Jobstreet Salary Guide 2023: How Much Should i Be Making?

As an employee, do you ever wonder if you are getting the right compensation for the work you are putting in at work? Well, that question is no longer a mystery because of the recently published Jobstreet salary guide. So how much should you be making?

Read: How much you can make as a fresh graduate?

The Jobstreet salary guide compiles industry level data of all the industries and how much workers can earn on average in the industry. In this article, we are going to show you some ways you can use the Jobstreet salary guide to your advantage.

-

Are You Getting Your Salary Worth In Your Current Job?

source: jobstreets.com.sg

Have you ever felt like you are getting underpaid for the amount of work that you are tasked to do? Or do you feel burnt out while your mind doesn’t feel justified when you receive your salary at the end of the month?

Well, one reason could be that you are getting the short end of the stick when it comes to salary.

There are many reasons that can contribute to that. For instance, your employer might be referencing the salary you last drew to make a “fair” offer to you when you first joined. Or it could be that you were with the company for a long while but didn’t experience the same salary growth as the rest of the industry.

Therefore, it is important that you understand your own worth by comparing your own compensation against the industry average.

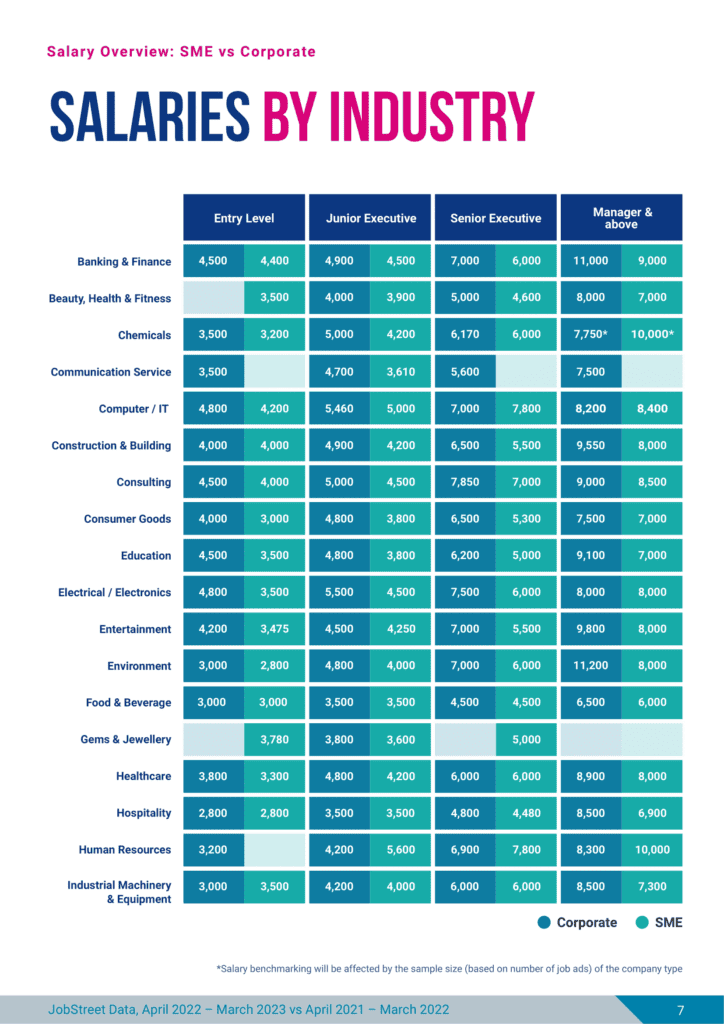

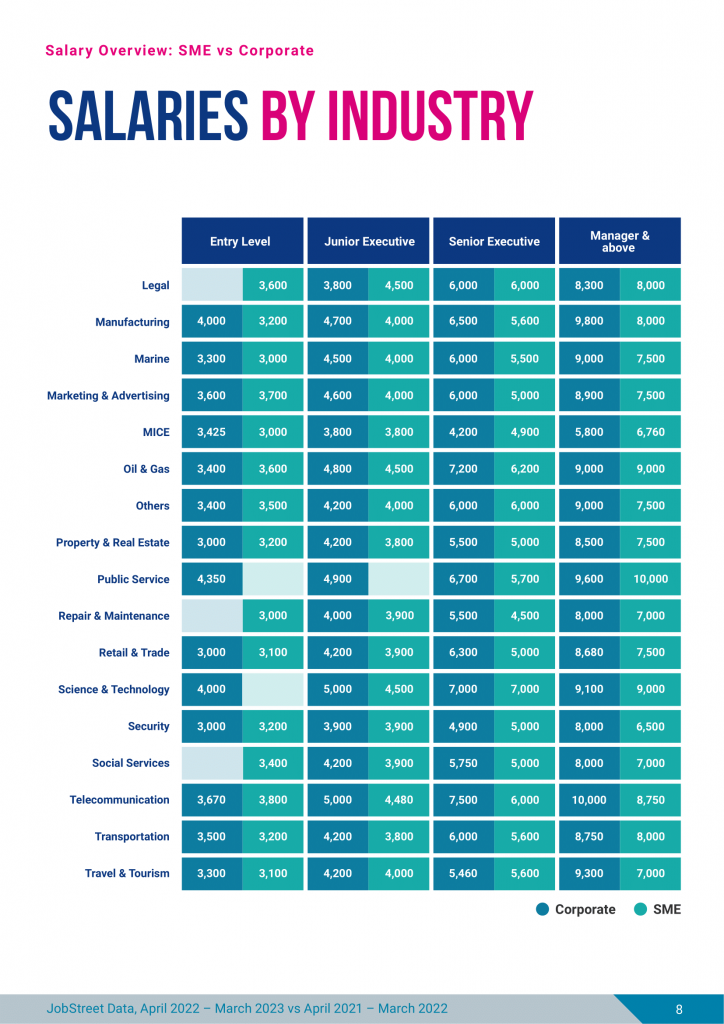

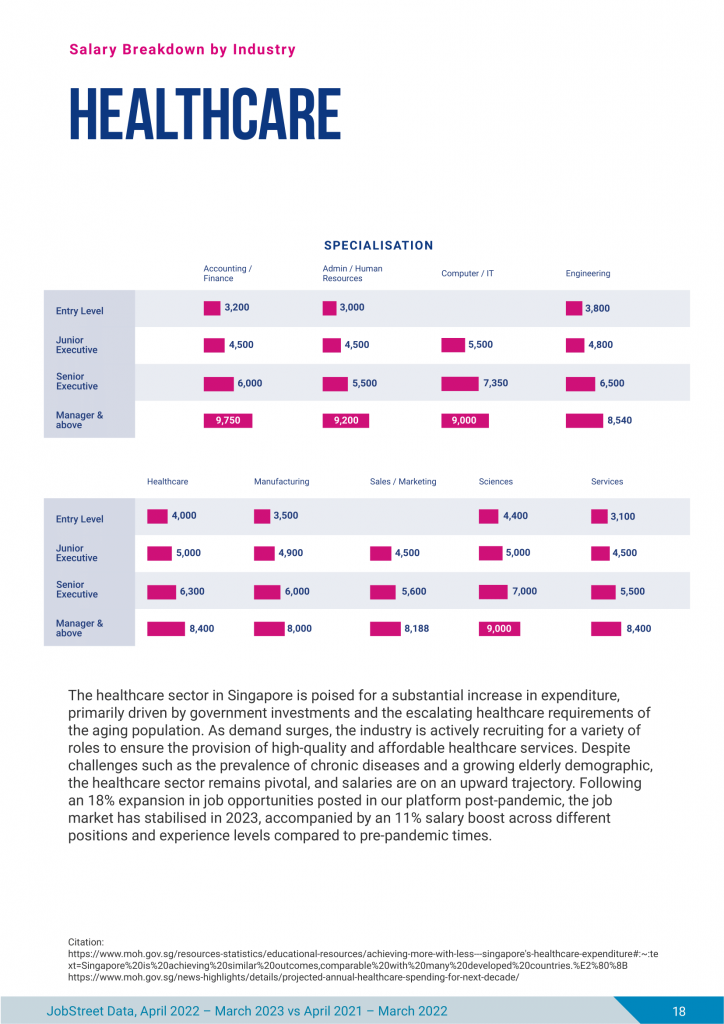

The Jobstreet salary guide publishes an industry level guide on the average salary against the job experience. It also compares between multinational corporations (MNCs) and small and medium enterprises (SMEs).

With this as your guiding reference, it gives you a better sense of how much salary you should be drawing in your industry at your current job level. If you know that you are being underpaid, make sure to fight for your compensation in the yearly compensation calibration exercise in your company.

Or if your company is too stingy to raise your salary, then it might be a signal to move on and work for one that appreciates your skills and expertise with a fairer compensation.

-

What Should Be Your Next Career Move?

Another good use of the salary guide is to use it as a reference for your next career move. There are two ways of how you can do that.

Do You Try To Climb To The Top Of The Ladder In Your Existing Industry?

The typical career move that most people make is to climb to the top of the industry that you are currently in. That’s because it is already a field that you are very experienced in and your experience also grows with time. Generally, your compensation grows linearly with your increased experience.

Therefore, climbing up the corporate ladder is the simplest way to increase your compensation.

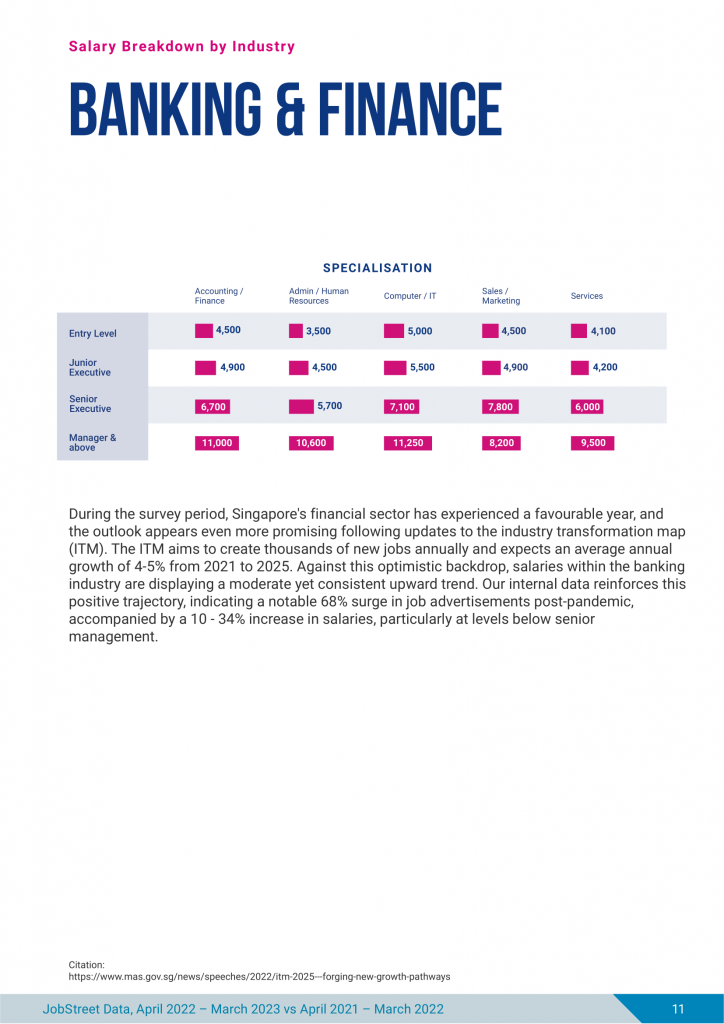

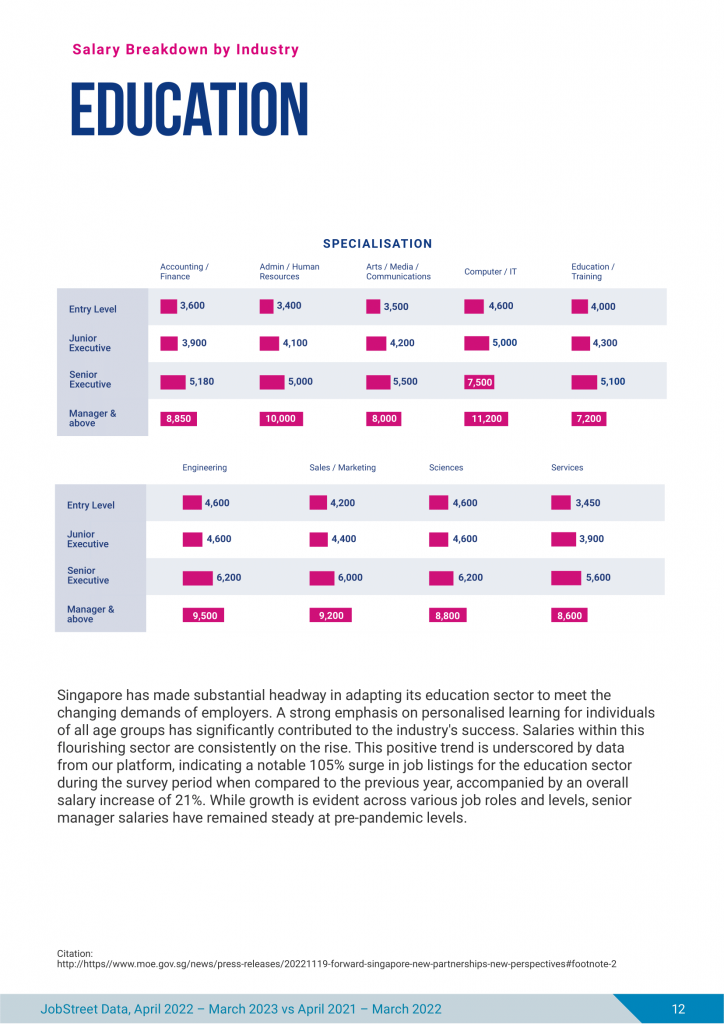

The Jobstreet salary guide shows you a breakdown of different specialisation and the associated compensation at different level of experience. With this, you can judge what’s the average compensation jump from your current level to the next level.

For example, if you are in the healthcare sector and you are currently a senior executive, your next move will be to the managerial level. On average, such a promotion will give you a ~33% (or more) salary increment.

Should You Make A Career Switch To Another Industry?

What if you find that it is not worth making it to the top of the field that you are in?

Imagine you’re currently working in the Education sector, where the average salary for someone at the managerial level is $7,200—an amount notably lower than averages in other industries. This might prompt you to question the worth of staying in a sector where your passion is lacking. As a financial advisor, you have the potential to surpass these income constraints. Have you ever wondered about the earning potential in the financial service sector? Leave your contact information below to delve into exciting opportunities and explore a career in finance