Who’s The Best Integrated Shield Plan Provider? As Ranked By Medical Professionals

Health insurance is one of the key form of financial protection that anyone needs to have. It is also one of the first type of insurance that one should start with when you first enter the workforce.

All Singaporeans Enjoy Basic Health Insurance Coverage

In Singapore, health insurance plan is a basic coverage for all Singaporeans and PRs. Everyone who contributes to CPF will get basic health coverage under MediShield Life. This covers hospital bills that are incurred if you get warded in C or B2 ward types.

But if you want to get more premium healthcare protection (e.g. ward B1, A, or private medical coverage), then you have to top up your own. This additional type of health insurance is known as Integrated Shield Plan (IP) in Singapore.

Why Do You Need Integrated Shield Plan If You Already Have Basic Health Insurance Coverage?

As mentioned earlier, basic health coverage under MediShield Life is limited to ward C or B2. While this may meet the health protection needs for some, others might prefer to top up for additional health insurance coverage.

Help! Every Insurance Player Has Its Own Health Insurance

The biggest issue that most people face when it comes to choosing additional health insurance is the paradox of choice.

Almost every insurance provider in Singapore offers its own Integrated Shield Plan (IP). From home grown brands like Singlife, Income, Great Eastern to multinational companies like Prudential, AIA, HSBC, they each have their own health insurance plan that they offer to the market. Even a healthcare provider like Raffles Medical has its own health insurance plan.

Because there are so many different insurance providers to choose from, that makes it hard to make a choice.

Best Integrated Shield Plan Providers: Ranked By Medical Professionals

To help consumers make a better choice, the Singapore Medical Association (SMA) carried out a survey between 5 January to 5 February 2022. In the survey, 568 respondents were polled to understand how each insurance provider performed in the following categories:

- Overall rating

- Panel Rating

- Inclusiveness of panels

- Obstacles put in place by the IP provider to dissuade patients from seeing a non-panel doctor

- Transparency of doctor selection criteria for panels

- Pre-Authorisation Rating

- Timeliness of pre-authorisation approval

- Ease of pre-authorisation process

- Payment

- Timeliness of payment

- Fee Scale Reasonableness

- Appropriateness of fee scales with respect to the MOH Fee Benchmarks

These are ranked by medical professionals (aka doctors) themselves on how much they valued each IP provider. For each category, medical professionals could choose a rating between one (worst) to five (best).

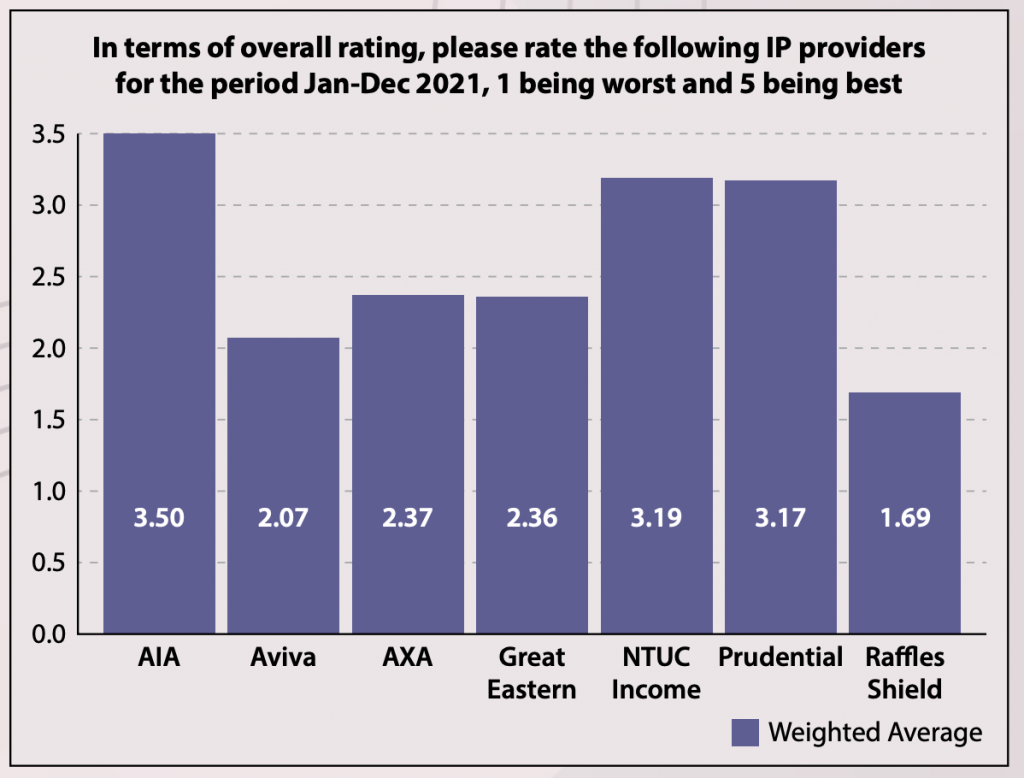

1. Best Overall Rating IP Provider: AIA

Among the IP providers, the top IP provider as ranked by medical professionals is AIA. It is by far the best with an average rating of 3.50.

Income and Prudential came in second and third respectively with a fairly close average rating of 3.19 and 3.17 respectively.

They were followed by AXA and Great Eastern in the next tier with an average rating around 2.37 and 2.36.

The last two positions were Aviva (now known as Singlife) and Raffles Medical.

2. Inclusiveness Of Panel: AIA

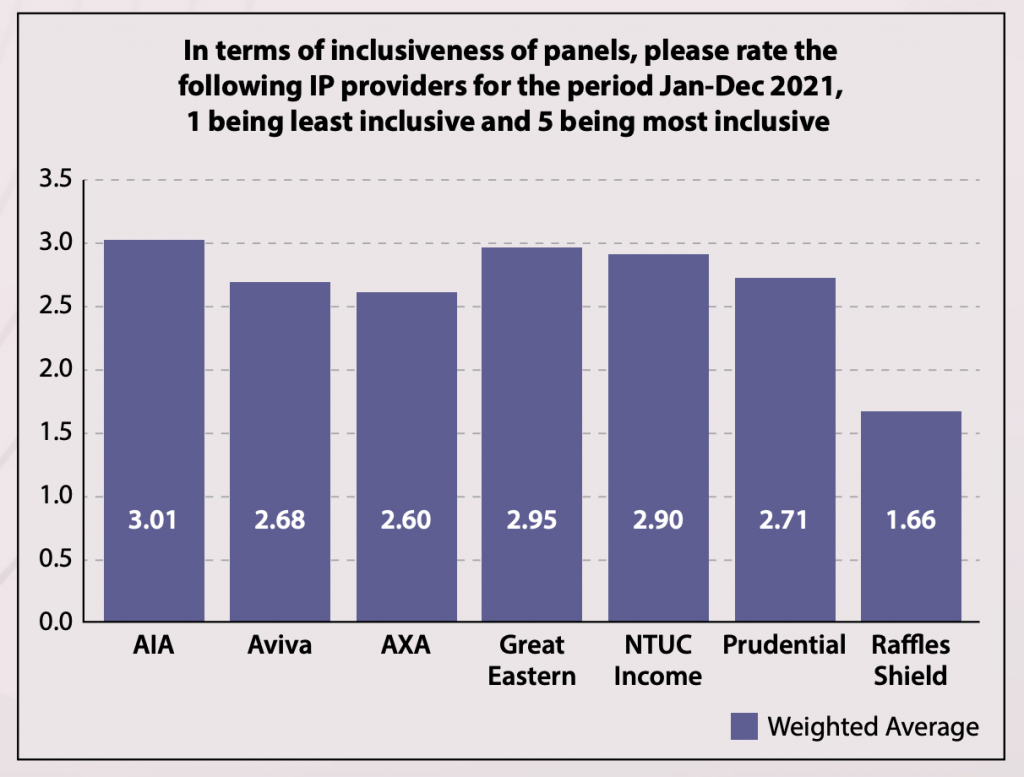

Every IP provider has its own list of healthcare providers (i.e. specialists) that its consumer can visit for treatment. This is known as panel, a short hand for “panel of doctors”. Therefore, another important factor to consider is the inclusiveness of these panels. The more inclusive a panel is, the more options you have to choose from for your treatment.

Among the IP providers, three emerged as the top picks from medical professionals:

1st: AIA

2nd: Great Eastern

3rd: Income

They all had an average weighted ranking close to three.

Interestingly, none of the IP providers scored more than four in terms of weighted average rating. And surprisingly, Raffles Medical came in last in the overall ranking survey.

Tip: If you are looking for an IP provider with a wider range of choice for specialist treatment, AIA, Great Eastern, and Income would be your pick.

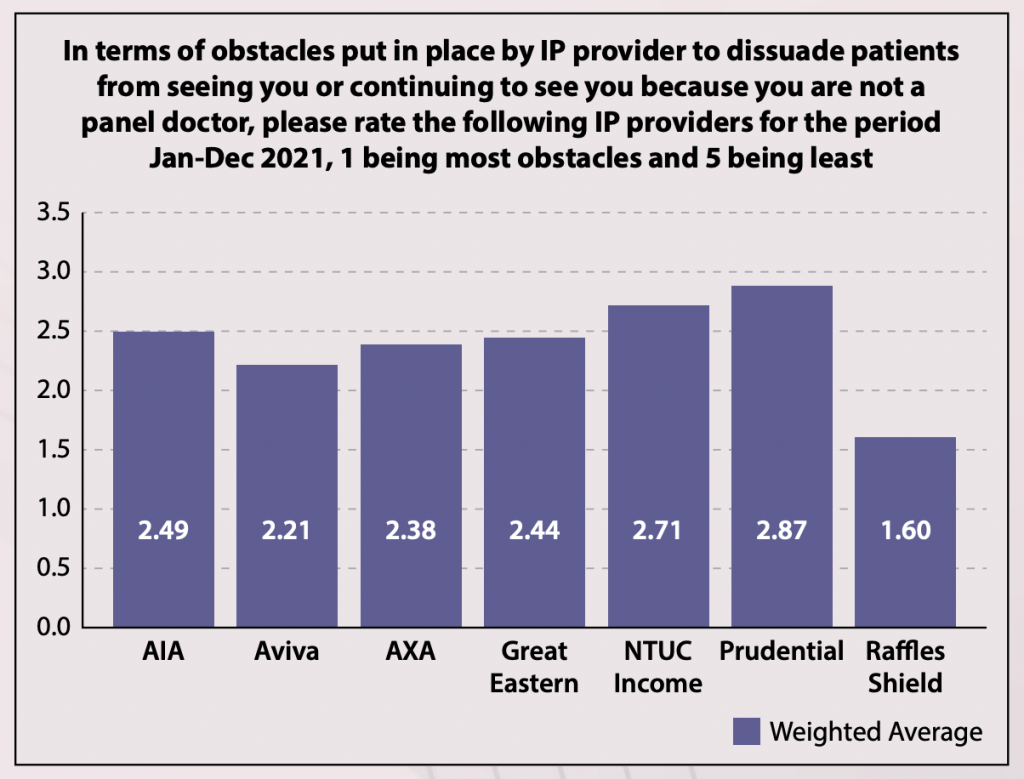

3. Obstacles To Dissuade Non-Panel Doctors: Prudential

Non-panel doctors are kind of like a black box for IP providers. That’s because panel doctors undergo a stringent set of criteria and audit to be part of the panel list. Therefore, if you are seeing a non-panel approved doctor, there is a possibility you can get overcharged for treatment or receive non-optimal treatment. As such, IP providers want to encourage its clients to use panel doctors as much as possible.

But sometimes, you may not be able to find the right specialist you need for your treatment. Having a more flexible IP provider gives you more options as a consumer.

Among the IP providers, Prudential offers the least resistance when you visit a non-panel doctor, followed by Income, and AIA.

The lowest on the list is Raffles Medical. This is likely because they want you to visit their own doctors at Raffles Medical instead of other specialists outside of the group.

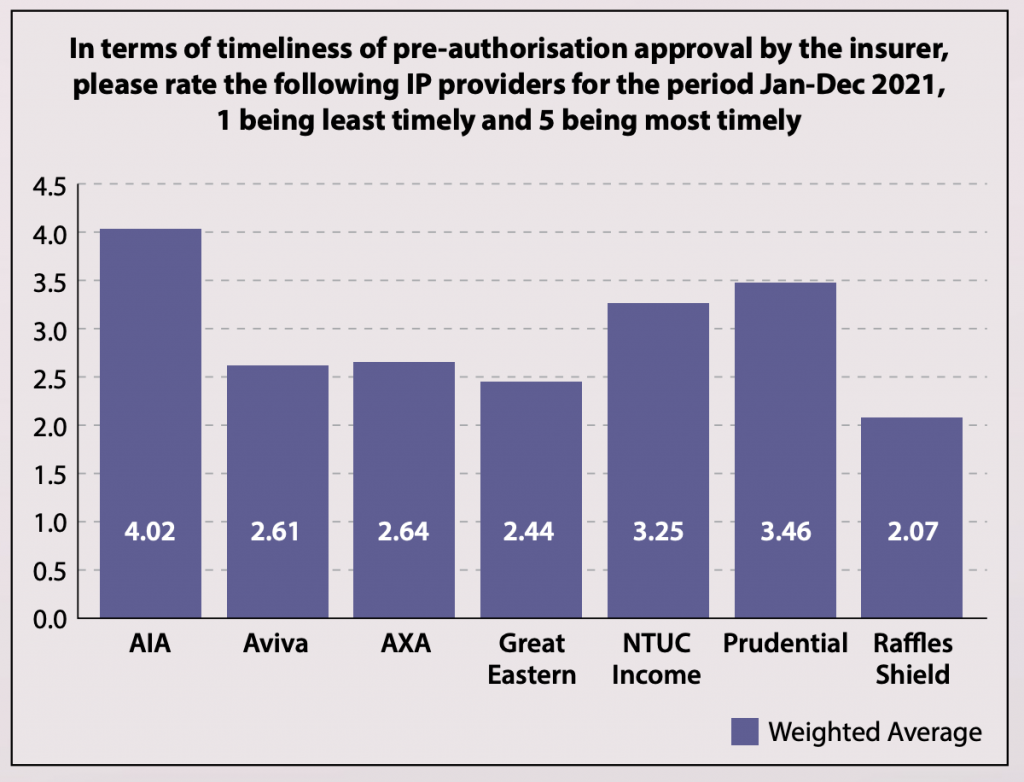

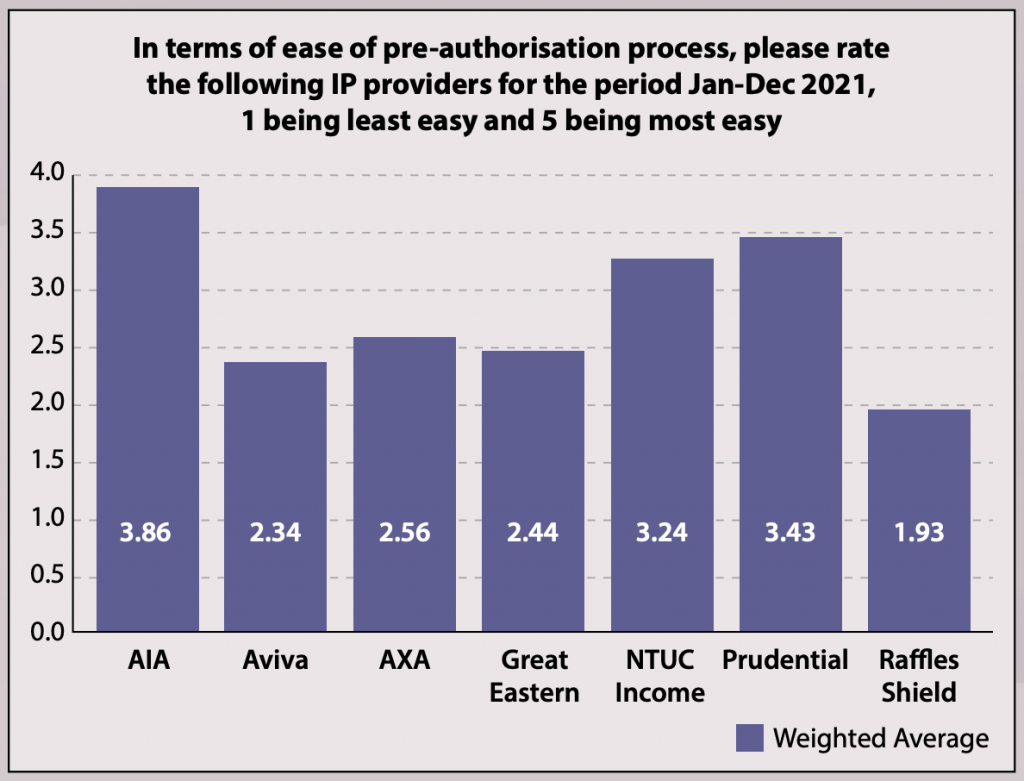

4. Pre-Authorisation Rating: AIA

Pre-authorisation is the process where the IP provider lets you know the amount that is covered by the IP provider prior to you undergoing treatment. This will allow you to make a more informed decision, rather than having to dispute the amount post-treatment.

AIA is by far the clear winner in the timeliness of its pre-authorisation approval. This means that, among the IP providers, they are the quickest to respond to your pre-authorisation request.

The pre-authorisation process is also the easiest among IP providers with AIA clearly leading the rest with its 3.86 average rating. Prudential and Income are just slightly behind with a 3.43 and 3.24 average rating respectively.

Tip: Having a timely and smooth pre-authorisation process helps you clear lots of doubts ahead of your treatment. This allows you to get a peace of mind when you undergo the treatment without having to worry about the dollars and cents. If this is important for you, AIA does offer the best in class, based on its pre-authorisation rating.

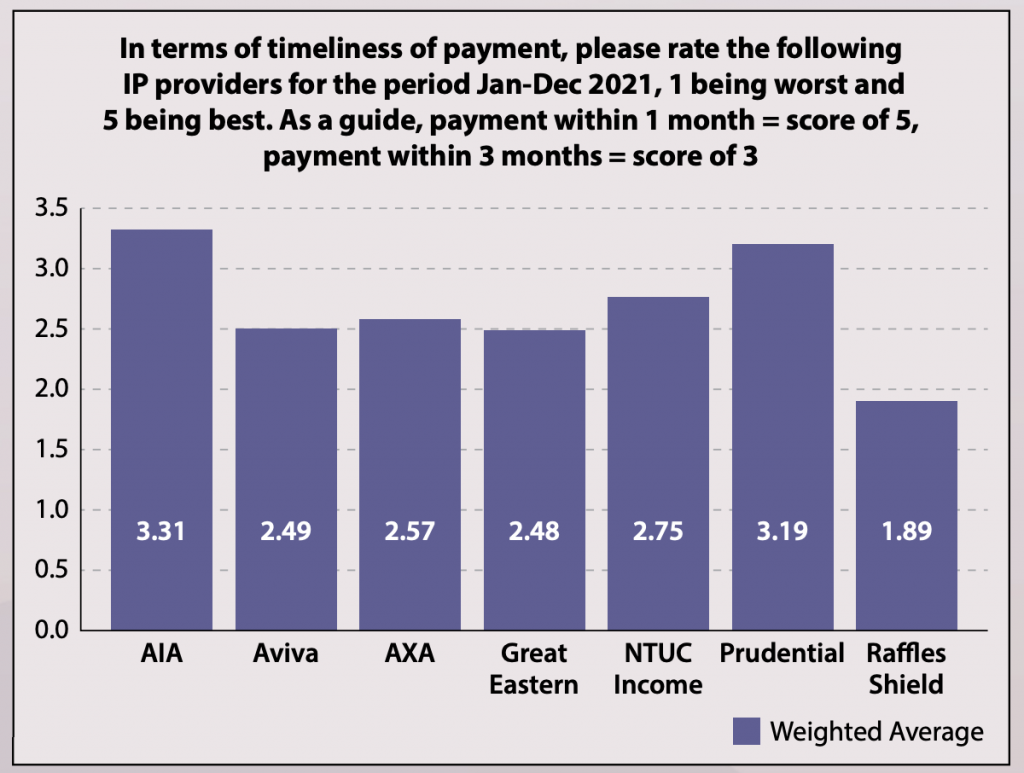

5. Payment Process: AIA, Prudential

Having your treatment claimable amount pre-authorised is one thing. Receiving the actual money is another time. Since you need to make a claim after you undergo the treatment, the timeliness of the payment process is also important. Imagine if it takes you a year just to recover what you paid for the treatment.

Luckily, on average, it takes around 3-4 months for payments to be disbursed across IP providers. The worst on the list is Raffles Medical, which takes around 5 months on average. Most IP providers take 3-4 months, which is quite decent.

And if you want to get your claim the fastest, then AIA and Prudential are your best choices.

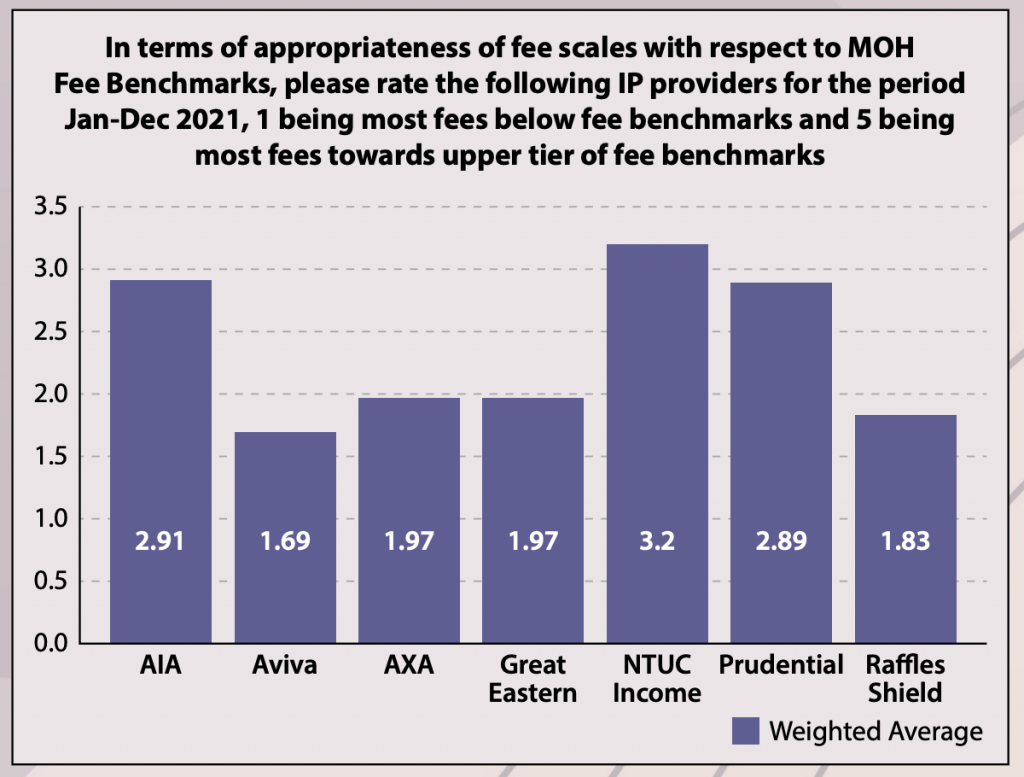

6. Fee Scale Reasonableness: Income

Did you know that Ministry of Health (MOH) releases a list of hospital bills and fees for private hospitals? The fees are released on its website so that consumers like you and I know what are the recommended charges for surgery routines and treatments. This is so that we don’t get charged unnecessarily by bad doctors.

As stated on MOH website, the fee benchmarks is a range of actual fees charged by doctors or hospitals, depending on factors like complexity. Less complex medical cases should be on the lower range while more complex cases will be on the higher end. If you see yourself getting charge for way above the range, then clearly something is wrong.

Among the IP providers the fee scales in respect to the MOH fees benchmark is the most reasonable for Income. This is followed by a close second and third race between AIA and Prudential.

Interestingly, Raffles Medical wasn’t the bottom of the ranking for this category. Instead, Singlife took the bottom spot.

Still Can’t Choose Your Own Integrated Shield Plan?

While these are indicative numbers that can help you make a better decision as a consumer, we know that it can still be challenging to make that choice. If you need help to choose your IP provider, why not seek professional help with Moneyline.sg?

At Moneyline.sg, we offer free financial planning session to help you take care of your financial health while you take care of your personal health. We provide comprehensive analysis for your health insurance needs so that you can select the most suited IP provider that gives you more value for what you are paying.

To arrange for an appointment with us, simply leave your contact