AXA Super CritiCare: Reset Your Coverage on Early & Intermediate Stage Cancer, Heart Attack and Stroke

As we approach the end of 2019, there is another insurer that is upping their game when it comes to the critical illness coverage arena. We are referring to AXA’s new Multi pay-out critical illness plan, the AXA Super CritiCare.

In this review, we are going to summarize the claim criteria into 3 different brackets and address what we like and what we don’t like about this plan. AXA hasn’t been the strongest insurer when it comes to multi/recurrent critical illness products, but things may change and AXA Super CritiCare may be about to make AXA Great Again.

Thanks to the efficient PR Team from AXA, we have made a few amendments to our description of how the plan works and further add on some pointers. Please note that this remains an unsponsored post and AXA is sporting enough to allow us to have a go at their plan!

How does it work?

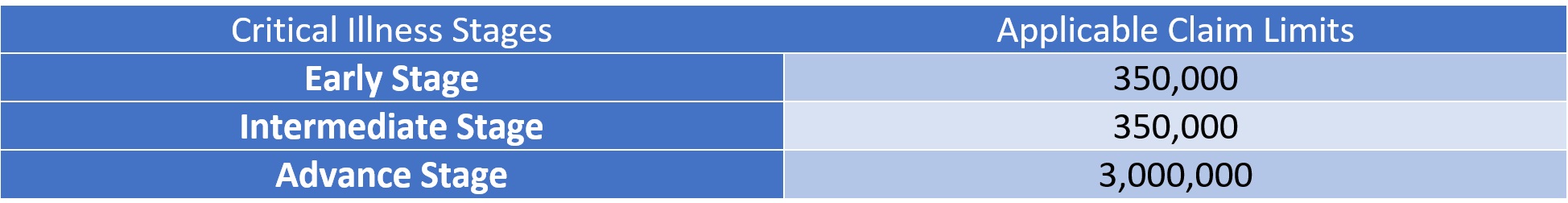

Unlike its previous plan, the AXA Super CritiCare provides up to 600% basic sum assured payout in the event of multiple critical illness or different stage critical illness diagnosis. It also has a higher payout limit of 350,000 for each early/intermediate stage ci event.

Once an initial 100% critical illness pay-out has been claimed, the waiting period differs depending on the nature of the subsequent claim. For example, if a separate early, intermediate or an advanced stage ci is diagnosed, there will be 12 months waiting period for the subsequent claim. However, if the same early or intermediate stage CI progresses to an advanced stage, the remaining sum assured left will be paid out without a waiting period.

First bracket: Same CI Conditions

Only 1 claim can be payable for each Early/Intermediate /Advance Stage CI Condition. However, if you select a sum assured above 350,000, there can be a subsequent claim of the remaining sum assured with no waiting period if the same Early/Intermediate stage critical illness condition progresses to an advance stage ci.

e.g. Customer buys a 500,000 Sum Assured AXA Super CritiCare and a claim limit for early-stage cancer has been met for 350,000. The remaining 150,000 will be paid out if the client was diagnosed with an advance stage cancer which progresses from the early stage claim with no waiting period.

Second Bracket: Different CI Conditions

Upon diagnosis of a separate/different critical illness condition regardless of stages, there will be another 100% pay-out of the sum assured up to the applicable limits after 12 months waiting period

During the waiting period, AXA will pay the remaining Sum Assured up to the applicable limits. After the waiting period, AXA will pay 100% of the Sum Assured up to the applicable limits.

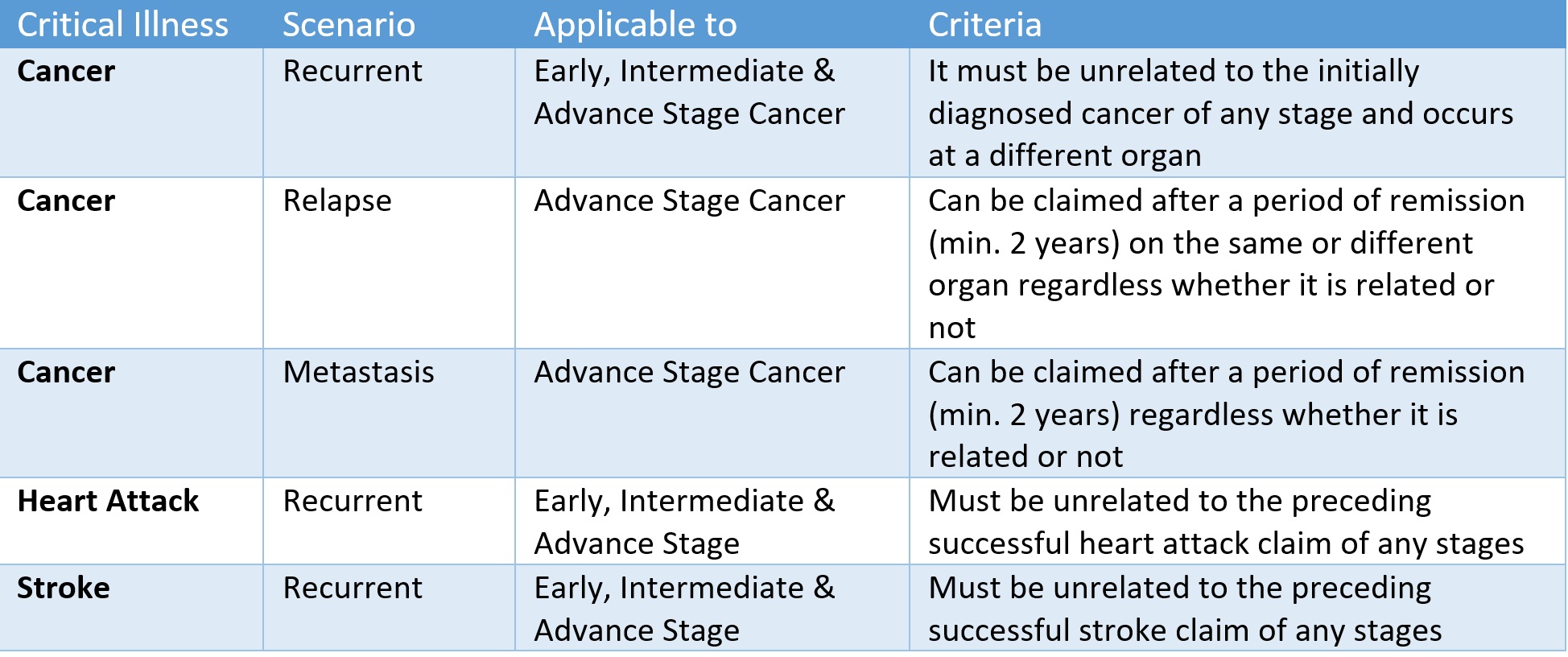

Third Bracket: Re-diagnosed Cancer, Recurrent Heart Attack and Recurrent Stroke

This is where AXA Stands out, it is the only insurer so far to pay-out upon re-diagnosis of early/intermediate stage cancer, recurrent heart attack or stroke of any stages. However, there are two criteria for this.

Criteria 1

There will be 24 months waiting period for re-diagnosis and recurrent claims on the same diagnosed condition for Cancer/Heart Attack/Stroke.

Criteria 2

We look at the summarised table below on the three conditions and criteria for subsequent re-diagnosed/recurrent claim

It should, however, be noted that the waiting period starts from the date of diagnosis instead of remission, and there is no minimum period of remission.

The total sum assured for all re-diagnosed or recurrent cancer, heart attack and stroke is capped @ 300% Sum Assured

Diabetes Care Programme

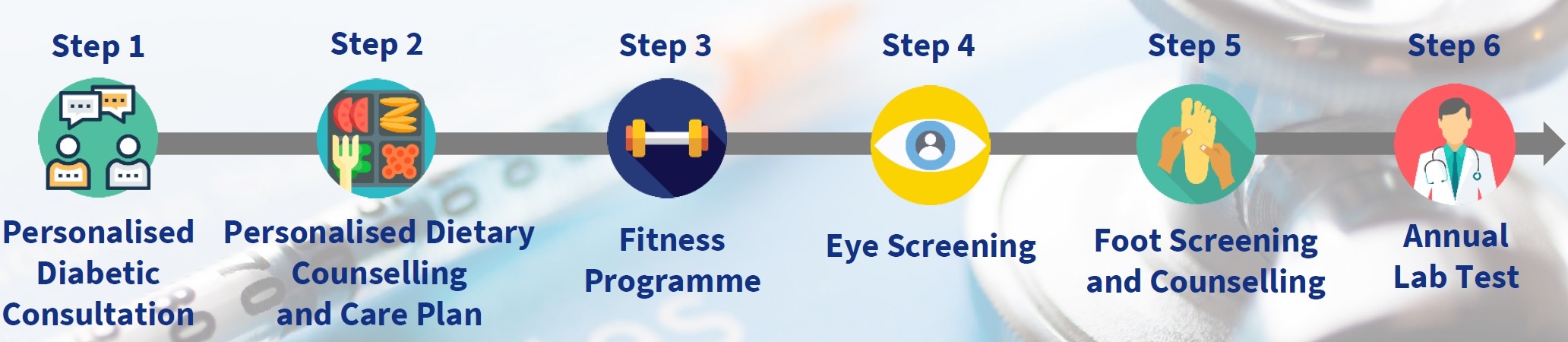

AXA is also the first insurer in the market to provide the insured with a free 12 months renewable diabetes care programme. Upon diagnosis of diabetes, the life assured will enjoy an effective and carefully crafted programme to manage their diabetes as long as his/her policy is in-forced. This programme is an additional benefit and it will not reduce the sum assured of the policy.

Here are the 6 steps:

source axa.com.sg

What we like about AXA Super CritiCare

- First in the market to offer recurrent claim for any stages of non related cancer, heart attack and stroke subjected to two years waiting period.

- Free diabetes care programme offered to the life assured upon diabetes diagnosis

- A higher number of critical illness conditions covered as compared to the older plan (111 Early/Intermediate/Advance CI) (10 Juvenile) (11 Special conditions).

- 350,000 claim limit on early-stage critical illness per claim

- Early-stage Carcinoma in-situ definition has been improved to include more sites.

- Guaranteed renewable policy term of 5,10,15,20,25 & 30 years

- Or choose a coverage term till age 50/55/60/65/70/75

What we don’t like

- One year waiting period still applies after the first critical illness claim. While a waiting period applies for the reset of the Sum Assured, customers are still able to claim for any remaining Sum Assured within the waiting period in the event an Early or Intermediate Stage CI progresses to Advanced Stage, or the diagnosis of a different CI regardless of stage.

- Second ci claim must be from a different ci after 1 year waiting period except for re-diagnosed/recurrent coverage for cancer, heart attack and stroke.

In regards to the second point, there are scenarios where a customer could make a claim without a waiting period, or for the same CI condition:

- If same CI condition but not top common CI: can claim if progressed to Advanced stage and there is still remaining SA

- If the same CI condition but top common CI: can claim 100% SA after 24 months waiting period or remaining SA during the waiting period

- If different CI condition: can claim 100% SA after 12 months waiting period or remaining SA during the waiting period

Too confusing? Maybe.

What to Do Next?

Once again, Moneyline.sg has done the homework. Not only we help you make an informed decision on your pending purchase, but we also work with financial planners that have access to multiple insurers to provide you with objective recommendations. To get a quote and have your coverage needs assessed, fill in the form below and a licensed financial planner will contact you and draft you a proposal based on your given inputs

2 Comments