China Taiping I Saver 8 – Shortest Participating Plan Endowment Up to 3.13% p.a.*

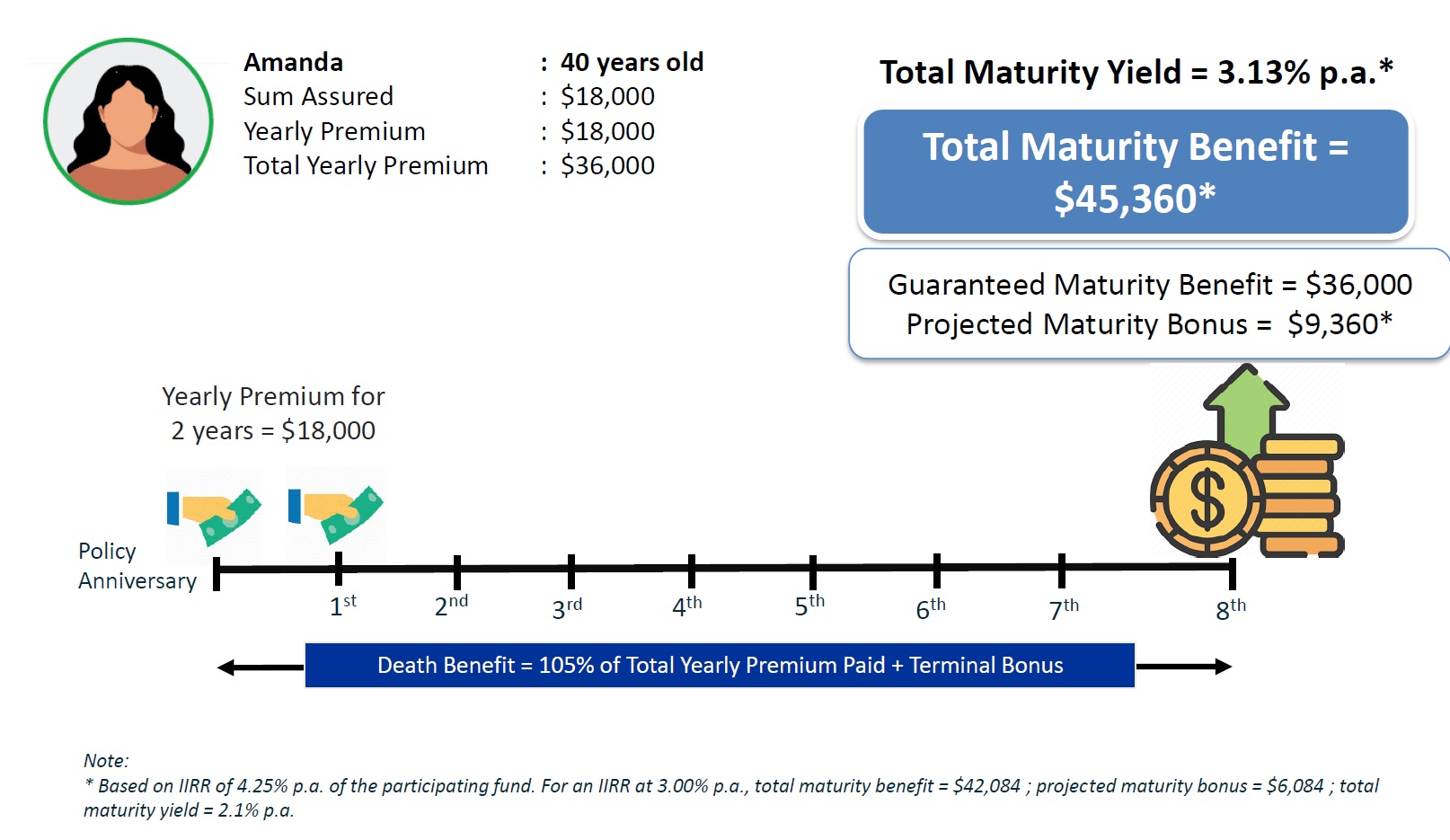

It is hard to find a fixed maturity participating plan endowment nowadays that is shorter than 10 years and pays a decent yield but the China Taiping I Saver 8 definitely packs a punch. As the name goes, this is an 8 years Singapore Dollars maturity participating endowment plan that only requires 2 years of premium payment term, you may also opt for a 1 year advance premium.

*Based on illustrated investment rate of 4.25% p.a. for 8 years

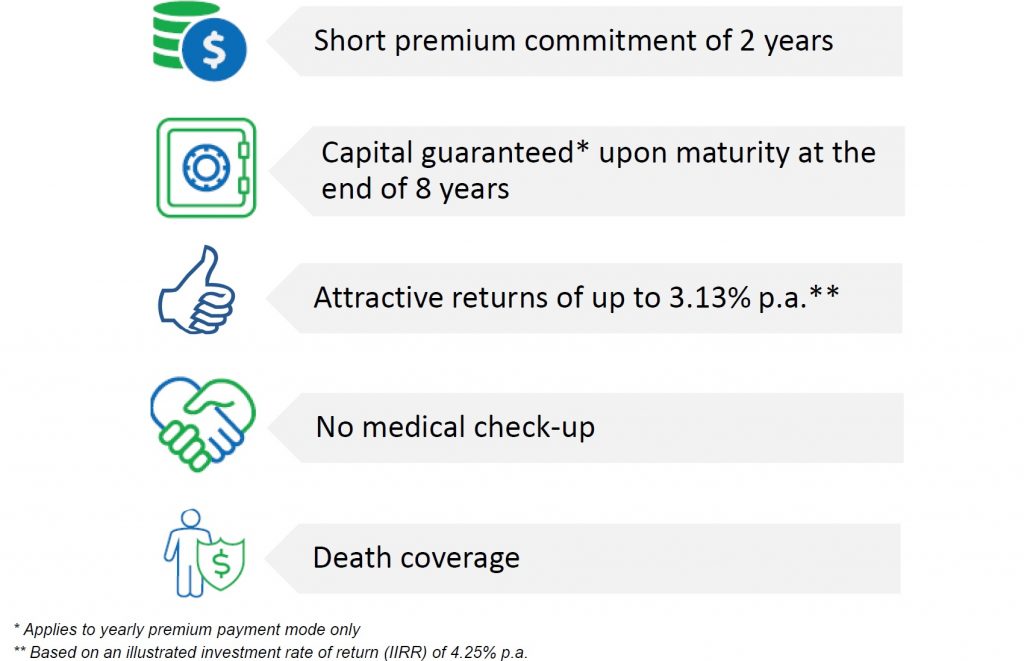

Benefit in a nutshell

source chinataiping

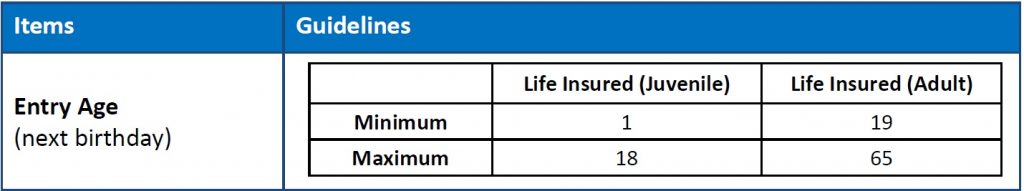

Entry Age

The China Taiping I Saver 8 (SGD) can be purchased by an individual between 18 to 65 years of age. The entry age of the life insured can be as young 1 – 19 years old which means a parent can buy on the life of his/her children.

Minimum and Maximum Savings to Start

The minimum savings amount to kick start the policy will be $18,000 per annum ($36,000 in total for 2 years) and the maximum savings amount will be $500,000 per annum ($1,000,000 in total for 2 years). This is very suitable for middle age group of demographics that wish to protect their money from the current stock market volatility but at the same time protect their money from inflation in the medium term horizon.

Death Benefit

If the life assured passes on within the 8 years policy term, their beneficiary shall receive 105% of the total premium paid plus a non guaranteed bonus. You can nominate a beneficiary anytime during the policy term to ensure that your money will be passed on to your love ones even without a will.

Suitability

This plan is suitable for those whom are looking at

- Lump Sum Maturity on the 8th year

- Short Term Premium Commitment

- No Medical Underwriting

- Principal Guaranteed upon Maturity

This plan is not suitable for

- High Protection Cover

- Regular Income Payout

- 1 – 3 years Plan Maturity

Short Term Goals Product

If you have the following short term financial goals, you may consider this plan.

- Wish to retire with a lump sum within the next 10 years with your principal protected and potentially higher than bank savings yield

- Wish to plan for a lump sum payout for your children education within the next 10 years with a potentially higher thank bank savings yield

- Any short term savings goal that needs to materialise within the next 10 years.

If you have a longer term goal and would like to check out some of the industry best endowment plans, you may check it out here.

How it works?

What are your goals?

Let us help you with your goals. An MAS-Licensed Expert will provide you with objective advice and help you compare insurance quotes from different providers. 100% Free & No Commitment.