4 Ways The Change In Projected Investment Returns For Insurance Policies Will Affect You

Since 1st July, there’s a watershed moment in the life insurance industry that everyone who is ever thinking about buying an insurance should know. The moment that we are referring to is the downward adjustment of the projected investment returns on benefit illustration of life insurance policies.

Benefits Illustration: What’s That?

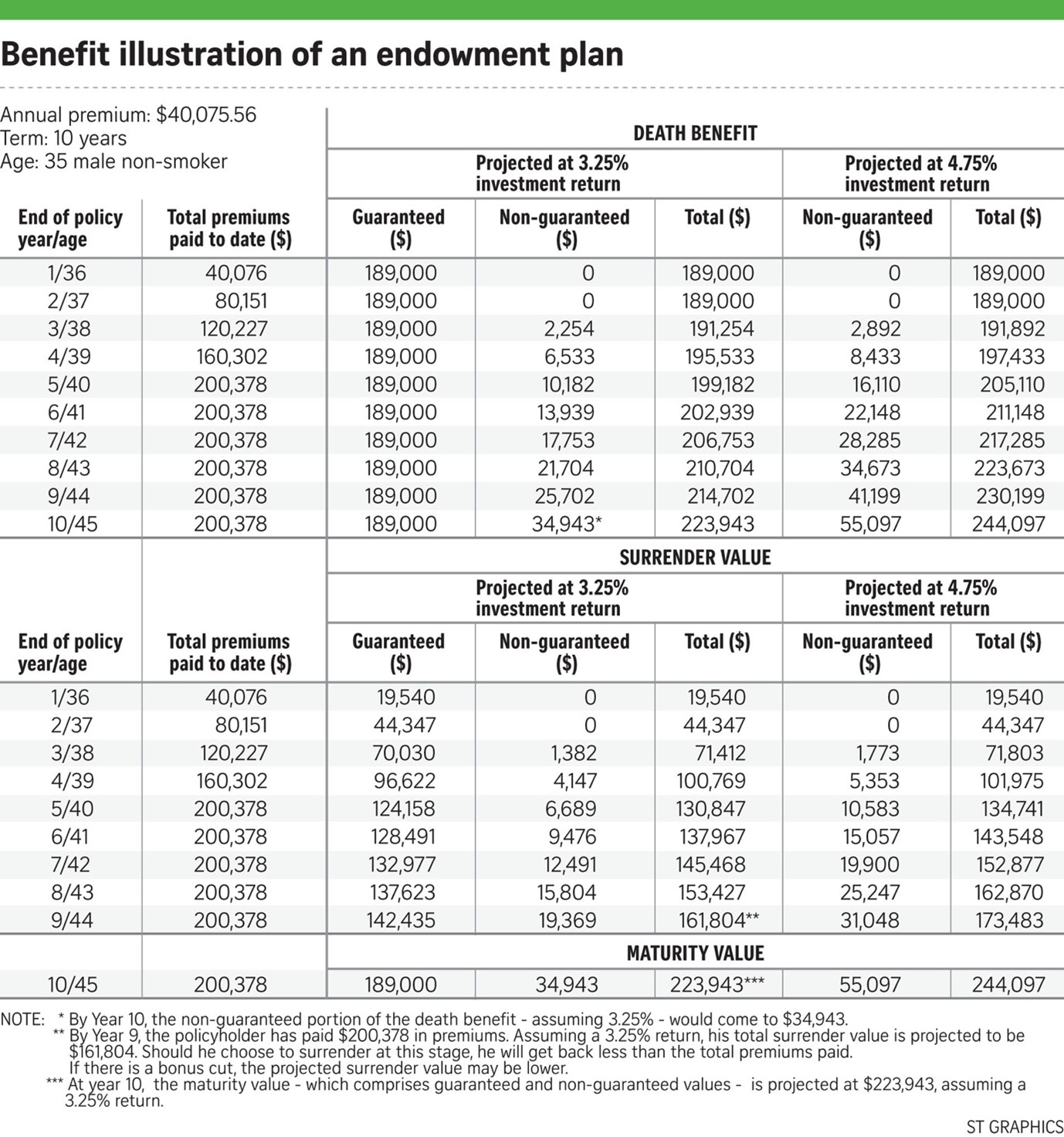

Source: Straits Times

Source: Straits Times

Typically, benefit illustration comes in the form of a table like the one that you see above. It is applicable only for participating insurance policies that have cash value such as endowment and whole life policy.

The benefit illustration table indicates the following:

- How much premium you would have paid to date;

- Guaranteed surrender/cash value of the policy;

- Non-guaranteed surrender/cash value of the policy; and

- Maturity value of the policy when the policy matures/terminates

What Has Changed In The Benefit Illustration Table?

Since 1st July, 2 things have changed on the benefit illustration table for participating policy. The indicative projected return of 3.25% and 4.75% will be adjusted downwards.

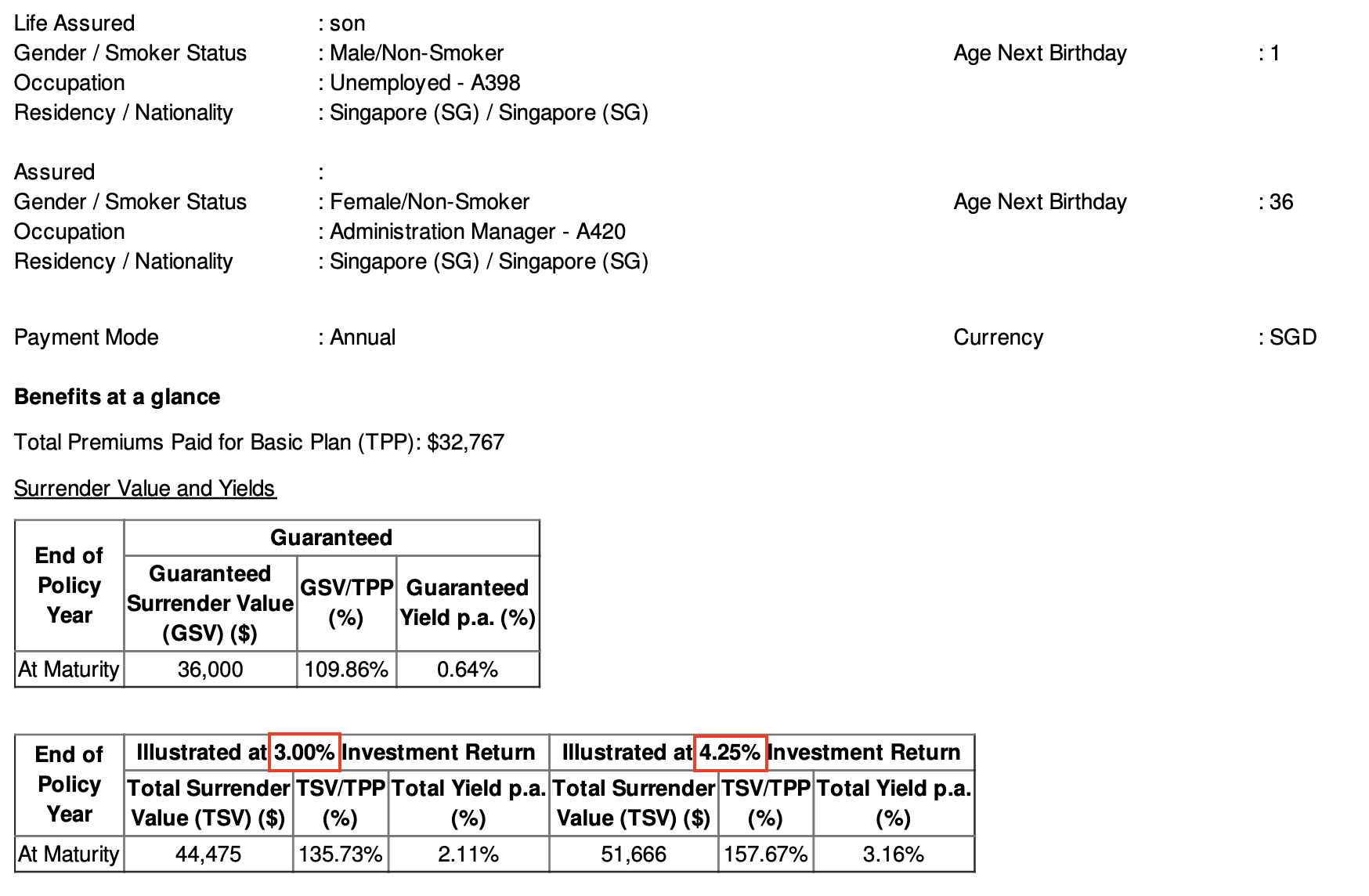

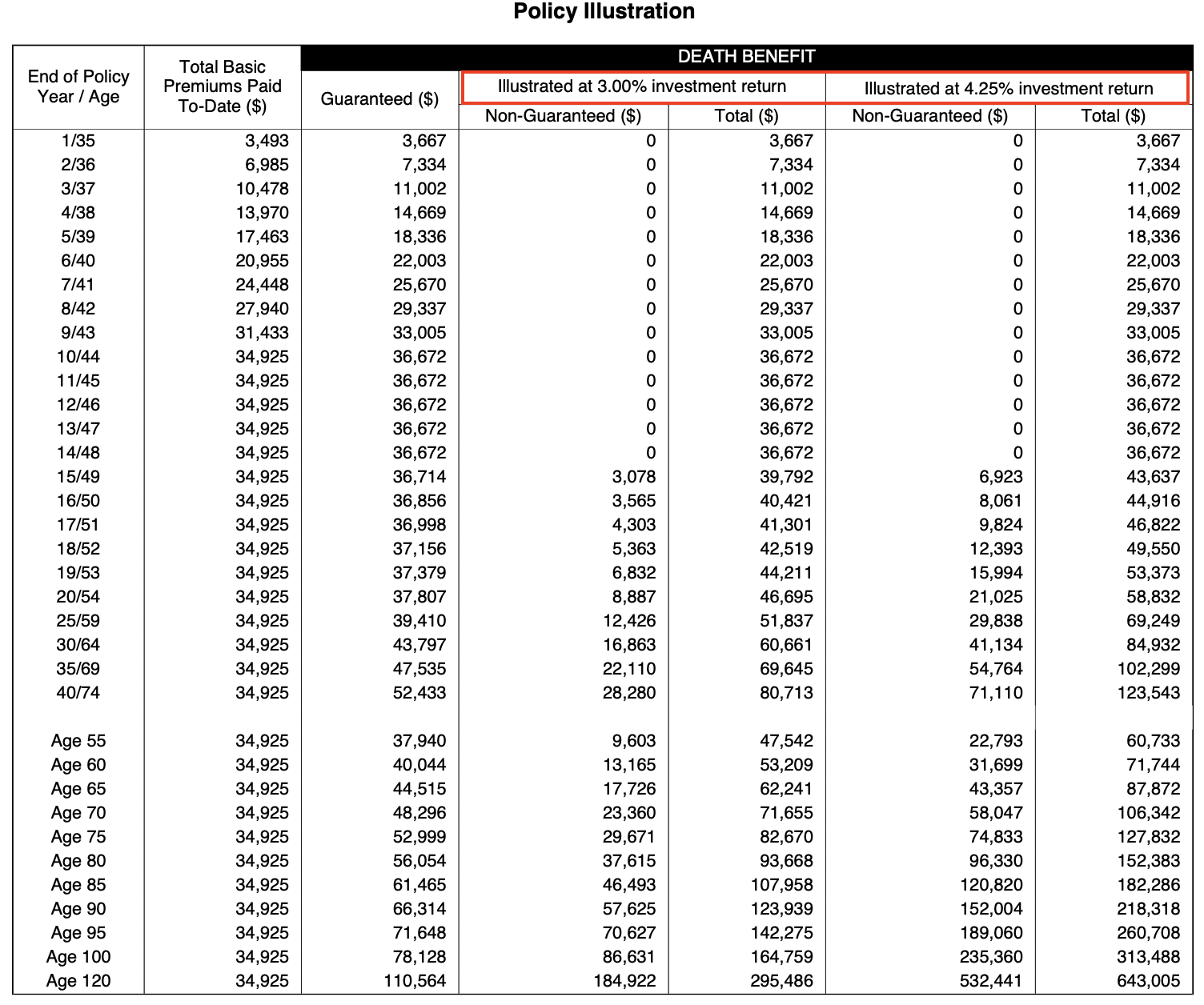

Source: Aviva

Source: Aviva

Under the new guidelines from Life Insurance Association (LIA), the upper investment return scenario will be capped at 4.25% (50 basis points lower than the previous 4.75%). The lower investment return scenario will have to be at least 1.25 percentage points lower than the upper cap. This means that the maximum indicative projected investment return scenario will have to be 3% or lower.

How Does the Change in Projected Returns Affects You?

-

No Dip In Actual Performance Of Participating Policy Yet

Before you go into panic mode, the change in projected investment return does not mean that actual return on existing policies has dipped. That’s because these are indicative investment returns, not the actual returns from the participating policy.

A simple analogy will be like buying durians. Before you purchase the durian, the durian seller will pre-empt you what kind of “taste performance” you will get from the durian flesh. However, the taste of the durian is still dependent on the durian itself, not based on the durian seller’s words.

-

Early Warning That Lower Returns Will Be The Norm

Since that’s the case, then what is the purpose of introducing this change in projected investment return?

One major reason for this change is to provide an early warning for those buying participating insurance policy. The aim of the projected investment return is to provide insurance policy buyers to have a realistic view of the returns so as to make more informed financial decisions.

The latest adjustment in projected investment return is to reflect the downward trend in investment returns of the overall market. For instance, Singapore Government Securities and US Treasuries yields have been on a multi-year down trend. Moving forward, insurers managing the participating funds may not be able to get as high returns as it used to between 1990 to 2020.

-

Will You Have To Pay More Premiums For The Same Benefits?

The impact of lower investment return doesn’t just affect the surrender/cash value of participating policy holders. It also has the potential to impact the amount of premiums that you have to fork out for the participating policy.

The reason for this is because part of the investment returns that are earned on your participating policy is used to cover (i) the cost of insuring your life and (ii) grow the surrender/cash value in your participating policy.

If the insurer can no longer grow it as fast, then they will need to resort to charging higher premiums in order for you to keep the same kind of benefits.

-

Or Maybe Get The Option To Keep Premiums Constant But Lower Benefits?

But what if you can’t afford the higher premium? Well, the other reality is that insurers can continue to keep premiums constant but the benefits that you will receive will be lower than before. LIA has already warned that “some life insurers may review and redesign the features of their product offerings”.

However, do note that all these scenarios that we are referring to on policy benefits and premiums is mainly for new policies going forward.

But one thing is for sure, whatever decision that one insurer takes, it will likely impact the whole industry. Based on past behaviour, the rest of the insurers will likely follow suit.

How Should New Policyholders React To This Change?

The change in projected investment return is a reminder that we are entering into a new investment climate. Returns will no longer be as high as what our parents experienced in the last 30 years. Thus, we need to be very careful when making investment decisions.

For those who are looking for better investment returns, gone are the days where you can rely on participating insurance policies for such return. You will need to consider other source of investments. If you are looking for a risk-managed portfolio

Read the pros and cons of buying from an agent vs fa vs banker