Singlife Multipay Critical Illness – A Summarised Understanding of a New Multiple Claim Ci Benchmark

The Singlife Multipay Critical Illness the latest in a series of great Multiple claim critical illness plan being released by Singlife over the last few years. This time, Singlife does it again with another revolutionary CI product. Truth be told, the features of the older plan was hard to match and Singlife wasn’t looking to match that for sure. Here are some of the old features we will not see in this new plan

No More Groupings of Critical Illnesses by Pots

In this Singlife Multipay Critical Illness, there will no longer be 3 grouping of Early/Intermediate stage critical illness by different pots, namely cancer and other major organs; heart related illnesses and nervous system critical illness conditions.

End of “No Waiting Period” for Separate Early/Intermediate Stage Critical Illness Claims

The “no waiting period” feature for two different pots of early stage/intermediate stage ci claim will no longer be a feature in this new product.

How Singlife Multipay Critical Illness differs from Aviva Multipay CI Plan III

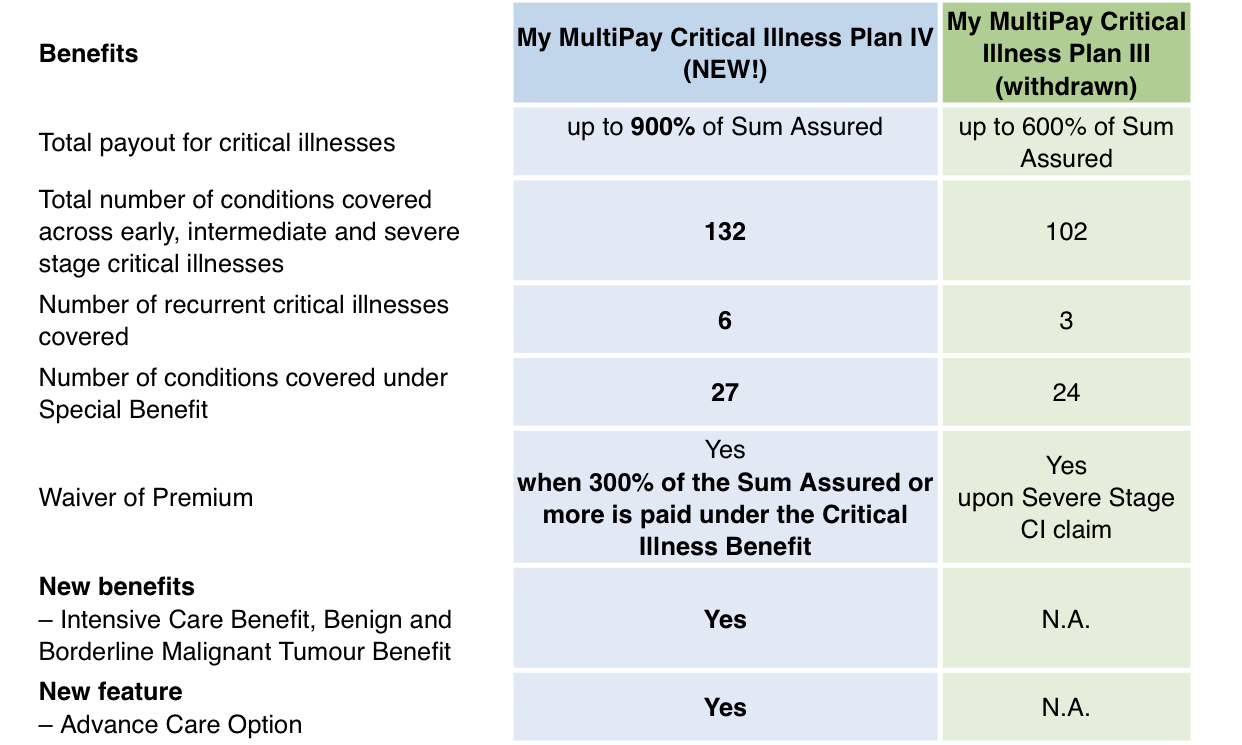

The Singlife Multipay CI plan provides higher payout and more critical illness conditions covered. The new plan also provides up to 900% of Sum Assured vs the old 600%, below is a table of differences between the new and old.

Source: Singlife.com.sg

New Payout Structure: 60 Groupings of Individual Critical Illness

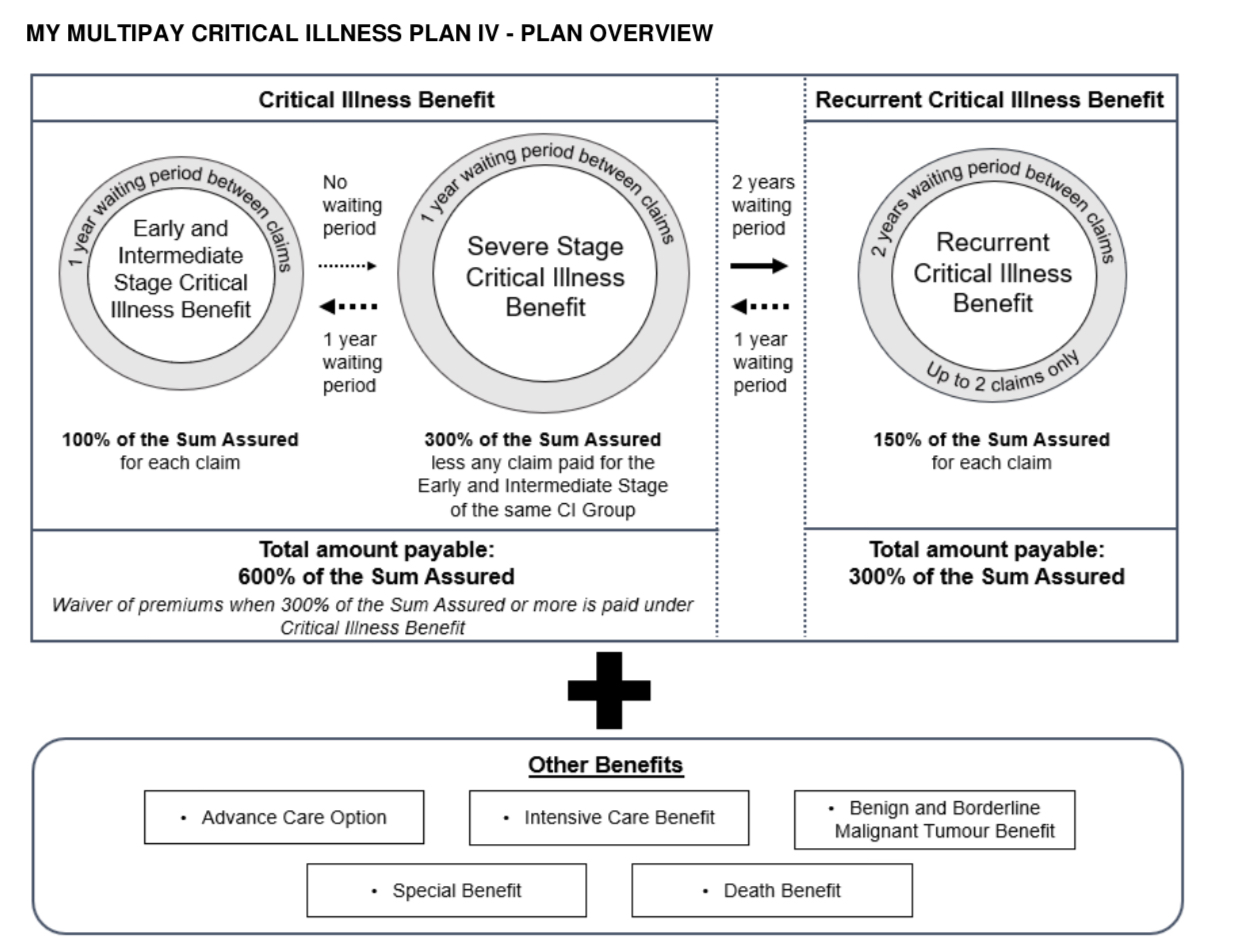

It’s probably hard to comprehend looking at the diagram below, but here is how it works. The grouping of Critical illnesses is no longer limited to 3 pots but grouped into 60 different critical illnesses conditions. Of the 60 conditions listed by Singlife, 40 conditions have early/intermediate stage and 35 of these conditions are officially defined by the Life Insurance Association CI 2019 Guideline. Please read on.

One Year Waiting Period For Different Early/Intermediate Stage CI Claim

With the lax in CI grouping as compared to the previous plan, there is now a one year waiting period between different early/intermediate stage critical illness diagnosis. There can be up to 6 claims with up to 100% Sum Assured each claimable for early/intermediate stage critical illness condition for this policy.

No Waiting Period From Early to Advance Stage Critical Illness Diagnosis

Similar CI Group – If an advance stage CI progresses from an early stage CI of the same group, a maximum of 300% sum assured will be paid out with no waiting period less any claim paid for early and intermediate Stage CI of the same group

Different CI Group – If an advance stage CI was diagnosed after an early stage CI diagnosis of a different group, a 100% sum assured will be paid out + an additional 300% sum assured will be paid out with a No waiting period for different group of CI

Choose Between Advance Care Option or Recurrent Critical Illness Benefit

The first of its kind, The Singlife Multipay Critical Illness now allows the insured to choose between two of its pay-out feature based on the listed conditions below (Late Stage Only)

- Major Cancer

- Heart Attack of Specific Severity

- Stroke with Permanent Neurological Deficit

- Open Chest Heart Valve Surgery

- Major Organ/Bone Marrow Transplantation

- Coronary Artery By-Pass Surgery

Advance Care Option – Choose to get an additional 100% Sum Assured if the above conditions were to be diagnosed as a first advance stage critical illness condition. This means on top of claiming for the 300% payout if any of the above conditions were diagnosed at an advance stage, you will get an additional 100% of the payout. That is a whopping 1,000,000 payout for a 250,000 Sum Assured with no waiting period. By choosing this option, however, the Recurrent Critical Illness Benefit of the plan will cease

Recurrent Critical Illness Benefit – If the life assured is re-diagnosed, suffers from relapsed, or newly diagnosed with any of the above condition after two years waiting period from the advance stage critical illness claim, a 150% Sum Assured will be paid out. After a further 2 years waiting period, if the same scenarios were to occur, another 150% will be paid out. However, if a different CI group is diagnosed after the recurrent CI benefit is claimed, there is only a 1 year waiting period for the next CI Claim. This benefit will only be available if the Advance Care Option was not exercised during the first Advance Critical Illness Diagnosis.

Additional 20% Sum Assured For the Following Event (Capped @ $25,000)

Intensive Care Benefit

Again, the first of its kind, the plan provides an additional 20% Sum Assured payout capped @ $25,000 if the insured is warded into an Intensive Care Unit stay of 4 days or more due to either illness or accident in one hospital admission.

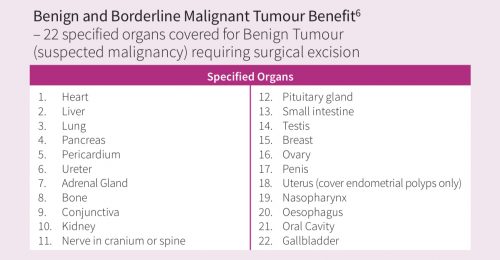

Benign and Borderline Malignant Tumour Benefit

Suppose a complete surgical excision of a benign tumour requiring surgical excision from any of the 22 specified organs listed above, another 20% Sum Assured capped @ $25,000 will be paid out

27 Special Benefits (16 Additional 11 Juvenile)

20% Additional Sum Assured will be given if the life assured diagnosed with any of the 27 listed Special conditions, a maximum of 6 claims will be allowed under this benefit with a cap of $25,000 per conditions

Here is a summary on what we like and don’t like about this new policy from Aviva

What we like about Singlife Multipay Critical Illness

- No waiting period between early to advance stage critical illness diagnosis to claim 300% Sum Assured within the same or a different advance stage CI

- Option to claim up to 400% in the event of common advance stage ci diagnosis with no waiting period by exercising Advance care option

- More number of conditions covered (165) as compared to the older plan (129)

- Higher number of total pay-out (up to 900% Sum Assured)

- Claim for Pre Early Cancer Benefit & ICU

- No more pots grouping for different Early/Intermediate CI Claim

- One more 300% SA claim for another Advance Stage CI with 1 year waiting period

What we don’t like

- One year waiting period to claim another early/intermediate stage CI after the first early/intermediate critical illness claim

- Complex payout structure for layman to understand

- Max sum assured remains at $250,000

- Death benefit for stand alone plan remains at $5,000 regardless of sum assured

Is Singlife Multipay Critical Illness

Let our partnered financial planners compare, analyse and advise you further. To get a quote for Singlife Multipay Critical Illness and have your coverage needs assessed, fill in the form below and a licensed financial planner will contact you and draft you a proposal based on your given inputs

9 Comments