How to Top up CPF Special Account (CPF SA)

CPF Special Account Top up How-tos: The Central Provident Fund (CPF) Special Account is a savings account in Singapore that is set aside for retirement. It is an important part of Singapore’s retirement system, and it is useful for Singaporeans and permanent residents to regularly top up their Special Accounts to ensure that they have enough savings for their golden years.

There are a few ways to make your CPF retirement savings work harder, In this blog, we will provide a step-by-step guide on how to top up your CPF Special Account in Singapore. By following these steps, you can easily top up your account and ensure that you have sufficient savings for your future.

Determine the amount that you want to top up to CPF Special Account

The first step in topping up your CPF Special Account is to determine the amount that you want to top up. You can top up your CPF Special Account with any amount that you wish, but there is a maximum amount that you can top up each year. This amount is known as the “Ordinary Wage Ceiling” and is based on your age and the average wage in Singapore.

The difference between the CPF Annual Limit of $37,740 and the compulsory CPF payments paid for the calendar year is the maximum amount you can voluntarily top up.

It is important to note that you can only top up your Special Account with CPF transfer or cash. You cannot top up your account with investments, such as securities.

Follow the instructions to complete the CPF Special Account top up

The steps to complete the top up will depend on the method you have chosen. For example, if you are topping up online, you will need to log in to your CPF account and follow the prompts to make the payment. It is important to follow the instructions carefully to ensure that the top up is successful. If you make a mistake or encounter any issues, you may need to contact the CPF Board for assistance.

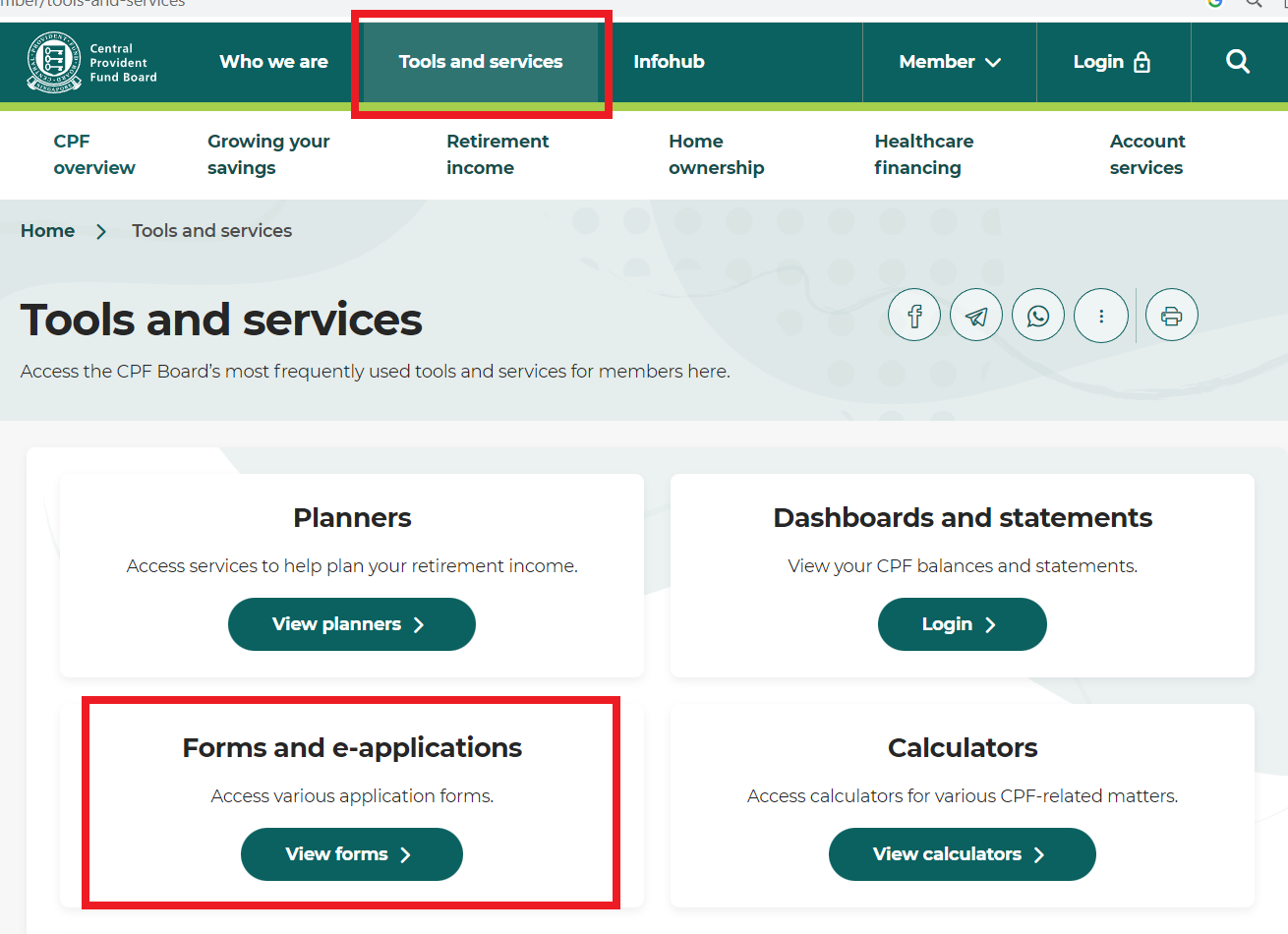

Step 1: Go to the “Forms and e-Applications” section on the CPF homepage

- On the CPF homepage, look for the “Tools and Services” section.

- Click on the “Forms and e-Applications” link.

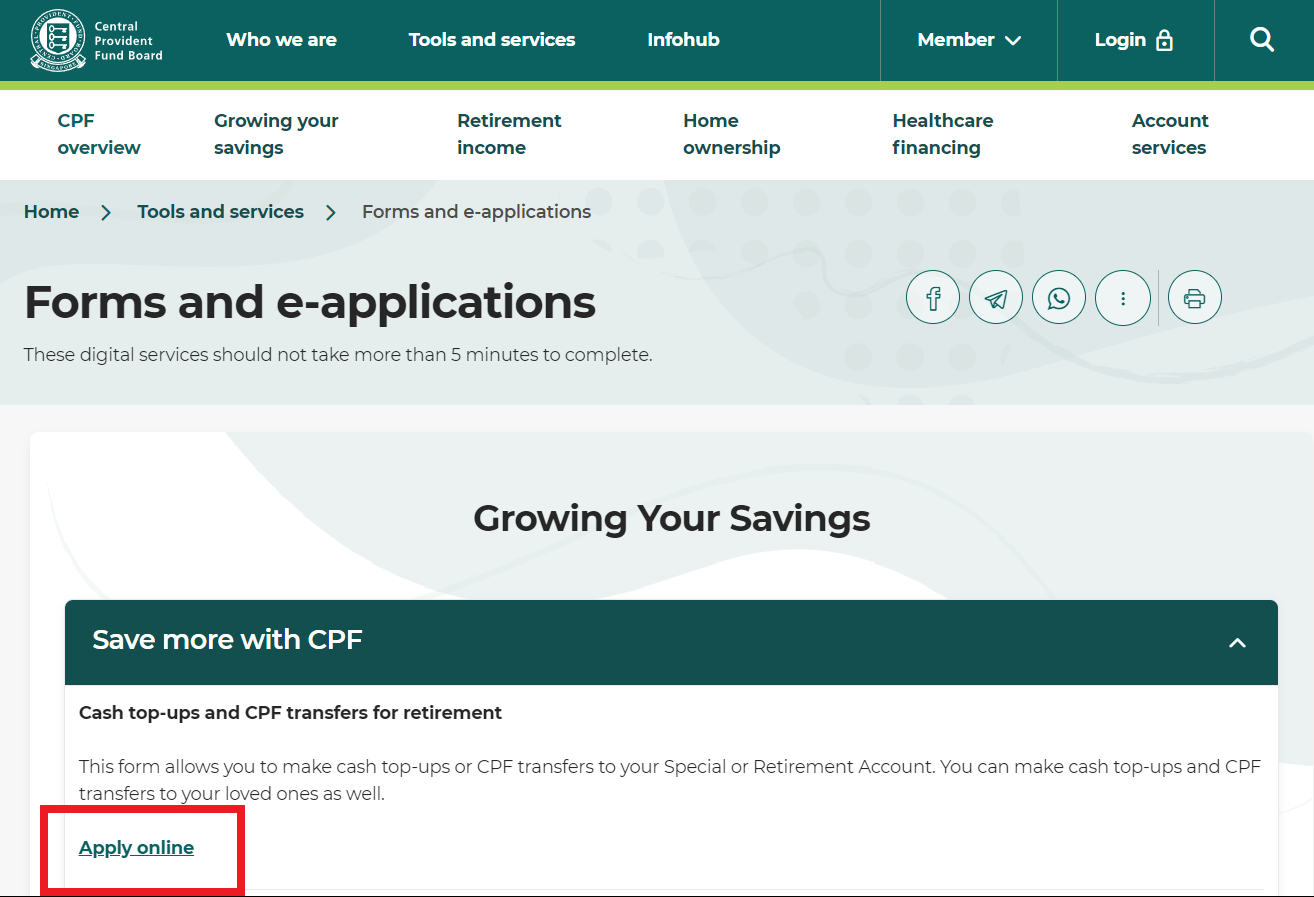

Step 2: Select the “Apply Online” option

- Expand the “Save More With CPF” tab,

- Click on “Apply Online” link under the”Cash top-ups and CPF Transfers for Retirement“

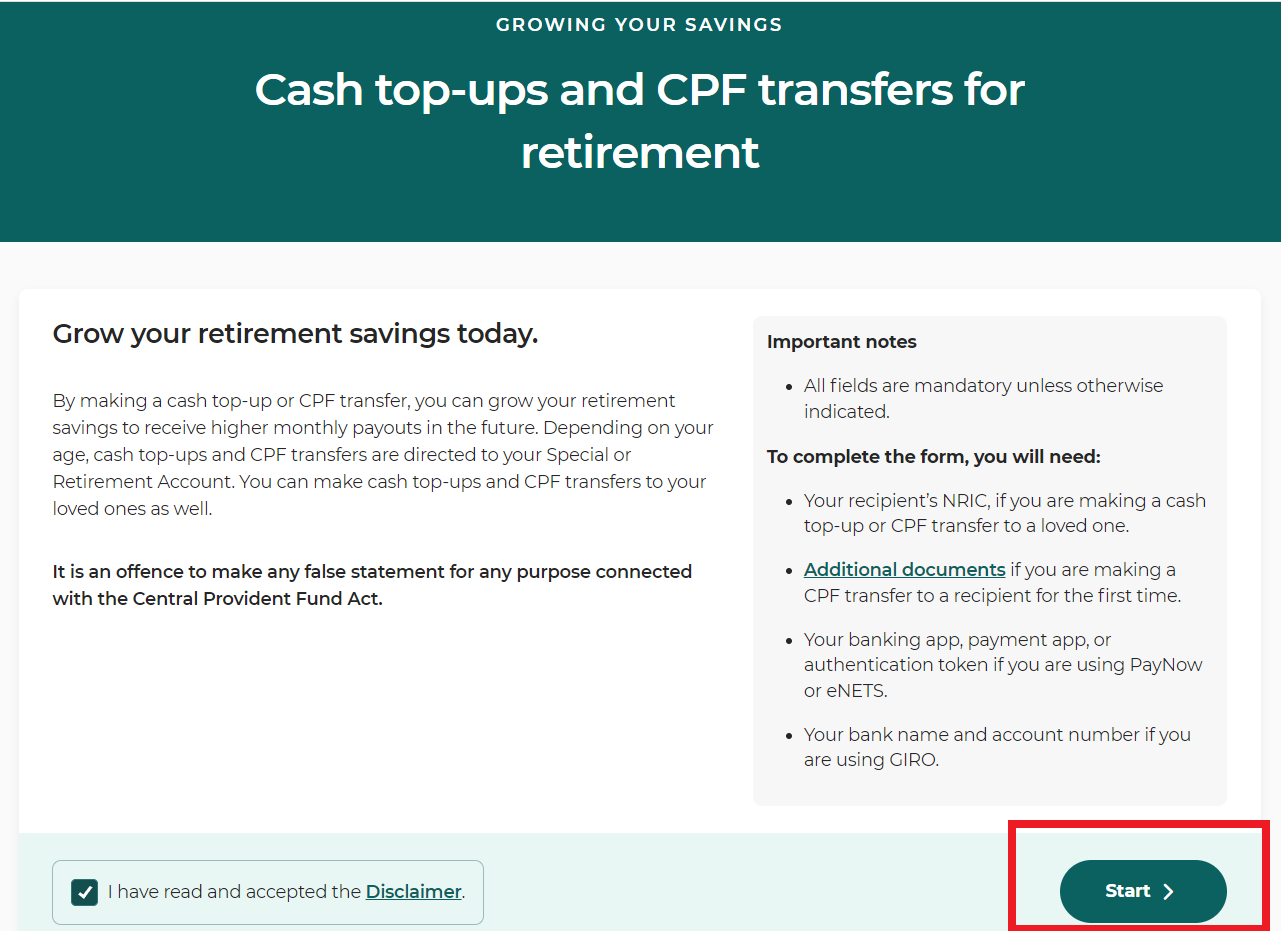

Step 3: Read the disclaimer and click “Start”

- Carefully read the disclaimer that appears on the screen.

- Once you have read and understood the disclaimer, click the “Start” button to begin the top-up process.

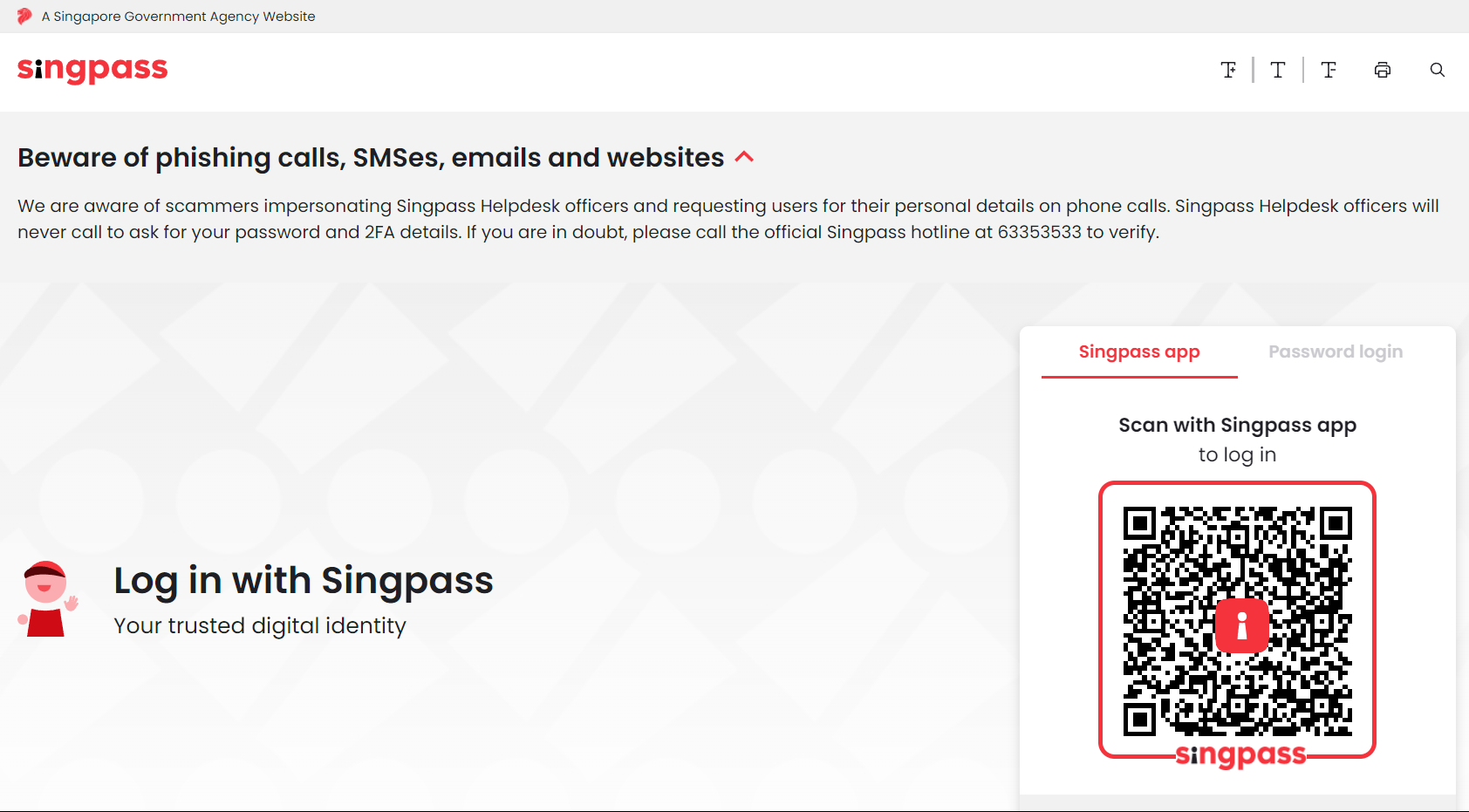

Step 4: Log in with your SingPass

- To do this, open the SingPass app on your mobile device and scan the QR code displayed on the login screen.

- This will log you in to your CPF account automatically.

- If you do not have the SingPass mobile app, you can download it from the App Store or Google Play.

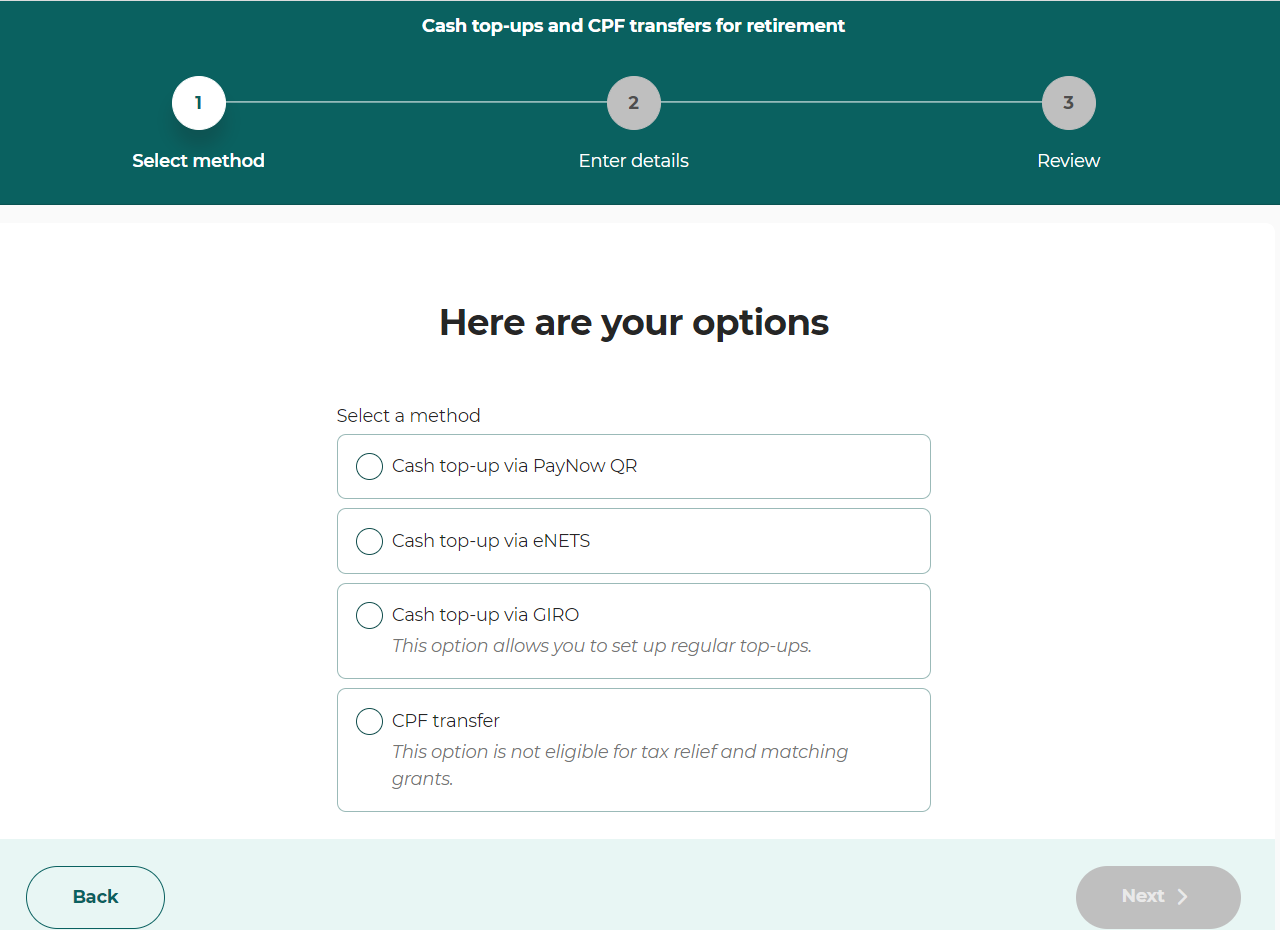

Step 5: Choose your payment method

- After logging in to your account, you will need to select a payment method for your top-up.

- There are several payment methods available, including PayNow QR, eNETS, GIRO, and CPF transfer.

- In this example, we’ll demonstrate using PayNow QR.

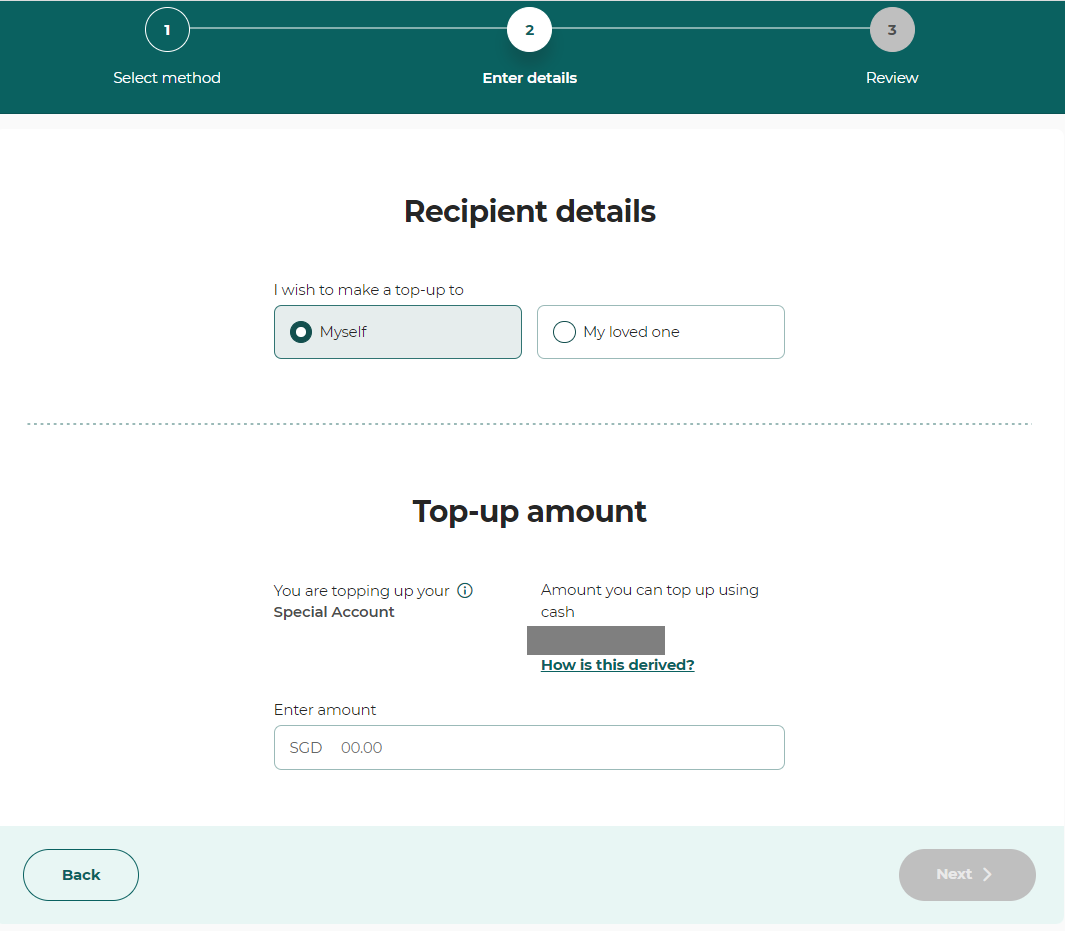

Step 6: Enter your top-up details

- After selecting your payment method, you will need to enter your top-up details.

- You will need to specify whether you are making a top-up to your own account (“Myself“) or the account of a loved one.

- You will also need to Enter the amount that you want to top up.

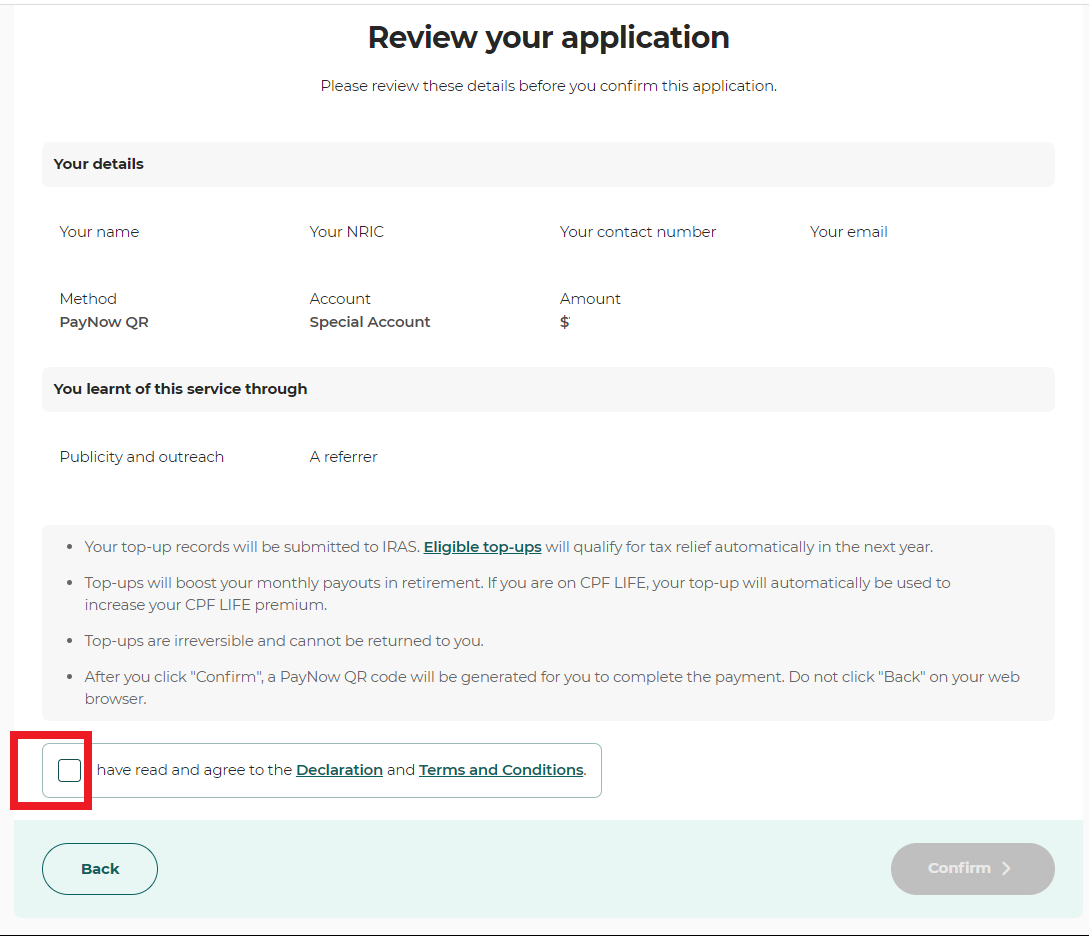

Step 7: Review and confirm your top up

- Before completing the top up, it is important to review your details to ensure that everything is correct.

- Once you are satisfied with your top up details, you can proceed to confirm the top up.

- Click the “Confirm” button to complete the process.

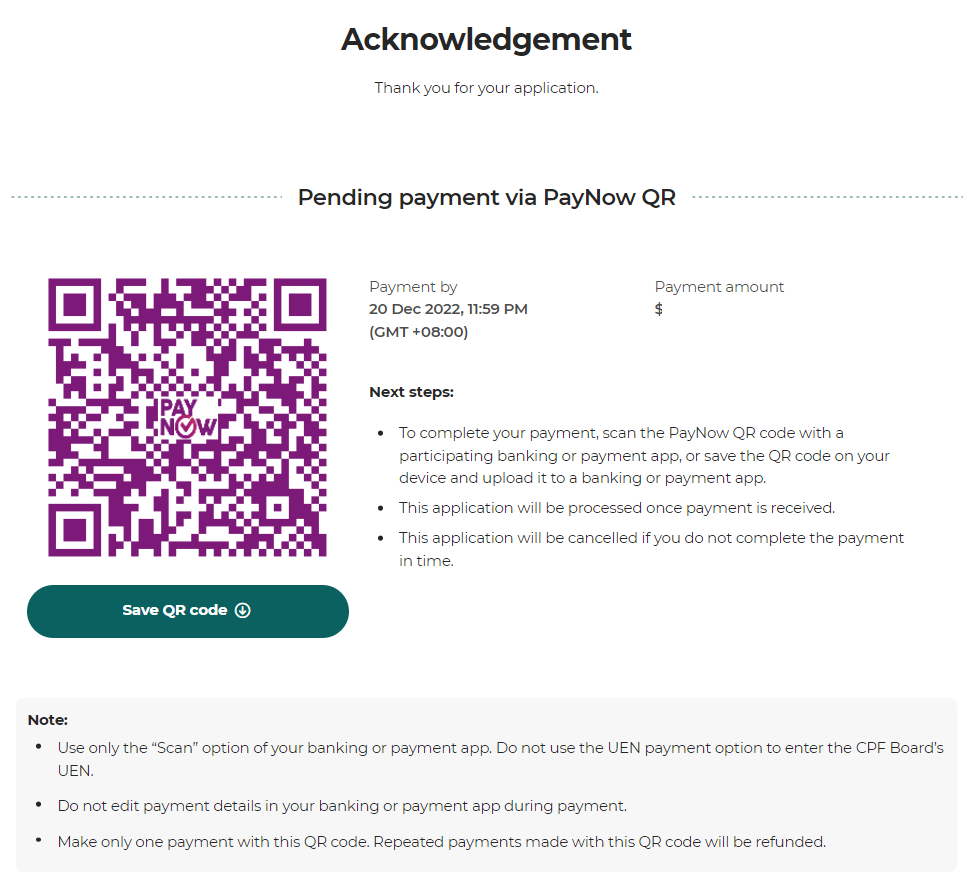

Step 8: Make payment using your chosen payment method

- After confirming your top up, you will need to make payment using your chosen payment method.

- If you are paying by PayNow QR, you will need to scan the QR code displayed on the screen using your mobile banking app.

- If you are paying by other methods, you will need to follow the prompts to complete the payment.

- Make sure to carefully follow the instructions to ensure that the payment is successful.

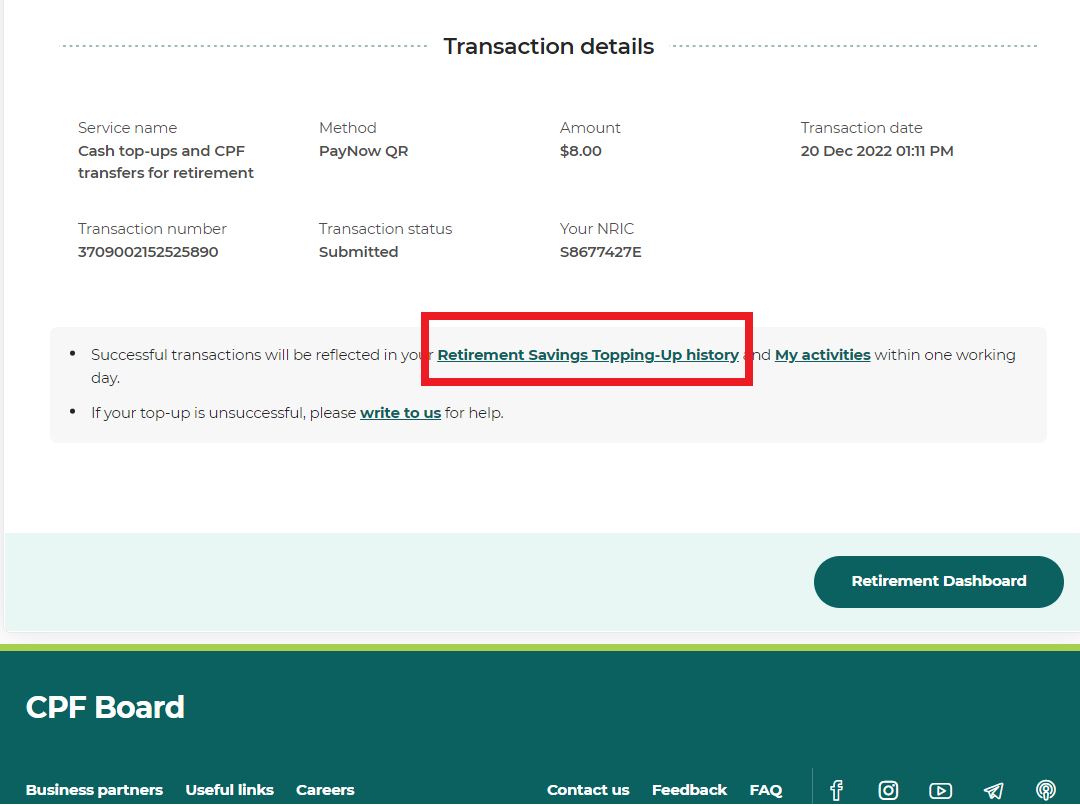

Step 9: Verify that your payment has been received

- After making payment, it is important to verify that your top up has been successful.

- To do this, you can either refer to the payment page earlier (at the bottom), otherwise do this:

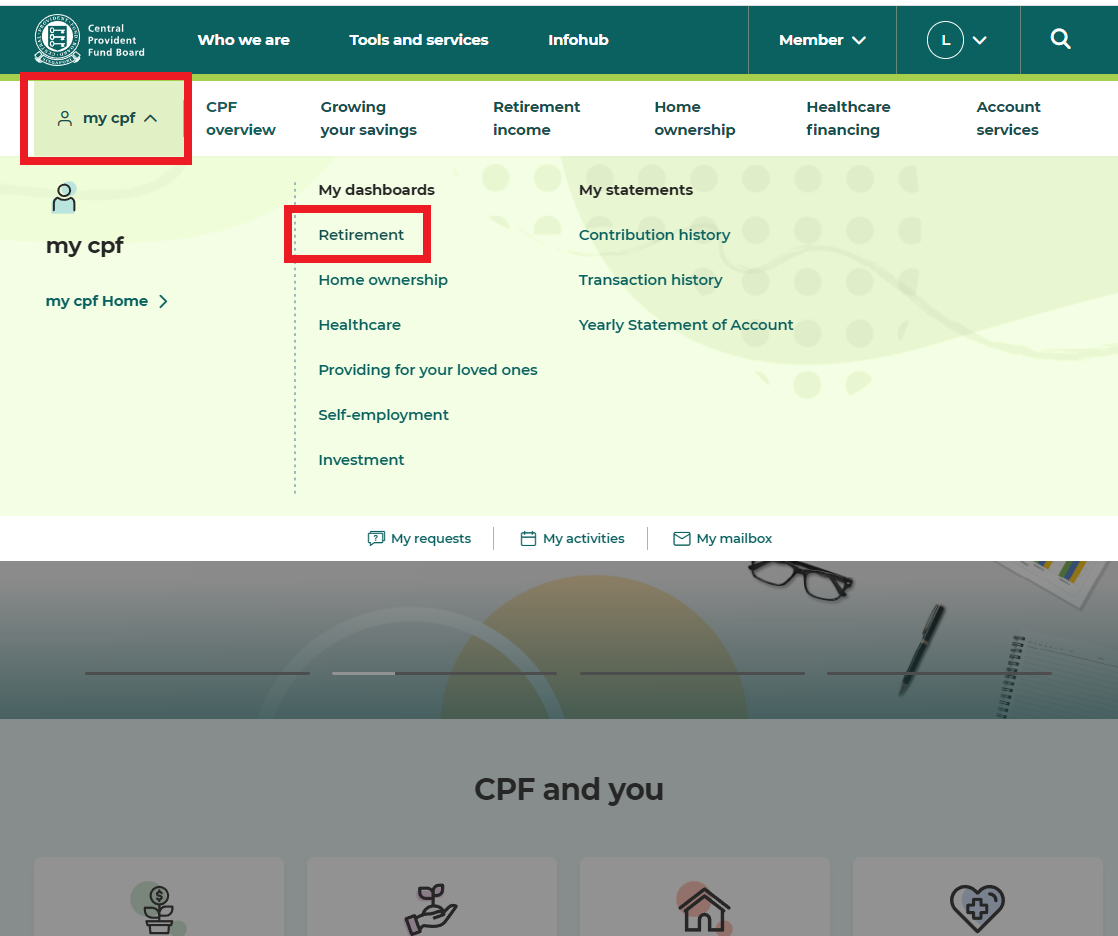

- Log in to your CPF account and go to the “my cpf” tab on the homepage.

- Click on the “Retirement” button to view your account balance and transaction history.

- If your payment has been received, you should see a new transaction in your history and an updated account balance.

- If you do not see any updates, or if you notice any discrepancies, you should contact the CPF Board for assistance.

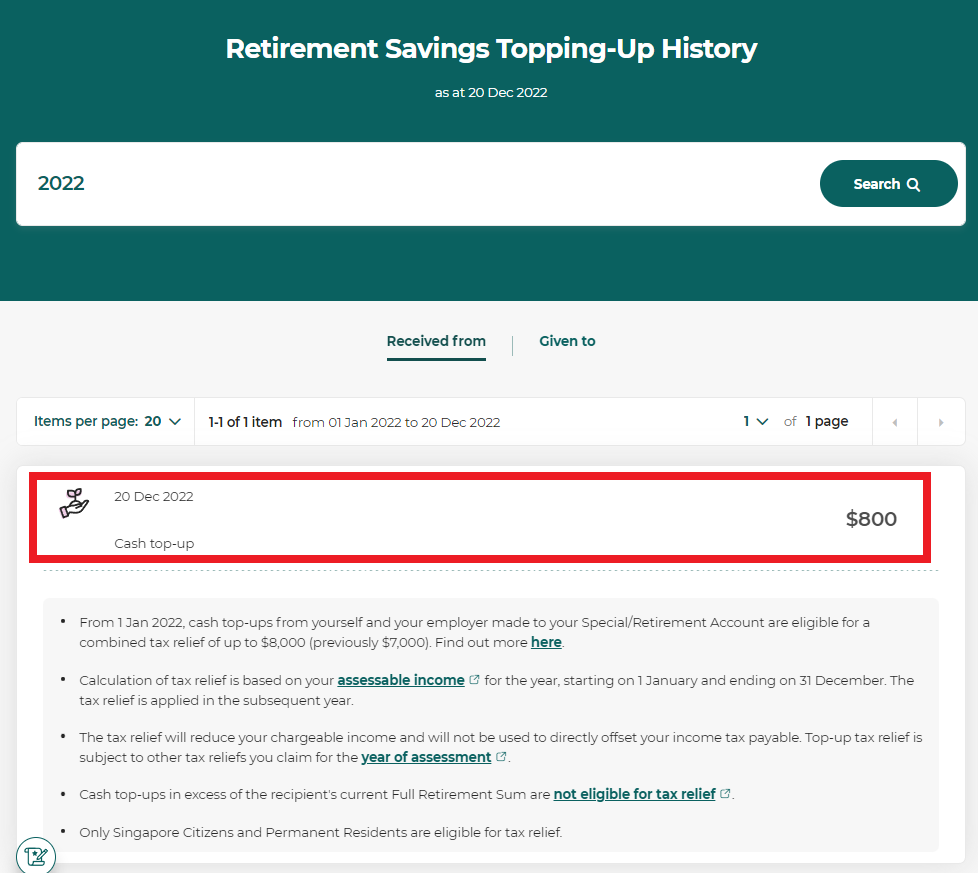

Step 10: Confirm your CPF-SA top up is successful

Once you have completed the top up process, it is important to confirm that the top up has been successful. You should receive a confirmation email or message from the CPF Board indicating that the top up has been credited to your account. You can also check your account balance online to ensure that the top up has been credited to your account.

It is important to verify that the top-up has been successful, as mistakes or issues with the top up process can sometimes occur. If you do not receive a confirmation email or message, or if you notice any discrepancies in your account balance, you should contact the CPF Board for assistance.

It is also a good idea to keep a record of your top-up transactions, as this can help you track your savings and plan for your future. You can view your top-up history online through your CPF account, or you can request a copy of your transaction history from the CPF Board.

By following these steps and confirming the top-up, you can ensure that your Special Account is properly credited and that you have sufficient savings for your retirement and healthcare needs.

Conclusion:

In conclusion, topping up your CPF Special Account is an important step in planning for your retirement needs in Singapore. By following the steps outlined in this guide, you can easily top up your account and ensure that you have sufficient savings for your future.

Remember that there are certain restrictions on how you can use the funds in your Special Account. You cannot use the funds to pay for everyday expenses or to invest in high-risk investments. However, you can use the funds to invest in safer investments such as CPF SA- approved investment funds.

By regularly topping up your Special Account and using the funds wisely, you can ensure that you have sufficient savings for your retirement in Singapore.

Have any questions? Contact us now to get them answered!

3 Comments