Manulife Ready Life Income III review

Manulife Ready Life Income —Whether you’re looking to just protect the financial needs of your loved ones, or you’re also interested in offering a lifetime annual payout till age 120, Ready Life Income III has you covered.

This policy offers lifetime payouts till 120, coverage amount, premium freeze option and a retrenchment benefit which pays out a lump sum in the event of retrenchment.

It’s also one of those policy that offers a premium freeze option. This allows you to stop paying your premiums during difficult times, but still maintain coverage.

Manulife Ready Life Income III: Overview

Ready Life Income by Manulife is a regular premium participating whole life insurance plan designed to give you both guaranteed and nonguaranteed yearly income up till age 120.

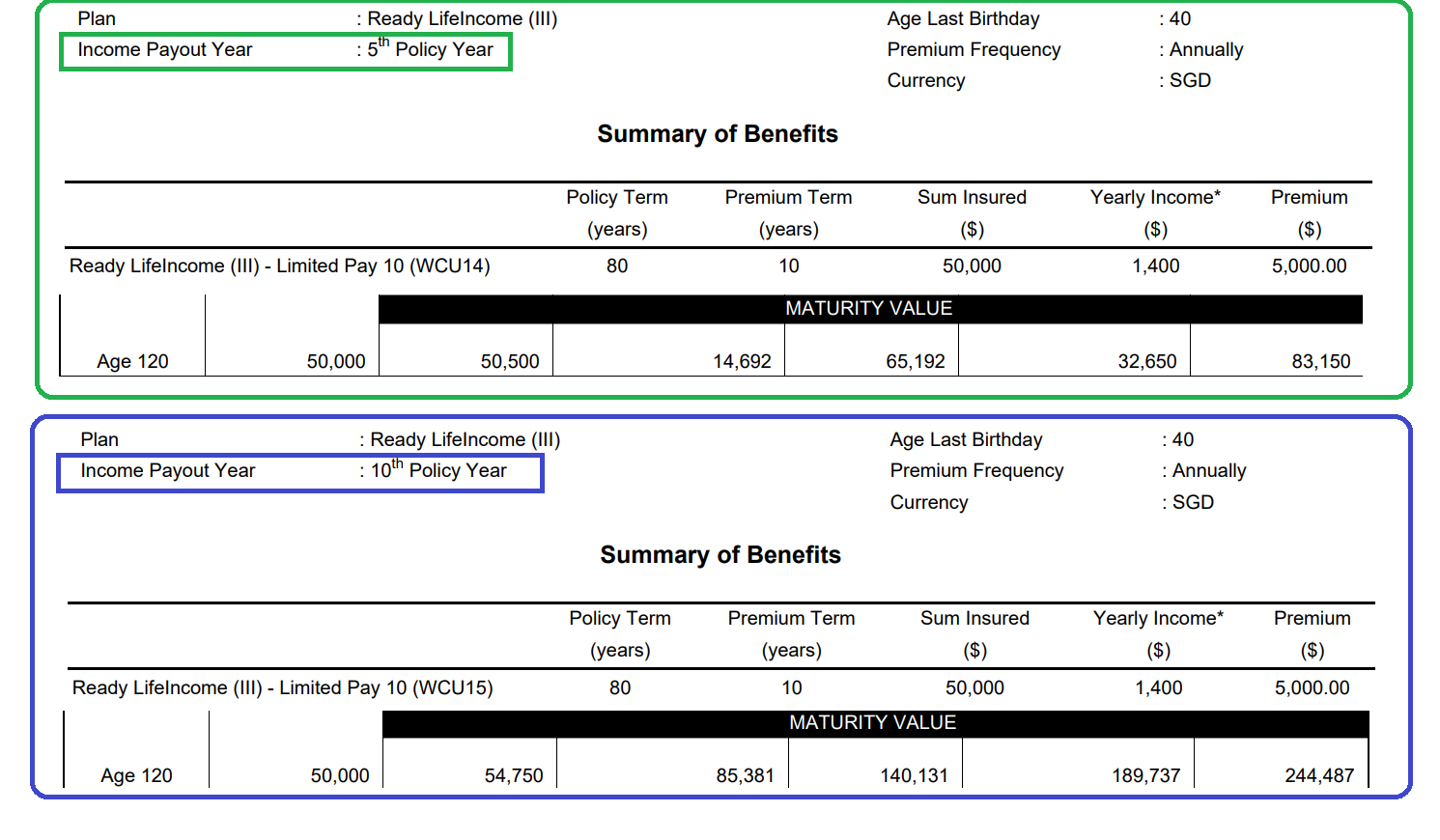

It offers flexible premium terms of 5 or 10 years. You can choose your Income Payout Year from the end of 5th or 10th policy year, in which case you will receive an annual income for life, starting from that year onwards.

You have the option to freeze your premiums should you not be able to meet your future premiums. This option allows you to continue your policy without paying any further premiums.

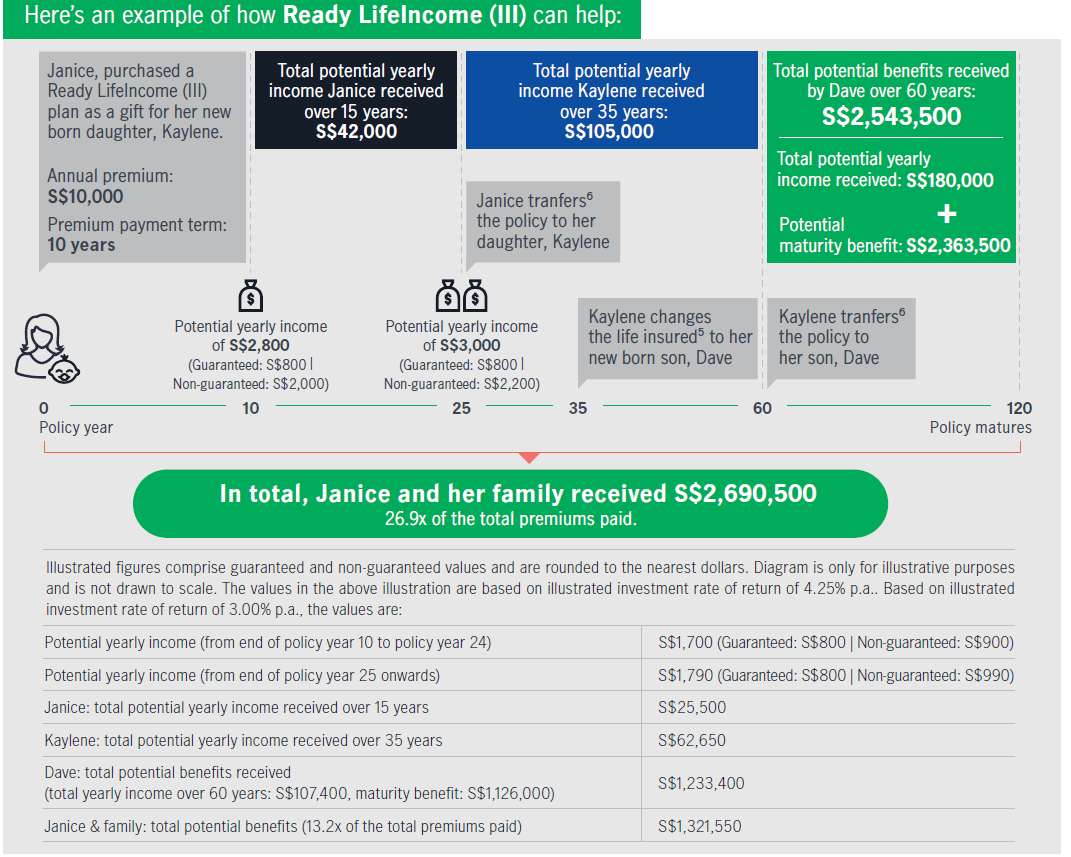

You can also transfer ownership of the policy to your loved ones, allowing them to enjoy the benefits from this policy.

If you are still alive at age 120, a maturity benefit will be paid out at the end of the policy.

The plan also provides Retrenchment benefit, death and terminal illness coverage, with an additional waiver of premium feature on diagnosis of Total and Permanent Disability (TPD).

Manulife Ready Life Income III: Benefits and features

Every Manulife Ready Life Income plan comes with Lifetime annual income benefit, MATURITY BENEFIT, Change of Life Insured, Death and Terminal Illness Benefit, Waiver of Premium in TPD (Continuity of Policy for Disability) case.

Source: Manulife

Benefit 1: Lifetime annual income for you or your family with Manulife Ready Life Income

With this plan, you can expect a yearly income starting on the end of year 5 or 10 and up to age 120. Plus, from year 25 onwards, you’ll receive an additional boost to your yearly income!

Benefit 2: Retrenchment Benefit

But what if something goes wrong? Will you be able to manage a sudden income change? With our Retrenchment Benefit option, you can rest assured knowing that even if you’re retrenched, you’ll still get 50% of annual premium paid out if your policy is for 5 years or 100% of annual premium paid out for 10 years. And best of all—the benefit is applicable to policies where the policy owner is aged 64 and below!

Benefit 3: Premium freeze option

And we don’t think making long-term financial commitments should be a hassle. That’s why they made it easy: if you purchase this plan, you can stop paying premiums for 1 year after maintaining your policy after 2 policy years with 2 full annual premium payments!

Benefit 4: Change of Life Insured: Option to change the life insured to your loved ones with Manulife Ready Life Income

You can change the life insured (if you already have someone who is covered) to your loved ones, and after two policy years, you can request a change in the original insurance policy until the term is up—and increase your chances of receiving Maturity Benefit. This option will be offered only twice.

Benefit 5: Maturity Benefit at age 120 (if any)

The plan will pay Maturity Benefit if the last insured lives through the 120th policy anniversary. The final policy owner receive at least 101% of total premiums paid plus bonuses.

In other words, as long as they live until they’re 120 years old and are still in force, they’ll receive ADDITIONAL of at least 101% of total premiums paid plus bonuses. This makes it easy to make sure that you ensure your policy continuity by utilising the change of life insured option (Benefit 4 above)

Benefit 6: Death & Terminal Ilness benefit

And if your loved one dies before age 120, they’ll be covered against death, terminal illness up to age 120.

Benefit 7: Waiver of Premium in case of TPD (if any)

You’ll also be covered against total and permanent disability (for the insured person), so that if anything happens to them during your premium payment term, the insurer will keep paying for their coverage too.

What makes Manulife Ready Life Income III product stand out?

Ready Life Income III from Manulife Singapore is a life insurance policy with a wealth accumulation component. With this policy, you’ll enjoy the following benefits:

- Lifetime annual payouts till age 120

- Retrenchment benefit which pays out a lump sum

- Premium freeze option to pause premiums while keeping your policy in force

- Change of Life Insured allows you appoint your loved ones as your policy’s new life insured to continue your wealth accumulation

- Maturity benefit at age 120

- Death and Terminal Illness coverage

- Waiver of Premium on diagnosis of Total and Permanent Disability (TPD)

Best of all? It’s hassle-free with no health check required.

Manulife Ready Life Income III: Who should get this product?

There are many life insurance plans available in the market today. However, Manulife Ready Life Income III offers a unique solution to your financial needs while protecting your loved ones.

The plan has been designed for individuals who want to safeguard their loved ones future and their own with financial stability. It offers lifetime annual payouts till age 120. Not only this, there is also a retrenchment benefit and premium freeze option that comes with the policy.

The best part about this plan is that you can use it for your retirement planning as well as passing on wealth to your loved ones.

If you are looking for an insurance policy that covers your basic needs and offers additional benefits like retrenchment benefit, premium freeze option and more, then Manulife Ready Life Income III is worth considering.

Why get this product? – Manulife Ready Life Income III review

1. Manulife Ready Life Income III, a whole life insurance policy that provides lifetime annual payouts until age 120, will help ensure you and your loved ones have a secure financial future.

2. if you want to safeguard your loved ones future or

3. if you’re interested in a policy that has a retrenchment benefit, and premium freeze option, then contact our customer hotline right away.

If you’re looking for one of these things, connect with us right away!

Manulife Ready Life Income III: How does it work?

Now, this is a very simple illustration of how Manulife Ready Life Income III works. To know more about the similar kind of benefits you can enjoy from Manulife Ready Life Income III, do contact us today!

Step 1: Decide on your premium term and premium amount for Manulife Ready Life Income

Flexible premium terms of 5 or 10 years

Premiums start at around $3,800 per year

Flexible premium terms of 5 or 10 years, you decide how long you pay into the policy. You can also decide how much you pay in premiums, which affects the amount of the lifetime income benefit. Premiums are guaranteed to stay level for the duration of the payment period.

Step 2: Choose your Income Payout Year from the end of 5th or 10th policy year

The next step is to pick an Income Payout Year: either the end of 5th or 10th policy year.

When you buy a policy with a premium term of 10 years, you can choose the Income Payout Year from the end of the 5th or 10th policy year.

When you buy a policy with a premium term of 5 years, the Income Payout Year will be from the end of the 5th policy year.

The best thing about this plan is that it’s flexible. You can choose a premium term of 5 years or 10 years and select an Income Payout Year from the end of the 5th policy year or 10th policy year. When you buy a policy with a premium term of 10 years, you can choose the Income Payout Year from the end of the 5th or 10th policy year. If you buy a policy with a premium term of 5 years, your income payout will be from the end of the 5th policy year, which means that you’ll receive income payments for 100 years.

This plan offers a great deal of flexibility and freedom—you get to decide how long you want to pay your premiums, and how long you want to receive income payments. Remember that if you choose an Income Payout Year from the end of your 10th policy year, this means that your last guaranteed payment date will be 95 years after your first guaranteed payment date. This option gives you more potential for higher maturity payout at end of 120 years old of the original insured.

Step 3: Apply for a Ready Life Income III policy from Manulife Singapore to experience the benefits.

You’ve taken the first step toward a lifetime income! By selecting the Manulife Ready Life Income III plan, you can feel comforted knowing your money is invested in a reliable product. Once you’ve completed the premium payment of your plan, you’ll be able to rest knowing that your investment will provide you with a lifetime payout when it comes time to collect it.

If at any point in the process you feel uncertain about your decision or have any questions, please don’t hesitate to contact us.

Source: Ready LifeIncome – Manulife Singapore

Manulife Ready Life Income III review: Takeaway

If you’re looking for a whole life plan that offers regular payouts, Manulife’s Ready Life Income III might be right up your alley. It’s a comprehensive plan that provides not only a regular income stream, but also the security of insurance benefits for your family in the event of death or retrenchment.

The best part is, there are no medical checkups required!

The main downside is that it has a lower upside potential than some other plans that allow you to allocate your premiums in your chosen investment funds. That said, if what you want is a solid plan with security and guaranteed income, this is one you should definitely consider.

Make a commitment to save

To get started, simply fill out an enquiry and provide us with details about yourself! Once you submit your information, it will be reviewed by one of our advisors who will contact you within 24 hours for more details about your needs so we can find the right policy for your life situation.

We look forward to serving you!