How Financial Planning Is Actually As Simple As 4 Letters: GGLP

Singaporeans love our acronyms. We have acronyms for literally everything. From PIE to MRT to HDB, we can barely complete a paragraph without dropping a couple of acronyms. Our love and obsession with acronym is down to the fact that acronyms are able to encapsulate the essence of anything so well within just a few letters.

In fact, acronyms are so powerful that they can even explain something as complex as financial planning with just four letters: GGLP.

The Origin Of GGLP From Life

GGLP is actually derived from the four key pillars of life: Grow, Give, Live, Protect (GGLP). That’s because every human being live our life with these four key pillars.

As humans, we always seek new areas of GROWth. Be it whether it is in a career context or social context, we are all looking for growth as a human. As we attain our personal growth, we want to be able to GIVE so that we can fulfil our innate desire to contribute to someone else’s life.

Obviously, every human wants to be able to LIVE our life to the fullest and experience what there is in life. And lastly, we also crave to PROTECT what we think is important to us, be it family, friends, or things that we built.

What Is GGLP In Financial Planning?

Taking these four key pillars in life, we can translate them into the same key pillars to explain financial planning.

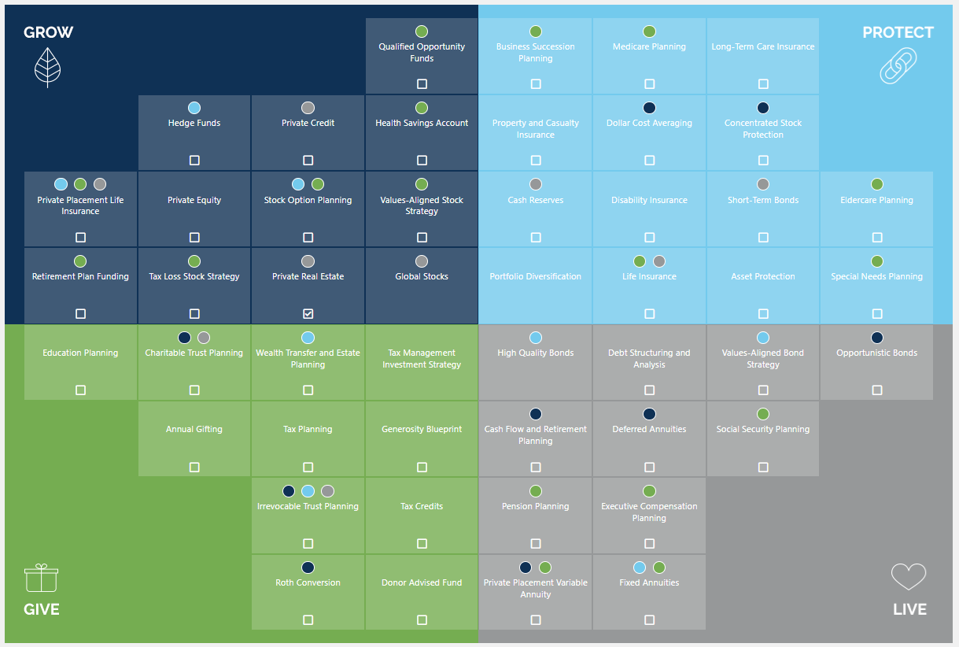

Source: Forbes

-

Grow

In life, we seek growth so that we can grow as a human being. In the context of financial planning, growth focuses on strategies and tools that helps us to growth our financial capital.

These useful tools range from stocks to saving plans that can help us to grow our wealth so that we have more capital for Give, Live, and Protect.

One thing to note about the growth phase is that you should start it as early as possible. In life, having more time in the growth phase gives you more opportunities and also more room to make mistakes. Similarly, you want to have that kind of flexibility when it comes to financial planning as well.

Financial Tools That Can Help You Grow

-

Give

The idea of giving is very similar in both life and financial planning. In both context, you are planning for the ones you loved, be it whether it’s your children or your parents.

For instance, you may be thinking about starting an education fund for your child so that you can prepare for his/her university education. You may also be thinking about the retirement adequacy of your parents because you want them to be able to retire well.

Financial Tools That Can Help You Give

-

Live

As the saying goes, “The proper function of man is to live, not to exist”. You don’t want to be going through life just living through the motion. You want to actually live and enjoy your life. But in order to do that, you got to have good financial standing so that your living funds doesn’t dry up while you are enjoying life.

Importantly, you want to make sure that you save and plan well during your prime working years so that you have enough to last you through your retirement.

Planning early for your retirement is one way to help you prolong your wealth through your years so that you can enjoy living the life. That’s why retirement planning is one area that is given a lot of importance in financial planning.

Financial Tools That Can Help You Live

-

Protect

Protect is our failsafe mechanism in life. While we enjoy the Grow, Give, and Live themes of life, we never forget about having the right protection in life so that we are always prepared for the worst.

Similarly in financial planning, protection is key to ensure we are financially protected. This is where insurance plays a huge role in making sure that we are well covered from financial stress.

In fact, before we even go on to the Grow, Give, and Live themes, we need to have the right financial protection in place first. Protect is always the first thing that is recommended by financial planners before we consider other themes.

Financial Tools That Can Help You Live

How To Identify Key Gaps In Your Financial Planning?

Knowing the four key themes around financial planning is half the battle won. But sometimes, knowing is one thing. Being able to plan and execute on it is another. A key challenge that we often observe is cognitive bias.

As humans, it is always hard for us to spot our own mistakes. We might have missed out on key gaps in our financial planning, but we fail to spot it. That’s why it is always recommended to have a professional third party do it for you to prevent any blind spots.

As a professional financial planner, Moneyline.SG provides free comprehensive financial planning that can benefit you. We provide you with the right expertise so that you can leverage on expert opinion while you map out your own GGLP.

2 Comments