Singapore Is The World’s Most Expensive Place To Retire. Here’re 5 Ways To Help You Beat It

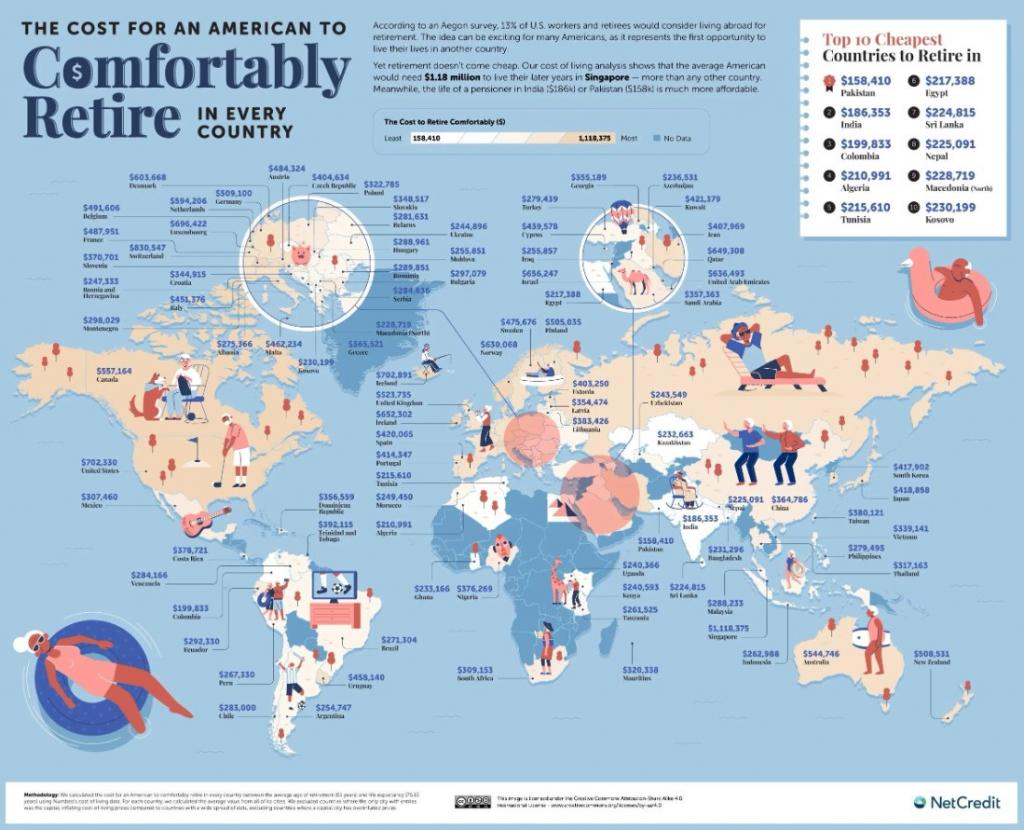

According to a study by NetCredit, Singapore got the top honours of being the most expensive place in the world to retire for an American.

Considering that the spending power of an average American is relatively higher than a majority of the world, being ranked number one in this study seems to be a reminder of how expensive it is to retire in Singapore.

Source: NetCredit

Source: NetCredit

But we are not here to lament about how expensive it is or how the government isn’t helping Singaporeans to retire. Instead, we are here to solve the problem.

We are here to share with you five tips on how you can beat the most expensive place to retire in the world.

5 Ways To Help You Beat Retiring In Singapore

-

Kickstart Retirement Planning Early And Start Small

One of the biggest regrets about retirement planning among retirees is starting too late. The problem with starting late is that you have less years to get enough in your retirement savings to last you through your retirement. The earlier you start planning for your retirement, it gives you the added advantage of having time on your side.

Just imagine this. If you want to save $1M in 10 years, you need $100,000 a year. But if you want to save $1M over 30 years, that’s just $33,000 a year. And if you translate to a monthly savings rate, that’s $3,000 a month. This is so much less suffocating for you compared to $8,500 a month (or $100,000 a year).

The other thing is, don’t think that your retirement planning can only start when you have a lump sum of money. Even if you can only squirrel away with a small amount of savings every month, that helps too. Bit by bit, little by little, you can accumulate it into sizeable savings for your retirement with enough time.

And if you need any help with your retirement planning, you can get free, comprehensive, and professional advice from Moneyline.SG.

-

Rethink Your Expenses And Seriously Consider How Long You Want To Be Retired

Saving for retirement isn’t rocket science. On the contrary, the math behind it is really rudimentary. The amount of retirement savings you need will be the monthly expenses you require multiplied by how long you want to stay retired.

Higher monthly expenses like owning a car and eating out at restaurant on a regular basis are reasons why you need more retirement savings. Or if you plan to retire early (e.g. in your 40s), then your savings need to sustain you for a longer period of time, which in turn means more retirement savings required.

Therefore, one way to ensure that your retirement planning is sustainable is to keep your expenses at an affordable rate. For instance, if you can take public transport, then you don’t need a car. Perhaps travel once a year instead of travelling once every month. Or if you really want to travel frequently, consider a travel destination that is more affordable (e.g. Thailand instead of Germany).

-

Semi-Retirement Mode With Flexible Income

We typically think about retirement as a point in our lives where we will be doing absolutely nothing and just drink coffee with our friends at the coffeeshop. But is that really the kind of retirement life for you?

Often times, what many of you really want for your retirement life is the flexibility and freedom to do what we like. Such flexibility allows you to do things like volunteering, going on a solo backpacking trip, or just doing freelance work for what you like.

Instead of thinking about retirement as doing absolutely nothing, why not spend your retirement life doing something more fruitful? How about continuing to stay employed but with more flexible working hours, e.g. a part-time arrangement?

Being in such a semi-retired mode not only gives your something to keep your mind and body busy, it also lets you earn some income to cover your expenses. With that, you don’t have to touch your retirement savings until it’s really needed.

-

Keep Your Retirement Savings Growing Steadily

When it comes to retirement savings, there’s actually a hack about it that you might not realise. This hack is that if you already have a decent amount of retirement savings, growing it steadily means you can spend without drawing down on your core retirement savings.

Let’s say you have $300,000 in your CPF Retirement Account (RA). CPF RA offers 4% p.a. interest rate on your retirement savings. This means that money in your CPF RA will increase by $12,000 every year. That translates to an additional of $1,000 for you to spend every month. And if you can keep your monthly expense within $1,000, your retirement savings of $300,000 will never go down.

-

Stay Sufficiently Insured

It might seem counter intuitive that we are talking about insurance when the topic is about retirement, but hear us out. Insurance forms an important part of your financial planning in the lead up to your retirement. That’s because insurance policies are there to protect you against a major event in your life that may cause a financial deficit.

For instance, if you get into an accident, it will impact your earning ability while you recover. If you don’t have the right insurance in place, it will force you to dig deep into your account that was meant for your retirement savings. With insurance, it ensures you do not get a huge deficit in your retirement savings in case of any emergency.

A lot of us don’t know this and therefore don’t really get well insured when we are younger. Some of us also fall into the pitfall of over-insuring on certain aspects of insurance and end up with an imbalanced insurance portfolio.

That’s why we think it’s important to get the right financial advice from a professional financial planner like Moneyline. At Moneyline, we always ensure you get the right coverage for your current life stage.

Kickstart Your Financial Planning Today With Moneyline

If you are keen on beating the world’s most expensive place to retire, let us know