Singlife ChoiceSaver review

Singlife ChoiceSaver review – this is a endowment plan that gives you the flexibility to manage your risk coverage and savings. The plan provides you with 3 key benefits:

1. Capital Guaranteed for your security —Singlife ChoiceSaver review

We looked into Singlife MyChoiceSaver for you, and here’s what we found:

It’s a lump-sum. And not just any lump sum. When Singlife MyChoiceSaver comes on maturity, they pay you with 100% capital guarantee. That means you WILL get at least the premiums paid to date back, and that’s on top of the guaranteed benefits under your plan.

100% capital guaranteed : assurance that you’ll get back at least all of your premiums paid for your basic plan at the end of the policy term

Receive a lump-sum maturity benefit consisting of 100% of the Sum Assured and non-guaranteed bonuses when the policy term ends

Potential to earn bonuses on top of guaranteed benefits

Your premiums will be allocated into the underlying participating fund(s). Your plan value will be boosted by potential non-guaranteed bonuses, which are subject to investment performance of the participating funds.

2. Flexibility to Customise your plan —Singlife ChoiceSaver review

Life is full of uncertainties. You never know what’s around the corner, so it’s important to be prepared for the unexpected. But we don’t always have time to plan ahead and work out what we need to do.

That’s why Singlife ChoiceSaver gives you the flexibility to choose how long your life insurance policy will last and when you want to pay your premiums.

With Singlife ChoiceSaver, you get:

Flexibility for your convenience Choice of policy term: 10 to 25 years or cover to 99 years old

Choice of premium payment term: 5, 10, 12, 15, 18, 20 or 25 years

Option to change Life Assured so you can pass your policy to your family member as legacy gift

3. Additional Protection as you Save—Singlife ChoiceSaver review

SingLife ChoiceSaver is a endowment insurance plan that aims to provide you with the best of both worlds: Protection for your assurance Coverage for death and Terminal Illness

- Additional 100% payout for accidental death

- Up to 12 months waiver of interest for premiums that are not paid when you’re unemployed or retrenched

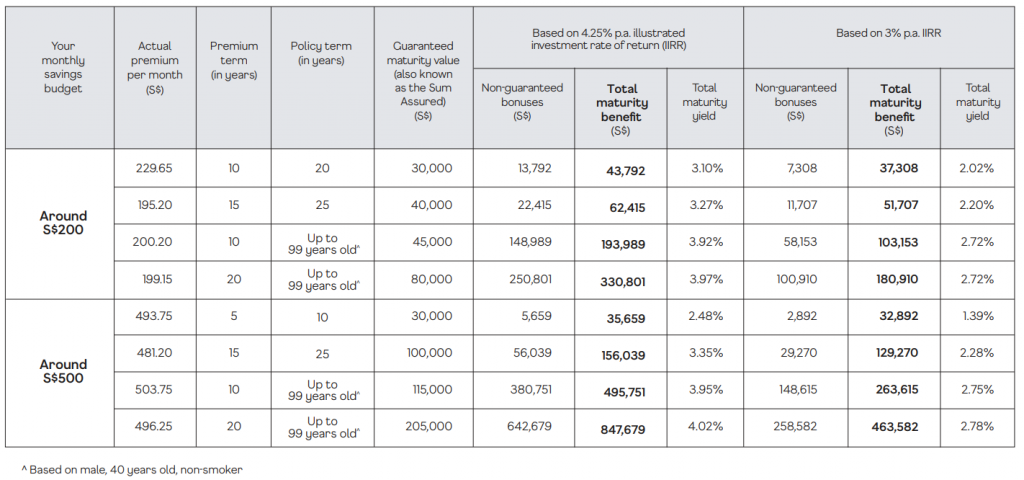

Here’s a picture of what your savings will do for you—Singlife ChoiceSaver review

Source: Singlife

What are the unique aspects of this product?

1. It offers policy term from 10 to 25 years or till 99 ANB that gives you the flexibility to plan for your saving goals

2. It offers 105% of the Total Premiums Paid in the form of death benefit in the unfortunate event of death of the assured

3. It offers another 100% of sum assured in additional of death benefit in the unfortunate event of Accidental death of the assured

Who are the target audiences of this product?

1. People who are looking for a regular premium endowment plan

2. People who are looking for a flexible saving plan with the option of receiving their maturity proceeds with policy term 10 – 25 years or till age 99 as a form of legacy planning

3. People who want to save with peace of mind as the Singlife MychoiceSaver their capital is guaranteed upon maturity

Takeaway: Singlife ChoiceSaver is a flexible endowment insurance plan that offers capital guaranteed for you.

The Singlife ChoiceSaver Plan is a flexible plan tailor-made for you to save your money, for you to get the savings that you want and to ensure that your money is safe. The flexibility of this plan gives you the opportunity to grow your savings in options that you find comfortable.

What you say matters… to me