What Is CONQUAS And Why Every Condo Aspirant Should Know About It

In the ever-evolving landscape of real estate, condominiums have become increasingly popular among individuals seeking a modern and convenient living experience. If you are a condo aspirant, there is one thing that you must know: CONQUAS.

What is CONQUAS?

For some of us, this might be your first time hearing about CONQUAS. However, CONQUAS isn’t something new. In fact, CONQUAS has been around since 1989. It might even be older than some of us.

CONQUAS is the acronym for Construction Quality Assessment System. It was first introduced in 1989 as a national standard to assess the construction workmanship quality of building projects, be it residential or commercial buildings.

If CONQUAS Isn’t New, Why Are We Talking About It?

While CONQUAS was first created almost 35 years ago, it has been periodically fine-tuned and enhanced. There have been multiple versions of CONQUAS, from CONQUAS 21 (1998), CONQUAS 9th Edition (2017), and CONQUAS 2022 (2022).

The CONQUAS that we are referring to in this article is CONQUAS 2022, which was updated in May 2023.

How Does A Layman Understand CONQUAS?

Well, not everyone is technical enough to understand the inner workings of CONQUAS. But here’s what you need to know.

CONQUAS scores both developers and builders into bands. There are a total of six bands, ranging from Band 1 to Band 6. The lower your band, the better your track record for producing quality buildings. The banding also takes into account feedback from end users on any major defects that affect safety and liveability of the building. Any bad feedback from users will lower the banding of the developer/builder.

According to BCA, “Band 1 projects having a very low incidence of major defects and Band 6 having an unsatisfactorily high incidence of major defects”. It takes into account projects built in the past six years for the developer/builder.

For example, Kingsford Development Pte Ltd is classified as CONQUAS Band 5. They were infamous for shoddy work on multiple developments, including Kingsford Waterbay in Upper Serangoon and Kingsford Hillview Peak in Bukit Panjang. This led to a ban by the Singapore government for Kingsford Development to start work on their en-bloc purchase of Normanton Park.

How Do You Use CONQUAS?

There are a few ways to use CONQUAS.

-

Comparing Developers/Builders

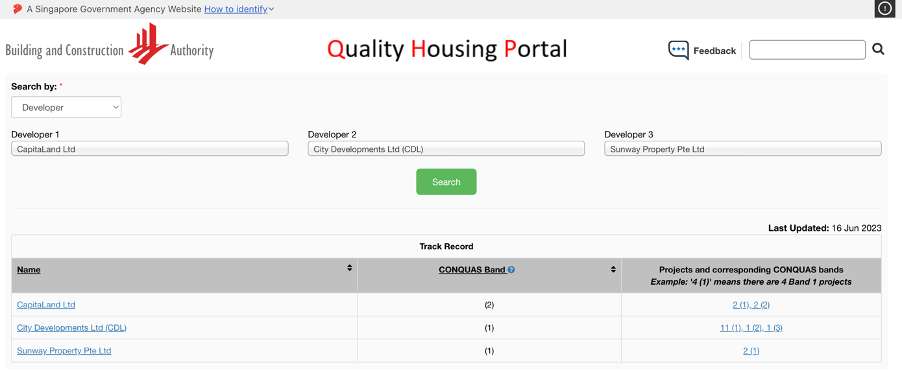

The most straightforward way to use CONQUAS is to compare developers/builders head to head.

For instance, if you are considering between three new condo launches and they each have a different developer/builder, you can see who has a better track record using CONQUAS bands.

Source: BCA

-

Comparing By Development

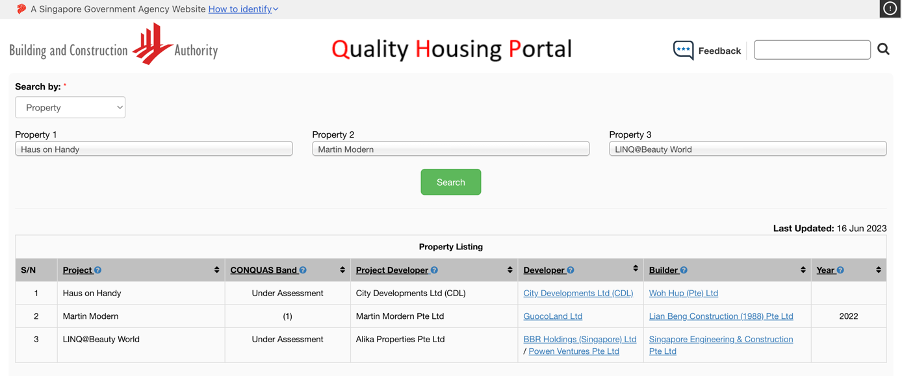

If you are buying a resale condo, then you can compare the quality of the development itself. Through CONQUAS, you can view the exact banding for the particular project. This also lets you compare how well built a condo project is against another project.

Source: BCA

-

Comparing By Banding

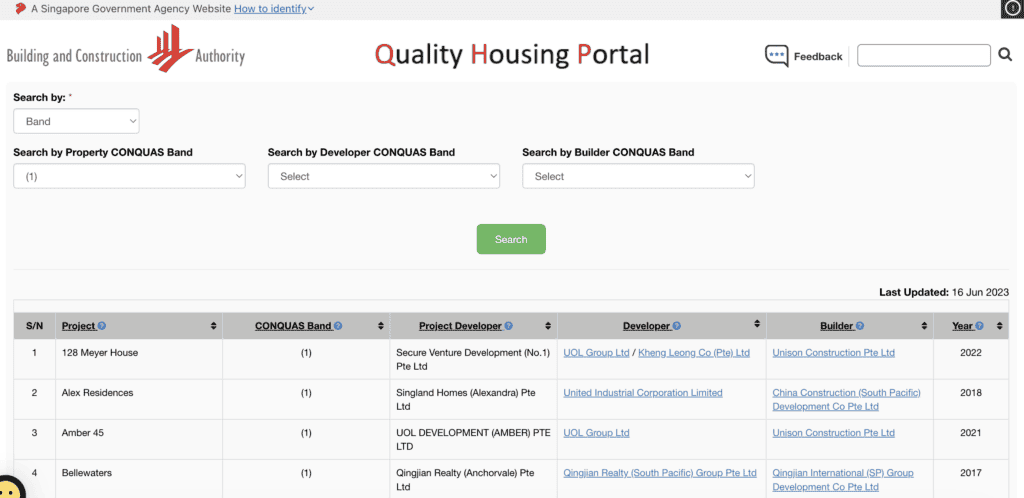

If you only want to consider condo developers that produce good quality developments, then the ability to filter them by CONQUAS banding will be helpful for you.

You can indicate the banding type (e.g. Band 1) and you can get a full list of developers/builders that fall under this band.

You can also find a full list of condo projects that are in Band 1. It can also be a combination of the two where you only view condo developments and condo developer that are CONQUAS Band 1.

Source: BCA

Where And Who Can Access CONQUAS?

CONQUAS is publicly available information on the Building and Construction Authority (BCA) Quality Housing Portal (QHP). Anyone can get information on the past construction workmanship quality performance of developers and builders for free.

Being Discerning Helps You Make Smarter Homeownership Decision

Being discerning about what you buy is one way to keep your home ownership cost affordable. After all, if you buy a development with potential defects, you may end up spending your spare cash to pay for defects. You certainly don’t want to be spending your hard owned money on those stuff.

Don’t Waste Your Money On Paying Excessive Mortgage Interest

On that same note, you also don’t want to be wasting your money on paying for excessive mortgage interest. You need to always keep a close track of your mortgage because, who knows, you might already be eligible for a refinancing that will help you save a few hundred dollars in mortgage payment each month.

If you accumulate this by 20 years, that’s going to be a sizeable amount of interest savings for you. Make sure you subscribe to Moneyline.sg if you want to get the latest information on what’s the best mortgage package in the market right now.

1 Comment