Best Hospitalisation Shield Plan in Singapore

If you’re wondering if Medishield Life itself is sufficient for hospitalisation coverage and what is the best hospitalisation shield plan in Singapore, this article will help touch on and address the key feature of shield plans across different insurers

What is Medishield Life?

MediShield Life is a compulsory basic health insurance plan for Singaporean/PR, administered by the Central Provident Fund (CPF) Board, which helps to pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer. Its aim is to reduce the medisave/cash needed to pay for large hospitalization bill.

What does Medishield Life covers?

- Pre-existing conditions.

- Room and Bed with daily claim limit (Not as charged)

- Surgery with limits (Not as charged)

- Claim limit per policy year caps at (150k per policy year)

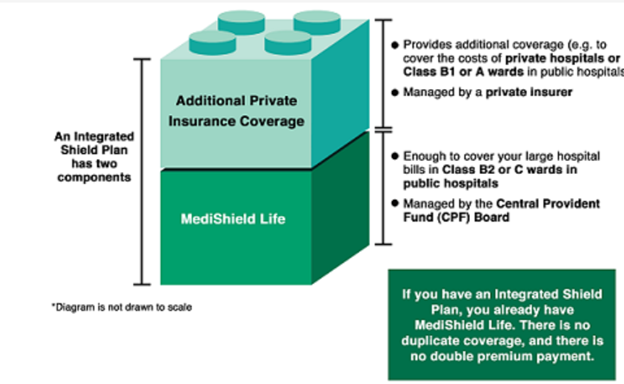

What is Integrated Shield Plan (IP)?

Medishield Life together with additional private insurance coverage makes up an Integrated Shield Plan (IP). It is optional and can be paid using medisave subjected to withdrawal limits.

What does Integrated Shield Plan covers?

– As charge coverage for public and private hospitals

– Pre/post hospitalisation claim

– Providing a higher per policy year claim limit (can goes up to 2.5mil per policy year)

– Riders can be added to cover deductible and cover up to 95% of the total hospitalisation bill

CPF.gov.sg

As per the image above, integrated shield plan and medishield life are complimenting each other and its mutually inclusive.

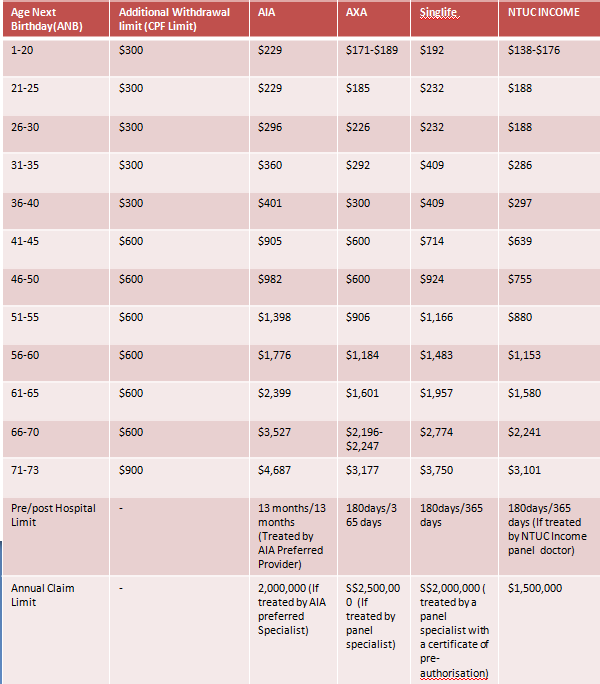

Comparison of Integrated Shield Plan Premiums (Private Hospitals)

Special Features from Different Integrated Shield Plans Private Hospitalisation

AIA

- Receive consultation and medication delivered at the comfort of your home at a flat rate of $12 (exclude delivery and other charges)

- Longest Pre/Post Hospitalization cover in the market

- Most outpatient coverage a compared to plans in this article

- Shortest congenital abnormabilties waiting period of 10 months as compared to plans being compared in this article

AXA

- S$10 (excluding other charges) consultation fee per visit for General Practitioner (GP) Panel

- S$100 (excluding other charges) standard consultation fee per visit (Except Pediatric Panel up to S$150) and S$70 (excluding other charges) for follow-up standard consultation fee per visit for Specialist Panel

- One of the most affordable private hospital IPs

Singlife

- free (up to $50,000) newborn benefit for children (up to 6 mths old) starting from 15 days old or from the date of discharge from the hospital, whichever is later

- 10% Co-insurance caps at $25,500 per policy year after deducting deductible.

NTUC Income

- Option to choose for more affordable rider to be attached to- Classic Care Rider

How IP riders works:

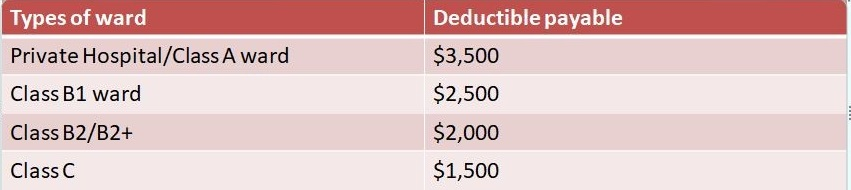

An IP without rider will require individual to pay a 10% co-insurance as well as deductibles. Here is a chart for easy references on deducible payable.

(Annual deductible for Life Assured age 80 years and below next birthday):

Now, let’s take this case scenario as an example.

Mr A, age 45, got warded in a private hospital and incurred a hospital bill of $100,000. He has an IP plan without rider and got to pay a deductible of $3,500 and a co insurance of 10% ($9,650). Amount he needs to fork out is $13,150 and amount claimable by IP is $86,850.

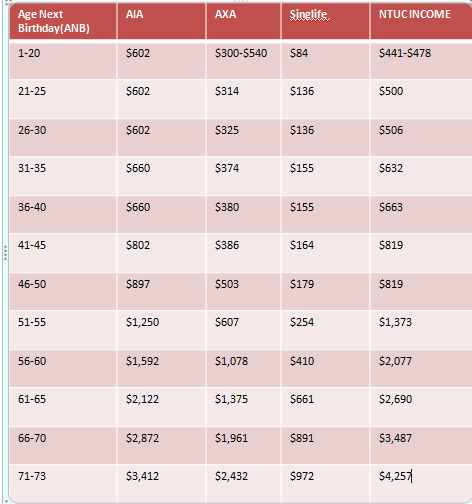

The primary purpose of adding a rider to IP’s main plan is to reduce out of pocket expenses with the exception of a 5% co-payment to be borne by the insured. Below is a table of comparison of premium of rider for Private Hospital from the various insurance companies for references. Payment of rider is only payable via cash.

Comparison of IPs rider for private hospital plan

Here is a general example of how adding rider to a main plan helps to reduce cash payable by life insured.

Mr A, age 45, got warded in a private hospital and incurred a hospital bill of $100,000.

Scenario 1: If Mr A seeks treatment via panel doctor:

He has an IP plan with a rider, amount he needs to fork out is $3,000 (5% co-payment caps at $3000) and amount claimable by IP is $97,000.

Scenario 2: If Mr A seeks treatment via non panel doctor:

He has an IP plan with a rider, amount he needs to fork out is $5,000 (5% co-payment, no caps) and amount claimable by IP is $95,000.

Conclusion

In conclusion, IPs can be used to protect your assets from draining away from paying excessive medical bills. Let us help you compare the right type of coverage across 8 insurance companies by filling the form below