Understanding SRS And Maximising Its Benefits

We might all be pretty familiar with using our CPF money for property financing and investment but the Supplementary Retirement Scheme(SRS) might be less heard of. Essentially, it is a savings scheme introduced to complement your CPF savings for retirement.

Key Features To Note About SRS

The SRS is a voluntary scheme. The maximum amount you can contribute a year is $15,300.You can only start to make withdrawals from age 62. 50% of your accumulated SRS savings will not be taxed (i.e. a 50% tax concession) when you withdraw after reaching the statutory retirement age. This concession will last for 10 years.

There is a 5% penalty should you make withdrawals before 62 years old.

Joining the SRS Scheme obviously has a number of benefits, including a reduction in your taxable income as well as using the funds for selected investments. So here’s a detailed look at what you can expect by contributing to your SRS.

1. Tax Deferment

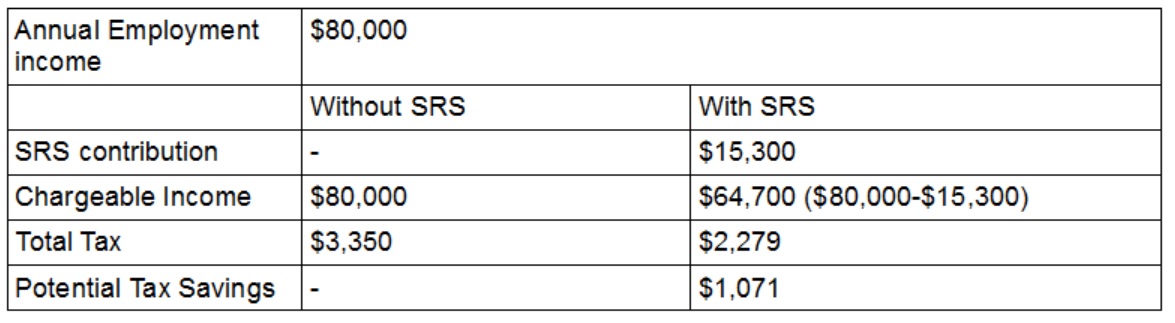

One of the highly-advertised benefits of contributing to the SRS Scheme is the amount of tax reduction you can enjoy from your current taxable income. Let’s illustrate how this works:

By putting the maximum amount of $15,300 per year in your SRS account, you get to enjoy more than $1,000 in tax savings! Looks like quite a good deal? What we realise is that this is actually a tax deferment rather than a direct saving. Why? This is because many people overlook the fact that your SRS savings are still taxable when you start making withdrawals at age 62. However, you will still enjoy some savings. The logic is simple – you will most likely be in a lower tax bracket from age 62 onwards as you stop working. Additionally, there is a 50% tax concession for the first 10 years, which will most likely work out to be a discount on what you need to pay now.

Let’s say you decide to withdraw $40,000 per year after reaching the age of 62. This means that only $20,000 (50%) is subjected to tax. But because this is the only reported income, it falls under the minimum income required for tax payments, which means this income will be totally tax-free!

2. Using SRS Funds for investments

A less well-known usage of your SRS funds is to use it for investments. Most people know that you can use the money in your CPF Ordinary Account for investments but using the funds in your SRS is actually smarter.

This is because your CPF-OA earns you an interest of 2.5% per annum, while the SRS funds only earn you the minimal interest rate similar to a savings account. In this sense, it makes more sense to use the money in the SRS for investment since your opportunity cost is smaller.

You can use the money in your SRS account to invest in a wide variety of investment products, including shares, bonds, unit trusts, fixed deposits and insurance. But taking into consideration this fund will form part of your retirement savings, you should choose products that are a little less risky if you intend to preserve much of the capital.

Read: SRS Investment Products Based on 5 Different Risk Appetites

Investing your SRS safely

The majority of people who have opened an SRS account either park it in cash or in stocks. For the former, it isn’t really a wise option since you are only earning minimal interest rates. For those with a bigger risk appetite, using their SRS funds to invest in shares could be a good option; but this also means that you are subjecting your retirement funds to the volatility of the stocks market.

An alternative is to use it for an insurance endowment plan. An endowment plan provides insurance coverage against death and permanent disability during the policy term. On top of that, it also comes with a savings component where you’ll receive a payout after a fixed term. Be very sure to find out about the guaranteed amount you will receive and how much risk you will be exposed to if you have a participating policy.

Another type of product you can consider is an annuity. An annuity is a popular type of retirement planning product because they begin to pay a monthly income stream at retirement age. The premiums are paid as a lump sum or through periodic payments and they may be paid out for life, or for a specific term of say, 10 years. Annuities are commonly combined with term life insurance policies.

Some considerations on choosing a retirement product include:

- do you want a consistent yearly payout or one that differs?

- the total amount of payout

- would you prefer a higher payout over a shorter time period or a lower payout over a longer period?

- Is the amount of payout guaranteed or does it come with a non-guaranteed component?

There are many options available to make your SRS funds work harder rather than just leaving it as cash earning meagre interest. Retirement income-based insurance is probably one of the better options. Want to know more? You can contact us below

4 Comments