CI vs Early CI vs Multi-Pay CI

Insurance: 5 Things You Should Know Because Getting Sick In Singapore Is Expensive

Did you know that critical illnesses (CIs) are major cause of deaths among Singaporeans? They contribute to more than 60% of deaths in Singapore! The scary thing about CI is that, not only is the risk of death high, the cost of treatment is even higher, especially in an expensive city like Singapore where the cost of healthcare increases every year. For example, the cost of cancer treatment can be anywhere between $8,000-$17,000 per month. The longer your cancer drags, the more it will cost you to seek treatment.

In order to financially protect yourself against the risk of CIs, you can buy a CI insurance. But did you know that there are a few types of CI insurance you can get?

- Basic CI

- Early Stage CI

- Multi-Pay CI.

Each of these CI insurance covers a different type of CI risk so that you are financially protected because getting sick in Singapore is just too expensive. This article is meant to help you get a better understanding about each type of CI insurance, from CI to early CI and to multi-pay CI.

-

CI 101: What Are The Illnesses That Are Considered As CI?

Let’s start with the basics of CI insurance. What are the illnesses that are classified as CI by insurance companies?

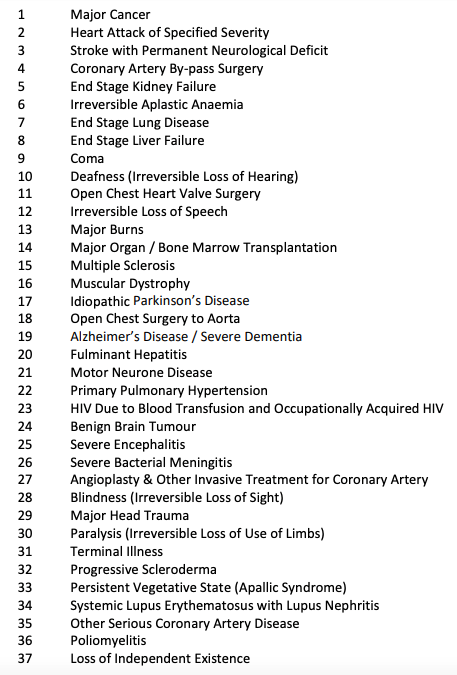

According to the Life Insurance Association (LIA), there are 37 illnesses that are defined as CI. The illness can only be considered as CI if it is part of this list published by the LIA. In order to claim against your CI insurance, you need to be medically diagnosed to one of the 37 CIs based on the medical specifics stated in your policy.

Source: LIA

-

What Is The Difference Between CI And Early Stage CI?

You might have heard of CI insurance. You might even have bought your classic CI insurance. But did you know that there is another type of CI insurance known as ‘Early Stage CI’?

You might be wondering, “Isn’t CI insurance the same as Early Stage CI insurance?”. Well, they aren’t. Here’s why they are different.

Financial Protection (CI) vs Recovery (Early Stage CI)

The only similarity between both CI and Early Stage CI (or Early CI) provides a lump sum payout upon diagnosis of CI. Now, here comes the difference.

For the usual CI insurance, a claim can only be made once your CI condition enters into the critical stage. From a medical standpoint, a critical stage means that your chances of full recovery is quite low, albeit not impossible. On the other hand, Early Stage CI covers the early and intermediate stages of CIs where you still have a good chance of recovery.

Because of the differing nature of CI and Early Stage CI, they are suited for different kind of protection. An Early Stage CI is meant for you to seek early treatment so that you have a better chance of recovery whereas CI is meant for financial protection as you reach the late stages of a CI. Thus, CI and Early Stage CI insurance are complementary and protects different stages of a CI.

Thinking of getting an early stage CI? Here’re the 2 best early CI plans for you to consider.

-

What Is The Difference Between Single-Pay CI And Multi-Pay CI?

For CI and Early Stage CI, they are both considered single-pay CI insurance. That’s because you can only make a single claim from your insurer. Once your insurer makes a lump sum payout, your CI or Early Stage CI policy expires. Even if your CI (e.g. cancer) relapses, you can no longer make a claim.

What’s worse is that you won’t be able to find another insurer that is willing to insure you for CI anymore. Even if you do, it is very likely that you will need to agree to an exclusion for the CI you were diagnosed with.

-

Single-Pay CI vs Multi-Pay CI: What Happens If There’s A Relapse?

Unfortunately, the problem with CI is that there is chance of relapse. What happens if you experience a relapse? You will be left without any financial protection because you no longer have a CI insurance to cover your CI risks. That’s why it is crucial for you to consider getting a multi-pay CI.

What Does Multi-Pay CI Insurance Cover?

The coverage of multi-pay CI is akin to a combination of CI and Early Stage CI plus the option for multiple claims.

-

Multi-Payout For Up To 5 Different CI Conditions

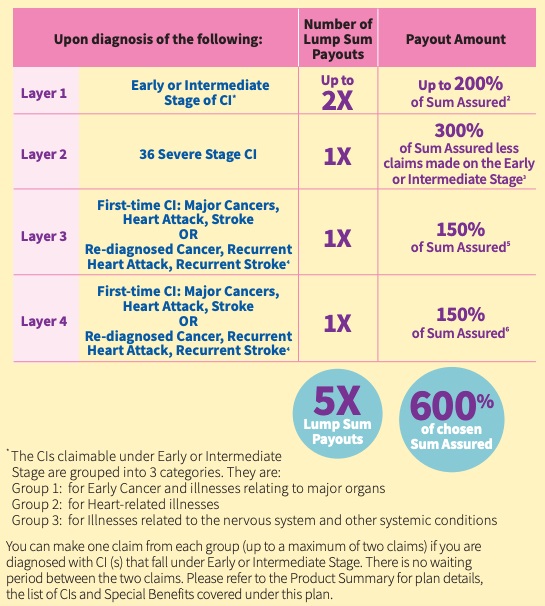

Multi-pay CI insurance allows you to make up to 5 lump sum claims upon diagnosis of different CI in the early, intermediate and late stages. Unlike single-pay CI, you are insured for up to 5 different kind of CIs throughout your lifetime. You don’t have to worry about being uninsurable after making your first CI claim.

-

Multi-Claims For Recurring CI

If you suffer from a relapse for the same recurring CI, you can make up to 2 claims. This will help you relieve the stress of worrying about your finances should you be in the unfortunate position of suffering from a relapse. You can focus your effort on recuperating, rather than worrying about your finances.

-

Multiplier On Sum Assured

Besides that, multi-pay CI also provides a multiplier on the sum assured for claims made. This is meant to provide you with additional coverage to manage your expenses as you seek a cure for your CI. For example, Aviva’s My MultiPay Critical Illness Plan III provides you with a payout amount of up to 300% for severe stage CI.

Source: Aviva

-

Which CI Insurance Should You Get?

So, in order to insure yourself against CI, which type of CI insurance should you get?

Haven’t Gotten Any CI Insurance Yet? Get A Multi-Pay CI For Comprehensive Coverage

If you haven’t gotten your CI insurance yet, then you should definitely consider getting a multi-pay CI insurance. That’s because a multi-pay CI insurance covers you for the risk of relapse and lets you claim for multiple CI conditions, unlike a single-pay CI. Having a multi-pay CI insurance helps ensure that you are financially protected to seek the long term care required to fully recover from your CI and future relapses.

Check out the 3 best multi-pay CI insurance plans in Singapore here.

Check Whether You Have Adequate Coverage

Some of you might already have bought a basic Critical Illness insurance. Or if you have already gotten a term or life insurance, chances are that you would have gotten yourself the CI rider that comes with it. This will have given you the basic CI protection that you need. But the question is, “Is that enough?”.

The first thing to do is to check how much coverage you have for your Critical Illness. As a rule of thumb, it should be 5-10 times of your annual income at any stage of your life. If it isn’t, it is recommended that you increase the coverage of your basic CI insurance.

Get A Multi-Pay CI To Cover The Financial Risk Of Relapse

Given that the basic CI insurance is meant for financial protection for your loved ones, it is also recommended that you get a multi-pay CI insurance. That’s because a multi-pay CI insurance protects you against the relapse of your CI illness. With a multi-pay CI insurance, you don’t have to worry about the finances you need for a full recovery.

Disclaimer: This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided. Read our General Disclaimer

What If You Don’t Know What CI Insurance You Have, Or Which CI Insurance To Get?

Insurance can be a tricky personal finance topic to navigate around that we sometimes don’t even have a clear idea of what insurance we have in our financial portfolio. If you don’t even know what you have, how can you make the decision on which CI insurance you need next?

That’s why Moneyline is here to help. If you are not sure whether you need a CI, early CI or multi-pay CI, feel free to reach out to us for an obligation-free consultation. You can have your personal financial portfolio reviewed and evaluated to determine whether you are adequately protected during the review. If you aren’t, we will provide you with our professional recommendation on what type of CI insurance is suitable for your profile and life stage.

2 Comments