Into The Future: What Can You Really Buy With Your CPF LIFE Income?

You might not notice it, but Singaporeans are working too much for our own good. On average, Singaporeans are spending 45 hours a week at work. This makes us the second hardest working city in the world (yes, the world!). Because of this long hour tradition, it is no wonder Singaporeans like you and I are feeling lethargic about life. How we wish we could retire right here and right now, isn’t it?

But let’s be real. Honestly, without the right amount of savings, we can hardly retire. But thinking about retirement from using numbers can sometimes be really hard. That’s why we want to give you a visual representation of how much money you really need to retire and whether CPF Life is enough to pay for your retirement.

How Much Payout Can You Get From CPF Life?

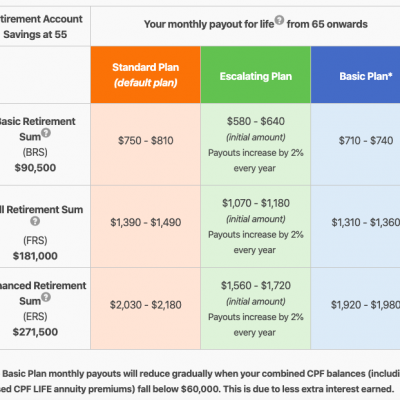

Before we go into the expenses, let’s pause for a moment to reflect on the 3 CPF Life plans and the corresponding retirement sum amount. Depending on your choice of retirement sum and your choice CPF Life plan, your monthly payout from 65 onwards varies.

Source: CPF

What Can You Pay For With Your CPF Life?

1. Paying For Basics (Food Expense)

Food expense is the most fundamental expense of any human being. As long as you are alive, you need to eat. However, there’s always a choice. For food, you have to make a choice of how you want to dine and how often to dine at those places.

| Meal Type |

Budget |

Basic |

Premium |

| Hawker Fare/Home-cooked meal |

70 meals a month @ $3 per meal

(e.g. Caifan, chicken rice) |

65 meal a month @ $5 per meal

(e.g. Zichar fried rice, hor fun) |

65 meals month @ $8 per meal

(e.g. Fast food) |

| Restaurant

(e.g. Paradise Dynasty, Din Tai Fung) |

15 meals a month @ $20 per meal |

20 meals a month @ $20 per meal |

15 meals a month @ $20 per meal |

| Fine-dining/Buffet (e.g. Buffet Town, Kiseki, Korean BBQ buffet) |

5 meals a month @ $40 per meal |

5 meals a month @ $40 per meal |

10 meals a month @ $40 per meal |

| Total |

$710 |

$925 |

$1,220 |

2. Paying For Basics (Travel Expense)

Since you are retired, you no longer have to travel to work. However, it doesn’t mean that you don’t have to travel around Singapore anymore. Be it to meet your friends for a chit chat session or to fetch your grandchildren, you will still incur some transport expense. Here’s a breakdown of how much you will need to spend on transport.

| Travel Type |

Budget |

Basic |

Premium |

| Public Transport |

$2 per trip for 2 trips per day |

$2 per trip for 4 trips per day |

$2 per trip for 6 trips per day |

| Grab/Taxi |

$10 per trip for 5 trips a month |

$10 per trip for 10 trips a month |

$10 per trip for 15 trips a month |

| Total |

$170 |

$340 |

$510 |

For some of you, you might be thinking about getting a car to meet your travel needs. Because of the cost of car ownership in Singapore, it will cost you much more.

| Travel Type |

Budget |

Basic |

Premium |

| Car Ownership

(New Car) |

Honda Jazz ($71,000)

$35,000 upfront payment +

$490 instalment per month +

$240 petrol, parking cost per month |

Toyota Altis ($100,000)

$50,000 upfront payment +

$700 instalment per month +

$360 petrol, parking cost per month |

Mercedes GLA 180 ($150,000)

$75,000 upfront payment +

$1,049 instalment per month +

$450 petrol, parking cost per month |

| Car Ownership

(2nd Hand Car) |

For 2nd hand cars, you can expect a 15-25% discount of the monthly instalment. |

3. Paying For Wants (Holiday)

Most of us dream of travelling around the world when we retire. Well, that’s not impossible, but it’s going to cost you. Be it budget trips or basic trips, it will set you back anything between $200 a month to $2,000 a month. So, if that’s what you want, you better be prepared to save a lot before you retire.

| Travel Destination |

Budget

(2 Trips Per Year) |

Basic

(4 Trips Per Year) |

Premium

(6 Trips Per Year) |

| Southeast Asia |

$1,000 per trip for 5 days |

$1,000 – $2,000 per trip for 10 days |

$2,000 – $3,000 per trip for 10 days |

| Asia/Oceania |

$1,500 – 2,000 per trip for 10 days |

$2,000 – $3,000 per trip for 10 days |

$4,000 – $5,000 per trip for 15 days |

| Europe/Africa |

$2,000 – $4,000 per trip for 10 days |

$4,000 – $6,000 per trip for 10-15 days |

$6,000 – $8,000 per trip for 15-20 days |

| North America/South America |

$4,000 – $5,000 per trip for 15 days |

$6,000 – $8,000 per trip for 15-20 days |

$8,000 – $10,000 per trip for 20 days |

What Can You Do To Supplement Your CPF Life?

As you can see, your food and travel expenses already takes up more than half of the monthly payout you receive from CPF Life. In some cases, you might even have to top up from your own retirement savings to meet your basic needs. If you are thinking of wants like having your own car or going on an occasional holiday trip, the payout from CPF Life will not be enough to meet your needs.

That’s why you need to consider different ways to supplement your CPF Life payout with your own retirement plan while you are still earning a decent income. You can then channel your current income into retirement savings plan to supplement and enhance your retirement income so that you can live the retirement life that you want.

4 Mindset Change to Achieve FIRE

Find out what kind of retirement plans are available for you to enhance your retirement income.