Singlife MyLifeIncome III the 3rd version of the popular lifetime income plan that can provide principal guaranteed immediately after paying…

[Review] Aviva MyProtector Legacy Leaving An Inheritance Can Be Easy

In Asia, there is a strong culture of leaving an inheritance for your children. Many of us find that the greatest fulfilment in life comes from providing our children with the best, even after we are not around. As such, we often think about how we can pass down heirlooms (i.e. inheritance) to our children for their aspirations.

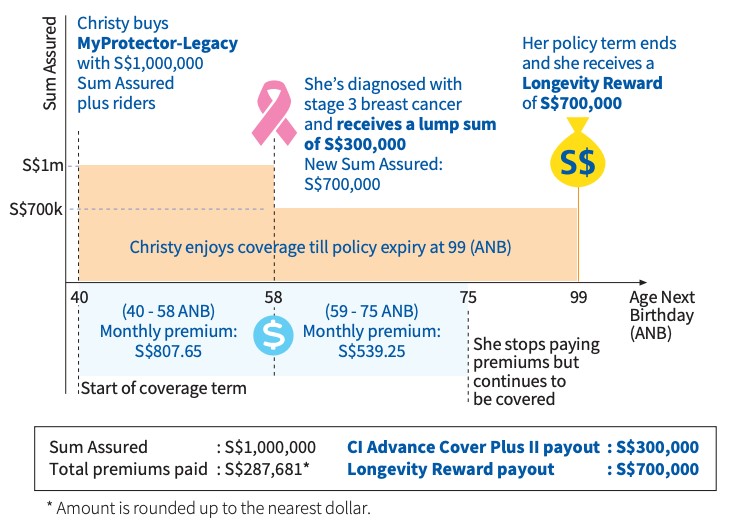

According to Aviva’s Consumer Attitude Survey, 41% of Singaporeans acknowledge that it is important to leave behind an inheritance. The inheritance could help our children or grandchildren open doors to education in prestigious universities or their entrepreneurial endeavours. If you are planning on leaving behind an inheritance, one legacy planning insurance you should definitely consider is Aviva MyProtector Legacy.

Aviva MyProtector Legacy: One Of Its Kind Legacy Planning Insurance

One of the endeavouring things about Aviva MyProtector Legacy is that it offers both protection and legacy planning in one plan. It is one of its kind and the first such plan in Singapore’s insurance market. Aviva MyProtector Legacy was designed to be a dual purpose plan that comes with high coverage for unexpected events (e.g. death, TPD) while allowing you to leave a meaningful legacy for your children.

A Hybrid between Term Life and Whole Life Limited Pay Insurance?

Yes, you heard it right, it is the first of it’s kind. Think a hybrid between a term and whole life insurance.

First, the policyholder (aka you) chooses your desired sum assured amount. This is the amount that you want to leave behind for your children as inheritance regardless of whether they are self-sufficient or not.

Next, you decide how many years you want to make premium contributions to the Aviva MyProtector Legacy plan. You can choose to either pay till you are age 65 or 75, just like a limited payment whole life insurance policy. (Note that paying till age 65 will mean that the monthly premium will be slightly higher than paying till age 75).

After that, all you need to do after that is to continue making monthly/yearly premium payments until the chosen age (e.g. age 65). Aviva MyProtector Legacy plan then provides insurance coverage for you till age 99 for both death and TPD.

Aviva also provides you with the option of surrendering your policy for a part of the basic premium paid if you think the product may not meet your financial objective eventually. You are entitled to receive 30% of your total premium paid for the basic premium from year 3 right until the end of the policy term, the surrender benefit will be 50% of your basic premium paid from the end of the premium payment term onwards.

How Does Aviva MyProtector Legacy Differ From A Typical Whole Life Insurance?

-

The Longevity Reward

So far, it sounds like typical whole life insurance. But there is one major difference between Aviva MyProtector Legacy and typical whole life insurance: The longevity reward feature.

Upon death or TPD, both MyProtector Legacy and typical whole life insurance plans pay out the sum assured amount. However, the difference is when you outlive your policy term. Under usual whole life insurance, the insurer will pay out less than the sum assured upon maturity. On the other hand, Aviva MyProtector Legacy pays out 100% of your sum assured upon maturity.

Source: Aviva.com.sg

-

Payout Upon Maturity Is Not Dependent On Declared Bonuses

It is worth pointing out that typical whole life insurance comes with a non-guaranteed portion. This is the bonus element that is declared by the insurer whenever the insurer makes a positive return on its investments.

With declared bonuses, the total amount paid out upon maturity for whole life insurance might exceed Aviva MyProtector Legacy. But this comes with a major caveat: The investment performance of your insurer needs to be consistent and make positive returns in the long run. A financial crisis or long recession can easily wipe out the gains, just like in 2009. Many policyholders had their insurance bonuses cut, which led to a drop in their non-guaranteed bonus.

Unlike most whole life insurance, the payout for Aviva MyProtector Legacy is not dependent on declared bonuses. Even if Aviva’s investments don’t perform (e.g. during financial crisis), they will still make a payout that is equivalent to your sum assured.

-

Opportunity To Increase Sum Assured When You Hit Key Life Milestones

Whenever you buy a whole life insurance, you need to decide your sum assured up front. Once you have decided the sum assured, it sticks for life. You can only choose to downgrade (or reduce) your sum assured. But with Aviva’s MyProtector Legacy, it gives you the opportunity to upgrade (or increase) the sum assured.

The upgrade option kicks in when you hit key life milestones such as graduation from university, marriage, buying your first home or becoming a parent. When any of these life milestones take place, you will be given the choice to increase your sum assured. It allows you to increase your sum assured by up to $500,000. The flexibility to upgrade your sum assured lets you change your mind about leaving more inheritance for your children.

2 Things To Like About Aviva MyProtector Legacy

-

Limited Payment Term Reduces Your Financial Burden After Retirement

A key feature is the limited premium payment term. Although Aviva MyProtector Legacy provides insurance coverage till age 99, you only need to pay premiums up to age 65/75. This reduces the financial burden on you once you hit retirement age. Compared to a limited pay whole life insurance, Aviva MyProtector Legacy is a cheaper option.

-

Multiple Rider Options For Enhanced Protection

Another important feature of Aviva MyProtector Legacy is the possibility of adding multiple riders to your plan. The plan gives you the option of the following riders to enhance your protection:

- TPD Advance Cover Plus II

- CI Advance Cover Plus II

- MultiPay CI Cover III

- Early CI Cover

- CI Premium Waiver

- Payer CI Premium Waiver

- Payer Premium Waiver Benefit

However, do note that with the exception of Early CI Cover and Multipay CI Cover III riders only provide coverage till age 65/75. The other riders all provide coverage till age 99

Honest Thoughts About Aviva MyProtector Legacy

One question that continues to linger in our minds about Aviva MyProtector Legacy is whether anyone really needs protection till age 100. For most people, insurance coverage till age 65 or 70 would already suffice. This makes Aviva MyProtector Legacy a much more suitable insurance plan for those who wants to leave behind a legacy.

For those who wish to use Aviva MyProtector Legacy to leave behind a legacy, it is vital to consider the effects of inflation on the sum you are planning to leave behind. Due to the effects of inflation, $1,000,000 today will be less than 50% of its value in 40 years’ time. You will definitely need to leave more behind for your children in order to really leave behind a legacy.

Plan to leave behind a legacy for your children? Find out more about how Aviva MyProtector Legacy can help you

Compare Term insurance

or

Get Aviva MyProtector Legacy Quote Here !

A Licensed financial planner will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

2 Comments