Planning To Buy An Insurance Plan? Make Sure You Know These 3 Things First

Seen a lot of sponsored post on your social media accounts with misleading online advertisements about insurance lately? Well, it seems like you aren’t the only one. It has now been so widespread that it has even caught the attention of the Monetary Authority of Singapore (MAS), i.e. Singapore’s financial watchdog whose job is to prevent mis-selling and misrepresentation of financial products. With ads that claim to offer claims of “up to 500% if diagnosed with over 100 types of illnesses”, it’s not hard to imagine why.

Indeed, one of the genuine challenge with buying insurance plans to protect you and your loved ones is the limited number of advisors who are honest and trustworthy. These advisors are driven by the incentives of selling you insurance plans without understanding your protection needs. That’s why if you are planning to buy an insurance plan anytime soon, here are 3 things you should know.

3 Things You Should Know Before You Commit To An Insurance Plan

-

Build Your Insurance Knowledge With Bite-Size Readings

One reason why dishonest advisors are able to bluff their way through is because of the lack of knowledge about insurance among consumers. The way insurance products are designed and worded also adds to that problem. But avoiding dishonest advisors can be as simple as spending 5 minutes a day on some bite-size readings about insurance.

For instance, at Moneyline.SG, we update our blog regularly with simple and easy-to-understand sharings about insurance to help our readers make more informed decisions. All it takes is just 5 minutes a day and you will find your insurance knowledge improving exponentially.

P.S. It also comes with other useful articles about personal finance that will help you in making decisions when it comes to personal finance.

-

Learn To Make Smarter Decisions With An Insurance Comparison Tool

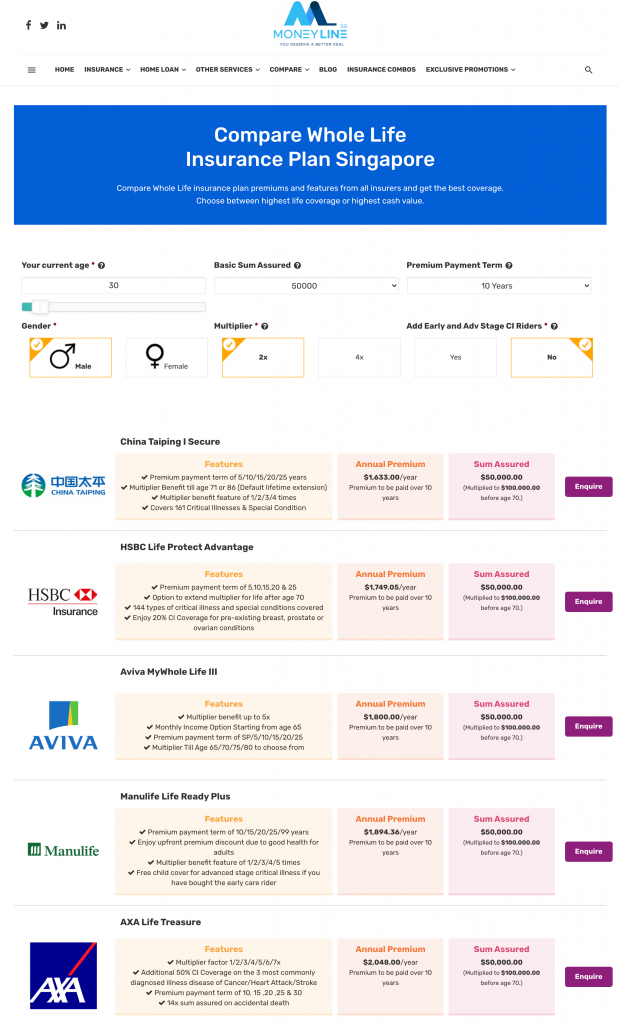

Information asymmetry is also another legacy issue with insurance products. And it doesn’t help that insurance companies aren’t exactly the most digital savvy industry. Unlike other financial products, you sometimes find pricing information of insurance plans missing on the websites of insurance companies. You either have to write in to them, or speak to an advisor. Without the pricing information, this makes it hard to compare the price of insurance plans.

We realised this problem in the industry as well. That’s why we built an insurance comparison tool where we aggregate the price information from different insurers. We then combine them in our insurance comparison tool so that you don’t have to live with the information asymmetry, which lets you make smarter decisions about which insurance plan to buy.

-

Build The Right Combination Of Insurance Plans With Insurance Combo Tool

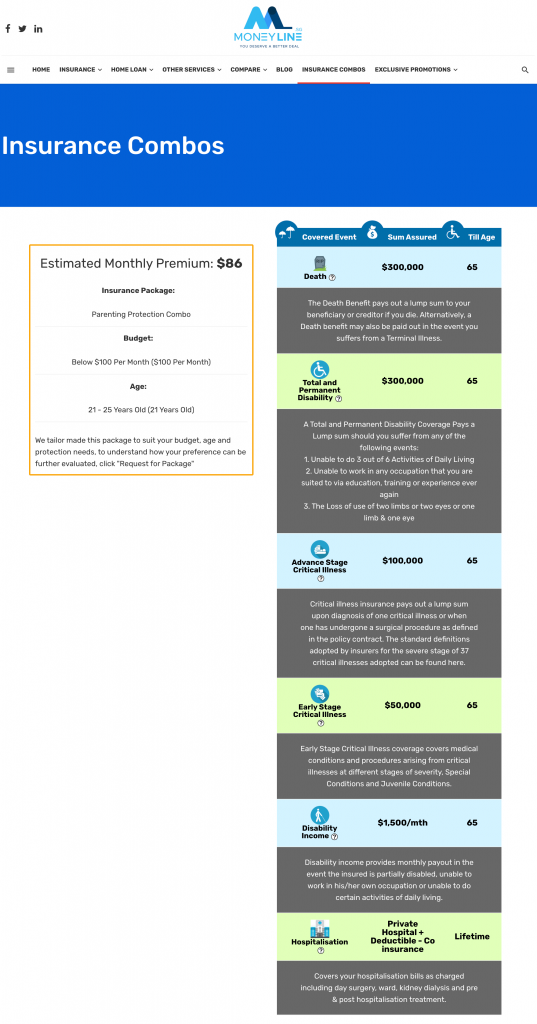

The interesting (and sometimes confusing) thing about insurance plans is that they are often complementary. Because of different background, life stage and experience, everyone needs a different combination of insurance plans to ensure that you are well protected. As such, you hardly find a one-size-fits-all kind of plan. That’s why financial advisors are there to be your guiding light to map out the right insurance plans for you. But make sure you find a trustworthy advisor like Moneyline to manage it for you.

But what if you prefer a more scientific way of building the right combination of insurance plans? Well, that’s why we built the Insurance Combo Tool to offer it as a service to consumers who want to DIY and be more involved in building your own insurance combos.

This tool provides you with a high level overview of the amount of coverage you need for different insurance types so that you can customize your own plan even if you aren’t a financial expert.

Prefer Face-To-Face Interaction With A Financial Advisor?

We know that some of you prefer the traditional face-ot-face interaction with financial advisors. We do too! That’s why, on top of the digital services that we provide, Moneyline also offers valuable face-time with our readers who need valuable financial advice. P.S. It’s free!

1 Comment