SRS Investment Products Based on 5 Different Risk Appetites

If you are an above-average income earner and wish to chuck aside more money for your retirement beyond your mandatory and voluntary CPF contribution, the Supplementary Retirement Scheme a.k.a SRS Investment is a great way for you to save.

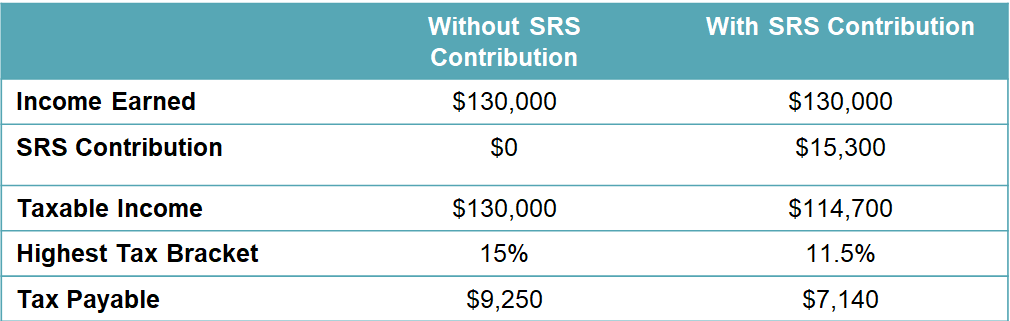

As most people would know, the SRS is a voluntary scheme that allows Singaporeans, PR and Foreigners working here with a valid pass to not only save for their retirement but also can help to relieve some tax burdens.

Anyone above the age of 18 can open an SRS account in any of the 3 local banks (UOB, OCBC and DBS/POSB).

Maximum Contribution for Singaporeans and PR

The maximum contribution allowable for Singaporeans and PR is $15,300 as of 2019

Maximum Contribution for Foreigners

The maximum contribution allowable for foreigners with a valid pass is $35,700 as of 2019

A Quick Look at How SRS Help you save

So what do you do with your SRS Contributions?

So you’ve contributed to your SRS and happy that you are able to save some tax expense for next year, but wait a minute, do you know that your interest rate on the SRS funds by default will only be at 0.05% per annum? Therefore, it’s not such a great idea to just let your SRS Contribution idle and do nothing about it. There is actually a multitude of products you can invest your SRS monies in to let it grow depending on the type of investment risk appetite you may have. Here at Moneyline.SG we discuss 5 types of Risk profile you may be categorised under and the type of investment for you to consider.

The Conservative

Fixed Deposits

If you belong to this group of investors, you are likely the type that can accept little to no risk on your capital. If you want a short term yet principal guaranteed solution, you may want to consider putting your money in a Fixed Deposit Account, the fixed deposit typically yield around 1% – 1.5% p.a. depending on the tenure of your placement.

Singapore Government Bond/SSB

If you have a slightly longer time horizon, you may consider investing into the Singapore Government Bond/Singapore Savings Bond. The Singapore Government is one of the only few countries in the world that are AAA rated by reputable credit agencies. Even though the principal is not guaranteed, most investors should have no qualms about getting their money back in the long run. Expected return on Singapore Government bond over a period of 10 years can yield roughly 1.5 – 2.6% p.a.

Endowment

For most conservative investors with a long term time horizon, a single premium or recurrent single premium endowment plan can be considered. With sufficient time given and consistently good performance by the underlying insurer’s participating funds, a good endowment policy will not only provide you with principal guaranteed but may even provide a non-guaranteed yield of up to 4.5% per annum return. There are two types of endowment plans, one is a retirement plan that pays out regular income from your chosen retirement age, and the other kind will give you a lump sum as and when you would like to start withdrawing with the flexibility to partial withdraw anytime.

The Moderate

High-Quality Investment Grade Corporate Bonds

The moderate risk appetite investors may be able to take some risk with their capital and can consider investing in a high-quality investment-grade retail corporate bond. These individual bonds are usually issued by blue-chip companies with a sound credit rating of BBB and above. Typically expected returns can range anywhere from 2 – 5% p.a.

Fixed Income Exchange Traded Funds

If you prefer not to put all your monies into one bond, you can consider investing into an index bond fund, this basket of bond allows you to diversify your monies across different corporate and government bonds into one entity passively managed by a designated fund manager. Non-guaranteed return may range from 2 – 4% p.a.

Fixed Income Unit Trusts

Similar to investing into an index bond fund but you want your monies to be actively managed, one may consider into a bond fund managed by a Unit Trust Manager. Returns may or may not outperform the Exchange Traded Fund but you may expect to pay higher management and brokerage fees. Non-guaranteed return ranges anywhere from 2 – 4% p.a.

The Balance

Combination of Stocks/ETFs and Bonds

If you’re a balanced risk appetite investor, you should be able to take a higher risk than a moderate risk investor and can look into a little exposure into owning both shares and bonds in your portfolio at the same time. SRS Investment allows linkage of stock brokerage account and can choose to invest a portion of your fund into blue-chip shares or Index ETF while portioning another part of it into a bond fund or any retail corporate bonds. Expected returns can range from 3 – 7% p.a.

Balanced Fund or Balanced Portfolio of Funds

If you prefer to leave it to the experts, you can consider investing directly into a balanced unit trust comprising of Bonds and Shares or invest separately into different bonds and equity funds to be managed. Potential return can range from 3 – 7% p.a.

The Growth

High Yield Bonds or Junk Bonds

If you prefer the thrill of hit or miss, you can consider investing in lower-quality investment-grade bonds, such bonds are usually rated below BBB or maybe ungraded. Due to the higher risk of default, these bonds tend to provide higher coupon pay-out usually higher than 6% p.a. A safer way to invest in such bonds will be via a basket of it in the form of mutual funds or unit trust.

Basket of Blue Chip Stocks

Blue-chip companies are behemoths in their industry, they usually own a large market share in their line of business and are more resilient to economic downturns. Expected return in the range of 8% or more

Basket of REIT

REITs are professionally managed funds that invest in real estate properties and distribute rental revenues from these assets at regular intervals to REIT investors. REITs are typically categorised into different types, namely commercial, industrial, healthcare, retails, data centre or even hospitality. REITs are usually considered lower risks than stocks and shares as they are backed by an asset, which is usually the property that they invested in. Typical potential REIT returns including dividends can range from 5 to 10% p.a.

Equity Funds – ETF & Unit Trust

If monitoring and picking your own stocks is a hassle, investing in equity funds may be an ideal solution, there are two ways to go about investing into funds; one is through an index fund which is passively managed and another through a unit trust, managed actively via an investment manager. Potential returns ranges anywhere from 6 to 20% depending on the kind of funds you select, there are industry equity funds, single country equity funds, regional equity and global equity funds to pick.

The Aggressive

For the aggressive investor, the sky is the limit; potential returns may range from double-digit percentage growth or even a few folds in return over a specific period of time.

Single Company Stock/REIT

For the YOLO investors, there is plenty of excitement out there. One way is to throw all your eggs into one basket if you’re confident enough that this particular company will experience phenomenal growth whether is it for the short or long term.

Industry or Specific Focus Funds

Such funds are on the higher side on the risk scale. Its make or break as fund managers are focused in a certain sector or industry or a niche investment objective, e.g. disruptor focused equities.

Commodities

You may also invest in commodities such as precious metals using your SRS Account; such investment may provide a good hedge during economic uncertainties or may be stagnant during times of economic growth.

Conclusion

There are no hard and fast rules on what to invest in using your SRS Funds, your risk appetite and investment objective may change each year. Most importantly, the sole purpose of contributing to your SRS should be building your retirement nest egg, the tax savings part comes as a bonus and one may want to think twice about contributing to their SRS especially they are unsure about their cash flow.

At Moneyline.SG we ally ourselves with a licensed representative who is well versed in advising on your SRS Investment. Hit us up with some details below and a licensed representative will contact you within the next working day to help draft a financial solution targeted to your needs and risk profile.