Singlife Flexi Retirement (Previously MyRetirement Choice) review

I am reviewing a product called Singlife Flexi Retirement, which provides guaranteed income for your retirement. The flexibility of this plan is what I really like! It’s my opinion that if you’re looking for guaranteed income for your retirement, this is a good option to consider!

Quick Summary of Singlife Flexi Retirement

- Flexibility to customise your retirement plan:

- Determine the Guaranteed Monthly Income for your retirement lifestyle

- Choose the age you want to retire

- Select the payout period for your retirement income – from 5 to 35 years

- Set the premium payment term – 5, 10, 15, 20 or 25 years

- 100% Capital Guaranteed at your chosen retirement age

- Receive additional disability care payouts should you be unable to perform at least 2 out of 6 ADL during the Income Payout Period (Care Income Benefit)

- Flexibility to receive a lump-sum payout during disability (Fast Forward Option)

- Receive bonuses to boost your payouts, where you’ll get non-guaranteed bonuses in the form of:

- Lump-sum payout at your retirement age which can be converted to monthly payouts; and

- Monthly Cash Bonus

- Payout in the event of death or Terminal Illness

- Guaranteed acceptance without need for health check-ups

- Premium waiver upon Totally and Permanently Disablement (TPD)

- Option to withdraw or reinvest your monthly payout for higher returns

100% Capital Guaranteed at your chosen retirement age

So, you’re thinking of buying a retirement policy. You want to make sure your earnings are safe, right? With Capital Guaranteed at your chosen retirement age, you’ll be able to rest assured that your money is safe.

It’s guaranteed at the end of the chosen Accumulation Period (which is also the start of the chosen retirement age), provided that 100% of the total premiums are paid before the end of the grace period.

Singlife Flexi Retirement will protect your capital and provide a guaranteed monthly income! This is a great option for you if you want to know that your capital will be guaranteed and you can retire comfortably. Just be sure that you’re paying all of your premiums before the grace period ends.

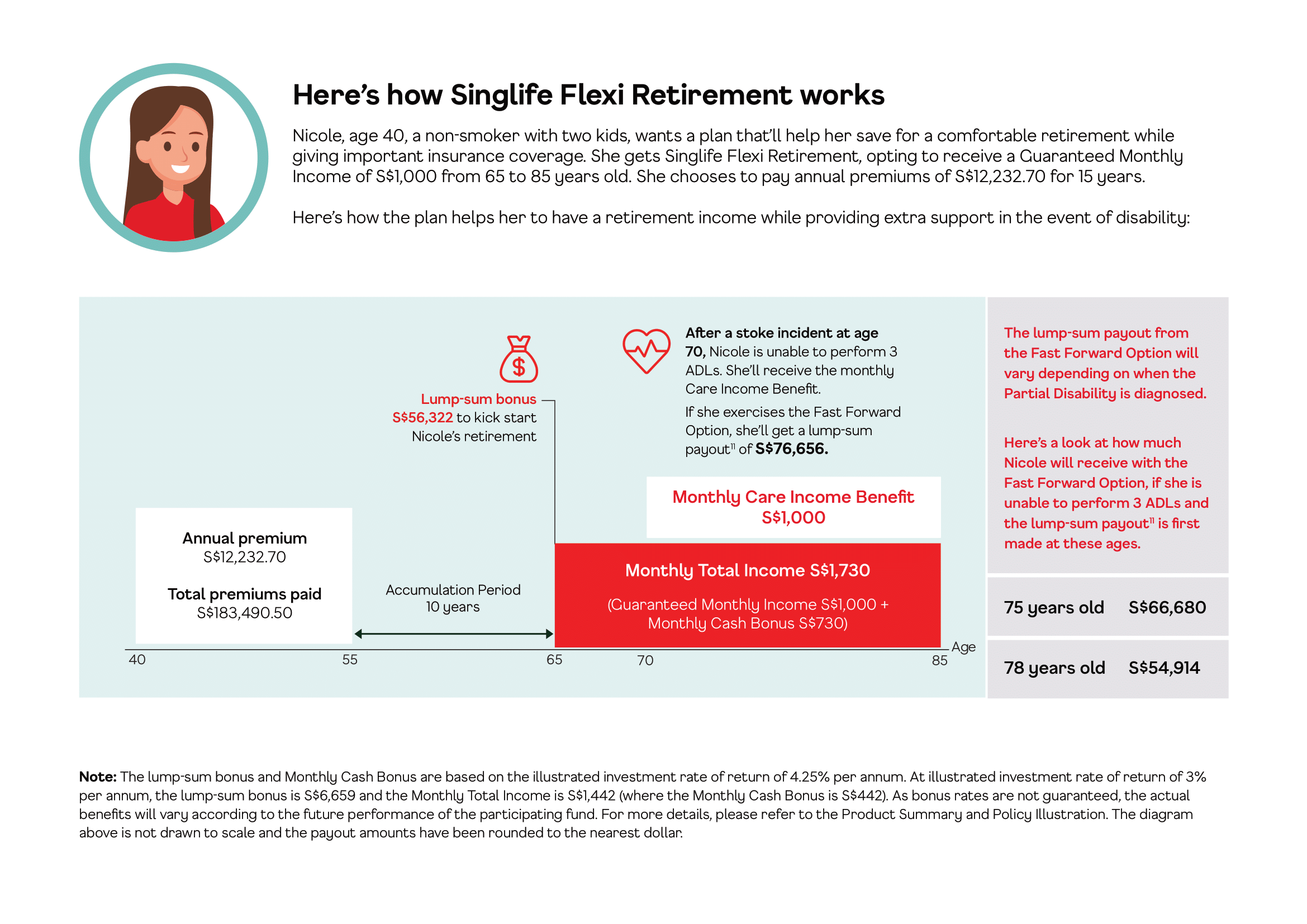

How Singlife Flexi Retirement works

Nicole, 40 years old with two kids, wants a plan to help her save for a comfortable retirement while offering protection coverage. We give her Singlife Flexi Retirement, with Guaranteed Monthly Income of S$1,000 from 65 to 85 years old. She pays annual premiums of S$12,232.70 for 15 years.

Potential bonuses to boost your payouts with Singlife Flexi Retirement

Singlife Flexi Retirement is one of the best retirement plans in Singapore.

Why? Because it gives you a lot of flexibility.

Unlike most insurance companies, Singlife gives you the power to decide how much you want your payouts to be.

You can choose between a lower payout with higher Lump-sum payout (at retirement), or a higher payout with lower Lump-sum payout.

The bonuses are non-guaranteed, which means that insurer does not have to pay them to you if it is unable to do so if during a bad year.

But don’t worry: Singlife is one of the biggest insurance companies in Singapore and Smoothing policy. It will definitely pay you your bonuses!

Note on Smoothing policy: Insurers will try not to have large fluctuations in the level of non-guaranteed bonuses from year to year. To do this, they will sometimes smooth bonuses over time. For example, they may hold back some bonuses in years when the investment markets have been doing well and give these back at a later time when the markets are performing badly. As a result, the amount of non-guaranteed bonuses may not necessarily follow the short-term ups and downs of the investment markets.

You have the flexibility to withdraw your monthly payout or re-invest with Singlife Flexi Retirement

Singlife Flexi Retirement is a retirement plan that gives you the flexibility to withdraw your monthly payout or re-invest in your plan. You have the option to grow your money by reinvesting your monthly payout for higher returns in the future. When you decide to re-invest your income payout, it is done at prevailing non-guaranteed interest rates of up to 3.00% p.a currently.

The Singlife Flexi Retirement is a retirement plan is backed by a life insurance provider, which means that you can get protection coverage in case of unfortunate events. The protection coverage will be paid to your beneficiary if something happens to you during the policy tenure.

Additional monthly disability payouts under the Care Income Benefit under Singlife Flexi Retirement

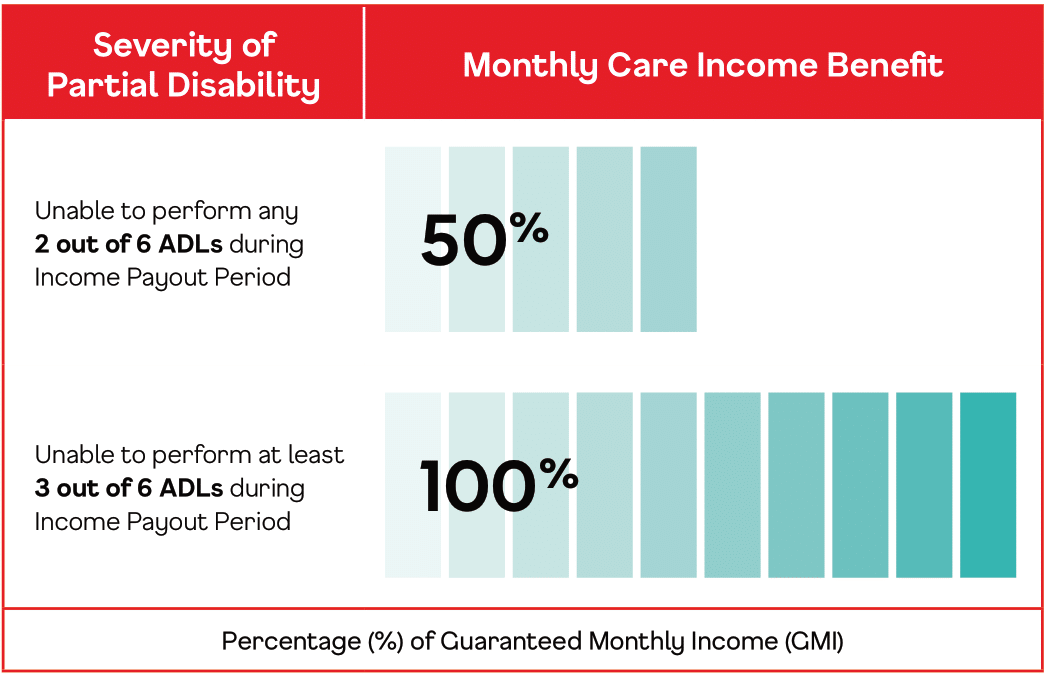

Receive 50% or 100% of your guaranteed income every month, respectively, if you have a disability, i.e. if you cannot perform 2 or at least 3 out of the 6 activities of daily living (ADLs) during the income payout period.

Source: Singlife with Aviva

The benefit is available at any time during the Income Payout Period. If the Life Assured meets the Partial Disability definition, it will pay a Care Income Benefit of up to 100% of the chosen Guaranteed Monthly Income every month, depending on the severity of the Partial Disability, starting from the next Monthly Anniversary Date after a 90-day period from the date (inclusive) on which a Registered Medical Practitioner certifies the Partial Disability.

Are you looking for a standalone disability income plan? Then Careshield Life Supplement may be the best option for you.

Fast Forward Option(FFO): You may decide to take a lump-sum payout for larger one-time expenses if you choose to exercise it under Singlife Flexi Retirement

This policy comes with some extra bells and whistles that are sure to make it a favorite among the community:

Flexibility to exercise the Fast Forward Option to receive the Care Income Benefit in one lump sum (instead of monthly income) if the Life Assured is first diagnosed with Partial Disability during the Income Payout Period and it is the first valid Care Income Benefit claim.

It’s a pretty exciting addition, to sum it up—the Singlife Flexi Retirement comes with cool Disability Care features:

- The ability to select from two different options:

- Care Income Benefit : Choose to receive an ADDITIONAL 50% or 100% of your guaranteed income every month, or

- Fast Forward Option: Choose to receive the above in one lump sum (instead of monthly income)

Other Protection benefits

When it comes to insurance, peace of mind can go a long way.

i. Premium Waiver upon TPD

If you want to be protected against the debilitating effects of an disability, Singlife Flexi Retirement plan has got you covered. This comprehensive retirement plan gives you the peace of mind that comes with knowing you’re prepared for all life’s challenges, including permanent disability.

All future premiums of the basic plan will be waived from the next premium due date following the date of commencement of TPD until the end of the premium payment term. This means that your retirement savings will not be affected and will continue to grow so that you can enjoy a worry-free retirement.

ii. Death and Terminal Illness

Oh, and one other thing: Lump-sum Payout in the event of death or Terminal Illness is often available with Retirement income plans, which means that you can receive payments monthly or yearly until the end of time—or until your death or Terminal Illness, whichever comes first!

Guaranteed Acceptance for Singlife Flexi Retirement

Singlife Flexi Retirement is a guaranteed acceptance retirement plan. That means there’s no need to undergo health check-ups before you are able to join the plan.

Takeaway: You can be in control of how and when you want to receive your retirement income with Singlife Flexi Retirement

It is not easy to get 100% capital guaranteed, because there are no guarantees in the stock market. But with this plan, YOU CAN! And if you want to be in control of how and when you want to receive your retirement income then Singlife Flexi Retirement is a good choice.

1 Comment