your overall portfolio.

Imagine if you only had stocks in your portfolio. Your portfolio would be down at this point and you would have lost out on the opportunity to earn risk-free interest rate from T-bills, high interest savings account, and endowment plans.

Thus, having a good mix of different asset classes to reduce your overall risk and potentially increase your returns. But before you do that, make sure you are clear about your own risk profile and risk appetite.

Need help understanding your risk appetite and risk profile? Talk to us at Moneyline.sg to schedule a free risk consultation.