3 Important Financial Lessons You Need To Learn From OCBC Wellness Index Survey 2022

Easy access to cheap credit and a booming economy for the last 1.5 decades have been driving economic consumption around the world. However, the musical chair of global economies being driven by cheap money is now coming to an end. Many of us are starting to feel the impact of it, from layoffs to higher interest on mortgage payments.

On top of that, we are starting to face greater money issues in our lives because of the economic slowdown and rising interest rate environment. This was what the annual OCBC Wellness Index Survey released in November 2022 revealed to us.

Background Of OCBC Wellness Index Survey 2022

The annual survey is based on 10 pillars of financial wellness such as savings habits, spending beyond means, manageable debts, protection from financial emergencies, regular reviews, regular investing, retirement planning, excessive speculation, borrowing money from loved ones, and gambling habit.

After reading through and understanding the survey findings, here are three of the most important financial lessons that we think you and I need to learn from to get our 2023 in shape.

3 Important Financial Lessons You Need To Learn From OCBC Wellness Index Survey 2022

-

Savings Rate Is Going Up, But Singaporeans Need To Save Smarter

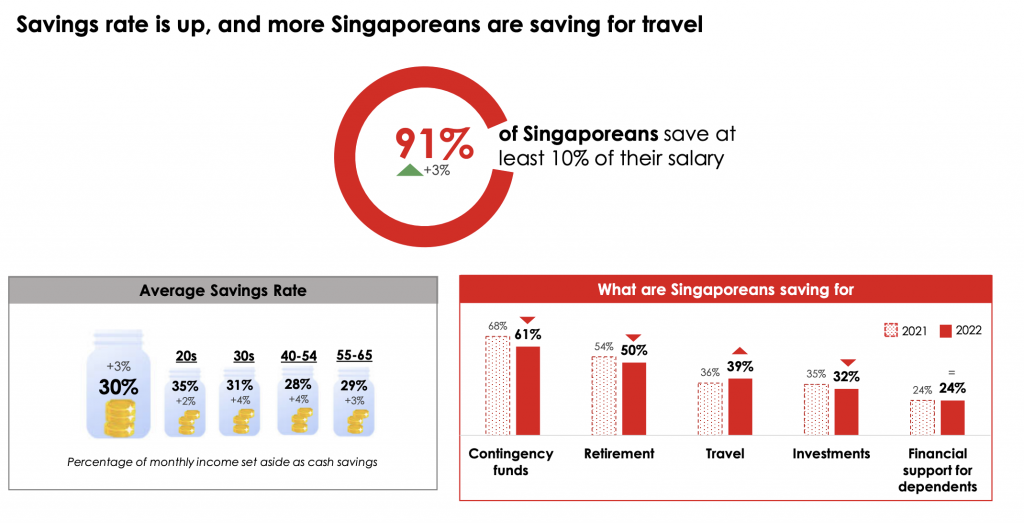

According to the survey, Singaporeans are showing a stronger inclination to save. On average, Singaporeans are setting aside 30% of income as savings. Another interesting trend to note is that the savings rate among younger Singaporeans seem to be higher.

Among the 20s, savings rate is 35%. This goes down slightly to 31% for Singaporeans in your 30s. It then plateau around 28-29% for those in the 40-54 and 55-65 age group.

Source: OCBC Financial Wellness Survey

The keen interest shown in saving among Singaporeans is definitely a good sign. That said, there are still some areas of improvement. The problem is that not everyone of us is saving smart. In fact, some of us might even be just saving up in our bank account that is just giving us a meagre 0.05% interest rate on our savings.

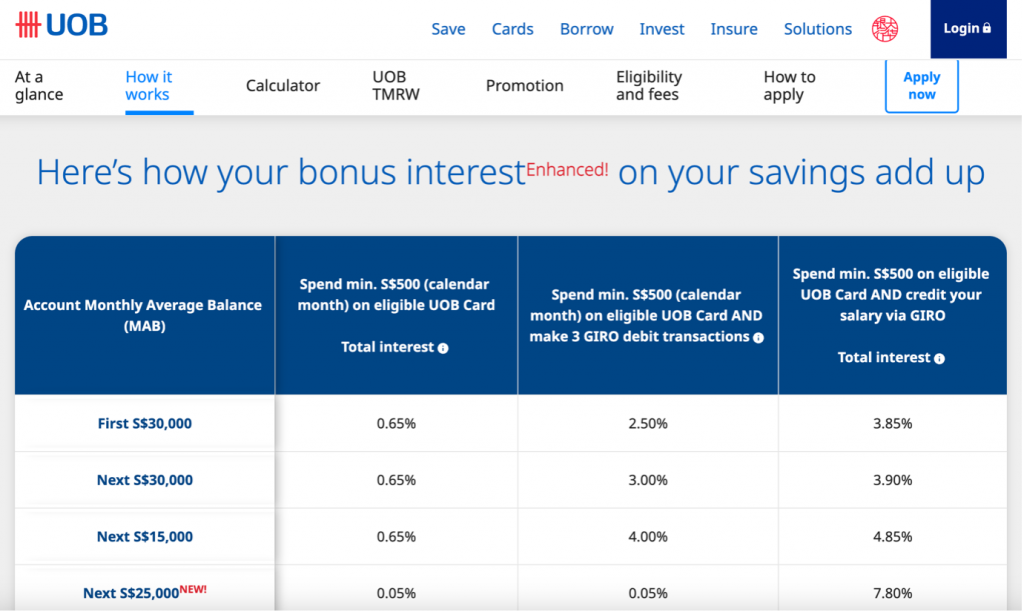

Tip: Instead of just saving in your regular bank account, make sure you find a high interest savings account to lock in a better interest rate for your savings. For instance, UOB One account offers tiered interest rate of up to 7.80% if you credit your salary, spend $500 each month, and have a saving balance of $100k.

Source: UOB One

Alternatively, you can park your money in a short-term Treasury Bill (T-Bill) that the Singapore Government is offering. At 4% p.a., T-Bills beat a lot of regular savings account that banks are offering.

-

Start To Better Manage Your Financial Debt

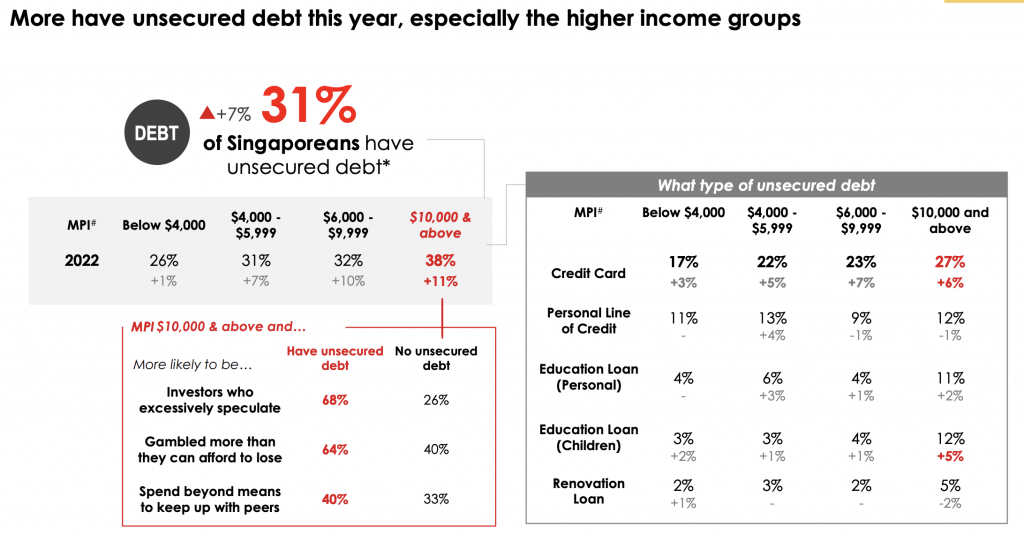

One worrying sign for Singaporeans is the rise in level of financial debt. 31% of respondents indicated that they have an unsecured debt. This was up from 24% in 2021. And if you look at those with high level of income (i.e. ≥ $10k of monthly income), that proportion goes up to 38%.

This is contrary to popular belief that those with low income are the ones with debt. But the reality is that it is the opposite. The risk of being burdened by high debt worsens as your income goes up.

Source: OCBC Financial Wellness Survey

Tip: If you think that you are at risk of being overwhelmed by your debt, the first thing to do is to acknowledge that you have a spiralling debt problem. The next step is to start taking ownership of it and manage it. You can adopt either the debt snowball method or debt avalanche method to clear your debt in an timely manner.

-

Professional Financial Advice Beats DIY

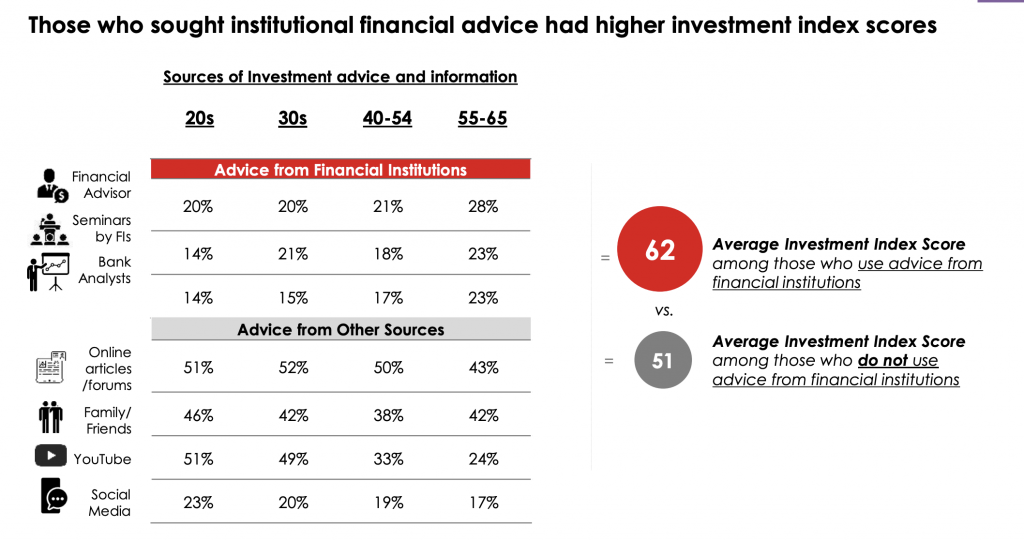

The rise of wealth tech apps has made it so easy for anyone to become a Do-It-Yourself (DIY) investor. All you need to do is make a few simple clicks on the app and you are now a “fund manager”. But are retail investors who DIY really showing good performance in the stock market? According to data collected by OCBC, the answer is a resounding no.

Source: OCBC Financial Wellness Survey

The average investment score for retail investors who DIY their own investments is just slightly above the 50 mark. Those who chose to seek professional advice from financial advisors had a much better average investment score of 62. It turns out that DIY investing is not so sexy after all.

Tip: If you find that your investments are exactly in the best of shape, take this opportunity to seek professional financial advice. Find out how professional financial advisors like Moneyline.SG can help you make the right financial calls. This will help to lift the stress off your own shoulders to make financial decisions that can make or break your portfolio

1 Comment