2 Best Early Critical Illness Plan: A Plain Vanilla Solution

In Singapore, there is a cliché saying, “Better to die than to fall sick”. While it is cliché, there is probably some truth in it. Let’s be honest. We have all read enough stories of expensive medical bills leading to financial insecurity whenever one gets diagnosed with critical illness or early critical illness (e.g. cancer).

Fact: More Than Half Of Singaporeans Do Not Have Critical Illness Protection

Despite knowing how expensive medical bills can be when we get sick, 57% of people in Singapore don’t have any critical illness protection. This means if someone gets seriously ill, not only do they have to deal with the emotional stress, but also the financial burden. Even among those with critical illness protection, 63% don’t feel confident it’s enough for their financial safety.

The truth is, critical illness can happen to anyone at any time. Every day, 36 people in Singapore are diagnosed with cancer. Since 2010, the number of cancer cases has gone up by 17%, and 1 in every 4 to 5 people will develop cancer in their lifetime. Another common critical illness is stroke, which affects 1 in every 6 people. Despite these challenges, there is a bit of good news….

Early Detection And Treatment Is Key To Recovery

With today’s medical advancements, early detection of critical illness is not only possible, but it also gives us a much better chance of recovery. In order to get the best treatment early and not having to worry about the loss of income, mounting debt or our children’s education fees, it is important to ensure you are financially protected. One way to get yourself the right financial protection is through an Early Critical Illness plan.

How Early Critical Illness Plan Differs From Critical Illness Plan?

Upon the diagnosis of an early or intermediate stage Critical Illness, the Early Critical Illness plan ensures a prompt lump sum payout, providing crucial financial support for the treatment of any early diagnosis. Critical Illness plans release payouts only when your condition is at a later and more severe stage. More access to the right treatment upon early detection significantly improves your chances of effectively managing the Critical Illness and addressing its root cause.

Which Early Critical Illness Plan Should I Consider?

There are two Stand-Alone Early Critical Illness plans in the market you can consider that provides you value or comprehensive coverage: China Taiping i-Care and Singlife Comprehensive Critical Illness.

Both plans are single lump sum Early Stage Critical Illness plans. Upon diagnosis of Critical Illness, you can make claims. You will then receive a lump sum payout and the plan expires. This is unlike a multi-pay CI plan where you can make multiple claims should your Critical Illness relapse or you get diagnosed with another Critical Illness.

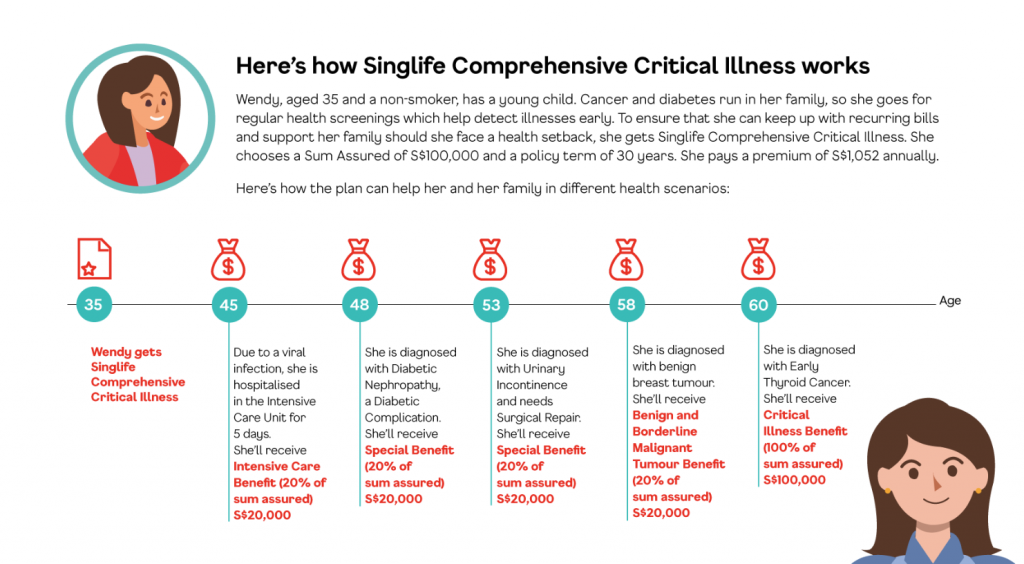

Source: Singlife

2 Best Early Critical Illness Plans China Taiping i-Care vs Singlife Comprehensive Critical Illness: What Are The Key Differences?

The only similarity between China Taiping i-Care and Singlife Comprehensive Critical Illness plan stops at them both being lump sum Critical Illness plans. Here’s a look at the key differences between China Taiping i-Care and Singlife Comprehensive Critical Illness and which plan gets an edge over the other.

1. Number Of Critical Illness Covered

When you purchase a Critical Illness plan, it is important that you have a clear idea which are the Critical Illnesses covered under the plan. If your Critical Illness does not fall under the list, you will not be able to make a claim, even if you think your condition should be considered a Critical Illness.

Between China Taiping i-Care and Singlife Comprehensive Critical Illness, they cover a different number of conditions. Singlife Comprehensive Critical Illness allows you to claim against 165 conditions whereas China Taiping i-Care allows you to claim for 161 conditions.

Singlife also provide coverage against Benign/Borderline Malignant Tumour as a special benefit which can be considered a Pre-Early Cancer protection cover.

Edge: Singlife Comprehensive Critical Illness

2. Coverage Term

One other key difference between China Taiping i-Care and Singlife Comprehensive Critical Illness is the coverage term.

China Taiping i-Care gives you less choice for coverage term compared to Singlife Comprehensive Critical Illness. With China Taiping i-Care, you can only choose coverage up to age 75, 85 and 99.

Singlife Comprehensive Critical Illness gives you a much more flexible choice with coverage term from 5 years till age 99.

Edge: Singlife Comprehensive Critical Illness

3. Premium

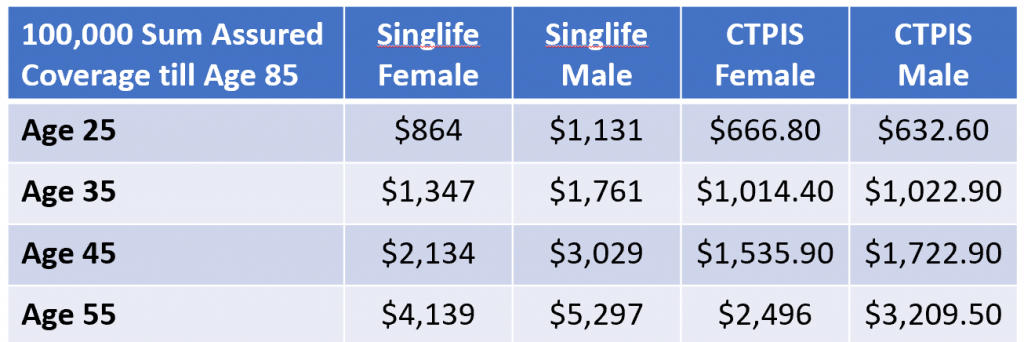

Besides coverage term and conditions covered, premium is also an important aspect for comparison. While Singlife Comprehensive Critical Illness might provide more coverage, it might come at a higher cost.

Based on our research, for the same coverage term, Singlife Comprehensive Critical Illness does come at a higher premium than China Taiping i-Care across all age categories.

Edge: China Taiping i-Care

4. Sum Assured

Singlife’s comprehensive critical illness plan offers flexibility in lump sum payout options, allowing a range from 50,000 to 250,000, with the option to add coverage in increments of 1,000 within that span. On the other hand, China Taiping i-care restricts choices to three sum assured permutations—100,000, 200,000, and 300,000. Although Singlife provides greater flexibility, with the ability to tailor coverage, its maximum payout is capped at 250,000. In contrast, China Taiping offers less flexibility but provides a potentially more cost-effective option with a higher max payout of 300,000.

While both policies also provides death benefits, China Taiping i-Care provides death coverage equal to the sum assured for early critical illness. This means if the insured passes away during the policy term without making a critical illness claim, their beneficiaries receive the same amount as the coverage for early critical illness. On the other hand, Singlife Comprehensive Critical Illness only provides $5,000 coverage in the event of death.

Edge: Draw

Edge:

If you want more coverage – Singlife Comprehensive Critical Illness

If you want a cheaper plan – China Taiping i-Care

If you want coverage period & sum assured flexibility – Singlife Comprehensive Critical Illness

Get both insurers quotes plus more for the most competitive plan here !

A Licensed financial planners will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

Get your Early Stage Critical Illness Insurance Quotes Here.

3 Comments