Singlife Disability Income review (Previously IdealIncome)

Introduction

In our previous post, we looked at Singlife’s term life insurance product, Singlife Elite Term. Today, we are going to take a look at one of the more unique products in Singlife’s suite of offerings – its disability income plan – Singlife Disability Income, or what used to be known as IdealIncome.

What Is Singlife Disability Income?

Singlife Disability Income is a comprehensive disability insurance plan that provides protection for your family’s future and financial security.

It is designed to replace your income in the event of disability due to illness or accident, giving you peace of mind that your family will still be comfortable even if you aren’t able to work.

Your monthly income is protected, even if you are disabled due to illness

The policyholder of Singlife Disability Income can potentially receive two different types of main benefits: Total Disability Benefit and Partial Disability Benefit.

Key features of Singlife Disability Income

Singlife Disability Income provides you with a comprehensive suite of benefits to ensure you have the right level of support in the event you become disabled.

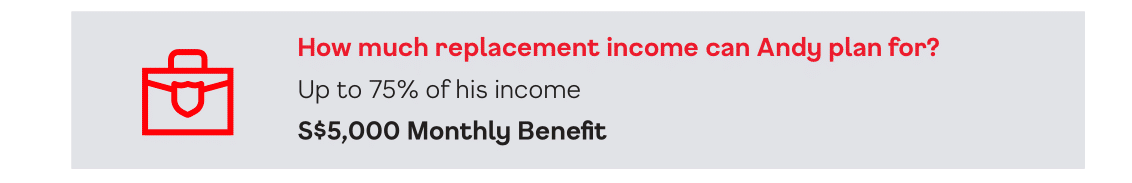

Total Disability Benefit – Monthly replacement income

Total Disability Benefit from this Singlife Disability Income plan covers up to 75% of your declared income and can be paid out monthly.

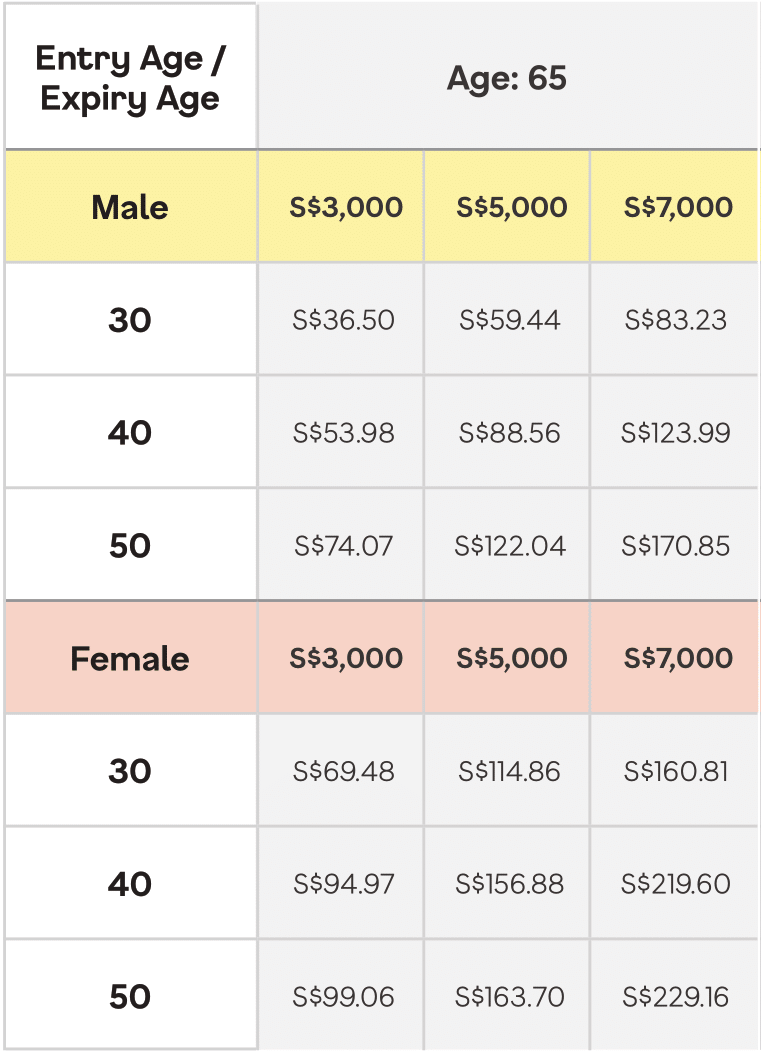

Premiums will vary accordingly based on age and cover amount selected by the insured (i.e., more coverage equals higher premiums).

Premiums will vary accordingly based on age and cover amount selected by the insured (i.e., more coverage equals higher premiums).

Partial Disability Benefit – Receive a portion of monthly income if you are not fully recovered even if you have returned to work

Singlife Disability Income’s Partial Disability Benefit pays out on a percentage basis, which means that if you return to work but are only earning a portion of your pre-disability income, the Total Disability Benefit would be replaced by this type of benefit.

For example, if you are earning 50% of your previous income then half of your monthly benefit would payable to you.

Option to increase your monthly payout – By 3% per annum, to keep up with inflation

With Singlife Disability Income, you can choosee to have yearly increase in the Total Disability and Partial Disability Benefit to be 3% per year.

With that increase being compounded each policy anniversary, starting from the year of claim.

Extra benefits

Premium waiver – No need to continue paying premiums while receiving disability payout

One thing I like about Singlife Disability Income is that there’s no need to continue paying premiums if you become disabled and qualify for any disability payout.

This feature allows you to focus on getting better rather than worrying about how you are going to pay the Singlife Disability Income insurance premiums.

Rehabilitation Benefit – Received 3 times extra monthly benefit from Singlife Disability Income

Singlife Disability Income is a disability income insurance plan that also provides a lump sum payout in the event of total or partial disability.

Rehabilitation Benefit = 3 times monthly benefit

If you are totally or partially disabled, you may need additional rehabilitation services to help recover and return to work. These expenses may include such things as medical equipment, workplace modifications, and occupational therapy. The maximum amount payable under the Rehabilitation Benefit is three times your monthly disability benefit.

Death Benefit (if you die while receiving disability income) of S$5,000

The death benefit is the lump-sum payment that Singlife Disability Income will pay upon the death of the insured. This benefit is payable if you die while receiving your disability income.

Death Benefit = S$5,000

Your family will receive this fixed lump sum payment of S$5,000 regardless of your plan’s sum assured.

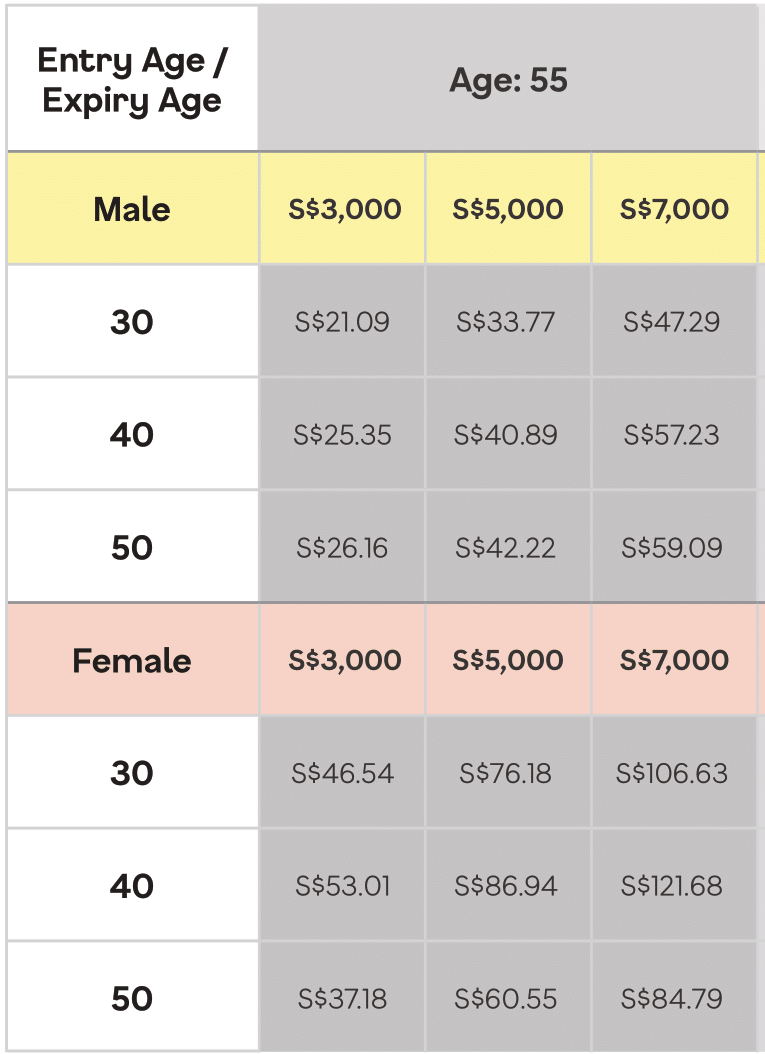

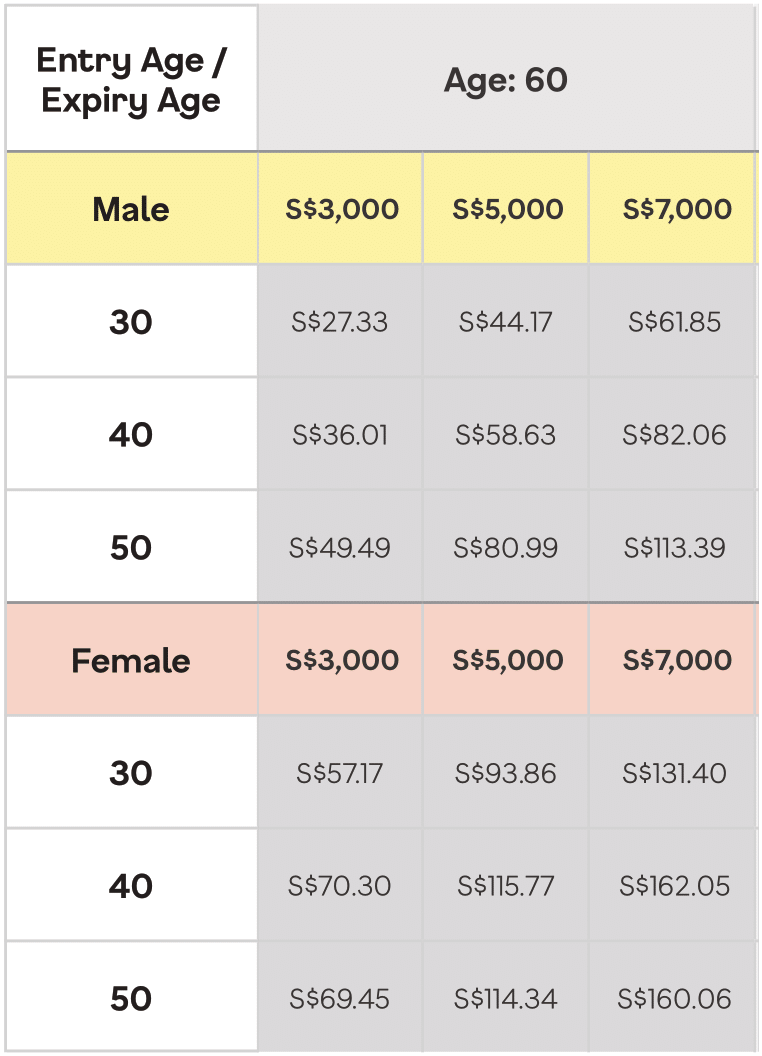

Pricing & premiums

Singlife Disability Income premiums are based on:

• Age Next Birthday

• Non-smoker

• Deferred Period: 3 months

• Escalation Benefit: 3%

• Includes 35% perpetual discount

Source: Singlife

Potential shortcoming/s

The biggest drawback of this Singlife Disability Income plan is that it offers only partial coverage during your non-working period, so claims qualify only if you are unable to do three out of six activities of daily living (ADLs).

There’s a fixed choice of deferment period—you can only choose between three or six months.

Lastly, if you change jobs, you need to inform the insurer so they can adjust your monthly payout accordingly.

Conclusion

Disability Income protection insurance is one of the most important coverages you can have. After all, if you become disabled and can’t work, what will you do?

Singlife Disability Income (formerly IdealIncome) is a great option for those who need disability income insurance that’s flexible and affordable.

This product is not just for people who are disabled due to an illness, but also for anyone who is disabled through non-accidental causes. This includes those who are unable to work because of a illness or medical condition that was not known at the time they purchased the policy.

Takeaway: Singlife Disability Income is a great disability income plan.

You should definitely give this plan a look before deciding to obtain a disability income plan. It offers good benefits and may be more affordable than most of the other plans in the market.

For a limited time, Singlife is offering 35% off this plan. Contact us now to learn more!

2 Comments