Etiqa Invest Smart Flex

Etiqa Invest Smart Flex is a regular premium investment-linked plan that offers flexibility and control over your wealth accumulation goals. With a minimum monthly investment starting from as low as S$200, this plan provides you with a world of possibilities.

Invest Smart Flex is an Investment-Linked Plan designed to cater to your specific needs, giving you the opportunity to plan for the medium and long term. You can choose from premium terms of 10, 15, or 20 years, allowing you to customize the plan based on your preferences and financial goals.

Here are some key benefits that make Etiqa Invest Smart Flex stand out:

Multiple Bonus Units

Accelerate your investment returns with the potential to earn multiple bonus units. You can enjoy a start-up bonus of up to 80% of the regular premium paid in your first year of investment. Additionally, from the 6th policy year onwards until the end of the premium payment term, you can benefit from a special bonus of 5% of the regular premium paid. Moreover, a loyalty bonus of 0.2% p.a. of the account value awaits you starting from the policy anniversary after the end of the premium payment term.

Flexibility to Tailor the Plan

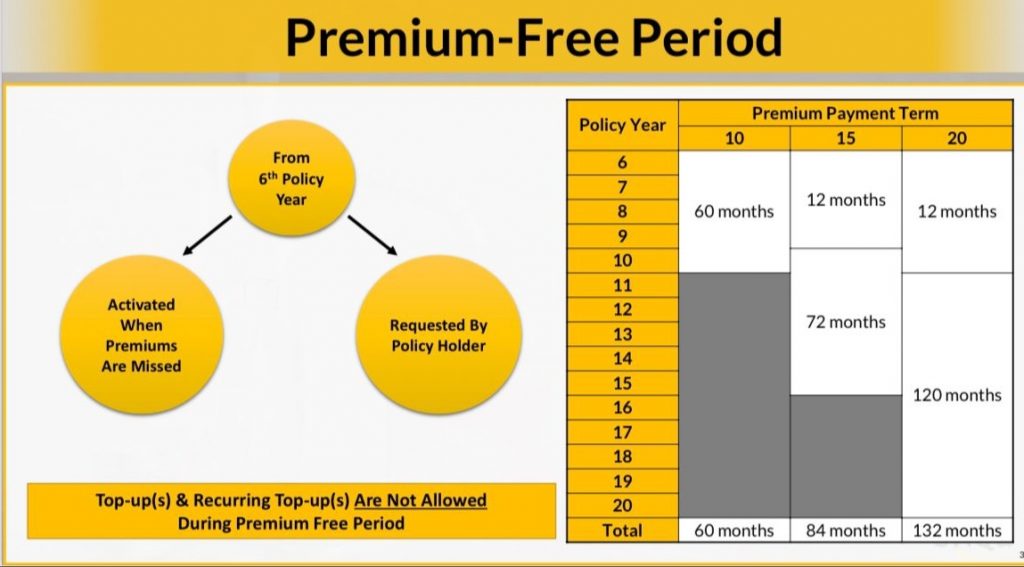

Policyholders can make 2 free partial withdrawals throughout your premium payment term (starting from the 4th policy year) with low partial withdrawal charges from the 6th policy year. Policy holder will have the option to reduce the regular premium amount or activate a premium free period base on the given table table.

Furthermore, you can change the life insured at any time from the 3rd policy year and switch funds without incurring any charges.

Exclusive Access to Reputable Funds

Start your investment journey with as little as S$200 a month and gain access to institutional funds managed by top regional and global asset management companies such as Fundsmith and Baillie Gifford. This exclusive access allows you to diversify your portfolio globally to reduce risk and potentially maximize your returns. See Etiqa Portfolio of Funds

Protection Against Unforeseen Events

Etiqa Invest Smart Flex offers coverage to protect your loved ones. In the event of total and permanent disability or death, you will be covered at the higher of 105% of net premiums or account value.

Policy owner can also choose to add 2 premium payment riders to protect their intended life assure due to any eventualities such as

- Extra Secure Waiver II: Ensure additional protection by extending your policy’s benefits. With the Extra Secure Waiver II rider, you can continue your policy without paying premiums if the life insured is diagnosed with any of the 37 covered severe-stage critical illnesses. This means you can focus on recovery without the financial burden of premium payments.

- Extra Payer Waiver II: Secure your loved ones’ financial future with the Extra Payer Waiver II rider. In the unfortunate event of the policyholder’s death, total and permanent disability, or diagnosis of any of the 37 covered severe-stage critical illnesses (before age 86), this rider allows your policy to continue without premium payments. It provides peace of mind knowing that your loved ones are protected and the policy remains intact during challenging times.

By adding these optional riders to your policy, you can enhance its coverage and ensure comprehensive protection for you and your family. Please note that these riders are subject to underwriting, and eligibility will be determined based on individual circumstances.

Hassle-Free Application

Applying for Invest Smart Flex is a breeze. With the guaranteed issuance policy (without riders), you won’t need to undergo any health checks to secure the plan.

Low Breakeven yield

Enjoy less than 1% p.a. breakeven yield for 10 years policy term while having access to Accredited Investors funds

Conclusion

Etiqa Invest Smart Flex ensures that your wealth accumulation goals are within reach. With its premium payment flexibility, multiple bonus units, access to reputable funds, and protection against unforeseen events, this investment-linked plan is designed to meet your specific financial needs.

This is not an investment/financial advice and as always when it comes to any investments, past performance does not guarantee future returns. The risk rating of the funds may not be suitable for you, please seek financial advice before you make any investment decisions. Readers should also understand that they may lose all their monies by investing into such products. For detailed information, kindly refer to the policy contract and seek advice with our partner practitioners

Seek Advice

Our MAS-Licensed Partner will provide you with objective advice and help you compare insurance quotes from different providers. 100% Free & No Commitment. Retrieve your info using your Singpass App or Manually fill in the forms below.