CPF Life Vs Private Annuity?

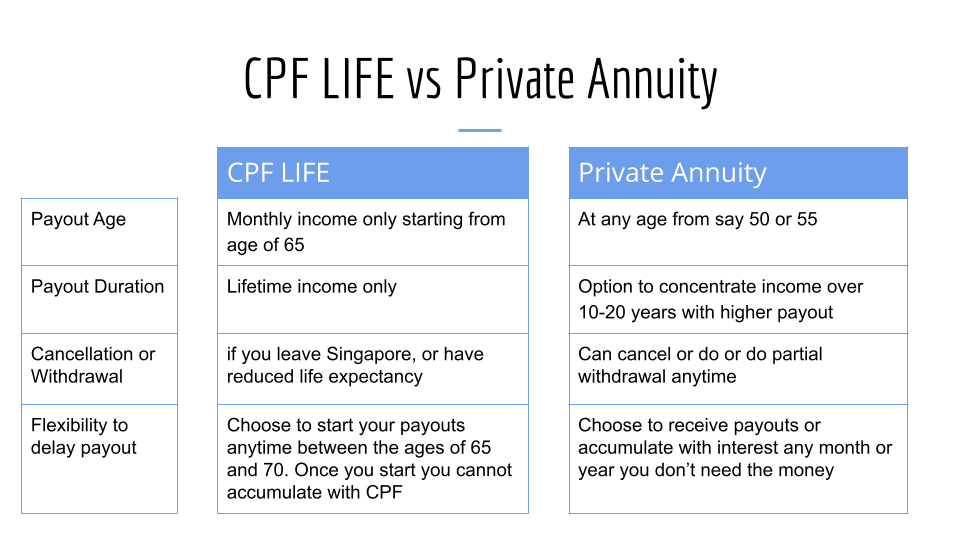

You are probably having difficulty choosing between the two — CPF Life vs Private Annuity? If you are confused about which course of action is best for you, don’t worry, we’ve put together an infographic that breaks down the difference between the two.

Do you know ‘CPF LIFE’ stands for ‘CPF Lifelong Income For the Elderly’? — CPF Life Vs Private Annuity

One of the biggest retirement concern for most Singaporeans is whether they will have enough money to live on during their golden years.

The CPF LIFE Scheme was launched in 2009 to address this concern by providing a lifetime monthly income stream for CPF members who have set aside the Basic Retirement Sum or Enhanced Retirement Sum in their CPF accounts.

The monthly payout starts from age 65 and continues for life. There are also options for you to purchase additional premiums with your CPF savings to increase the monthly payout.

It will pay you monthly, no matter how long you live.

CPF Life Vs Private Annuity— Annuities are a great way to cover your retirement needs. They provide a guaranteed income stream for a specified period of time or for life, and offer protection against the risk of outliving your assets.

With these new retirement schemes, we are able to utilise our CPF savings to enjoy a monthly income once we reach 65 years of age.

But what if we want to get our funds out earlier? Or start receiving a monthly income before the age of 65? What if we don’t want to be tied down with a monthly payout that only ends at our demise?

During the first 15 to 20 years of retirement, people often face greater expenses due to their desire to travel, pursue hobbies, or obtain higher education. Giving your retirement planning a head start might be a good idea!

Private Annuities can be fully cashed out from Retirement Age — CPF Life Vs Private Annuity

CPF-LIFE and Private Annuity are both retirement products that provide you with a monthly payout for as long as you live. They offer different features and flexibility, so you can choose which one is more suitable based on your needs.

Here are the key differences between CPF-LIFE and private annuities:

CPF-LIFE is compulsory under the CPF. You must join CPF-LIFE if you have sufficient balance in your Retirement Account (RA) at age 55.

CPF-LIFE is guaranteed for life, even if you outlive your payout. When you die, the remaining payout will be passed to your nominated beneficiaries.

Private annuities are not covered by the CPF. You may use cash or assets from other sources to purchase the annuity from a private insurer.

Private annuities can be fully cashed out from the start when you reach your retirement age.

While CPF-LIFE must be started with at least a Basic Retirement Sum or higher. You can withdraw any excess amount above your starting sum as a lump sum. The rest will be used to buy monthly payouts. You can cancel your CPF LIFE plan ONLY if you are leaving Singapore or West Malaysia permanently or if you are fully exempted from setting aside the retirement sum in your Retirement Account because you are receiving a monthly pension/annuity payout. The annuity must be issued by a licensed provider registered with MAS, and it must comply with the stringent rules set out in the Insurance Act. If you surrender or terminate your annuity/pension after you make a withdrawal, the amount you get back must be refunded to your Retirement Account up to the Full Retirement Sum applicable to you.

CPF LIFE varies with your CPF balances, gender and age.

At the age of 65, your CPF savings would be used to buy you a monthly payout for life. This is known as your CPF LIFE payout.

How much you get from your CPF LIFE payout depends on:

1. Your balance in your Retirement Account at the end of the year before you turn 55;

2. Your gender and age; and

3. Which CPF LIFE plan you choose.

In addition, your CPF savings are locked in when you commit to CPF LIFE. This means that if you change your mind later, you cannot access your savings easily.

Private Annuities are flexible— CPF Life Vs Private Annuity

On the other hand, with a private annuity plan, you can choose how much to invest, the payout period and even how often you wish to receive payments (monthly/annually/lump sum). There is no lock-in as well; if you need to access your savings, you can do a partial or full surrender. And if you die early, any remaining premiums will be paid out to your beneficiaries.

You may change your mind even after you have made a choice between CPF LIFE or private annuity! (BUT ONLY ONCE!)

If you are automatically included in CPF LIFE, you will have to choose your CPF LIFE plan when you wish to start receiving your CPF LIFE monthly payouts. Let’s say if you do not choose a plan before age 70, they will automatically place you on the CPF LIFE Standard Plan and start your payouts at 70. What if you are not automatically included in CPF LIFE? Then, you can choose your CPF LIFE plan when you wish to join the scheme, any time from 65 to one month before you turn 80.

You cannot change your CPF Life plan as this will affect the payouts of other members on the scheme. However, you can change your mind within 30-days from the date of your policy letter by contacting CPF via My Mailbox.

Takeaway: There is no right or wrong answer when it comes to which option to choose between CPF Life and private annuity, as long as you know what you sign up for!

Nobody looks forward to retirement.

No, seriously, no one does.

I have yet to meet someone who gets excited at the idea of doing nothing for the rest of their lives. Even if you are financially secure and don’t need a job to survive, it’s still not something most people look forward to.

Retirement is not about being financially secure and having an endless bank account full of money for you to spend as you see fit. It’s about having enough money so that you can spend your time however you want to, with whomever you want to – and this is when a suitable annuity comes in handy!

Choose the best private annuity

1 Comment