Unlocking The Potential Of Your CPF Money With These 5 Tools

One of the biggest myths about CPF is that it is being “locked up” with the government until you are age 55/65 before you can start tapping into your CPF money. Well, that’s only true to some extent. In fact, there are actually ways for you to unlock the potential of your CPF money via the CPF Investment Scheme (CPFIS).

For the uninitiated, the CPFIS lets you “invest your Ordinary Account (OA) and Special Account (SA) savings in a wide range of investments to enhance your retirement nest egg”. So, if you are considering ways to unlock the potential of your CPF money and enhance your retirement nest egg, here are 5 tools that you should consider.

5 Tools To Unlock The Potential Of Your CPF Money

-

Unit Trust/ETF

When it comes to unlocking CPF money, the first thing that comes to mind is to invest in the stock market. After all, the stock market is one of the best performing investment asset classes.

In the last 30 years, the annualized return of stocks is 10.7%. Even after adjusting for inflation, those who have invested in the stock market for the last 30 years have at returns of 8.3% on average. That’s more than 3 times the return that CPF OA (2.5%) is providing.

If you are thinking of investing your CPF money in the stock market, there are two ways you can do so: Through unit trusts or exchange traded funds (ETFs).

Unit trust is a collective investment scheme where investors pool investment funds together and let it be managed by a professional fund manager. The fund manager then invests according to the fund’s objective and investment strategy. Note that there are currently 81 unit trusts that you can invest in from your CPF OA.

Similar to unit trust, ETF is also a collective investment scheme. But the main difference is that ETF is usually an index-tracking investment that is also publicly traded in the market. It tracks and replicates the performance of indexes like the Straits Times Index or Singapore Bond Index. For ETF, there are currently 5 ETFs that you can invest your CPF money in.

-

Annuity

Annuity is a type of plan where you get paid for a fixed period of time (or the rest of your life) as long as you are still alive during the period.

CPF LIFE is one such annuity plan that most Singaporeans should be familiar with. It acts as a fixed stream of income that can continues to be paid in your retirement years. The amount that you can receive from CPF LIFE is between $720 (Basic Retirement Sum) to $2,060 (Enhanced Retirement Sum), depending on how much savings you have in your CPF. However, for CPF LIFE, you can only start your payout from 65 years onwards.

For private annuity plans (i.e. non-CPF LIFE), you have the flexibility of starting the payout earlier than age 65. You can also use private annuity plans to front-load your annuity payout in the earlier years of retirement so that you have more to spend on your hobby or travel while you are still healthy.

Find out more about how you can get the best annuity retirement plan with your CPF money here.

-

Government Bond

In order to keep a country up and running, governments need to have the money to pay for its operations and also pay its debt obligations. Like all countries, the Singapore government also issues its own set of bonds known as the Singapore Government Securities (SGS) bonds.

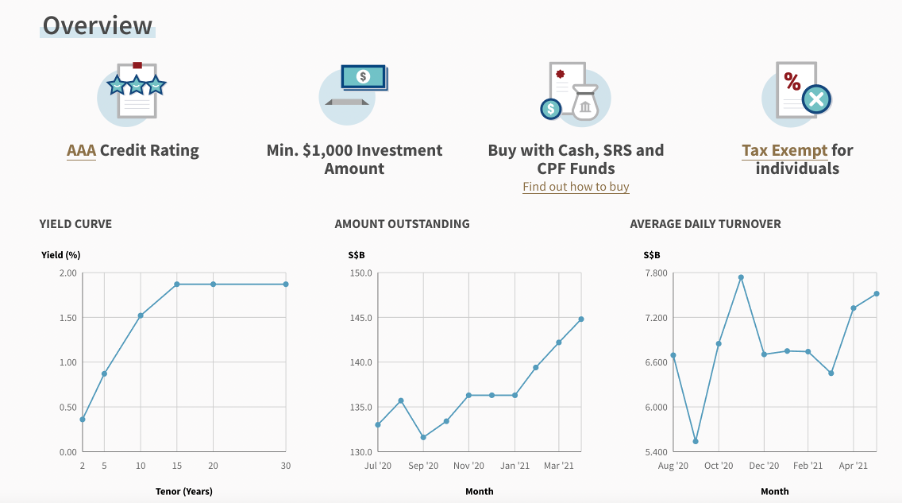

Source: MAS

With a minimum of $1,000, you can invest in an AAA-rated government bond. For SGS bond, you can invest in it using your CPF money. You can choose from bonds with tenor ranging from 2, 5, 10, 15, 20 to 30 years. Each SGS bond comes with fixed, semi-annual coupon and allows for transaction on the secondary market to any willing buyer.

At the moment, the highest yield on the SGS bond is 1.87% for bonds with tenor of at least 15 years. This is lower than the 2.5% that you will receive from CPF OA and this is due to the low interest rate environment around the world. In the future, there could be a possibility that yields will go above and beyond the 2.5% that CPF OA is offering. Thus, you might want to consider the other tools to unlock your CPF money for now.

-

Gold, Gold ETF

One of the scariest enemy of retirement is inflation, i.e. the eroding of purchasing power of every dollar you own. Inflation is what causes your chicken rice to cost $3 today compared to the $2 it used to cost 20 years ago.

Fortunately, there are ways for you to mitigate the impact of inflation and gold is one of them. In fact, gold is the ultimate hedge against inflation that protects your purchasing power. That’s because gold is a globally acknowledged store of value.

In the last 30 years, gold provided investors with a return of 5.2% p.a. After adjusting for inflation (~2.5% p.a.), gold delivered 2.7% p.a. of annualized returns over the three decades. While the return of gold is not the best (compared to property, stocks), it is still much better than the 2.5% you are earning in your CPF OA.

To invest in gold, you can either invest in Gold products (under UOB), or through gold ETF with SPDR Gold Shares.

-

Endowment

Endowment, or sometimes known as saving plan, is a type of insurance that helps you save regularly towards a specific financial goal. Saving for your child’s education, your wedding or your first home are some of the common financial goals that endowment can help you save towards.

This makes endowment one of those useful investment products that everyone should invest in. That’s why endowment was included as one of the approved investment products that you can invest your CPF money in.

On top of instilling financial discipline, endowment plan also provides you with reliable returns that is better than fixed deposits and slightly above the 2.5% CPF OA interest rate. Plus, endowment plan also comes with a protection element that pays out a lump sum to your family should anything happen to you.

With these features, it’s not hard to understand why endowment is one of the popular ways of unlocking your CPF money.

Find out more about how you can get the best endowment plan with your CPF money here.

Start Unlocking The Potential Of Your CPF Money Today

Now that you have the knowledge you need to unlock the potential of your CPF money, it’s time to put it to good use and unlock the hidden potential of your CPF money.

For those of you who are still not sure where to start, you can start by doing a comprehensive financial review to identify where the gaps are in your financial plan. We will then provide you with recommendations on how you can unlock the potential of your CPF money to bridge those retirement gaps. Book an appointment with us today here.

4 Comments