Cancer Drug Costs in Singapore: MOH Subsidies & Alternatives

Cancer, an arduous battle that no one should have to confront in solitude. Remarkably, in Singapore, the Ministry of Health (MOH) not only acknowledges this but also stands resolutely by the side of cancer patients. This commitment surpasses the realms of medical treatment, extending to encompass financial assistance via subsidies and a diverse array of support programs. In this blog post, we embark on a journey through the intricacies of cancer drug costs in Singapore and how the MOH is a stalwart source of aid. If you or a cherished one is currently grappling with this challenge, rest assured that you’re not traversing this path alone—read on to unravel the wealth of financial resources available.

Understanding Cancer Drug Costs in Singapore

Cancer, a formidable adversary, often requires an arsenal of medications for treatment. These drugs can be incredibly expensive, and their costs can place a significant burden on patients and their families. Let’s illustrate this with a numerical example:

Imagine a cancer patient in Singapore who has been prescribed a course of cancer drugs that total $3,000 per month. The total treatment duration is estimated to be six months, making the total cost $18,000.

Cancer Rates for Common Cancers in Singapore

To provide context for the prevalence of cancer in Singapore, let’s take a look at cancer rates for common cancers. The table below shows the leading incident cancers by gender:

| Males |

Females |

| Prostate – 16.8% |

Breast – 29.7% |

| Colon & Rectum – 16.3% |

Colon & Rectum – 12.9% |

| Lung – 13.5% |

Lung – 7.9% |

| Lymphoid Neoplasms – 7.3% |

Uterus – 7.3% |

| Liver – 7.3% |

Lymphoid Neoplasms – 5.2% |

Source: Singapore Cancer Registry Annual Report 2021

This data underscores the significance of cancer as a public health concern in Singapore, making it vital for patients to have access to necessary treatments.

The MOH Cancer Drug List and its Role in Managing Cancer Drug Costs

One of the key pillars of support is the MOH cancer drug list. This list consists of approved cancer drugs that are eligible for subsidies, effectively reducing Cancer Drug Costs. These subsidies can make a substantial difference in the affordability of treatment. Here’s a numerical example to demonstrate the impact:

If the cancer patient mentioned earlier is eligible for MOH subsidies, they may receive a substantial subsidy of up to 75% of the drug cost, significantly reducing their Cancer Drug Costs. This subsidy effectively reduces the monthly expenditure from $3,000 to $750, and the total treatment cost for six months becomes $4,500. [Source: Ministry of Health, Singapore – Medication Assistance Fund (MAF)]

Eligibility Criteria for Reducing Cancer Drug Costs

To benefit from the MOH subsidies and reduce Cancer Drug Costs, patients need to meet certain criteria. These criteria often consider factors like the type and stage of cancer, the drug prescribed, and the patient’s financial circumstances.

Financial Assistance Programs to Alleviate Cancer Drug Costs

The MOH doesn’t stop at subsidies alone; instead, they provide a range of financial assistance programs meticulously designed to further aid patients in need, effectively reducing their Cancer Drug Costs. These programs are thoughtfully tailored to various situations and are readily available to provide that much-needed helping hand when it’s required.

Is Cancer Insurance in Singapore Worth Getting for Managing Cancer Drug Costs?

While MOH subsidies and assistance programs can be a significant relief for managing Cancer Drug Costs, it’s essential to consider whether cancer insurance might be worth getting. Integrated shield plans cover your hospital bills but not daily expenses, and that’s where cancer insurance can fill the gap.

Cancer insurance provides a lump sum payout upon diagnosis, which you can use for various purposes, such as covering living expenses, transportation costs, and even alternative treatments to manage medical expenses. Consider cancer insurance if you can afford it, as it can offer peace of mind during a challenging time.

Integrated Shield Plans: An Alternative to Cancer Insurance

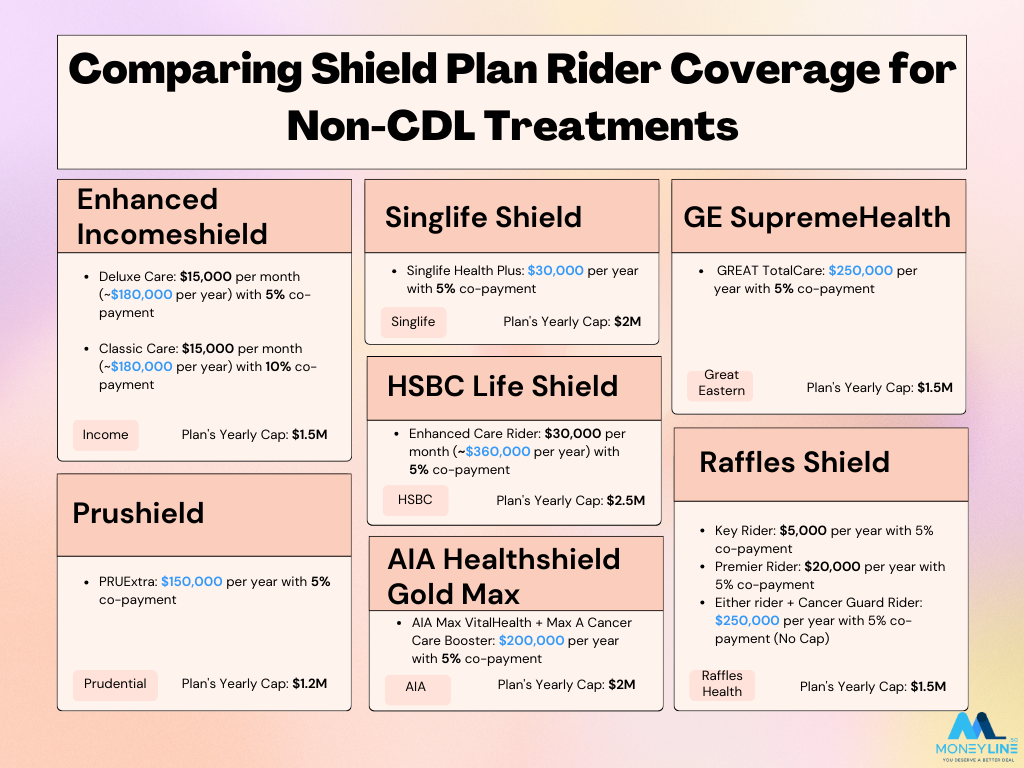

While cancer insurance is a valuable option for managing Cancer Drug Costs, another alternative worth considering is Integrated Shield Plans. These comprehensive healthcare plans are offered in Singapore and can provide coverage not only for cancer drugs on the Cancer Drug List (CDL) but also for a wide range of medical expenses, including cancer drugs that may not be on the CDL.

Integrated Shield Plans offer the advantage of a more holistic approach to healthcare coverage. They can include both inpatient and outpatient treatment, which means that not only the costs of cancer drugs but also various other medical expenses are covered. This can be especially beneficial as some cancer treatments may involve non-CDL drugs or non-cancer-related medications.

It’s important to carefully review the details of Integrated Shield Plans, as coverage can vary among different providers. Some plans may also include riders or additional options that can be tailored to specific healthcare needs.

Consider speaking with a financial advisor or insurance expert to determine which option, whether cancer insurance or an Integrated Shield Plan, aligns best with your unique circumstances and financial situation. The goal is to ensure that you have comprehensive coverage and peace of mind when it comes to managing your Cancer Drug Costs and other medical expenses.

A Supportive Community

Singapore’s fight against cancer isn’t just about medications and treatments; it’s about coming together as a community to support those in need. We’ll share stories of courage and resilience, highlighting the strength of individuals who have faced cancer head-on, with the MOH’s assistance as a vital ally.

Conclusion

Cancer is a battle that necessitates strength on both physical and financial fronts. Furthermore, comprehending the strategies to manage Cancer Drug Costs is of paramount importance. In Singapore, the MOH’s unwavering commitment is directed toward guaranteeing that the financial aspect remains far from being an insurmountable obstacle. By gaining an understanding of Cancer Drug Costs and the extensive support available, patients and their families can more effectively direct their focus towards the most crucial aspect: the battle against cancer. Should you or someone you know be grappling with cancer, do not hesitate to delve into the extensive spectrum of MOH’s subsidies and support—truly, it serves as a beacon of hope during these challenging times.

Contact Us for Guidance

If you have questions or need personalised assistance regarding Cancer Drug Costs and MOH subsidies in Singapore, please feel free to reach out to us. We’re here to help you navigate this journey and ensure you receive the support you need to manage your medical costs effectively.

2 Comments