China Taiping Infinite Harvest Plus Review – Principal and Monthly Income Guaranteed from 37th Month

The era of high interest rate has finally set in after more than a decade of cheap money. While high interest rate can create hardship towards an over leveraged investor, fortune may favour the timid. As borrowers see their variable interest repayment skyrocketed approximately 3 times within the last two years, conservative savers have seen their short-term savings interest increased drastically giving them potentially higher yield than riskier investors in 2022.

Of course, no one knows how beneficial/tumultuous this high interest rate will last. The last time interest rates were this high has resulted in a Global Financial Crisis where borrowers struggle to pay their mortgage instalments causing worldwide systemic issue. The result was a steep decline in interest rate lasting for more than a decade.

For savers, if you are looking to sustain this high interest rate pay out benefit without the uncertainty of reinvestment risk for a decade or two, and if you seek guaranteed income and potentially higher yield than fixed income products with liquidity in the medium to long term, take a look at China Taiping Infinite Harvest Plus.

Disclaimer: This article has not been reviewed by China Taiping and the Monetary Authority of Singapore; it is neither a financial advice nor a recommendation. Our purpose of this review is to serve as general information only. Information is correct as of 02nd September 2022

What is China Taiping Infinite Harvest Plus

China Taiping Infinite Harvest Plus is a participating lifetime income pay out plan, it provides the combination of wealth preservation and a stream of monthly income that can be payable up to age 120. The product also provides the option to reinvest the income to create a form of wealth accumulation for the policy owner.

Premium Term and Minimum Investment

China Taiping Infinite Harvest Plus provides 3 payment term option for policy holders. There is a Single Premium Option, 2 years premium term, 3 years premium term. Minimum Premium is a lump sum of 100,000, 50,000/yr for 2 years and 35,000/yr for 3 years respectively.

Age Eligibility

The plan is eligible for anyone between 1 to 70 years old

Unique Benefits: Principal Guaranteed on 37th Month with Guaranteed Income Payout

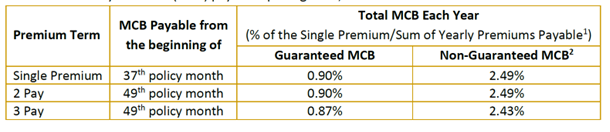

China Taiping Infinite Harvest Plus provides a principal guaranteed feature for Single premium right after the 3rd policy year (37th Month), this is the first Life income pay out product that features this benefit. The plan also pays a monthly guaranteed income + non-guaranteed income from the 37th month onwards till the life assured turns 120 years old. As it pays out, the guaranteed surrender value will gradually increase every year + a non-guaranteed yearly bonus that adds on to it.

Policy owner can also choose to save for 2/3 years instead of a lump sum. China Taiping will provide principal guaranteed and pay out starting from the 49th month if a regular premium payment option is selected. During the pay out, the surrender will increase every year with a non guaranteed yearly bonus that adds on to it

source: china taiping

Sample Payout Table

| Premium Term |

Premium |

Payout from |

Guaranteed Monthly Income |

Non Guaranteed Monthly Income at 4.25% p.a. projection |

Total Potentially Monthly Income |

| Single Premium |

$100,000 |

37th Month |

$75 |

$207.50 |

$282.50 |

| 2 years |

$50,000 |

49th Month |

$75 |

$207.50 |

$282.50 |

| 3 years |

$35,000 |

49th Month |

$76.13 |

$212.63 |

$288.76 |

This Product is Suitable for customers who are:

- Looking for income security in their retirement years

- Parents who would like to secure a lifetime income for their young children

- Prefer one-time or short premium commitment

- Prefer no medical underwriting upon application.

This Product is Not Suitable for customers who:

- Are looking for high protection

- Are looking for aggressive investment opportunities

- Prefer to spread out their premium commitment over a longer period e.g. 5 years or more

Death Benefit

The death benefit comprises the following, less any indebtedness:

(a) Higher of

- 105% of the Single Premium (for single premium payment) or Total Yearly Premiums Paid* (for premium payment term of 2 or 3 years) less all guaranteed monthly cashbacks paid to-date, or

- the guaranteed surrender value; and

(b) a non-guaranteed terminal dividend.

Is China Taiping Infinite Harvest Plus a right fit for your Investment portfolio?

Let our partnered financial planners compare, analyse and advise you further. To customize such product to your requirement, fill in the form below and a licensed financial planner will contact you and draft you a proposal based on your given inputs

Compare Best Lifeincome Plans